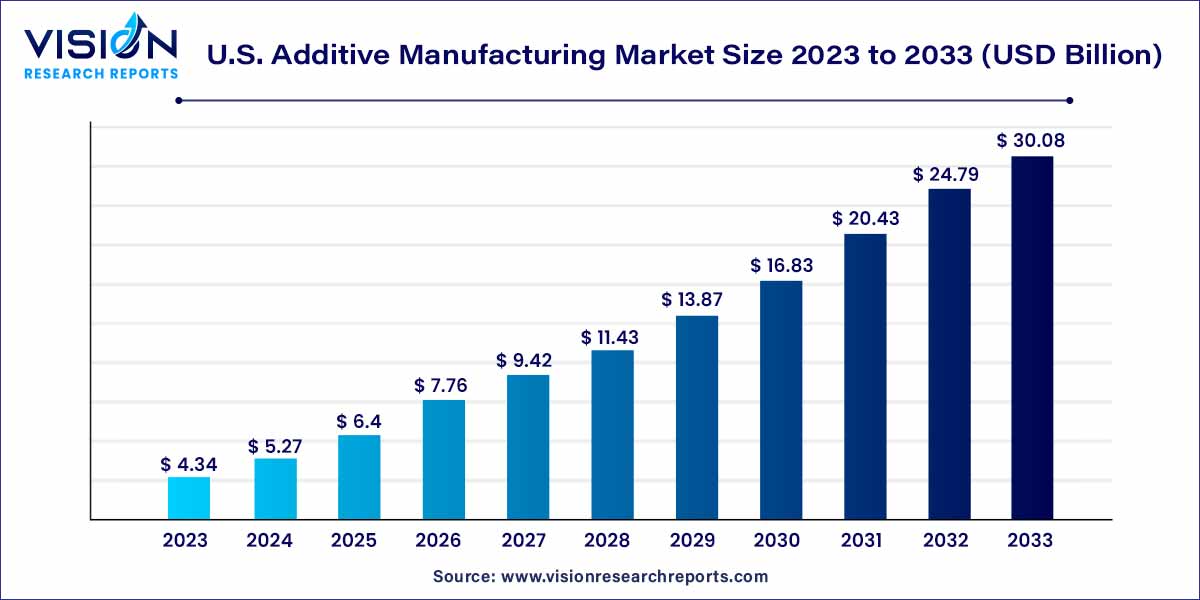

The U.S. additive manufacturing market size was estimated at around USD 4.34 billion in 2023 and it is projected to hit around USD 30.08 billion by 2033, growing at a CAGR of 21.35% from 2024 to 2033.

The U.S. additive manufacturing (AM) market has emerged as a dynamic and transformative force within the manufacturing landscape. Also known as 3D printing, additive manufacturing has evolved from a niche technology to a key driver of innovation across various industries. This overview provides insights into the current state, key trends, and factors influencing the growth of the U.S. additive manufacturing market.

The growth of the U.S. additive manufacturing market can be attributed to several key factors propelling the industry forward. Technological advancements play a pivotal role, with continuous innovations enhancing precision, speed, and scalability of 3D printing processes. The expansive development of new materials compatible with additive manufacturing, including metals, polymers, ceramics, and composites, contributes significantly to the versatility and applicability of the technology across various sectors. The cost efficiency associated with additive manufacturing, reducing waste and enabling on-demand production, is a driving force for businesses seeking streamlined and economical manufacturing solutions. Rapid prototyping capabilities further accelerate product development cycles, offering a competitive edge in time-to-market strategies. Additionally, the unparalleled design freedom provided by additive manufacturing fosters innovation, allowing the creation of complex geometries and customized products.

| Report Coverage | Details |

| Market Size in 2023 | USD 4.34 billion |

| Revenue Forecast by 2033 | USD 30.08 billion |

| Growth rate from 2024 to 2033 | CAGR of 21.35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

