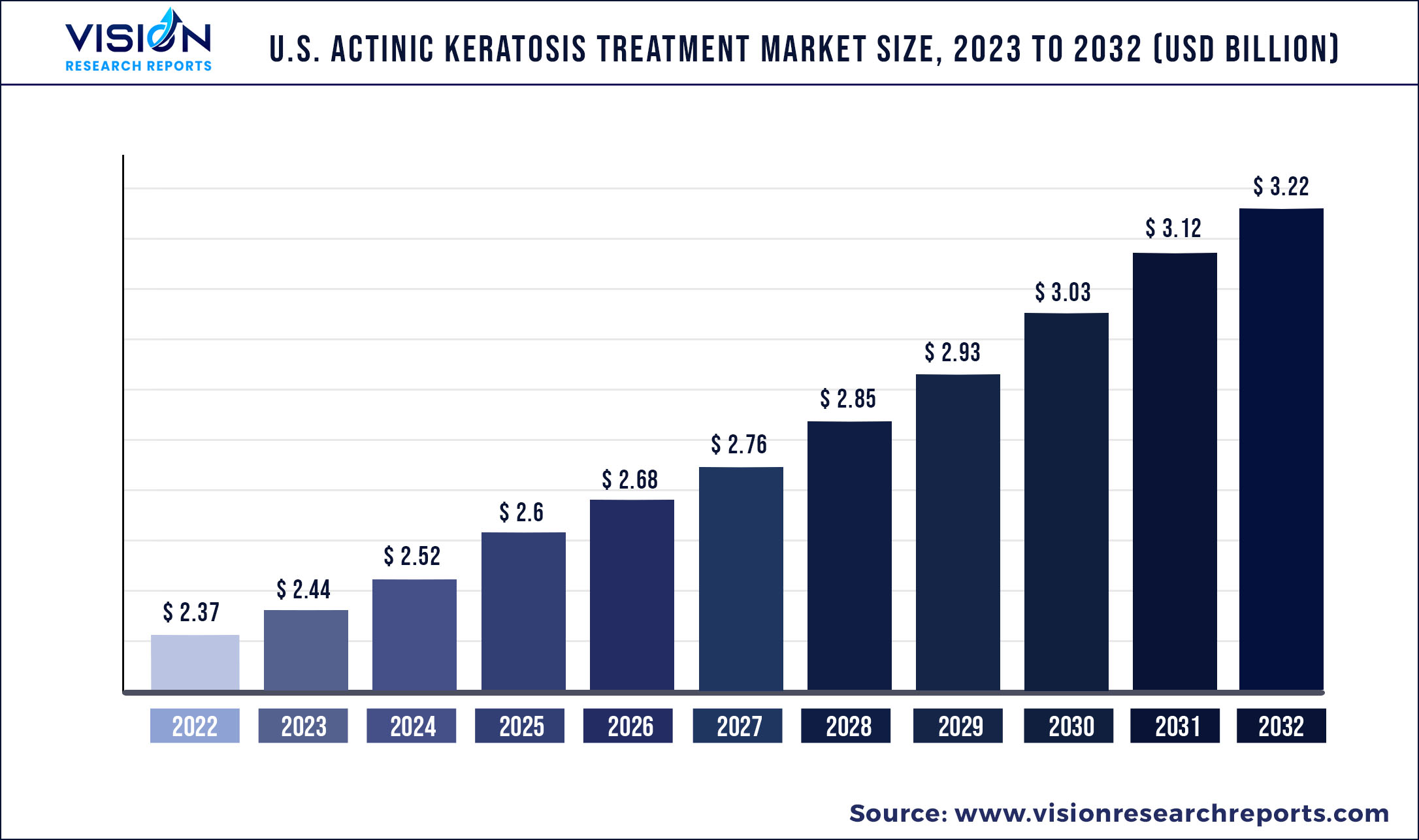

The U.S. actinic keratosis treatment market size was estimated at around USD 2.37 billion in 2022 and it is projected to hit around USD 3.22 billion by 2032, growing at a CAGR of 3.1% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 2.37 billion |

| Revenue Forecast by 2032 | USD 3.22 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.1% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Companies Covered | Bausch Health Companies, Inc.; LEO Pharma A/S; Almirall, S.A; Biofrontera AG; GALDERMA; Sun Pharmaceutical Industries Ltd.; Novartis AG; Hill Dermaceuticals, Inc.; 3M; Viatris, Inc. |

The increasing prevalence of actinic keratosis, the increased risk of developing skin cancer, and the surge in the geriatric population of the country are the major driving growth factors. For instance, according to a report published in JAMA Dermatology, actinic keratosis affects around three of every 10 older Medicare recipients. Moreover, the presence of potential investigational candidates in the pipeline and the rising R&D efforts from pharmaceutical companies to develop novel treatment approaches for actinic keratosis are likely to contribute to market expansion over the forecast period.

