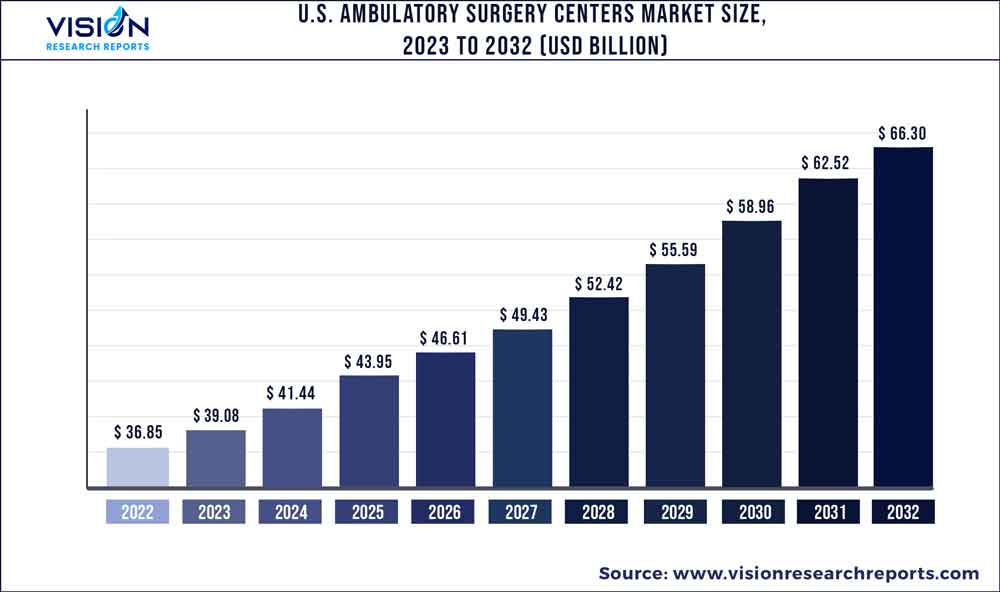

The U.S. ambulatory surgery centers market was estimated at USD 36.85 billion in 2022 and it is expected to surpass around USD 66.3 billion by 2032, poised to grow at a CAGR of 6.05% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Ambulatory Surgery Centers Market

| Report Coverage | Details |

| Market Size in 2022 | USD 36.85 billion |

| Revenue Forecast by 2032 | USD 66.3 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.05% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Envision Healthcare Corporation; Tenet Healthcare Corporation; Mednax Services, Inc.; TeamHealth; UnitedHealth Group; Quorum Health; Surgery Partners; Community Health Systems, Inc.; SurgCenter; Prospect Medical Systems; Edward-Elmhurst Health |

Market growth can be attributed to rising investment in ambulatory surgery centers (ASC) and favorable reimbursement for services at ambulatory surgery centers in the U.S. In January 2022, the CMS changed eligibility for Medicare reimbursement by removing the criteria of compulsory inpatient procedures at ambulatory surgery centers, allowing reimbursement for outpatient services. Favorable reimbursement for surgical procedures is driving market growth.

Ambulatory services have positively impacted the U.S. healthcare system, making care more accessible, efficient, and cost-effective for patients and providers alike. The number of inpatient admissions has significantly decreased in the past few years due to the shift of procedures toward ASCs. In the U .S., more than 65% of surgeries are performed in ASCs. This is primarily due to high inpatient hospitalization costs and the rise in adoption of advanced technologies by ASCs, enabling rapid and cost-effective treatment provision. Growing pressure from payers and Medicare has also increased the number of people opting for diagnostic tests in nearby ambulatory community care units, not city hospitals.

More people have been getting outpatient surgeries at Ambulatory Surgery Centers (ASCs) in recent years. These centers are popular because they cost less than other places for orthopedic surgeries. A study published in March 2022 found that between 2013 and 2018, the number of orthopedic surgeries performed at ASCs increased from 31% to 34%. The study also showed that there was a small yearly increase in the use of ASCs for specific surgeries, and they are becoming a more popular choice for outpatient surgeries, especially for outpatient surgical procedures.

In the last ten years, there has been a growing demand for ambulatory surgery centers, particularly multispecialty centers. This is partly due to the increasing elderly population, which may require more surgical procedures. A recent report by OR Manager, based on CMS statistics from January 2020, found that 57 million surgical procedures were performed in the U.S. that year. Less than 20% of these procedures were done in outpatient hospital facilities, indicating a shift in demand toward ambulatory surgery centers.

The COVID-19 pandemic had a high impact on the U.S. ambulatory surgery market. The U.S. government introduced guidelines for ambulatory surgery centers in response to the pandemic. In March 2020 , the Center for Medicare & Medicaid Services recommended complete halts on nonessential surgery. This resulted in huge financial losses for ambulatory surgery centers, as the majority of revenue-generating surgeries performed at these centers were non-essential. However, there was a positive impact on the demand for ambulatory surgery centers. Patients preferred ambulatory surgery centers due to the lower risk of infection and lower surgery costs than hospitals.

