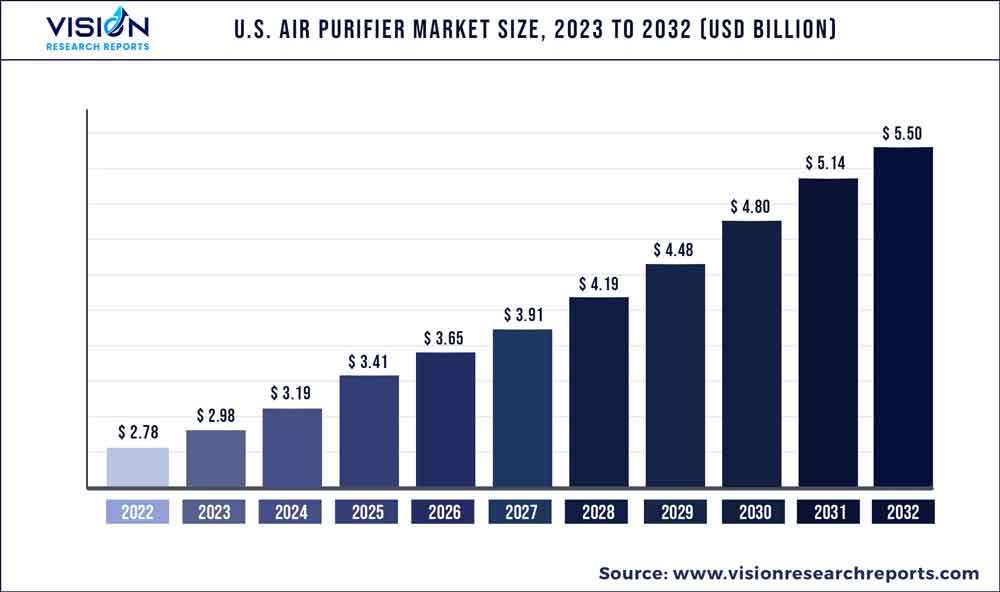

The U.S. air purifier market size was estimated at around USD 2.78 billion in 2022 and it is projected to hit around USD 5.5 billion by 2032, growing at a CAGR of 7.06% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Air Purifier Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.78 billion |

| Revenue Forecast by 2032 | USD 5.5 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.06% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Beyond by Aerus; Arovast Corporation (Levoit); KOIOS; Rabbit Air; WYND TECHNOLOGIES, INC; Oransi; Pure Enrichment; Amaircare; Blueair; Airpura Industries; IQAir; Honeywell International Inc.; LG Electronics |

Rising pollution levels and the frequency of airborne ailments in the country have increased product demand. This has also increased the production and sale of home products such as cleaning appliances, air purifiers, water filtration devices, and kitchen appliances. Moreover, growing health awareness has also contributed to increasing product sales in the country.

The U.S. Environmental Protection Agency (U.S. EPA) estimates that the average American spends about 90 % of their time indoors. Over the past few decades, the concentrations of certain pollutants found indoors have increased as a result of a number of factors, including the increased use of energy-efficient building construction and synthetic materials. Other sources of indoor pollution are the release of asbestos, formaldehyde, and radon, biological pollutants from coatings, paints, carpets, and damp environments among others. Using an air purifier, particularly one with a high-efficiency particulate air filter, which, according to the EPA, eliminates over 99.97% of particulate matter from the air.

Air quality legislation, such as the United States Environmental Protection Agency's (U.S. EPA’s) establishment of national ambient air quality standards, and U.S. Clean Air Act comprehensive emission reduction programs are projected to create new opportunities for air purifier manufacturers in the U.S. The creation and execution of regulatory measures, the organization of air quality management programs to raise public awareness, and the rising number of installations of extensive ambient air quality monitoring systems are all likely to drive product demand in the U.S. over the coming years.

The U.S. states such as California and New Jersey have regulations for indoor air quality. For instance, the New Jersey Indoor Air Quality standard sets standards related to indoor air quality during working hours in public employee-occupied buildings. Furthermore, the California state-level indoor air quality program focuses on detecting and researching public health issues linked with interior settings, as well as promoting healthy indoor environments throughout the state.

The growth of the air purifier market in the U.S. can be attributed to the consumer’s high disposable income, the large-scale adoption of air purifiers, and the presence of key players in the U.S. Moreover, increasing industrial output and rising air pollution facilitating the requirement for air purifiers, along with the expansion of product portfolios of key players such as IQAir, Honeywell International Inc., and LG Electronics, are anticipated to contribute to the growth of the air purifier market in the U.S. over the forecast period.

