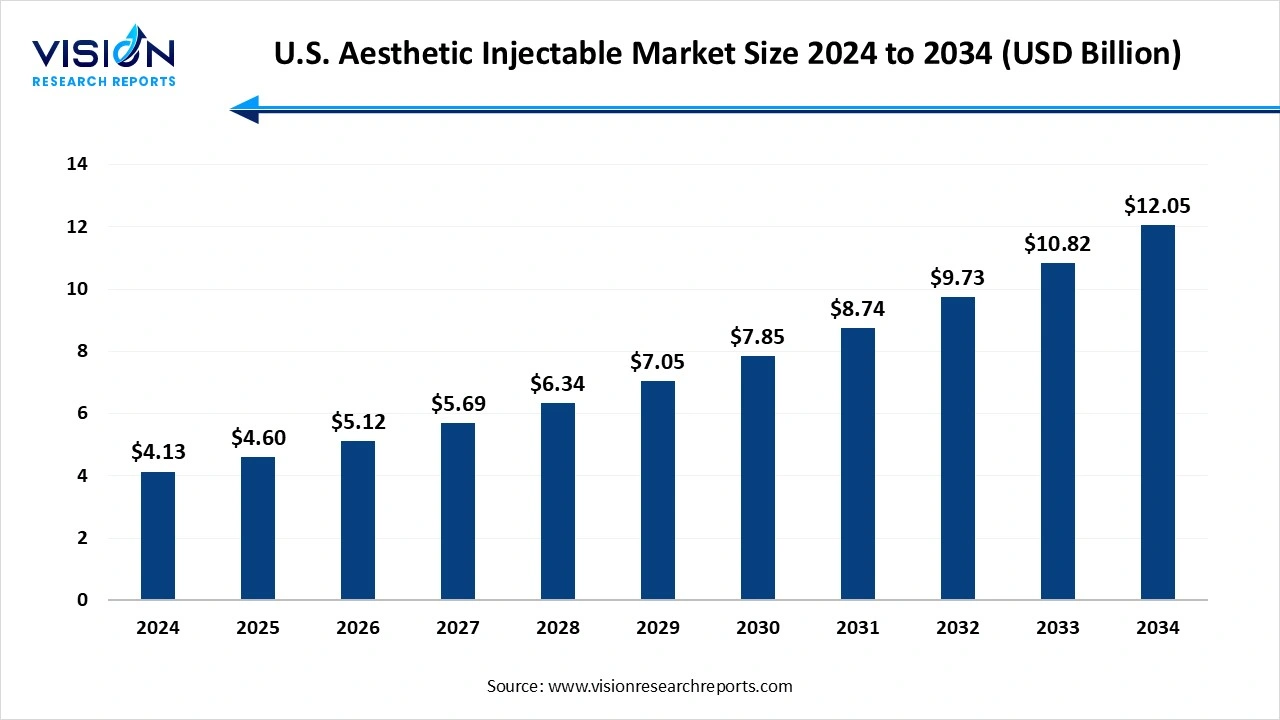

The U.S. aesthetic injectable market size was reached at USD 4.13 billion in 2024 and is expected to hit around USD 12.05 billion by 2034, growing at a CAGR of 11.30% from 2025 to 2034.

The U.S. aesthetic injectable market is experiencing robust growth, driven by increasing consumer demand for minimally invasive cosmetic procedures. These injectables, including botulinum toxin and dermal fillers, are widely used to reduce wrinkles, restore facial volume, and enhance overall appearance without the need for surgery. Rising awareness around personal aesthetics, a growing aging population seeking youthful looks, and advancements in product formulations have significantly boosted the market. Additionally, social media influence and a shift toward preventive aesthetic treatments among younger demographics are contributing to market expansion.

The U.S. aesthetic injectable market is being propelled by several key growth factors, most notably the increasing demand for non-surgical cosmetic treatments. Consumers are increasingly opting for injectables like botulinum toxins and dermal fillers due to their convenience, quick recovery times, and noticeable results without the risks associated with surgery. The aging population, particularly those between 35 and 60 years of age, is a major demographic driving the market as they seek to maintain a youthful appearance.

Another significant growth factor is the continuous advancement in injectable technologies and product innovations. Enhanced formulations with longer-lasting effects, improved safety profiles, and natural-looking results have encouraged more consumers to try these treatments. Moreover, the increasing availability of skilled professionals, growing acceptance of cosmetic enhancements, and the influence of social media and celebrity culture have further normalized aesthetic treatments in the U.S.

