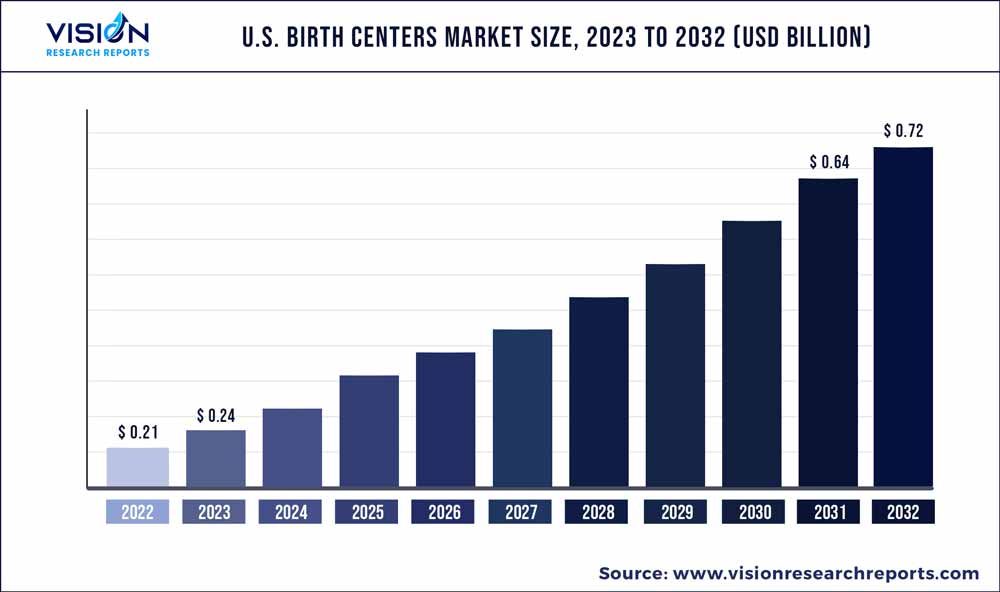

The U.S. birth centers market was surpassed at USD 0.21 billion in 2022 and is expected to hit around USD 0.72 billion by 2032, growing at a CAGR of 13.13% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Birth Centers Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.21 billion |

| Revenue Forecast by 2032 | USD 0.72 billion |

| Growth rate from 2023 to 2032 | CAGR of 13.13% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Ronald Reagan UCLA Medical Center (UCLA Health); Barnes-Jewish Hospital; Rose Medical Center; Cedars-Sinai Medical Center (Cedars-Sinai); Cleveland Clinic; Prisma Health Baptist Parkridge Hospital; The Mount Sinai Hospital; TriStar Centennial Women's and Children’s Hospital; Lenox Hill Hospital (Northwell Health); The Mother Baby Center; St. David's Women's Center of Texas; Norton Women's and Children's Hospital; NewYork-Presbyterian Hospital; The BirthPlace Santa Monica (UCLA Health); Hospital of the University of Pennsylvania; Houston Methodist Hospital; The Johns Hopkins Hospital; Massachusetts General Hospital; Mayo Clinic; Northwestern Memorial Hospital; NYU Langone Hospitals; Rush University Medical Center; Stanford Health Care’s Lucile Packard Children’s Hospital Stanford; University of Michigan Hospitals-Michigan Medicine; UCSF Medical Center; UCLA Medical Center |

Improved health outcomes and significantly lower costs associated with birth centers are likely to drive the demand for these services. Birth centers provide a more natural and personalized approach to childbirth, with a focus on a homelike environment and midwifery care. According to the American Association of Birth Centers, there are currently over 400 birth centers, including both freestanding and hospital-affiliated birth centers, in operation in the U.S. Some of the factors contributing to the rising demand for birth centers in the U.S. include a growing interest in natural childbirth and an increasing demand for more personalized care.

Birth centers also have a number of advantages for both mothers and babies, such as lower intervention rates such as caesarean sections and epidurals, as well as a more positive overall birth experience. Despite the growing demand for birth centers, they still account for a small percentage of all childbirth facilities in the U.S.

The costs of a normal delivery at birth centers are roughly half of those of a hospital delivery as the duration of the mother and baby's stay in a birth center is significantly shorter and involves no doctors or anesthesia. Birth centers are not intended for complicated pregnancies that necessitate costly services. Women who want to give birth without the use of pain relievers such as epidurals and women with low-risk pregnancies prefer birth centers. Pregnant women, who are over 35 years of age, are having multiple babies, have high blood pressure in the pre-delivery phase, or have diabetes, are excluded from birth centers, as these conditions require continuous medical attention.

The COVID-19 pandemic had a positive impact on the birth centers market. While the pandemic had led to some challenges, it had also highlighted the need for more flexible and personalized options for childbirth. The pandemic increased the burden on treatment sensitivity and healthcare services for critically ill patients and led to an increase in interest in alternative birth options. Many women were concerned about the risk of exposure to the virus in hospital settings, leading them to consider birth centers or home birth options. The rising prevalence of COVID-19 in various states, the rapid increase in COVID-19-infected patients in hospitals, and the high risk of infection for pregnant mothers are some of the factors contributing to the growth of the market.

The demand for birthing facilities increased significantly during the pandemic, as they were more affordable, culturally knowledgeable, and safer. The overall health outcome was positive in birth centers as compared to hospitals. Birth centers provide personalized and customized rooms with great safety, privacy, and freedom. The recovery time is also less which is 4 to 8 hours in birthing centers compared to 24 to 48 hours in hospitals due to the use of few medicines. Most birth centers have partnerships with local hospitals so that they can transfer the patient if any complications occur during delivery.

