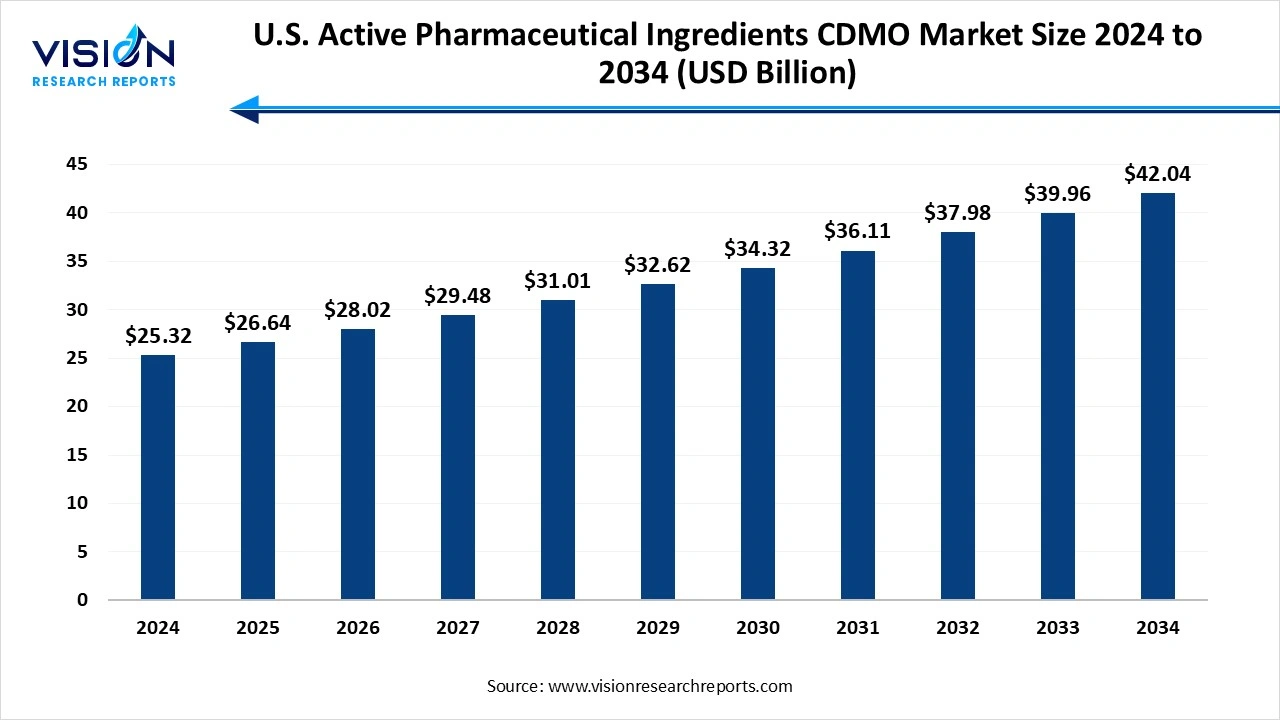

The U.S. active pharmaceutical ingredients market size was estimated at around USD 25.32 billion in 2024 and it is projected to hit around USD 42.04 billion by 2034, growing at a CAGR of 5.20% from 2025 to 2034.

The U.S. active pharmaceutical ingredients CDMO market has experienced consistent growth in recent years, driven by rising awareness of pet oral hygiene and the increasing humanization of companion animals. As more pet owners prioritize comprehensive healthcare, including dental care, the demand for veterinary dental services, products, and advanced technologies has expanded significantly. Conditions such as periodontal disease, gingivitis, and dental calculus are prevalent among pets, necessitating regular dental check-ups and treatments.

The growth of the U.S. active pharmaceutical ingredients CDMO market is primarily fueled by the rising awareness among pet owners about the importance of oral hygiene for overall pet health. Dental diseases such as gum infections, plaque buildup, and tooth decay are common in pets, particularly in aging animals. As pet ownership increases across the country, more individuals are proactively seeking preventive dental care to enhance the longevity and well-being of their pets. This shift in consumer behavior has led to increased visits to veterinary clinics for dental check-ups, cleanings, and advanced treatments.

Technological advancements and expanded service offerings in veterinary dentistry are playing a pivotal role in driving market growth. Clinics and hospitals are now equipped with modern diagnostic tools, anesthesia options, and ultrasonic cleaning devices that enable safe and effective dental procedures. The growing influence of pet insurance providers that now cover dental treatments, along with the availability of a wide range of dental care products such as chews, sprays, and toothbrushes, further contributes to the market's upward trajectory.

One of the most prominent trends in the U.S. active pharmaceutical ingredients CDMO Market is the increasing adoption of advanced dental technologies and specialized services in veterinary practices. Veterinary clinics are incorporating digital dental radiography, ultrasonic scalers, and laser therapies to improve diagnostic accuracy and treatment outcomes. These technologies enable veterinarians to detect hidden dental issues, such as abscesses and bone loss, that are not visible during routine exams.

Another key trend is the growing demand for at-home dental care solutions and preventive products. Pet owners are becoming more engaged in maintaining their animals' oral health between veterinary visits, leading to increased sales of dental chews, toothpaste, water additives, and oral rinses. This shift toward proactive care aligns with a broader movement in pet health that emphasizes prevention over treatment. Coupled with the influence of pet wellness campaigns and social media awareness, this trend is shaping consumer behavior and opening new opportunities for product manufacturers and service providers in the veterinary dental market.