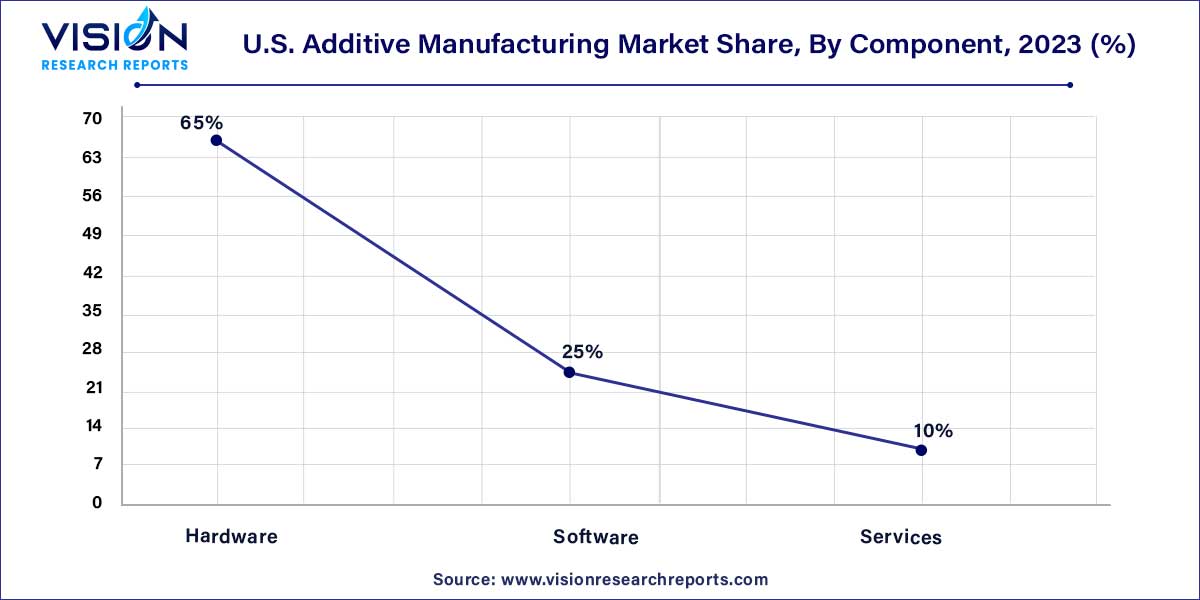

Based on components, the market has been further segmented into hardware, software, and services. The hardware segment led the market with the revenue share of 65% in 2023. The hardware segment has benefitted significantly from the growing necessity of rapid prototyping and advanced manufacturing practices. The expansion of the hardware segment can be primarily attributed to several factors, including swift industrialization, rising adoption of consumer electronic devices, the development of civil infrastructure, accelerated urbanization, and the optimization of labor expenses.

Technological proliferation, growing penetration of rapid 3D printing processes, such as rapid prototyping, and increasing applications across various industry verticals are the factors likely to propel the demand for various AM components. This technology enables the step-by-step production of 3D objects, interconnected through a system that utilizes relevant digital files. Aircraft production indirectly relies on mass 3D printing. 3D printing is faster and cheaper because it is well-equipped to create complex parts. It is often used as a master pattern for urethane casting of large aircraft parts. 3D printed designs are initially used to integrate multiple components into a fluid assembly. Thus, the use of additive 3D printing hardware technologies and 3D printing software in various industrial sectors is expected to boost the growth of the market.

Based on the printer type, the market has been further segmented into industrial and desktop 3D printers. The industrial printer section led the market with the revenue share of 69% in 2023. The higher share of industrial printers can be attributed to the extensive adoption of industrial printers in industries, such as automotive, electronics, aerospace & defense, and healthcare. Prototyping, designing, and tooling are some of the most common industrial applications across these industry verticals. The widespread embrace of additive manufacturing in prototyping, design, and tooling is fueling increased demand within the industrial sector. Consequently, the industrial printers segment is anticipated to maintain its dominance throughout the forecast period.

On the contrary, the utilization of desktop 3D printers was initially confined to hobbyists and small enterprises. However, their application has now expanded to encompass household and domestic functions. In addition, within the education sector, which encompasses schools, educational institutions, and universities, desktop printers are increasingly employed for technical training and research endeavors. Furthermore, small businesses are notably adopting desktop printers and broadening their operational scope to include additive manufacturing and associated services. A noteworthy trend in this regard is the emergence of 'fabshops,' gaining popularity in the United States.

Based on technology, the market has been further segmented into stereolithography, fuse deposition modeling (FDM), direct metal laser sintering (DMLS), selective laser sintering (SLS), inkjet, polyjet, laser metal deposition, electron beam melting (EBM), digital light processing, laminated object manufacturing, and others. Stereolithography segment accounted for the largest share of more than 12% in 2022. At present, the stereolithography technology holds the largest share as it happens to be one of the oldest and most conventional printing technologies. While the benefits and operational simplicity of stereolithography technology are promoting its adoption, progress in alternative technologies and R&D initiatives by industry experts and researchers are creating avenues for a range of other efficient and dependable technologies.

FDM also accounts for a considerable revenue share of nearly 11% in 2023, owing to extensive technology adoption across various 3DP processes. DLP, EBM, inkjet printing, and DMLS are also expected to witness a growing adoption over the forecast period, as these technologies are applicable in specialized additive manufacturing processes. The growing demand for numerous components & systems from aerospace & defense, automotive, and healthcare verticals would open opportunities for adopting these technologies.

Based on software, the market has been further segmented into design software, inspection software, printer software, and scanning software. The design software segment accounted for the largest share of 35% in 2023 and is expected to maintain its dominance over the forecast period. Design software is used to construct the object's designs to be printed, particularly in automotive, aerospace & defense, and construction & engineering verticals. It acts as a bridge between the objects to be printed and the printer's hardware. Demand for scanning software is estimated to grow due to the trend of scanning objects and storing scanned documents.

The segment is also expected to witness rapid growth and generate considerable revenues owing to the rising adoption of scanners. The scanning software segment is projected to grow at the highest CAGR of 21.85% from 2024 to 2033. 3D printing is a complicated process requiring various software to function correctly. As scanning the part that needs to be printed should be accurate up to the millimeter of its size, this software plays a vital role. Various software, such as design, inspection, printer, and scanning, help in solid modeling that generates a lightweight and manifold model. The U.S. is one of the leading creators of the software for additive manufacturing.