Ronald Reagan UCLA Medical Center (UCLA Health), Barnes-Jewish Hospital, Rose Medical Center, Cedars-Sinai Medical Center (Cedars-Sinai), Cleveland Clinic, Prisma Health Baptist Parkridge Hospital, The Mount Sinai Hospital, and TriStar Centennial Women's and Children’s Hospital are some of the key players due to their financial performances and strong product portfolios. The players are adopting strategies such as acquisitions, mergers, partnerships, and product launches, and also remain prominent drivers of growth. For instance, in April 2022, Carrum Health, Inc., a digital company that provides a technological platform to connect employees and employers to the Center of Excellence (CoE), announced a partnership with The Minnesota Birth Center to launch its maternity care benefit program. The partnership will enable the provision of an extensive maternity care program for low-risk babies and their moms, including delivery & labor and postpartum & prenatal care, at a single cost for self-insured employers.

Type Insights

Based on type, the birth centers are segmented into freestanding birth centers and hospital-affiliated birth centers. In 2022, the freestanding birth centers segment accounted for the highest revenue share of 77% and is expected to grow at the fastest CAGR over the forecast period. Key factors responsible for the largest segment share include the growing presence of freestanding birth centers in the country, affordability, and a home-like birth environment that attracts more and more customers.

In addition, growing investments by investment firms and venture capitalists in building new birth centers, especially in rural areas, is also expected to significantly influence market growth. The key players are launching services that are more affordable and convenient to the customers, thereby propelling market growth.

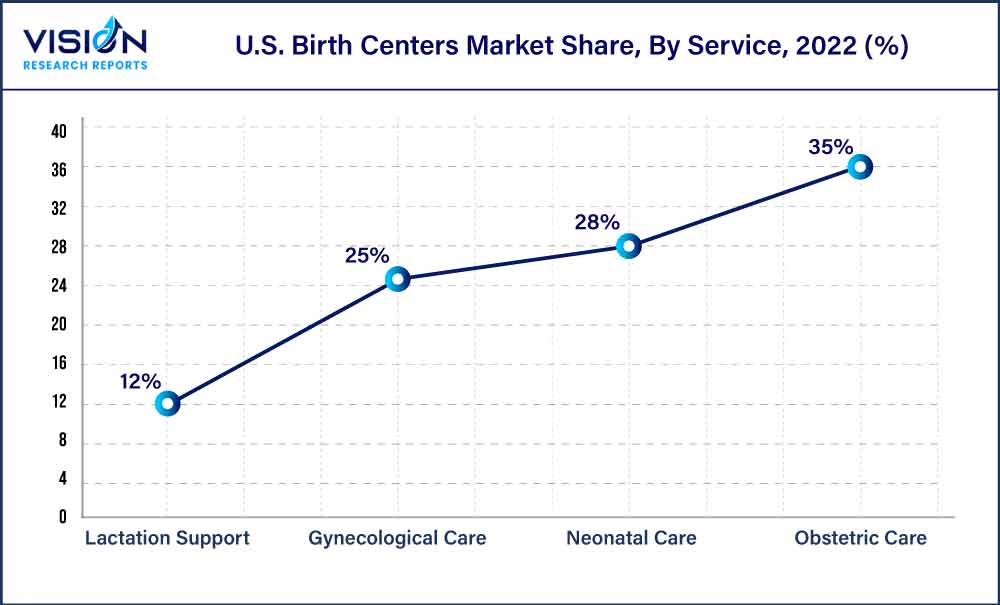

Service Insights

Based on services, the market is segmented into obstetric care, neonatal care, gynecological care and lactation support. In 2022, the obstetric care segment accounted for 35% of the revenue share and is expected to grow at the fastest CAGR over the forecast period. Some of the key factors contributing to the segment growth include the high demand for maternal care services, especially during the pandemic period.

The number of deaths in pregnant women is on the rise due to pregnancy or delivery complications, resulting in an increasing demand for specialty obstetric care provided by birth centers. There are more chances of experiencing conditions like cardiac arrest, uterine rupture, and severe bleeding when the baby is delivered through cesarean delivery. The risk of these outcomes increases due to cesarean delivery. Therefore, the number of pregnant women opting for obstetric care services at birth centers is growing significantly.

U.S. Birth Centers Market Segmentations:

By Type

By Service

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Birth Centers Market

5.1. COVID-19 Landscape: U.S. Birth Centers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Birth Centers Market, By Type

8.1. U.S. Birth Centers Market, by Type, 2023-2032

8.1.1. Freestanding Birth Centers

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Hospital-affiliated Birth Centers

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Birth Centers Market, By Service

9.1. U.S. Birth Centers Market, by Service, 2023-2032

9.1.1. Obstetric Care

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Neonatal Care

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Gynecological Care

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Lactation Support

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Birth Centers Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Service (2020-2032)

Chapter 11. Company Profiles

11.1. Ronald Reagan UCLA Medical Center (UCLA Health)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Barnes-Jewish Hospital

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Rose Medical Center

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Cedars-Sinai Medical Center (Cedars-Sinai)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Cleveland Clinic

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Prisma Health Baptist Parkridge Hospital

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. The Mount Sinai Hospital

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. TriStar Centennial Women's and Children’s Hospital

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Lenox Hill Hospital (Northwell Health)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. The Mother Baby Center

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others