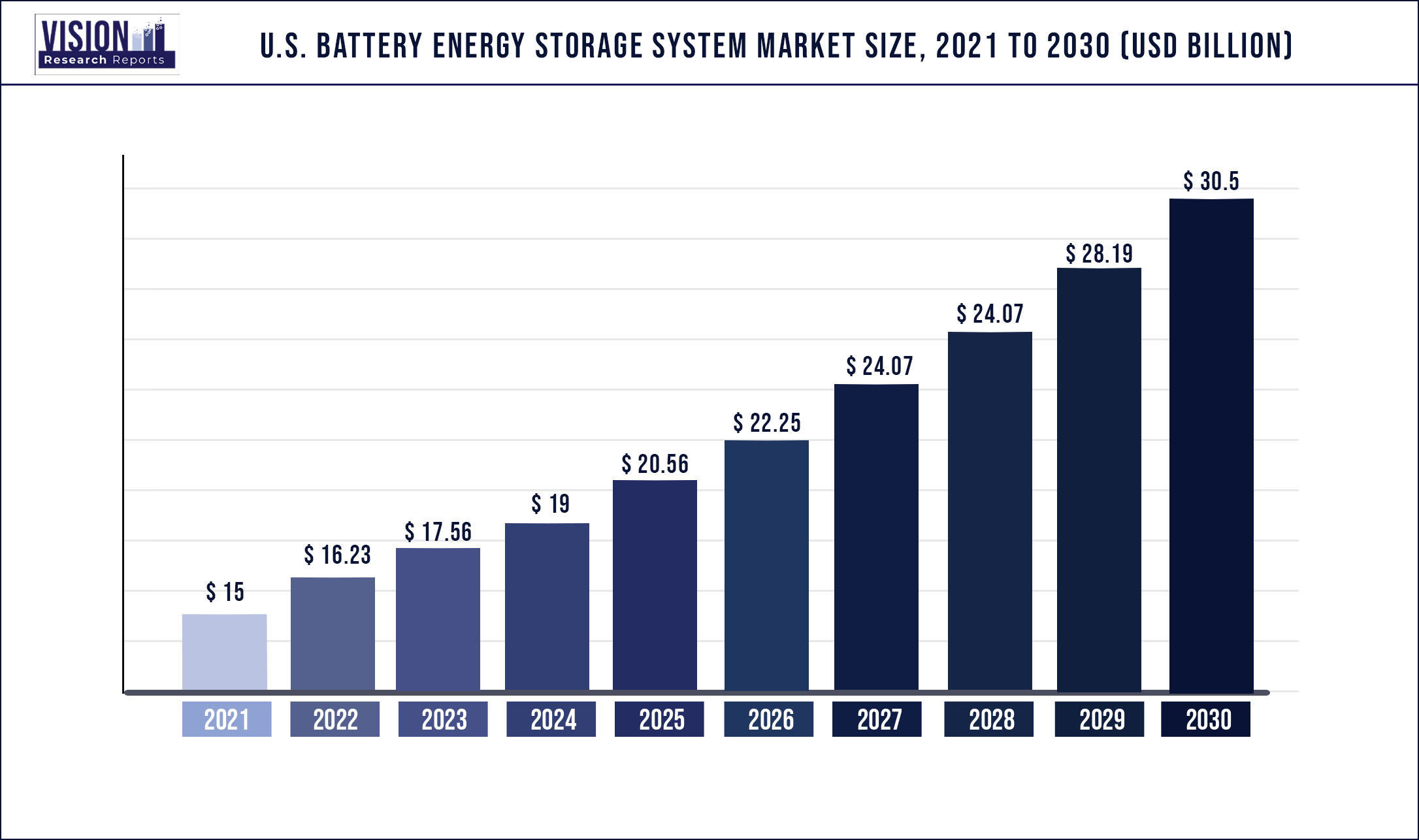

The U.S. battery energy storage system market was valued at USD 15 billion in 2021 and it is predicted to surpass around USD 30.5 billion by 2030 with a CAGR of 8.2% from 2022 to 2030.

Report Highlights

Rising deployment of renewable energy sources such as solar and wind are resulting in increased adoption of storage systems owing to the grid reliability offered by the technology. It provides constant power supply to the grid and compensates for intermittent nature of renewable power supply.

The systems are widely used in industries including medical, marine, telecommunication, production, energy, and information technology. With increasing requirement of efficient grid management, constant load management, and continuous power supply, the market is expected to witness significant growth over the forecast period.

The manufacturers supply batteries both through direct supply and third-party supply agreements to the manufacturers in the industry. The manufacturers assemble different batteries depending on the requirements of the end-use industries. The system manages the power quality, aids time shifting, and improves grid efficiency.

