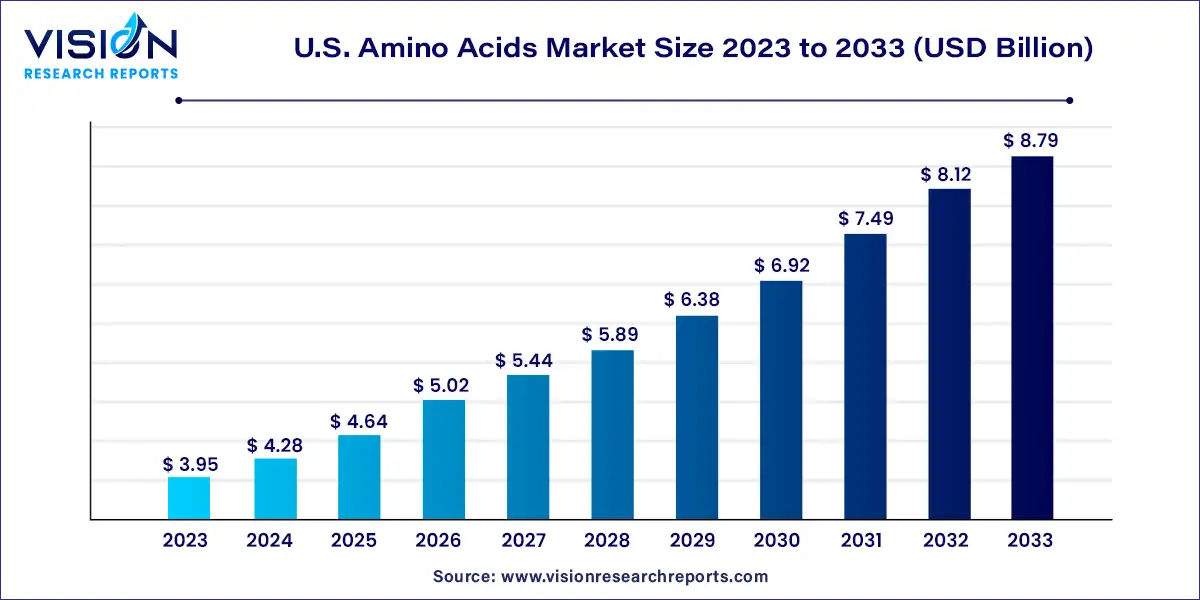

The U.S. amino acids market size was estimated at around USD 3.95 billion in 2023 and it is projected to hit around USD 8.79 billion by 2033, growing at a CAGR of 8.33% from 2024 to 2033. The U.S. amino acids market is driven by various factors such as increasing demand from the food and beverage industry, growing awareness regarding health and fitness, and the expanding application scope in pharmaceuticals and animal feed sectors.

The growth of the U.S. amino acids market is propelled by several key factors. Firstly, increasing consumer awareness regarding health and wellness has led to a rising demand for protein-rich diets, driving the consumption of amino acids as dietary supplements and functional ingredients in food and beverage products. Secondly, the expanding application of amino acids in the pharmaceutical industry for drug formulations, owing to their therapeutic properties, contributes significantly to market growth. Additionally, the animal feed sector's demand for amino acids as feed additives to enhance nutritional value and improve animal health further boosts market expansion. Furthermore, ongoing research and development initiatives by market players, coupled with strategic collaborations and partnerships, foster innovation and product diversification, driving market growth. Overall, these factors collectively contribute to the sustained growth trajectory of the U.S. amino acids market.

The non-essential type of amino acids dominated the market in 2023, accounting for a substantial revenue share of 52%. This growth can be attributed to their widespread use in animal feed formulations, aimed at providing animals with a comprehensive nutritional profile. Animal nutritionists meticulously design diets to fulfill all nutritional requirements, including protein, hence the inclusion of non-essential amino acids. Additionally, non-essential amino acids are commonly incorporated into dietary supplements to facilitate muscle growth, repair, and recovery. Non-essential amino acids, or NEAAs, are synthesized by the body, eliminating the necessity of acquiring them through food. They play vital roles in the body as neurotransmitters, metabolic regulators, and precursors for protein synthesis.

Within the non-essential amino acids segment, glutamic acid held the largest market share in 2023. This can be attributed to its involvement in protein synthesis and its presence in certain enzymes. Glutamic acid serves as a critical neurotransmitter in the brain and contributes to energy production. Furthermore, there may be cognitive and neuroprotective benefits associated with glutamic acid, making it valuable for brain health.

In 2023, the essential amino acids segment also commanded a significant market share. This growth is fueled by several factors, including the increasing prevalence of chronic illnesses, an aging population, and rising consumer awareness of the benefits of essential amino acids. Additionally, the rise of vegan and vegetarian lifestyles worldwide has led to the development of plant-based essential amino acids, further driving market demand for this segment.

