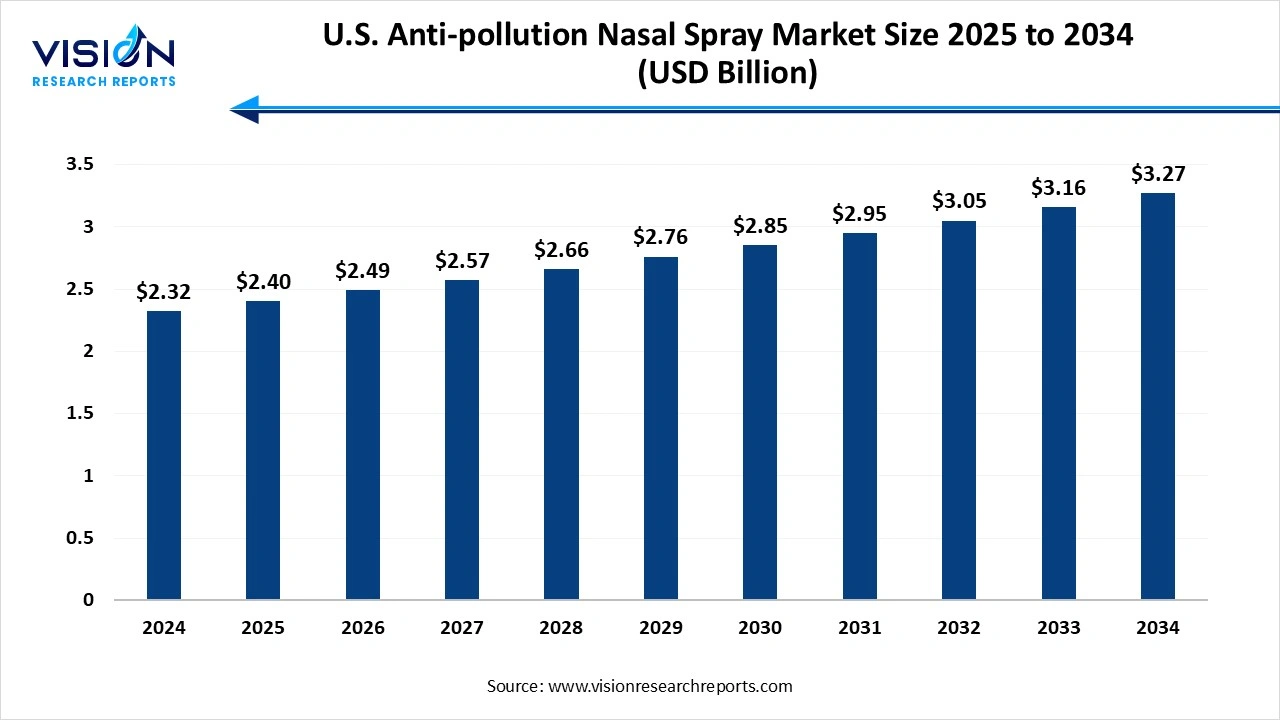

The U.S. anti-pollution nasal spray market size was exhibited at USD 2.32 billion in 2024 and it is projected to hit around USD 3.27 billion by 2034, growing at a CAGR of 3.5% from 2025 to 2034. The market growth is driven by increasing air pollution levels and rising awareness about respiratory health, the U.S. anti-pollution nasal spray market is experiencing steady growth.

Key Pointers

Key Pointers| Report Coverage | Details |

| Market Size in 2024 | USD 2.32 billion |

| Revenue Forecast by 2034 | USD 3.27 billion |

| Growth rate from 2025 to 2034 | CAGR of 3.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered |

NEILMED PHARMACEUTICALS INC., Xlear, Inc, Seagate Technology LLC, Clear Revive, Haleon Group of Companies, Himalaya Wellness (US), Sandoz Inc |

The U.S. anti-pollution nasal spray market is witnessing steady growth due to rising concerns over air quality and its impact on respiratory health. Increasing exposure to pollutants, allergens, and airborne toxins has driven the demand for nasal sprays that can protect and cleanse the nasal passages. These products are becoming popular among individuals living in urban areas with high pollution levels, as well as those suffering from allergies and sinus-related conditions. The market is also supported by growing consumer awareness regarding preventive healthcare and the availability of over-the-counter solutions. Innovations in spray formulations, such as the use of natural ingredients and non-steroidal options, further contribute to market expansion. With continued advancements in product development and a focus on wellness, the anti-pollution nasal spray segment is expected to maintain a positive growth trajectory in the coming years.

