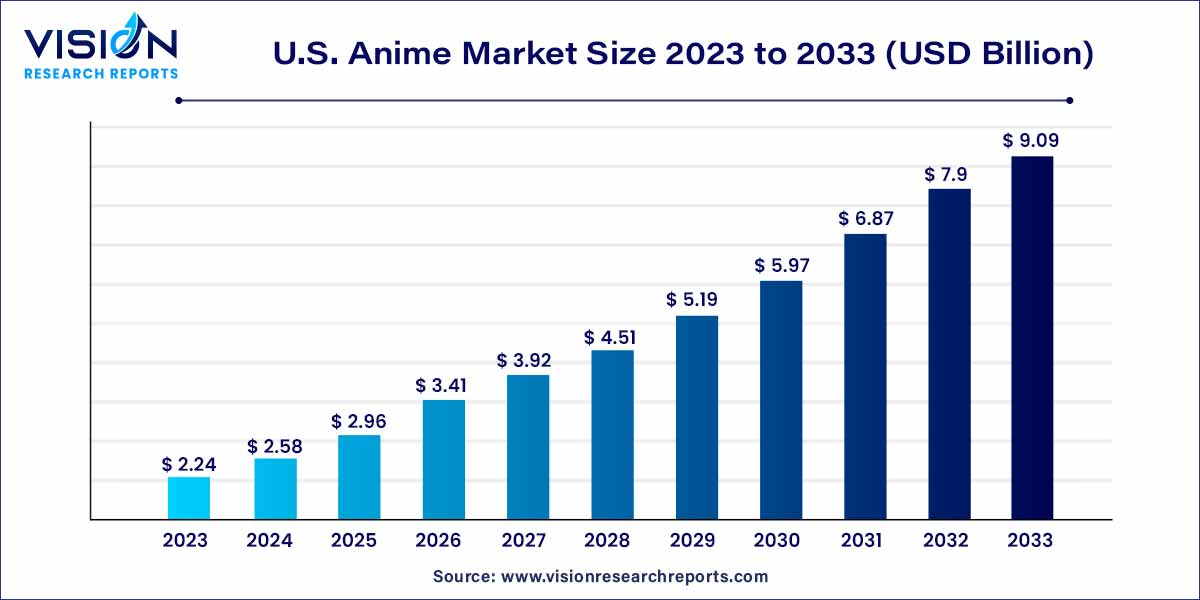

The U.S. anime market size was estimated at USD 2.24 billion in 2023 and it is expected to surpass around USD 9.09 billion by 2033, poised to grow at a CAGR of 15.03% from 2024 to 2033. The U.S. market is seeing a boom in events and goods, which highlights the thriving fan culture. Anime gatherings, product shops, and crossover partnerships between popular anime series and mainstream corporations are becoming more commonplace.

The anime industry has experienced remarkable growth and evolution within the United States over the past few decades. What was once considered a niche interest has now become a mainstream phenomenon, captivating audiences of all ages and backgrounds. In this overview, we'll delve into the current landscape of the U.S. anime market, examining key trends, growth factors, and the vast opportunities it presents for stakeholders.

The growth of the U.S. anime market can be attributed to several key factors. Firstly, the widespread availability of streaming platforms has made anime more accessible than ever before, allowing viewers to explore a vast catalog of titles at their convenience. Additionally, the increasing cultural acceptance of anime has led to a surge in mainstream recognition, attracting a broader audience base beyond traditional fan demographics. Furthermore, strategic partnerships between content creators and distributors have facilitated the localization and promotion of anime for Western audiences, driving market expansion. Moreover, the passionate and engaged fan community plays a significant role in fueling demand and generating buzz around new releases, contributing to sustained growth and longevity in the market. Overall, these factors combined have created a fertile environment for the continued expansion of the U.S. anime market, presenting lucrative opportunities for stakeholders across the industry.

In 2023, the internet distribution sector emerged as the market leader, accounting for 24% of total revenue. This surge can be attributed to the evolving landscape of content consumption patterns. The rise of online streaming platforms, such as Netflix and Crunchyroll, has significantly influenced this growth by providing unparalleled convenience and accessibility. With a vast library of anime titles available for on-demand viewing, consumers now have the freedom to access a diverse array of content at their leisure. This transition from traditional broadcasting to internet distribution is in line with the preferences of modern audiences, who prioritize flexibility in their viewing experiences. The seamless streaming experience, coupled with a rich content selection, has propelled internet distribution to the forefront, making it the preferred choice for many anime enthusiasts and driving its substantial market share in 2023.

Looking ahead, the merchandising segment is poised to experience a notable CAGR during the forecast period. This growth can be attributed to the thriving fan culture and the escalating demand for tangible connections to beloved anime franchises. As mainstream acceptance of anime continues to expand, fans are not only consuming content but actively seeking avenues to engage with their favorite series and characters. Merchandising serves as a conduit for enthusiasts to express their passion through the acquisition of collectibles, apparel, accessories, and more. Moreover, collaborations between anime franchises and mainstream brands further enhance the allure of anime merchandise. This trend underscores a growing desire for immersive experiences and tangible connections, thus driving the growth of the merchandising segment in the foreseeable future.

In 2023, the action and adventure segment emerged as the top revenue generator within the market. This achievement can be attributed to the widespread appeal and enduring popularity of its dynamic and thrilling storytelling. Action and adventure anime often boast intense and captivating narratives, intricate character developments, and visually stunning animation, which collectively attract a broad audience. The genre's knack for blending compelling plotlines with adrenaline-pumping sequences resonates strongly with both seasoned anime enthusiasts and newcomers alike. Furthermore, the success of streaming platforms in facilitating easy access to a diverse array of anime titles contributes significantly to the genre's growth. Viewers can effortlessly explore and engage with a wide range of action-packed series, solidifying its position as the foremost revenue contributor in the market.

Looking ahead, the sci-fi and fantasy segment is poised to achieve the fastest CAGR during the forecast period. This growth is fueled by the enduring allure of imaginative and otherworldly narratives that captivate viewers. Sci-fi and fantasy anime often delve into innovative and futuristic storylines, exploring unique concepts and fantastical worlds that resonate deeply with a diverse audience. As technology and animation techniques continue to advance, the genre benefits from visually stunning depictions of futuristic landscapes and supernatural elements, further enhancing the overall viewing experience. The popularity of iconic sci-fi and fantasy anime franchises in the U.S. has also contributed to the genre's growth, drawing in both long-time enthusiasts and new viewers seeking innovative and immersive storytelling experiences.

By Type

By Genre

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Anime Market

5.1. COVID-19 Landscape: U.S. Anime Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Anime Market, By Type

8.1. U.S. Anime Market, by Type, 2024-2033

8.1.1. T.V.

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Movie

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Video

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Internet Distribution

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Merchandising

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Music

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Pachinko

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Live Entertainment

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Anime Market, By Genre

9.1. U.S. Anime Market, by Genre, 2024-2033

9.1.1. Action & Adventure

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Sci-Fi & Fantasy

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Romance & Drama

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Sports

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Anime Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Genre (2021-2033)

Chapter 11. Company Profiles

11.1. Crunchyroll (Sony Pictures Entertainment Inc.)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Discotek Media

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Sentai Holdings, LLC (AMC Networks)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Viz Media, LLC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Atomic Flare

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bandai Namco Filmworks Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. The Walt Disney Company

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Toei Animation USA

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Lions Gate Entertainment Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Eleven Arts

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others