In 2023, the plant-based sector emerged as the dominant force in the market, capturing a substantial revenue share of 43%. This growth can be attributed to the increasing consumer awareness and demand for natural and organic products, which is expected to drive the production and consumption of plant-based offerings. Various plants such as soybeans, wheat, corn, potatoes, and peas serve as excellent sources of amino acids. Soybeans, in particular, stand out due to their widespread cultivation and consumption worldwide, making them a preferred commercial source of amino acids. Additionally, the demand for plant-derived amino acids is anticipated to surge due to heightened public consciousness regarding animal welfare issues and the consequences of animal slaughter.

Moreover, the fermentation segment held a significant market share in 2023, emerging as one of the most widely employed methods for amino acid production. Many companies are directing their efforts towards manufacturing plant-based products using fermentation techniques. In the fermentation process, microorganisms—typically bacteria or fungi—are utilized to synthesize amino acids. These microorganisms are cultivated under controlled conditions, where their metabolic processes convert substrates, often sourced from renewable materials, into amino acids. Due to its sustainability and efficiency in amino acid production, fermentation is a favored approach in the industry.

In 2023, the food and beverages segment emerged as the dominant player, securing the largest revenue share of 30%. Within the food processing sector, amino acids serve versatile roles as preservatives, nutrition enhancers, and flavor enhancers. Glycine and alanine are commonly utilized as flavor and taste enhancers, while monosodium glutamate (MSG), derived from glutamic acid, is a prevalent flavor enhancer in canned vegetables, soups, processed meats, salad dressings, bread, snacks, and ice cream. Tryptophan and histidine find application as preservatives in milk powder, whereas cysteine is employed in various beverages, including fruit juices, for preservation purposes. Additionally, the combination of phenylalanine and aspartic acid produces aspartame, increasingly used as a sugar substitute in soft drink formulations.

The functional beverages segment within the food and beverage industry also held a significant market share in 2023. Amino acids are incorporated into functional beverages to enhance concentration, mood, and cognitive function among consumers. Moreover, the inclusion of collagen, a structural protein comprising amino acids such as proline, glycine, and hydroxyproline, in functional drinks ensures the health of consumers' skin and joints, bolstering their overall structural integrity.

Furthermore, the dietary supplement segment commanded a substantial revenue share in 2023, driven by the myriad health benefits they offer beyond basic nutrition. Amino acids feature prominently in sports nutrition supplements, aiding athletes in performance enhancement and muscle recovery post-injury. Dietary supplements play a pivotal role in enzyme production, neurotransmitter regulation, and muscle repair, making them valuable for individuals on restricted diets, athletes, and anyone seeking to optimize their overall health and well-being by ensuring adequate intake of essential amino acids.

In 2023, the pharma grade segment held a substantial market share. This growth is attributed to the pivotal role these amino acids play in diverse biological processes within the human body, including protein synthesis, cell signaling, and neurotransmitter production. Pharmaceutical-grade amino acid products represent the highest quality and are associated with premium pricing. They find extensive use in various therapeutic applications, supporting muscle growth and recovery, enhancing athletic performance, managing specific medical conditions, and fostering overall consumer well-being.

Feed-grade amino acids are customized to meet the unique needs of animals, as different animal species have varying amino acid requirements. This adaptability enables nutritionists to formulate feed compositions that optimize animal growth, reproduction, and overall performance. Feed-grade proteins undergo a rigorous manufacturing process involving fermentation or hydrolysis of plant or animal protein sources. This process breaks down complex proteins into individual amino acids, facilitating their easy digestion and absorption by animals.

By Type

By Source

By Grade

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Amino Acids Market

5.1. COVID-19 Landscape: U.S. Amino Acids Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Amino Acids Market, By Type

8.1. U.S. Amino Acids Market, by Type, 2024-2033

8.1.1. Essential

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-essential

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Amino Acids Market, By Source

9.1. U.S. Amino Acids Market, by Source, 2024-2033

9.1.1. Plant-based

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Animal-based

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Chemical Synthesis

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Fermentation

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Amino Acids Market, By Grade

10.1. U.S. Amino Acids Market, by Grade, 2024-2033

10.1.1. Food Grade

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Feed Grade

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Pharma Grade

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Other Grades

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11.U.S. Amino Acids Market, By End-use

11.1. U.S. Amino Acids Market, by End-use, 2024-2033

11.1.1. Food & Beverage

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Animal Feed

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Pet Food

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Pharmaceuticals

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Vaccine Formulation

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Personal Care & Cosmetics

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Dietary Supplements

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Agriculture

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Other End-uses

11.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Amino Acids Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Source (2021-2033)

12.1.3. Market Revenue and Forecast, by Grade (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Bill Barr & Company

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. BI Nutraceuticals

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cargill Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. ADM

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Blue Star Corp.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Novus International

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. PACIFIC RAINBOW INTERNATIONAL, INC.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Sigma-Aldrich

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Gemini Pharmaceuticals

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Carolina Biological Supply

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others