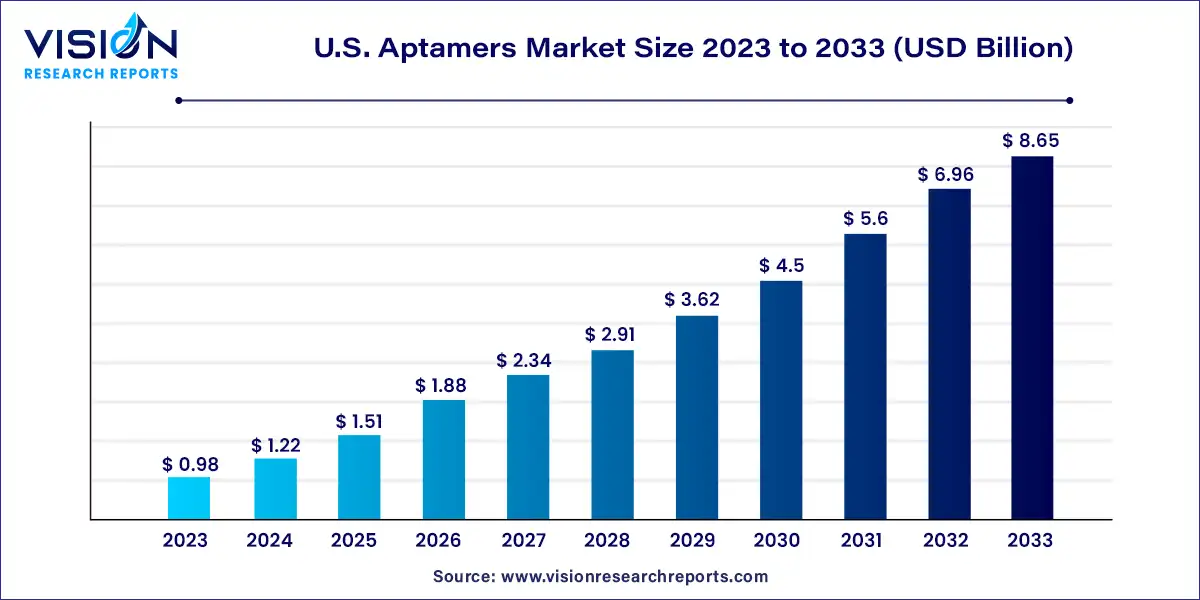

The U.S. aptamers market size was estimated at around USD 0.98 billion in 2023 and it is projected to hit around USD 8.65 billion by 2033, growing at a CAGR of 24.33% from 2024 to 2033.

Aptamers, with their remarkable potential across various applications, have been gaining traction within the United States. This versatile class of molecules, often termed as "chemical antibodies," exhibits high specificity and affinity towards target molecules, ranging from small molecules to proteins and even whole cells. As the biotechnology landscape evolves, aptamers emerge as promising tools for diagnostics, therapeutics, and research applications.

The growth of the U.S. aptamers market is driven by an escalating demand for targeted therapeutics in the healthcare sector is driving the adoption of aptamers due to their precise and customizable nature, which minimizes adverse effects and enhances therapeutic efficacy. Secondly, advancements in SELEX (Systematic Evolution of Ligands by Exponential Enrichment) technology have bolstered the efficient identification and optimization of aptamers against a diverse array of targets, expanding their utility across various industries. Additionally, robust research and development activities, supported by government initiatives and private investments, are fueling innovation in the field, leading to the exploration of novel applications and the broadening of the aptamer market's scope. These factors collectively contribute to the promising growth trajectory of the U.S. aptamers market, positioning it as a key player in the future of diagnostics, therapeutics, and biotechnology within the nation.

In 2023, nucleic acid aptamers dominated the market with a substantial share of 79%, and they are anticipated to experience the fastest growth throughout the forecast period. Currently, numerous companies are investigating the mechanism of action of nucleic acid-based aptamers in the treatment of various disorders, including AMD. In June 2021, IVERIC BIO obtained FDA approval to conduct the GATHER2 phase 3 clinical trial of Zimura under Special Protocol Assessment (SPA). Zimura is specifically designed to address geographic atrophy (GA) secondary to AMD, indicating significant strides in this therapeutic area.

The peptide aptamer segment is poised for lucrative market expansion in the coming years. This growth is attributed to the broad spectrum of applications for peptide aptamers in both diagnostic and therapeutic realms. For example, in August 2021, the Engineering Center for Microtechnology and Diagnostics introduced an advanced biosensor tailored for multiparametric express testing in preclinical diagnostics of cardiovascular diseases. Such innovations underscore the promising trajectory of the peptide aptamer segment, further fueling its market growth.

In 2023, the R&D segment claimed the largest market share at 32%. This dominance is attributed to a multitude of strategic initiatives pursued by key market players, including partnerships, collaborations, and agreements, aimed at advancing the research and development of aptamer-based therapeutic and diagnostic products. A notable example occurred in June 2021, when Ixaka Ltd and SomaLogic formed an R&D collaboration to bolster the discovery and production of aptamer-based bispecific therapeutics. This collaboration focused on assessing the efficacy and safety of antigen-specific SOMAmer reagents.

Expectations are high for the therapeutics segment to experience robust market growth throughout the forecast period. The escalating prevalence of genetic disorders serves as a significant driver for this growth. To optimize cost-effectiveness for therapeutic applications, aptamers are often condensed during synthesis. Furthermore, modifications are made to enhance nuclease resistance and diminish renal filtration rates, thereby augmenting their therapeutic potential.

By Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Aptamers Market

5.1. COVID-19 Landscape: U.S. Aptamers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Aptamers Market, By Type

8.1. U.S. Aptamers Market, by Type, 2024-2033

8.1.1. Nucleic Acid Aptamer

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Peptide Aptamer

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Aptamers Market, By Application

9.1. U.S. Aptamers Market, by Application, 2024-2033

9.1.1. Diagnostics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Therapeutics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Research and Development

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Aptamers Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. SomaLogic

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Aptamer Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Aptadel Therapeutics

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Base Pair Biotechnologies

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Noxxon Pharma

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Vivonics Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Aptagen, LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. TriLink Biotechnologies

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Altermune LLC

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. AM Biotechnologies

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others