Industry participants are focusing on largely commercializing flywheel storage as it is more economical than batteries. The main reasons for this are the long service life and low maintenance costs of the flywheel compared, which compensates for the higher purchase costs at the beginning of the installation. While flywheel storage normally has the same lifespan as the UPS technology, batteries have to be replaced several times during the lifespan of a UPS.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 15 billion |

| Revenue Forecast by 2030 | USD 30.5 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.2% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, product |

| Companies Covered |

General Electric; Hitachi Ltd.; GS YuasaBeckett Energy Systems; Exide Technologies; Samsung SDI; Enersys; AES Energy Storage; Imergy Power Systems Inc.; Altair Nanotechnologies Inc. |

Application Insights

The data center application segment accounted for the largest revenue share of 38.7% of the market in 2021. The rising need for uninterruptible power supply in data centers to enhance business productivity is expected to drive the market over the forecast period. Technology advancements such as dual usage of data center UPS systems as grid stabilizers in local electricity networks will further boost adoption of energy storage across data centers.

The telecom application segment was valued at USD 82.06 million in 2021. The telecom companies have been establishing contracts with battery energy storage systems manufacturers in order to facilitate cost-effective and continuous supply of power. Increasing telecom subscriptions in the economy have led to growth in telecom tower installations, thereby increasing the need to use battery energy storage systems.

Industrial application segment is anticipated to witness a CAGR of 27.3% from 2022 to 2030. The growing IT industry has led to increased utilization of UPS systems in order to protect computer networks and ensure continuous service. A rising number of power outages and voltage fluctuations have necessitated the adoption of UPS systems in commercial and industrial buildings, which is likely to propel demand over the forecast period

The others segment is expected to witness a significant CAGR of 26.2% over the forecast period. Other applications majorly include forklift trucks which are utilized for material handling. The U.S. has witnessed a rapid increase in demand for forklifts over the past years. Low charge time, runtime, and low cycle life of lead-acid batteries have led to the replacement of these batteries with lithium-ion batteries based energy storage systems.

Product Insights

The lithium-ion battery product segment is anticipated to account for a CAGR of 25.1% over the forecast period. Lithium-ion battery storage systems are used in numerous areas including communication base station, commercial and industrial buildings, grid frequency modulation, household energy storage, and smooth output of renewable energy. Rising demand for electricity along with shift from conventional fuel to renewable energy is anticipated to fuel the product segment growth during the forecast period.

The lead-acid battery product segment occupied largest revenue share and was valued at USD 67.2 million in the U.S. battery energy storage system market in 2021. Lead-acid battery advantages such as low-cost, simple manufacturing process, durability, dependability, low maintenance costs, and high discharge rate capability are expected to increase its demand over Li-ion and NiCd batteries. In addition, abundant availability of lead-acid battery in various sizes and specifications is expected to sustain the demand for these batteries over the next seven years.

The flywheel battery product segment is expected to witness significant a CAGR of 28.4% over the forecast period. The segment is growing in accordance with the growing energy storage demand in U.S. Market players are focusing on flywheel systems owing to their long life and higher efficiency as compared to other batteries.

In August 2021, VYCON Inc. added a new product VDC-XXT flywheel model to its existing family of products. The product can be paired with three-phase UPS, and it utilizes the patented technology of the company. This product will help the client to reduce its initial cost, and also it lowers ongoing energy and operational cost over the life of the product installed.

The others segment includes products such as redox flow batteries, alkaline batteries, silver oxide batteries, zinc-carbon batteries, iron batteries, and pure lead batteries. Exide Technologies; GS Yuasa Corporation; Eveready Industries India Ltd.; EnerSys; Duracell, Inc.; BYD Co., Ltd.; and Panasonic Corporation are the major players that have extensive battery product portfolios. Alkaline batteries and button silver oxide batteries are used in watches, calculators, and medical devices and instruments.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Battery Energy Storage System Market

5.1. COVID-19 Landscape: U.S. Battery Energy Storage System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Battery Energy Storage System Market, By Application

8.1. U.S. Battery Energy Storage System Market, by Application, 2022-2030

8.1.1. Telecommunication

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Data Center

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Medical

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Industrial

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Marine

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Battery Energy Storage System Market, By Product

9.1. U.S. Battery Energy Storage System Market, by Product, 2022-2030

9.1.1. Flywheel battery

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Lead-acid battery

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Lithium-ion Battery

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Battery Energy Storage System Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Application (2017-2030)

10.1.2. Market Revenue and Forecast, by Product (2017-2030)

Chapter 11. Company Profiles

11.1. General Electric

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Hitachi Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. GS YuasaBeckett Energy Systems

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Exide Technologies

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Samsung SDI

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Enersys

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. AES Energy Storage

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Imergy Power Systems Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Altair Nanotechnologies Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others