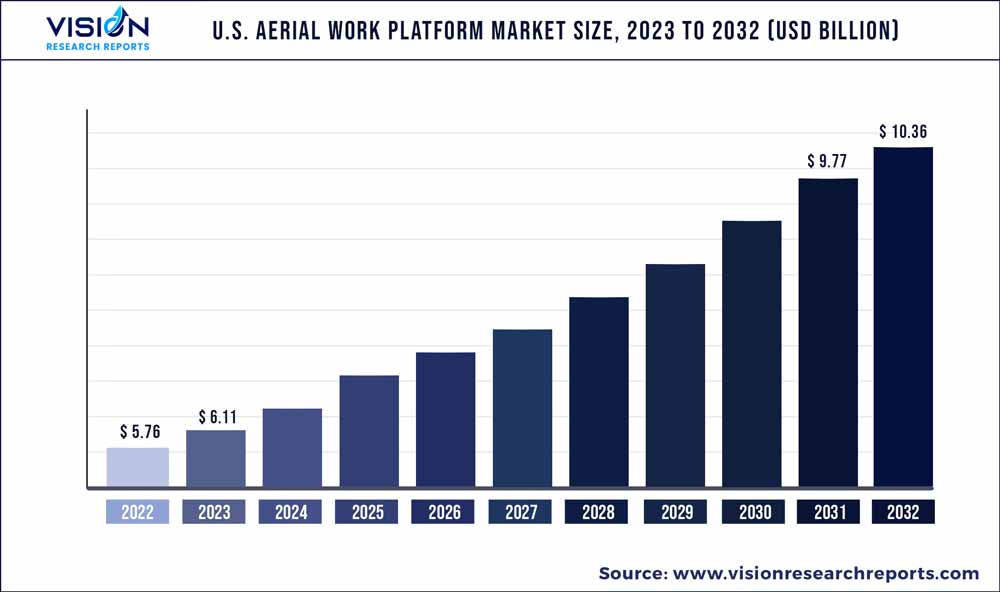

The U.S. aerial work platform market was estimated at USD 5.76 billion in 2022 and it is expected to surpass around USD 10.36 billion by 2032, poised to grow at a CAGR of 6.05% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Aerial Work Platform Market

| Report Coverage | Details |

| Market Size in 2022 | USD 5.76 billion |

| Revenue Forecast by 2032 | USD 10.36 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.05% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | AICHI CORPORATION; Advance Lifts, Inc.; Altec Industries; Bronto Skylift; DINOLIFT OY; EdmoLift AB; HAULOTTE GROUP JLG Industries; Linamar Corporation; MEC; RUNSHARE Heavy Industry Company, Ltd; Tadano Ltd.; Terex Corporation; WIESE USA; Zhejiang Dingli Machinery Co., Ltd. (DINGLI) |

The primary factors responsible for driving the growth of the market are a noticeable increase in construction activities coupled with increasing logistics activities in the country. With modern architecture gaining popularity, the demand for structural glass walls is increasing as it creates a large or long elevation of glazing. Contractors are extensively inclined towards the deployment of aerial work platform (AWP) at the construction sites as they aid in the easy installation of glass curtain walls, shorten the construction period, and eliminate the risk associated with labor working at high altitudes.

Likewise, aerial work platform supports indoor construction operations such as the installation of fire extinguishers, water pipelines, electric connections, etc., which is another factor expected to increase its demand in the U.S. market. The demand for aerial work platform is increasing as it provides better operational efficiency, easy maneuverability, and time-saving, which is another factor expected to positively impact the growth of the market. Also, aerial work platforms tend to be an asset to the building service owners as they aid in repairing ductwork and provide access to the high-up wiring, which are further anticipated to drive the demand for AWP.

Likewise, aerial work platforms are widely deployed at job locations, such as shipbuilding and aircraft repair, as they require machines with outstanding air reach capabilities to perform operations and also carry heavy equipment to work at the job location. Thus, the demand for aerial work platforms such as articulating boom lifts and telescopic aerial lifts from Maintenance Repair & Operations (MRO) industry is increasing as they aid in enhancing operational efficiency, which is another aspect anticipated to drive the growth of the industry.