Based on application, the market has been further segmented into prototyping, tooling, and functional parts. The prototyping segment led the market with the market share of more than 53% in 2023. In particular, the automotive and aerospace & defense industries leverage prototyping to precisely design & develop parts, components, and intricate systems. This approach allows manufacturers to achieve heightened precision & produce reliable end products. Consequently, the prototyping segment is well-positioned to uphold its market leadership throughout the forecasted duration. Functional components include compact joints and various metallic hardware connecting different parts. Precision and accurate sizing are of utmost importance when engineering machinery and systems.

Thus, the functional application segment is expected to register a CAGR of 21.83% from 2024 to 2033, driven by the rising demand for design & fabrication of these crucial parts. The U.S. is one of the prominent countries to use 3D printing extensively. 3D printing is used in various places, such as education, prototyping & manufacturing, and medicines. The U.S. is utilizing 3D printing in space and the aviation sector as well. For instance, in March 2023, a 3D-printed rocket called Relativity Space Terran 1 was launched from Cape Canaveral Space Force Station in Florida.

Based on verticals, the market has been further segmented into separate verticals for desktop and industrial additive manufacturing. The desktop additive manufacturing vertical comprises educational purposes, fashion & jewelry, objects, dental, food, and others. The verticals considered for industrial 3DP comprise automotive, aerospace & defense, healthcare, consumer electronics, industrial, power & energy, and others. The aerospace & defense, healthcare, and automotive verticals are anticipated to contribute significantly toward the growth of the U.S. industrial additive manufacturing owing to the active adoption of technology in various production processes associated with these verticals. In the healthcare sector, additive manufacturing plays a pivotal role in advancing the development of artificial tissues and muscles that closely mimic natural human tissue, offering promising solutions for replacement surgeries.

These capabilities are poised to stimulate the adoption of 3D printing across the healthcare industry, making a substantial contribution to the growth of the industrial segment. Conversely, the dental, fashion & jewelry, and food sectors are forecasted to make significant contributions to the expansion of the U.S. desktop additive manufacturing market in the foreseeable future. The dental field held a dominant position in 2021 and is projected to maintain its leadership in this segment. Furthermore, the utilization of additive manufacturing in the production of imitation jewelry, miniatures, artistic creations, as well as clothing and apparel, is steadily gaining traction. The automotive industry has witnessed a significant uptick in the adoption of 3D printing technology.

By Component

By Printer Type

By Technology

By Software

By Application

By Vertical

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Vertical Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Additive Manufacturing Market

5.1. COVID-19 Landscape: U.S. Additive Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Additive Manufacturing Market, By Component

8.1. U.S. Additive Manufacturing Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Additive Manufacturing Market, By Printer Type

9.1. U.S. Additive Manufacturing Market, by Printer Type, 2024-2033

9.1.1. Desktop 3D Printer

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Industrial 3D Printer

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Additive Manufacturing Market, By Technology

10.1. U.S. Additive Manufacturing Market, by Technology, 2024-2033

10.1.1. Stereolithography

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Fuse Deposition Modelling (FDM)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Selective Laser Sintering (SLS)

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Direct Metal Laser Sintering (DMLS)

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Polyjet Printing

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Inkjet printing

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Electron Beam Melting (EBM)

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Laser Metal Deposition

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Digital Light Processing

10.1.9.1. Market Revenue and Forecast (2021-2033)

10.1.10. Laminated Object Manufacturing

10.1.10.1. Market Revenue and Forecast (2021-2033)

10.1.11. Others

10.1.11.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Additive Manufacturing Market, By Software

11.1. U.S. Additive Manufacturing Market, by Software, 2024-2033

11.1.1. Design Software

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Inspection Software

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Printer Software

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Scanning Software

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Additive Manufacturing Market, By Application

12.1. U.S. Additive Manufacturing Market, by Application, 2024-2033

12.1.1. Prototyping

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Tooling

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Functional Parts

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Additive Manufacturing Market, By Vertical

13.1. U.S. Additive Manufacturing Market, by Vertical, 2024-2033

13.1.1. Industrial Additive Manufacturing

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Desktop Additive Manufacturing

13.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 14. U.S. Additive Manufacturing Market, Regional Estimates and Trend Forecast

14.1. U.S.

14.1.1. Market Revenue and Forecast, by Component (2021-2033)

14.1.2. Market Revenue and Forecast, by Printer Type (2021-2033)

14.1.3. Market Revenue and Forecast, by Technology (2021-2033)

14.1.4. Market Revenue and Forecast, by Software (2021-2033)

14.1.5. Market Revenue and Forecast, by Application (2021-2033)

14.1.6. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 15. Company Profiles

15.1. 3D Systems, Inc.

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Stratasys Ltd.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Arcam AB

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. GE Additive

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. HP Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Materialise NV

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Proto Labs, Inc.

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. EnvisionTEC, Inc.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others