One of the major challenges faced by the U.S. active pharmaceutical ingredients CDMO market is the limited awareness among some pet owners regarding the importance of regular dental care. While awareness is increasing, a significant portion of the population still underestimates the impact of dental diseases on overall pet health. Many pet owners seek dental treatment only after severe symptoms arise, which can lead to costly procedures and more complex treatments.

Another challenge is the high cost of advanced veterinary dental procedures, which may deter some pet owners from seeking timely care. Despite the growing availability of pet insurance, many policies have limited dental coverage, placing a financial burden on owners. In addition, there is a shortage of trained veterinary professionals who specialize in dental health, particularly in rural areas, which restricts access to quality dental services.

The traditional active pharmaceutical iIngredients (APIs) segment held the largest share of market revenue, accounting for 41% in 2024. The U.S. Active Pharmaceutical Ingredients CDMO Market is witnessing a growing emphasis on specialized pharmaceutical products, particularly Active Pharmaceutical Ingredients (APIs) and Antibody Drug Conjugates (ADCs), to address a broad spectrum of dental conditions in companion animals. APIs serve as the core components in various veterinary dental formulations, offering therapeutic effects essential for managing issues such as plaque, gingivitis, and periodontal disease. These ingredients are typically used in oral medications, rinses, and gels, providing both systemic and localized treatment.

The antibody drug conjugates (ADCs) segment is projected to witness the highest compound annual growth rate CAGR during the forecast period. These complex molecules combine monoclonal antibodies with active drugs, allowing for precise targeting of disease-causing cells or bacteria while minimizing damage to surrounding healthy tissues. In the context of veterinary dental care, ADCs hold potential for treating severe oral infections or inflammation that are resistant to conventional therapies. Although the use of ADCs is currently limited and still in developmental stages for veterinary applications, their anticipated future integration into treatment protocols underscores a significant advancement in precision medicine for animal health.

The synthetic APIs segment led the market, capturing the highest share of revenue. Synthetic APIs are widely used due to their cost-effectiveness, scalability, and consistent quality. These APIs are manufactured through complex chemical processes and are commonly found in antibiotics, anti-inflammatory agents, and antiseptic formulations used to treat dental infections and gum diseases in pets. The reliability and controlled manufacturing environment associated with synthetic APIs make them a preferred choice for many pharmaceutical companies serving the veterinary sector.

The small biotech API segment is expected to experience the most rapid CAGR growth throughout the forecast period. These APIs are typically developed using biotechnology methods such as fermentation or cell culture and are often used in advanced formulations, including biologics and peptide-based drugs. Although the production of small biotech APIs can be more resource-intensive, their effectiveness in managing complex dental disorders and their potential for reduced side effects are driving their demand.

The innovative segment accounted for the largest share of market revenue, leading the overall market in 2024. Innovative drugs, often the result of extensive research and development efforts, are designed to address specific dental diseases with enhanced precision, efficacy, and safety. These drugs may include advanced formulations for treating periodontal disease, controlling oral bacteria, or reducing inflammation and pain in pets. Many of these new therapies incorporate novel delivery systems such as extended-release formulations or bio-adhesive gels, ensuring better compliance and outcomes.

The generic drugs segment is projected to register the highest compound annual growth rate CAGR during the forecast period. These drugs, which are bioequivalent to their branded counterparts, offer cost-effective alternatives without compromising on quality or effectiveness. Generic formulations are widely used for common conditions like gingivitis, dental infections, and plaque control, allowing broader adoption among pet owners. The increased regulatory support for the approval of veterinary generics has encouraged pharmaceutical companies to expand their product portfolios in this segment.

The clinical manufacturing segment led the market by securing the highest revenue share. This stage is critical for evaluating the safety, efficacy, and dosage of new formulations, including advanced antibiotics, anti-inflammatory agents, or targeted biologics used in oral care for pets. During this phase, the focus is on compliance with Good Manufacturing Practices (GMP), traceability, and precise documentation to meet regulatory requirements before a product can proceed to large-scale manufacturing.

The commercial manufacturing segment is projected to grow at the highest compound annual growth rate (CAGR) throughout the forecast period. In this phase, veterinary dental drugs are produced in larger batches to meet market demand and are packaged and distributed for clinical and retail use. Commercial manufacturing incorporates automated systems, quality assurance protocols, and robust supply chain logistics to ensure timely delivery of products to veterinary clinics, hospitals, and pharmacies.

The oncology segment held the largest share of market revenue, leading all other segments. In veterinary oncology, dental health plays a crucial role, particularly when oral tumors or cancer-related lesions develop in the gums, tongue, or jaw. Early detection of oral cancers is vital, as these conditions can interfere with a pet’s ability to eat, groom, and maintain overall well-being.

The similarly, while glaucoma is primarily an ocular condition, its management often requires systemic treatments that may intersect with oral health considerations. Certain medications used to treat glaucoma in animals can have oral side effects or interact with dental drugs, necessitating coordinated care between veterinary ophthalmologists and dental specialists. Additionally, systemic inflammation or immune responses linked to oral infections may exacerbate ocular diseases, including glaucoma, underlining the importance of maintaining oral hygiene in affected animals.

By Product

By Synthesis

By Drug

By Workflow

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others