Moreover, stringent government regulation pertaining to the environment is resulting in manufacturers opting for electric lift machines that are eco-friendly and provide better functionality which are important factors anticipated to drive the growth of the aerial work platform market. For instance, in May 2021, MEC Aerial Work Platforms, a U.S.-based lift vehicle manufacturer, announced the launch of new MEC Mast Electric (MME) Series product line of vertical mast lifts. The introduction of a new product line is expected to help the company enhance its product portfolio and enhance its customer base.

Contractor and service business owners shift towards renting lift machines is a major factor expected to hamper the growth of the U.S. aerial work platform (AWP) market. Renting the aerial work platform lowers the cost associated with vehicle ownership and vehicle maintenance. Also, renting provided access to aerial work platforms that have advanced features, better safety options, and better platform elevation without a heavy investment in the equipment.

Product Insights

Based on the product, the scissor lift segment accounted for the largest revenue share of over 47% in 2022 and is anticipated to register the highest CAGR over the forecast period. The segment growth can be attributed to the exceptional operational efficiency of scissor lifts, due to their compact design, and ability to execute quick-loading tasks. The construction and maintenance industries are experiencing a surge in activity, resulting in higher demand for scissor lifts in various tasks, such as building maintenance, electrical work, and installation. The boom lifts segment is expected to grow at a significant CAGR over the forecast period.

The maintenance and repair work performed at elevated heights in industrial facilities, such as manufacturing plants, warehouses, and power stations, necessitates reliable equipment. With ongoing advancements in the industry, including improved reach, lifting capacity, and the rising popularity of electric and hybrid models for eco-friendly operations, the future of boom lifts in the U.S. AWP industry looks extremely optimistic. Boom lifts provide a secure and effective means for technicians and workers to access and maintain equipment, machinery, and infrastructure. The increasing focus on proactive maintenance and compliance with safety regulations is driving the demand for the segment in the industrial sector.

Propulsion Type Insights

Based on the propulsion type, the ICE segment accounted for over 64% of the revenue share in 2022. The segment growth is anticipated due to increasing demand from the construction sector for heavy-duty applications. ICE-powered aerial work platforms can withstand demanding loading conditions, allowing them to reach greater heights and carry heavier loads. The electric segment is expected to register the highest CAGR over the forecast period.

The growth of electric aerial work platforms is attributed to stringent government regulations related to the environment. The electric lifts are specifically designed to be compact, which makes them well-suited for warehouse operations that involve navigating narrow aisles and confined spaces. The increasing emphasis on sustainability and environmental awareness has resulted in a higher demand for electric AWPs, as they offer emission-free operations, thereby reducing carbon footprint and noise pollution.

Lifting Height Insights

Based on the lifting height, the 21-50 feet segment accounted for the largest market share of over 47% in 2022 and is expected to register the highest CAGR over the forecast period. These platforms offer a secure and dependable workspace that boosts efficiency and reduces potential hazards. 21 to 50 feet in height provides an optimal range for a diverse range of tasks. They can be utilized both indoors and outdoors, catering to the needs of industries such as construction, manufacturing, warehousing, telecommunications, and entertainment. The less than 20 ft segment is expected to grow at a significant CAGR over the forecast period.

Versatile machines with reduced lifting heights are highly adaptable and find extensive application in various fields. Industries such as construction, maintenance, and warehousing, which often require limited vertical reach, are witnessing a rising demand for compact and versatile lifting solutions. These AWPs serve multiple sectors, including construction, maintenance, electrical work, HVAC installations, and others, due to their flexibility. They enable workers to efficiently access elevated areas for tasks such as repairs, installations, inspections, and maintenance. By utilizing a single AWP for multiple purposes, productivity is enhanced, and the need for additional equipment is minimized.

