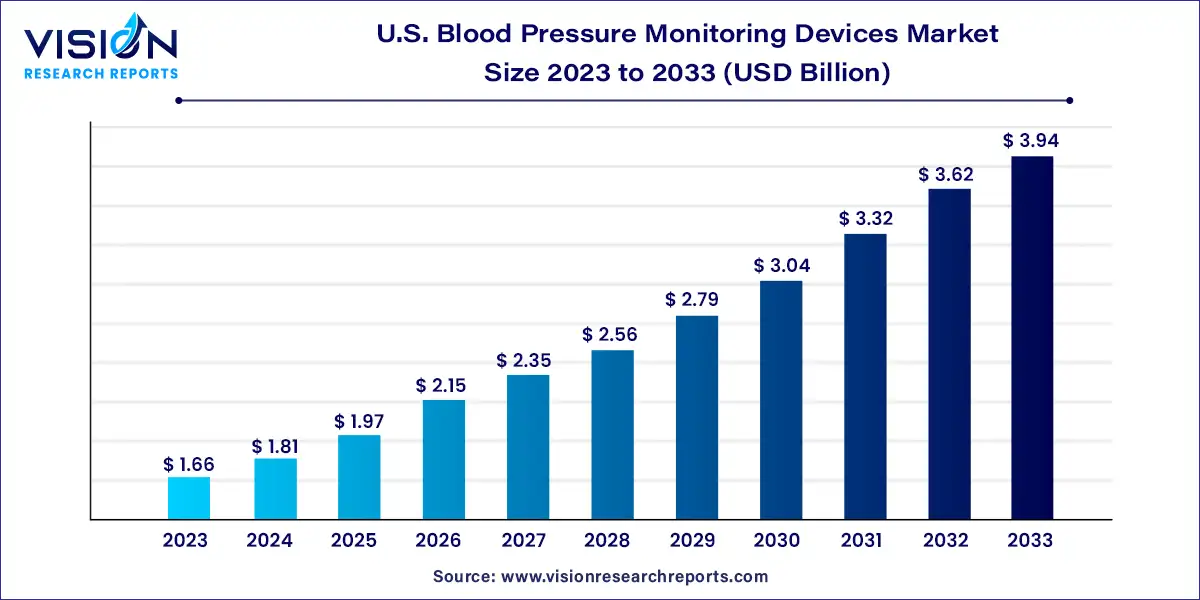

The U.S. Blood Pressure Monitoring Devices market size was estimated at around USD 1.66 billion in 2023 and it is projected to hit around USD 3.94 billion by 2033, growing at a CAGR of 9.04% from 2024 to 2033. The U.S. Blood Pressure Monitoring Devices market is driven by technological advancements in blood pressure monitors, the increased prevalence of hypertension, and the rising geriatric population are significant factors shaping the dynamics of the healthcare landscape.

The U.S. blood pressure monitoring devices market represents a vital segment within the broader healthcare industry, playing a pivotal role in the management and prevention of cardiovascular diseases. As cardiovascular health continues to be a significant public health concern in the United States, the demand for advanced and accurate blood pressure monitoring devices has been steadily increasing.

The growth of the U.S. Blood Pressure Monitoring Devices Market is propelled by various factors. Firstly, the increasing prevalence of hypertension and cardiovascular diseases among the population drives the demand for blood pressure monitoring devices. Secondly, technological advancements such as wearable devices and smartphone-compatible monitors enhance convenience and accuracy, further fueling market growth. Additionally, the shift towards home monitoring and the integration of digital health solutions contribute to the expansion of the market. Moreover, the aging population in the U.S. leads to a higher demand for blood pressure monitoring devices, as older adults are more susceptible to hypertension. Overall, these factors collectively drive the growth of the U.S. Blood Pressure Monitoring Devices Market, making it a crucial segment within the healthcare industry.

In 2023, aneroid blood pressure monitors dominated the market, capturing a significant share of 37%. The growth of this segment is propelled by its multifaceted applications, including easy accessibility, portability, and user-friendliness. A key advantage of aneroid blood monitors is their mercury-free composition, making them lightweight and convenient for transportation. The preference for aneroid blood pressure monitors in hospitals across the US is expected to further bolster market expansion. Meanwhile, the digital blood pressure monitors segment is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR) of 11.53% from 2024 to 2033. This surge is attributed to heightened awareness of cardiovascular diseases, hypertension, and the importance of blood pressure monitoring devices among the US populace.

Moreover, the increasing adoption of advanced technology-based wearables for blood pressure monitoring, such as mobile apps, is driving growth in this segment. Additionally, the segment benefits from intensified research and development endeavors aimed at producing innovative devices. For instance, in January 2023, researchers from the University of California San Diego Jacobs School of Engineering unveiled a groundbreaking blood pressure monitor capable of connecting to smartphones. This pioneering monitor boasts a compact design, one-touch operation, and cost-effectiveness compared to traditional blood pressure monitors.

In the United States, hospitals and clinics have emerged as the primary end-users of blood pressure monitors, commanding approximately 66% of the market share in 2023. This dominance is attributed to the escalating number of hospitalizations across the US populace, stemming from chronic ailments, injuries, and emergent medical situations. Significantly, hospitals and clinics are major consumers of blood pressure monitors due to the critical role of effective pressure management within healthcare settings. According to data from the Centers for Disease Control and Prevention, about 48.1% of US adults suffer from hypertension, intensifying the demand for blood pressure monitors in hospital and clinic environments.

Moreover, findings from the Journal of Managed Care and Specialty Pharmacy reveal a re-hospitalization rate of 21-23% due to heart failure among the US population, underscoring the imperative for proficient pressure management in medical facilities. Conversely, the homecare segment is poised to exhibit the swiftest Compound Annual Growth Rate (CAGR) of 10.9% from 2024 to 2033.

This growth is chiefly propelled by the burgeoning popularity of home monitoring devices, characterized by their user-friendly design, reliability, cost-effectiveness, and potential for curbing healthcare expenses. Furthermore, the integration of technological advancements such as WI-FI and cloud computing has further catalyzed market expansion. Additionally, governmental reimbursement policies and coverage schemes have significantly contributed to the uptick in demand for blood pressure monitors in the homecare segment. Consequently, substantial growth is anticipated in the homecare segment in the forthcoming years.

By Product

By End-user

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others