Specialty Insights

Based on specialty, the market for U.S. ambulatory surgery center has been segmented into orthopedics, pain management/spinal injections, gastroenterology, ophthalmology, plastic surgery, otolaryngology, obstetrics/gynecology, dental, podiatry, and others. The orthopedics segment accounted for the largest market share of 27.42% in 2022. This can be attributed to the improving diagnostic methods & imaging technologies in orthopedic surgeries and constant developments by the market players in this segment.

In February 2023, Spire Orthopedic Partners entered into a partnership agreement with the Orthopedic Associates of Dutchess County, making Spire one of the biggest orthopedic platforms in the U.S. This would help the company better serve the existing patients and meet the growing demand.

The otolaryngology segment is expected to witness the fastest growth during the forecast period, owing to patients' increasing adoption of ASCs for their Ear, Nose, and Throat (ENT) surgery. In the U.S., around 9% of the total otolaryngology cases are performed in ASCs. Thus, an increasing number of patients with Otolaryngology is anticipated to drive market growth.

Ownership Insights

Based on ownership, the U.S. ambulatory surgery center market has been segmented into physician-owned, hospital-owned, and corporate-owned. The physician-owned segment accounted for the largest market share of 62.23% in 2022. This can be attributed to its advantages, such as exclusively focusing on a small number of procedures in a single setting and the capability to bring concerns directly to the physicians, who have proper knowledge about every patient’s case.

Furthermore, it offers maximum professional control over the clinical setting and the standard of patient care. Some of these factors are responsible for contributing to the rise in patient footfall toward physician-owned ambulatory surgical centers for performing their procedures, thereby driving the market growth.

The hospital-owned segment is expected to witness the fastest growth during the forecast period, owing to the migration of patients from inpatient hospital settings to hospital-owned ASCs. Furthermore, strategic initiatives undertaken by key players increase their market share by acquiring physician offices and outpatient facilities. For instance, In February 2022 , Mayo Clinic announced a USD 432 million expansion in Jacksonville, Florida, which will upgrade an existing facility with 121 inpatient beds. This investment is expected to drive market growth.

Center Type Insights

The single-specialty segment accounted for the largest market share of 61.84% in 2022. This can be attributed to the presence of a large number of single-specialty ASCs in the U.S. According to the Report to the Congress: Medicare Payment Policy, the number of single-specialty ambulatory surgical centers in the U.S. was more than 2,890 in 2017. They offer patients a more convenient and cost-effective alternative to hospital-based care, and provide more specialized care as they focus exclusively on one type of surgery.

Surgeries performed in single-specialty ASCs include cataract surgery, hernia repair, joint replacements, colonoscopies, and other minimally invasive procedures. These facilities must comply with strict regulations and standards for patient safety and quality of care. Moreover, these centers are likely to have a high reimbursement per procedure.

The multi-specialty segment is expected to witness the fastest growth during the forecast period, owing to a comprehensive and patient-centered approach to surgical care that provides a range of services under one roof and helps streamline patients' healthcare experiences. Unlike single-specialty ASCs , a multi-specialty center has 50 to 100 surgeons. Thus, the benefits associated with multi-specialty ASCs are expected to drive market growth.

U.S. Ambulatory Surgery Centers Market Segmentations:

By Specialty

By Ownership

By Center Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Specialty Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Ambulatory Surgery Centers Market

5.1. COVID-19 Landscape: U.S. Ambulatory Surgery Centers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Ambulatory Surgery Centers Market, By Specialty

8.1. U.S. Ambulatory Surgery Centers Market, by Specialty, 2023-2032

8.1.1 Orthopedics

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Pain Management/Spinal Injections

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Gastroenterology

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Ophthalmology

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Plastic Surgery

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Otolaryngology

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Obstetrics/Gynecology

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Dental

8.1.8.1. Market Revenue and Forecast (2020-2032)

8.1.9. Podiatry

8.1.9.1. Market Revenue and Forecast (2020-2032)

8.1.10. Others

8.1.10.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Ambulatory Surgery Centers Market, By Ownership

9.1. U.S. Ambulatory Surgery Centers Market, by Ownership, 2023-2032

9.1.1. Physician Owned

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Hospital Owned

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Corporate Owned

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Ambulatory Surgery Centers Market, By Center Type

10.1. U.S. Ambulatory Surgery Centers Market, by Center Type, 2023-2032

10.1.1. Single-Specialty

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Multi-Specialty

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Ambulatory Surgery Centers Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Specialty (2020-2032)

11.1.2. Market Revenue and Forecast, by Ownership (2020-2032)

11.1.3. Market Revenue and Forecast, by Center Type (2020-2032)

Chapter 12. Company Profiles

12.1. Envision Healthcare Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Tenet Healthcare Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Mednax Services, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. TeamHealth

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. UnitedHealth Group

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Quorum Health

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Surgery Partners

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Community Health Systems, Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SurgCenter

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Prospect Medical Systems

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others