The U.S. aesthetic injectable market is witnessing several emerging trends that reflect changing consumer preferences and industry advancements. One notable trend is the rising popularity of preventive treatments, especially among younger consumers in their 20s and 30s. Instead of waiting for visible signs of aging, this demographic is increasingly using neuromodulators like Botox as a preemptive solution to delay the formation of wrinkles and fine lines. This shift toward early intervention is expanding the target audience for aesthetic injectables and contributing to long-term customer retention.

Another significant trend is the growing demand for natural-looking results. Today’s consumers prefer subtle enhancements that maintain their facial expressions and uniqueness rather than dramatic changes. This has led to increased use of smaller doses (a technique often referred to as "Baby Botox") and customized filler treatments designed to harmonize with individual facial structures.

There is a noticeable rise in male clientele seeking aesthetic injectables, challenging the long-held notion that these procedures are primarily for women. Men are increasingly interested in achieving a refreshed, youthful look without appearing "done," prompting providers to adapt techniques to suit masculine facial features. This diversification of the consumer base is reshaping marketing strategies and expanding the scope of the market.

The U.S. aesthetic injectable market, despite its rapid growth, faces several key challenges that could impact its trajectory. One of the primary concerns is regulatory scrutiny and safety issues. Since aesthetic injectables directly affect a person’s appearance and health, they are subject to strict FDA regulations. Any adverse effects, counterfeit products, or unapproved procedures can lead to legal complications, recalls, or even consumer mistrust.

Another major challenge is the high cost and limited insurance coverage of aesthetic procedures. Most injectable treatments are considered elective and cosmetic, meaning they are not covered by health insurance. This limits accessibility for a broader population and confines the market to high-income groups. Additionally, the cost of maintaining results over time since treatments often require regular follow-ups can be a barrier for repeat usage among price-sensitive consumers.

Intense market competition and commoditization are pressing issues. As the number of aesthetic clinics, med spas, and practitioners rises, differentiation becomes harder, leading to pricing pressures and the risk of diminished quality of service. Smaller or newer providers may struggle to compete with established brands that have strong reputations and loyal clientele.

The botulinum toxin (Botox) segment accounted for the largest market share of 46% in 2024. These neuromodulators are widely used to treat forehead lines, frown lines, and crow’s feet, offering visible results within days and lasting effects for several months. The growing demand for non-invasive anti-aging solutions has made Botox treatments a routine part of cosmetic care for a broad range of consumers.

The hyaluronic acid (HA) segment is projected to witness the fastest CAGR during the forecast period, fueled by its broad applicability, excellent biocompatibility, and ability to deliver immediate visible outcomes. HA is a naturally occurring substance in the body, primarily known for its moisture-retaining properties, making it a safe and effective material for cosmetic enhancements. These fillers are used to add volume, contour facial features, and smooth out deeper wrinkles, with applications in areas such as the cheeks, lips, nasolabial folds, and under-eye hollows. One of the key advantages of HA fillers is their reversibility, offering a layer of safety for patients concerned about the outcome. The market has also benefited from advancements in filler technology, such as improved cross-linking techniques that provide longer-lasting and more natural-looking results.

The facial line correction emerged as the dominant application segment, capturing the largest market share of 34% and reinforcing its leadership in the industry in 2024. Consumers are increasingly seeking non-surgical solutions to reduce the appearance of dynamic and static facial lines, such as forehead wrinkles, glabellar lines (frown lines), and crow’s feet. Aesthetic injectables, particularly botulinum toxins and dermal fillers, offer a minimally invasive and effective method to smooth out these lines, delivering natural-looking results with minimal downtime.

The growth of the facial line correction segment is further supported by technological advancements in injectable formulations and techniques that enhance safety, precision, and longevity of results. Additionally, the increasing number of trained aesthetic professionals and expanding access to services across medspas, dermatology clinics, and plastic surgery centers have made these treatments more mainstream and accessible.

The medical spas captured the largest market share at 48% in 2024, highlighting their expanding role as the main hub for non-surgical cosmetic treatments. These facilities combine medical expertise with a spa-like atmosphere, making them a preferred choice for individuals seeking non-invasive aesthetic enhancements. As the demand for facial rejuvenation and minimally invasive procedures grows, medical spas are capitalizing on their ability to offer tailored treatments using neurotoxins and dermal fillers without the clinical feel of traditional medical offices.

The rapid growth of medical spas in the U.S. is driven by increasing consumer demand for minimally invasive procedures that provide quick results with little to no downtime. As awareness about aesthetic injectables rises, medical spas are enhancing their service offerings, employing trained medical professionals, and adopting advanced technologies to deliver safe and effective treatments.

By Product

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others