According to the American Academy of Dermatology Association, more than 40 million Americans develop AK each year and the overall prevalence rate of AK in the U.S. is estimated to be about 26.5% in males and 10.2% in females. Factors such as severe baldness, the high tendency of sunburn, and skin wrinkling may increase the predisposition to AK in the male population. In addition, it is the most common pre-cancerous dermatological condition, around 5-10% of actinic keratosis can develop into Squamous cell carcinoma. Thus, the increasing prevalence of AK is anticipated to increase the treatment rate in the country.

Currently, treatment approaches such as home-based treatments with topical preparations, cryotherapy, and PDT are commonly employed to treat actinic keratosis. Moreover, several novel agents are under development phases to reduce adverse events, which is expected to increase the adoption rate of treatment of actinic keratosis. For instance, according to the NIH, some of the novel drugs being investigated for AK are resiquimod, betulinic acid, paclitaxel, potassium dobesilate, potassium hydroxide, and celecoxib. These therapeutic drugs are directed toward personalized treatment for patients having AK lesions as well as symptoms of cutaneous SCC.

In addition, the ongoing efforts to develop next-generation therapeutics for various dermatological disorders including AK, basal cell carcinoma, and atypical moles are expected to offer lucrative growth opportunities for the market. For instance, in October 2022, the Skin Cancer Foundation granted USD 125,000 to researchers to manage dermatological applications. This funding is mainly intended to promote innovation for the early detection and treatment of skin diseases such as AK.

Furthermore, higher rates of actinic keratosis treatment and increasing novel medicines usage in the country along with favorable initiatives from non-profit organizations to prevent actinic keratosis is a growth rendering factor for the market. For instance, in June 2021, the American Academy of Dermatology published new recommendations for the treatment of AK with its new GRADE approach. Moreover, according to Almirall’s presentation, the prescription of Klisyri in the U.S. AK topical market has increased by over 41,000 prescriptions since its launch.

However, most treatment options such as imiquimod, Solaraze, and Efudex have lost their patent exclusivities in the U.S., leading to the penetration of generics in the market. Genericization is expected to lower the revenue generation capacity of the market, thereby impeding market growth. Moreover, a stringent regulatory framework related to the safety and efficacy of drugs is further anticipated to reduce market growth over the forecast period.

U.S. Actinic Keratosis Treatment Market Segmentations:

By Therapy

By Drug Class

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Actinic Keratosis Treatment Market

5.1. COVID-19 Landscape: U.S. Actinic Keratosis Treatment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Actinic Keratosis Treatment Market, By Therapy

8.1. U.S. Actinic Keratosis Treatment Market, by Therapy, 2023-2032

8.1.1. Topical/Drugs

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Surgery

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Photodynamic Therapy

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Actinic Keratosis Treatment Market, By Drug Class

9.1. U.S. Actinic Keratosis Treatment Market, by Drug Class, 2023-2032

9.1.1. Nucleoside metabolic inhibitors

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Nonsteroidal anti-inflammatory drugs

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Immune response modifiers

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Photoenhancers

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Actinic Keratosis Treatment Market, By Product

10.1. U.S. Actinic Keratosis Treatment Market, by Product, 2023-2032

10.1.1. 5-fluorouracil

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Diclofenac

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Imiquimod

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Tirbanibulin

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Capecitabine

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Aminolevulinic acid

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Porfimer sodium

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Others

10.1.9.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Actinic Keratosis Treatment Market, By End-use

11.1. U.S. Actinic Keratosis Treatment Market, by End-use, 2023-2032

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Private clinics

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Homecare

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Actinic Keratosis Treatment Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Therapy (2020-2032)

12.1.2. Market Revenue and Forecast, by Drug Class (2020-2032)

12.1.3. Market Revenue and Forecast, by Product (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Bausch Health Companies, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. LEO Pharma A/S

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Almirall, S.A

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Biofrontera AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. GALDERMA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Sun Pharmaceutical Industries Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Novartis AG

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Hill Dermaceuticals, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. 3M

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Viatris, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others