Application Insights

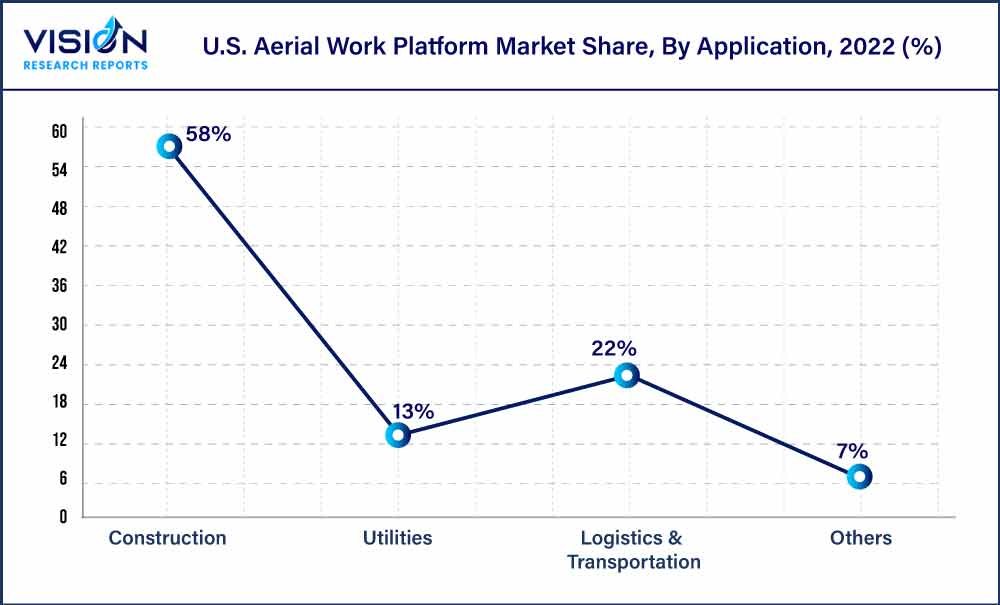

Based on application, the construction segment accounted for the largest market share of nearly 58% in 2022 and is expected to maintain its dominance over the forecast period. Construction sites require workers to operate at elevated heights and often involve rough terrain. These sites are susceptible to accidents, particularly those involving workers working at towering heights. Aerial work platforms provide enhanced safety and flexibility for workers and operators compared to traditional methods. With the growing emphasis on sustainability and environmental awareness, electric-powered aerial work platforms have been integrated, resulting in reduced emissions and noise pollution on construction sites.

In addition, the ongoing investments in infrastructure development, including road construction, bridge repairs, and commercial building projects, have greatly contributed to the widespread adoption of aerial work platforms. The utility segment is projected to grow at a significant CAGR over the forecast period. The rising demand for maintenance, repair, and construction tasks in power and telecommunications infrastructure is a significant driving force. This demand requires effective and secure access to elevated work areas.

Furthermore, the ongoing modernization and expansion of utility networks nationwide contribute to this need. Moreover, technological progress has led to the creation of more advanced and adaptable aerial work platforms. These AWPs offer enhanced safety features, improved maneuverability, and greater operational efficiency. These factors, along with the growing focus on worker safety and compliance, present multiple opportunities for utility companies to optimize their operational capabilities, boost productivity, and achieve cost savings in their field operations by leveraging AWPs.

U.S. Aerial Work Platform Market Segmentations:

By Product

By Propulsion Type

By Lifting Height

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Aerial Work Platform Market

5.1. COVID-19 Landscape: U.S. Aerial Work Platform Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Aerial Work Platform Market, By Product

8.1. U.S. Aerial Work Platform Market, by Product, 2023-2032

8.1.1. Boom Lifts

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Scissor Lifts

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Vertical Lift

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Aerial Work Platform Market, By Propulsion Type

9.1. U.S. Aerial Work Platform Market, by Propulsion Type, 2023-2032

9.1.1. ICE

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Electric

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Aerial Work Platform Market, By Lifting Height

10.1. U.S. Aerial Work Platform Market, by Lifting Height, 2023-2032

10.1.1. Less than 20 ft

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. 21 - 50 ft

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. More than 51 ft

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Aerial Work Platform Market, By Application

11.1. U.S. Aerial Work Platform Market, by Application, 2023-2032

11.1.1. Construction

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Utilities

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Logistics & Transportation

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Aerial Work Platform Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Product (2020-2032)

12.1.2. Market Revenue and Forecast, by Propulsion Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Lifting Height (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. AICHI CORPORATION

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Advance Lifts, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Altec Industries

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Bronto Skylift

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. DINOLIFT OY

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. EdmoLift AB

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. HAULOTTE GROUP JLG Industries

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Linamar Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. MEC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. RUNSHARE Heavy Industry Company, Ltd

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others