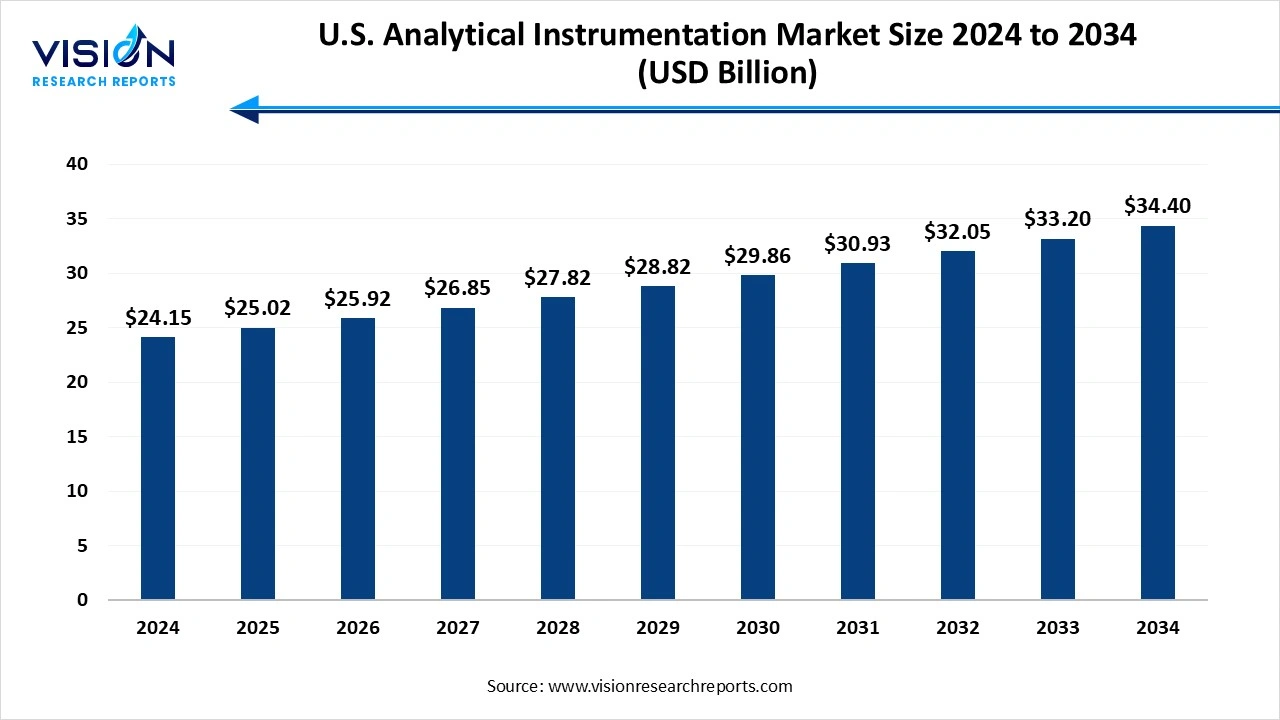

The U.S. analytical instrumentation market size was evaluated at around USD 24.15 billion in 2024 and it is projected to hit around USD 34.40 billion by 2034, growing at a CAGR of 3.60% from 2025 to 2034.

The U.S. analytical instrumentation market plays a critical role in scientific research, industrial applications, and quality control processes across various sectors, including pharmaceuticals, biotechnology, environmental monitoring, food and beverage, and chemical manufacturing. This market includes a wide array of instruments such as chromatography systems, spectrometers, microscopes, and analytical software solutions, all of which are essential for precise measurement and analysis. The U.S. stands as one of the most advanced and mature markets for analytical instruments, driven by high R&D investments, technological innovations, and a strong presence of key manufacturers and research institutions.

The growth of the U.S. analytical instrumentation market is primarily fueled by increasing investments in research and development across pharmaceuticals, biotechnology, and environmental science. With the rise in chronic diseases and the growing need for drug discovery and development, pharmaceutical and biotech companies are relying heavily on advanced analytical tools to ensure accuracy, regulatory compliance, and efficiency in testing and analysis. Additionally, stringent FDA regulations and quality standards have made it necessary for companies to adopt high-performance instruments for product validation and safety assurance.

Technological advancements such as automation, miniaturization, and the integration of AI and machine learning are significantly enhancing the capabilities of analytical devices. These innovations have improved data precision, accelerated testing processes, and reduced operational costs. The expansion of environmental monitoring initiatives and food safety regulations has also contributed to growing demand, as these sectors increasingly depend on analytical instruments for detecting pollutants, contaminants, and pathogens.