One of the primary growth factors driving the U.S. anti-pollution nasal spray market is the increasing prevalence of respiratory disorders linked to rising air pollution levels. With the surge in urbanization, industrial emissions, and vehicular pollution, individuals are more frequently exposed to harmful airborne particles such as PM2.5 and allergens. This has led to a growing demand for preventive healthcare products that can offer protection against environmental irritants.

Another key factor fueling market growth is the rising consumer awareness around personal health and hygiene. Consumers are becoming more proactive about safeguarding their respiratory health, especially in light of recent global health crises and heightened concerns about airborne diseases. The availability of over-the-counter anti-pollution nasal sprays, coupled with increasing promotions by manufacturers and healthcare providers, has enhanced product accessibility and visibility.

One of the key challenges in the U.S. anti-pollution nasal spray market is the lack of widespread consumer awareness and education about the benefits of these products. While pollution is a growing concern, many individuals are still unfamiliar with nasal sprays as a preventive solution. This limited awareness often results in slower adoption, especially in non-urban areas where the perception of pollution risk is lower. Additionally, the absence of strong clinical endorsements or physician recommendations can further hinder consumer confidence and product credibility.

Another significant challenge lies in the regulatory and formulation constraints that manufacturers face. Anti-pollution nasal sprays, particularly those claiming therapeutic benefits, must comply with stringent FDA regulations, which can delay product launches and increase development costs. Moreover, creating formulations that are both effective and safe, especially when using natural or drug-free ingredients, requires intensive research and testing.

The pollution defense products segment held the highest revenue share, accounting for 29% of the market in 2024. These sprays are gaining popularity among individuals residing in highly polluted urban areas and those who are regularly exposed to environmental irritants. By forming a physical shield, these products reduce the risk of respiratory issues, allergic reactions, and inflammation, offering users a convenient, non-invasive way to guard their respiratory health on a daily basis. Their increasing use among commuters, industrial workers, and health-conscious consumers has significantly contributed to market expansion.

The hydrating nasal spray segment is projected to experience substantial growth throughout the forecast period. These sprays help maintain the natural moisture balance in the nose, supporting mucosal function and improving overall nasal comfort. As more consumers adopt preventive wellness practices, hydrating sprays are becoming a staple in personal care routines, especially among those with sinus sensitivity or chronic dryness. Their gentle formulations, often infused with saline or natural ingredients, appeal to a wide demographic, including children and the elderly.

The retail pharmacy segment led the U.S. market, capturing the largest share in 2024. These physical outlets are often the first point of contact for customers seeking over-the-counter solutions for respiratory health, especially when recommended by pharmacists or healthcare providers. The presence of trained staff allows consumers to receive product guidance and clarifications, which boosts trust and encourages purchase. Retail pharmacies, both independent and chain stores, benefit from high foot traffic and the ability to provide immediate product availability, making them a convenient option for health-conscious individuals.

The online channel is anticipated to witness the fastest growth during the forecast period. The online channel has emerged as a rapidly growing distribution platform for anti-pollution nasal sprays, fueled by the increasing preference for digital shopping and home delivery services. E-commerce platforms and brand-owned websites provide consumers with the convenience of browsing, comparing, and purchasing products from the comfort of their homes. This channel also enables brands to educate customers through detailed product descriptions, usage guides, and customer reviews, helping to drive informed decision-making.

By Product

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Anti-pollution Nasal Spray Market

5.1. COVID-19 Landscape: U.S. Anti-pollution Nasal Spray Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Anti-pollution Nasal Spray Market, By Product

8.1. U.S. Anti-pollution Nasal Spray Market, by Product, 2024-2034

8.1.1. NEILMED PHARMACEUTICALS INC.

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Cleansing Nasal Sprays

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Hydrating Nasal Sprays

8.1.3.1. Market Revenue and Forecast (2025-2034)

8.1.4. Symptomatic Relief Nasal Sprays

8.1.4.1. Market Revenue and Forecast (2025-2034)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2025-2034)

Chapter 9. U.S. Anti-pollution Nasal Spray Market, By Distribution Channel

9.1. U.S. Anti-pollution Nasal Spray Market, by Distribution Channel, 2024-2034

9.1.1. Retail Pharmacies

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Supermarkets/General Retail Stores

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Online Channels

9.1.3.1. Market Revenue and Forecast (2025-2034)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2025-2034)

Chapter 10. U.S. Anti-pollution Nasal Spray Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Distribution Channel

Chapter 11. Company Profiles

11.1. NEILMED PHARMACEUTICALS INC.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Xlear, Inc

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Seagate Technology LLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Clear Revive

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Haleon Group of Companies

11.5. Intermountain Life Sciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Himalaya Wellness (US)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Sandoz Inc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others