Air purifier manufacturers in the U.S. sell their products through various e-commerce retailers such as Amazon.com and eBay. Owing to the growing popularity of e-commerce, major retailers such as Walmart, Best Buy, The Home Depot, Inc., and Target Corporation, among others, also operate e-commerce websites through which consumers can purchase air purifiers. Apart from these major e-commerce websites, independent internet sales companies also sell air purifiers in the country. For instance, Purifier Nation operates an e-commerce website purifiernation.com through which air purifiers from Airpura, AllerAir, and Austin Air are sold.

Manufacturers in the market also offer air purifiers through white labeling. White labeling is when the manufacturer removes its brand and logo from the end product and instead allows the use of branding that is requested by the purchaser. For instance, LakeAir, a U.S.-based air purifier manufacturer, offers its products in the white label market.

Technology Insights

HEPA led the market and accounted for 40.13% of the revenue share in 2022. These are a type of extended surface mechanical filter, majorly manufactured using submicron glass fibers. The texture of these filters is like blotter paper. HEPA filter’s enormous surface areas aid in the removal of 99.7% of particles larger than or equal to 0.3 microns. It is also highly effective at filtering both minute and large particles.

Activated carbon is expected to be the fastest-growing segment with a CAGR of 7.92% during the forecast period. Activated carbon or activated charcoal filters comprises small pieces of carbon in granular form or powdered blocks, specially treated with oxygen, to initiate the pores of carbon atoms. This aids in increasing the carbon surface area and making it porous, thereby increasing its capability to absorb airborne particles. These filters are used for odors from cooking and absorbing gases, smoke mold, pets, and chemicals.

Ionic filters, also known as air ionizers or ion generators, use anions (negative ions) to collect airborne particles. Ionic filters emit a cloud of anions with the help of electricity, which, when charged, attracts airborne particles so that they fall on the mechanical air filter, ceiling, nearest wall, or a charged collector plate.

Ionic filters can reduce the particulate size to around 0.1 microns. Only the filters having ozone emission concentration less than 0.05 ppm (parts per million) as per the standard of the California Air Resources Board (CARB) are to be used in air purifiers. Filters not conforming to the aforementioned standards are considered dangerous to human health.

Application Insights

The commercial application segment led the market and accounted for 57.24% of the revenue share in 2022. The segment is also expected to witness the fastest CAGR of 8.72% over the forecast period. The product has commercial uses in places including offices, hospitals, schools, hotels, conference centers, movie theatres, malls, and other leisure facilities. Since poor indoor air quality can reduce employee productivity, air purifiers are installed in offices to preserve the purity of the air there.

Air purifiers are used in dental & medical laboratories, veterinary hospitals, boarding kennels, clinics, animal kennels, and hospitals for removing allergens, airborne pathogens, and odor from the air as well as maintaining indoor air quality for patients as well as employees working in these facilities. The purifiers are used in patient care rooms in hospitals for controlling infectious and communicable diseases as well as to remove airborne pathogens, bacteria, and allergens to maintain a clean environment.

Residential applications include small and large homes and residential properties. Ambient air quality has been deteriorating over the past decades owing to the growing population and urbanization. This, in turn, has affected the indoor air quality owing to dust, gases, and other contaminants entering the indoor premises. The growing demand for clean air has resulted in augmenting adoption of air purifiers.

Air purifiers are used in pharmaceutical industries for the containment of chemical compounds formed during the production and development of pharmaceutical drugs. In the food & beverage industry, air purifiers with HEPA filters are responsible for maintaining cleanroom conditions for the processing and packaging of food-grade products as well as during the bottling process of various alcoholic and non-alcoholic beverages.

U.S. Air Purifier Market Segmentations:

By Technology

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Air Purifier Market

5.1. COVID-19 Landscape: U.S. Air Purifier Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Air Purifier Market, By Technology

8.1. U.S. Air Purifier Market, by Technology, 2023-2032

8.1.1. HEPA

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Activated Carbon

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Ionic Filters

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Air Purifier Market, By Application

9.1. U.S. Air Purifier Market, by Application, 2023-2032

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Commercial

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Air Purifier Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Beyond by Aerus

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Arovast Corporation (Levoit)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. KOIOS

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Rabbit Air

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. WYND TECHNOLOGIES, INC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Oransi

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Pure Enrichment

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Amaircare

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Blueair

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Airpura Industries

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others