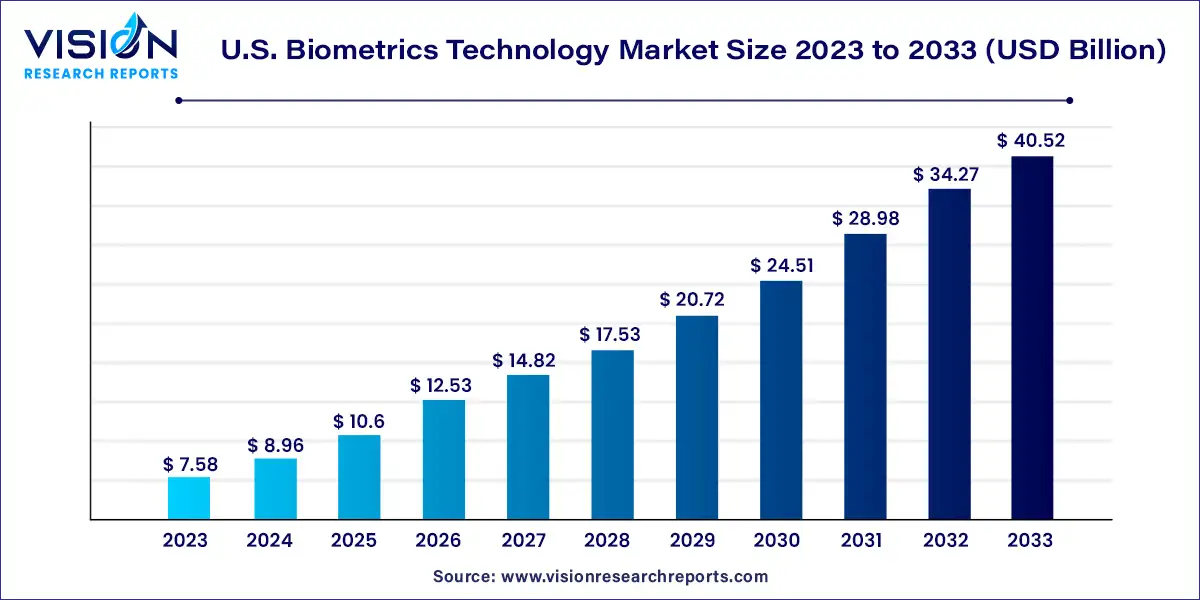

The U.S. biometrics technology market size was estimated at around USD 7.58 billion in 2023 and it is projected to hit around USD 40.52 billion by 2033, growing at a CAGR of 18.25% from 2024 to 2033.

The United States biometrics technology market stands at the forefront of innovation, revolutionizing the landscape of security and identity verification. Biometrics, the science of measuring and analyzing biological data, has witnessed exponential growth in recent years, driven by increasing concerns over security threats, identity theft, and the need for seamless authentication processes. This article provides an insightful overview of the U.S. biometrics technology market, highlighting key trends, drivers, challenges, and opportunities shaping its trajectory.

The growth of the U.S. biometrics technology market is driven by the rapid advancements in biometric technologies, including fingerprint recognition, facial recognition, and iris scanning, are driving adoption across various sectors. The integration of biometric features into mobile devices has further fueled market expansion, enhancing security and user convenience. Additionally, stringent regulations and government initiatives aimed at bolstering national security and combating identity fraud are driving demand for biometric solutions. Moreover, the healthcare sector's increasing adoption of biometrics for patient identification and data security presents significant growth opportunities.

The hardware sector led the U.S. biometrics technology market, capturing a 43% share of revenue in 2023. This dominance is attributed to the increasing presence of mobile biometric devices, the integration of biometric technology into consumer electronics, and the demand for hardware-based security features. Key factors such as high performance, precise identification accuracy, robust security, and reliability are expected to drive further growth in this segment.

On the other hand, the software segment is poised for strong growth driven by the demand for artificial intelligence (AI) and cloud services in biometric devices. Biometric systems heavily rely on software to enhance hardware capabilities and ensure compatibility across different biometric devices. The growing prevalence of real-time data processing and the necessity to store and analyze geographical data will incentivize industry leaders to invest more in software development.

The contact segment dominated the revenue share in 2023 and is expected to maintain strong growth momentum throughout the forecast period. This growth is fueled by the widespread adoption of systems capable of recognizing fingerprints, signatures, and palm prints. The increasing popularity of fingerprint recognition systems in consumer electronics, along with the demand for contact-based biometric tools in sports institutions, fitness centers, and wellness gyms, will contribute significantly to industry expansion.

Meanwhile, the contactless segment is poised for substantial growth, driven by rising hygiene concerns and supportive government initiatives. The onset of the COVID-19 pandemic has accelerated the adoption of contactless technologies, leading to increased demand for face recognition systems. The advantages of contactless biometrics, such as remote attendance marking, prevention of unauthorized logins, and enhanced premise access security, have made these solutions highly desirable among end-users.

In 2023, the single-factor segment led the regional market and is expected to continue its upward trajectory, driven by the increasing adoption of face and fingerprint recognition in travel, banking, and government sectors. Factors such as cost-effectiveness and user-friendly attributes have contributed to the popularity of single-factor authentication in the U.S. Additionally, advancements in biometric technologies like finger vein scans, retina scans, and voice recognition have further boosted the adoption of biometric verification systems.

On the other hand, the two-factor authentication segment is poised for notable growth, as organizations prioritize high security without compromising user experience. One-time passwords (OTPs) are particularly favored as a secondary authentication factor, with many organizations recognizing two-factor authentication as a robust method for verifying user identities. Industry leaders are expected to leverage two-factor authentication to enhance scalability and bolster security measures

The Non-AFIS segment is expected to experience significant growth, driven by increased adoption across PCs and cell phones. This growth is attributed to both the proliferation of applications and the implementation of regulations. Non-automated fingerprint identification system (AFIS) technologies, such as finger scanning, are anticipated to see high demand across various end-use applications. Furthermore, the industry will witness a surge in demand for robust algorithms, reshaping industry dynamics.

Meanwhile, the AFIS segment is poised for considerable growth, fueled by heightened demand in civil and law enforcement applications. Governments are increasingly utilizing AFIS for identification purposes in law enforcement, civil registers, and elections. Advanced AFIS technology enables accurate and rapid identification of individuals based on their unique fingerprint patterns. Fingerprint examiners are expected to utilize a range of biometric technologies, from face recognition to iris scanning and fingerprint analysis.

The government segment is poised to make a significant contribution to the U.S. market share, driven primarily by the imperative to eliminate corruption, enhance transparency, and streamline workflow processes. The U.S. Federal Bureau of Investigation (FBI) emphasizes that no two individuals can have more than eight minutiae in common, highlighting the precision and reliability of biometric identification. Additionally, the U.S. Customs and Border Protection (CBP) has substantially enhanced its non-intrusive inspection scanning capabilities and deployed forward operating labs to detect trends and identify suspected drugs. Furthermore, the CBP has leveraged facial biometric comparison technology to optimize existing travel procedures, enhancing efficiency in border security measures.

In the defense and security segment, notable growth is anticipated to address challenges arising from identity theft and illegal migration. Following the directives of the 9/11 Commission Report, the U.S. government has authorized the use of automated systems to record the arrivals and departures of visitors at land, sea, and air ports of entry. Biometrics will play a pivotal role in strengthening verification and identification processes, thereby reinforcing the safety and security of the nation.

By Component

By Offering

By Authentication Type

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others