One of the key trends in the U.S. analytical instrumentation market is the growing adoption of automation and artificial intelligence (AI) in laboratory settings. Automation helps streamline workflows, minimize human error, and increase throughput, especially in high-volume testing environments like clinical diagnostics and pharmaceutical research. AI integration enhances data interpretation, enabling faster and more accurate insights from complex analytical results.

Another significant trend is the increasing shift toward portable and miniaturized analytical devices. Industries such as environmental testing, food safety, and on-site chemical analysis are embracing compact, handheld instruments for faster decision-making in the field. In addition, there is a growing emphasis on sustainability, with manufacturers focusing on energy-efficient designs and reducing the use of hazardous materials in instrument production.

One of the primary challenges facing the U.S. analytical instrumentation market is the high cost associated with advanced instruments and their maintenance. Sophisticated analytical tools such as mass spectrometers, NMR spectrometers, and chromatography systems require significant capital investment, which can be a barrier for smaller laboratories, academic institutions, and start-ups. Additionally, the ongoing costs of calibration, consumables, and software upgrades further add to the total cost of ownership, making budget allocation a key concern for many organizations.

Another major challenge is the shortage of skilled professionals capable of operating and interpreting data from complex instruments. As analytical technologies become more advanced, there is a growing need for trained personnel who can manage sophisticated systems and ensure accurate analysis. This skills gap can limit the adoption and optimal use of instrumentation, particularly in smaller or less-resourced labs. Furthermore, evolving regulatory requirements and data integrity standards add layers of complexity, requiring continuous training and compliance efforts from end users.

The instruments segment accounted for the largest share of 55% in 2024, primarily driven by its widespread adoption and critical role in research and diagnostic applications. Instruments form the core of this market and include a wide range of devices such as chromatography systems, spectrometers, microscopes, and elemental analyzers. These instruments are extensively utilized in sectors like pharmaceuticals, biotechnology, environmental testing, and chemical manufacturing for applications ranging from substance identification to structural analysis and quality control.

The software segment is projected to register the fastest CAGR of 5.2% over the forecast period. Advanced analytical software helps users operate complex systems more effectively and ensures regulatory compliance through secure data handling and reporting features. With the rise of digital transformation and the integration of AI and machine learning in laboratories, analytical software is becoming increasingly sophisticated, offering predictive analysis and automation capabilities. The synergy between high-performance instruments and smart software solutions is reshaping analytical workflows and is expected to be a driving force for market expansion in the coming years.

The polymerase chain reaction (PCR) segment accounted for the largest market share in 2024. PCR is widely utilized for amplifying small DNA or RNA sequences, making it indispensable in applications such as disease detection, genetic research, forensic analysis, and food safety testing. The technology has experienced a surge in demand, particularly in clinical diagnostics, driven by the need for rapid and precise identification of infectious agents, including during public health emergencies like the COVID-19 pandemic. Innovations in PCR, such as real-time PCR (qPCR) and digital PCR, have further enhanced its sensitivity, speed, and ease of use, making it a cornerstone of modern analytical workflows in both research and clinical environments.

The sequencing segment is expected to register the highest CAGR during the forecast period. It allows for comprehensive analysis of genetic material by determining the order of nucleotides in DNA or RNA, providing deep insights into genomics, transcriptomics, and metagenomics. Sequencing is extensively used in biomedical research, oncology, personalized medicine, and microbiome studies. As sequencing costs continue to decline and throughput improves, the adoption of NGS platforms is expanding beyond research labs into clinical diagnostics and public health initiatives.

The life sciences research and development segment accounted for the highest share of total revenue in 2024. The U.S. analytical instrumentation market sees robust demand from life sciences research and development, which plays a pivotal role in advancing scientific innovation across biotechnology, pharmaceuticals, and academic sectors. In this application area, analytical instruments are used to study complex biological systems, identify molecular structures, and monitor chemical interactions. Chromatography, spectroscopy, and molecular biology tools such as PCR and sequencing are widely utilized for drug discovery, biomarker identification, and cellular research.

The clinical and diagnostics analysis segment is projected to register the highest compound annual growth rate (CAGR) over the forecast period. The demand for accurate, high-throughput diagnostic solutions has grown substantially due to the increasing prevalence of chronic and infectious diseases. Instruments such as mass spectrometers, immunoassay analyzers, and real-time PCR systems are essential for detecting disease biomarkers, monitoring treatment effectiveness, and ensuring early diagnosis.

By Product

By Technology

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others