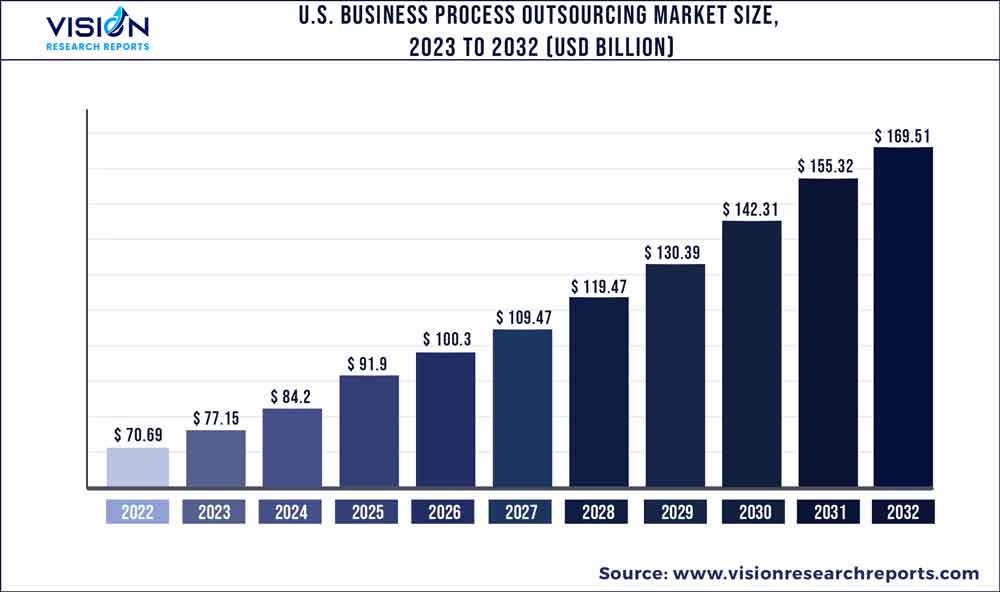

The U.S. business process outsourcing market was surpassed at USD 70.69 billion in 2022 and is expected to hit around USD 169.51 billion by 2032, growing at a CAGR of 9.14% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Business Process Outsourcing Market

| Report Coverage | Details |

| Market Size in 2022 | USD 70.69 billion |

| Revenue Forecast by 2032 | USD 169.51 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.14% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Accenture; Capgemini; Cognizant; Concentrix Corporation; ExlService Holdings, Inc.; Genpact; HCL Technologies Limited; IBM Corporation; Infosys Limited; NCR Corporation; NTT DATA Corporation; TATA Consultancy Services Limited; TTEC; Wipro Limited; WNS (Holdings) Ltd. |

The Business Process Outsourcing (BPO) industry is expanding due to innovations, increasing global competitive rivalry, and advanced technologies. BPO has provided companies with the capabilities to increase profits effectively and reduce costs. The advantages of cutting-edge technology, such as process automation, cloud computing, and social networking, encourage businesses to adopt new technologies. BPOs can further increase the efficiency of the services offered by businesses by leveraging the benefits of the growing adoption of these technologies.

The U.S. outsourcing service providers are expected to use technological advancements effectively to manage talent shortages, improve products and services, and resolve market issues while maintaining low operating costs. New technologies such as robotic process automation (RPA) have significantly impacted the BPO sector. RPA rapidly penetrates all corporate processes and industries owing to its benefits, such as increased cost savings, speed, and efficiency. In the management sector, robotic process automation has emerged as a BPO trend with the fastest growth rate, providing the higher generation with accelerated time-to-value and sizable cost reductions.

The customer service industry depended on websites and Interactive Voice Responses (IVR) to pass calls to the appropriate representative. However, most people have at least one social media account, which has led to a significant change in consumer behavior. Most people identify social media browsing as the third-most-popular online activity. Businesses are becoming aware of the popularity of social media, which offers consumer data and inputs that can improve a company's capacity for trend analysis and innovation.

Organizations have different types of processes across various business operations. These processes may primarily need a system-to-system exchange, human interaction, alteration of information, and creation of documents, or necessitate arrival at a significant decision. Additionally, processes can be categorized as simple or complex based on a limited or considerable number of transactions. Sales campaigns are time-consuming and may take several months, or years, whereas other processes might take less than a second to complete.

Processes may also be categorized as highly structured with repetitive tasks or unstructured, where the workflow can be identified during execution. The diversity of these processes has conventionally compelled enterprises to utilize multiple process management systems, which focus on handling a subgroup of these process types. This consequently increases the complexity of the system. However, efficiency may be achieved in a few processes, but complete efficiency and agility still need to be challenged due to the barriers imposed by a point process solution.

Services Insights

The finance & accounting segment of the U.S. business process outsourcing occupied more than 20.06% of the revenue share in 2022. The growth can be attributed to finance & accounting outsourcing trends such as automation & AI, cloud technology, and remote work. Accounting professionals can minimize additional time by using AI and automation to automate time-consuming, manual tasks. This will allow them to focus on more valuable tasks such as analyzing data trends, building relationships with clients and other departments, and in 2021, assisting businesses with reporting compliance.

The HR segment is projected to witness a CAGR of more than 9.03% over the forecast period. The growth of the segment can be attributed to cost savings, reduced legal complexities, and prevent overworking of employees. Furthermore, many organizations focus on outsourcing specific human resources activities, such as recruitment, salary surveys, job evaluation, and tax administration and payroll. Moreover, top companies such as Genpact, and IBM Corporation, offering HR outsourcing services have also contributed to the wider adoption of HR outsourcing services, driving this growth.

End-use Insights

By end-use, the IT & telecommunication segment occupied the largest share in the U.S. business process outsourcing market with more than 30.08% in 2022. Moreover, the IT & Telecommunication segment is projected to witness a growth rate of more than 9% over the forecast period. The increase in the number of IT businesses and rapid industrialization globally are factors boosting the demand for business process services across IT and telecommunication companies. IT & telecom BPO services cater to the increasing demand for connectivity, address security issues, and innovate new offerings for the latest devices and technology standards.

Telecom companies outsource business functions, ranging from call-center outsourcing to billing operations to finance and accounting. Outsourcing enables telecom companies to reduce their capital expenses, access specialized resources, optimize current investments, create a flexible strategy for acquiring and retaining more customers, and manage cost pressures.

The BFSI segment is projected to witness the highest CAGR from 2023 to 2032. The growth of the BFSI segment can be attributed to the initiatives taken by BFSI institutions to improve their cost efficiency. BFSI institutions opt for outsourcing processes for various BFSI domains, including investment and asset management, to stay ahead in market competition.

Moreover, major financial institutions, such as JPMorgan Chase & Co., Morgan Stanley, and American Bank, N.A., along with the presence of top companies in the U.S., the business process outsourcing market, which includes Genpact, IBM Corporation, and Helpware, has also contributed to the growth of the BFSI segment.

U.S. Business Process Outsourcing Market Segmentations:

By Service

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Business Process Outsourcing Market

5.1. COVID-19 Landscape: U.S. Business Process Outsourcing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Business Process Outsourcing Market, By Service

8.1. U.S. Business Process Outsourcing Market, by Service, 2023-2032

8.1.1. Finance & Accounting

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. HR

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. KPO

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Procurement & Supply Chain

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Customer Services

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Fund Administration Business

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Business Process Outsourcing Market, By End-use

9.1. U.S. Business Process Outsourcing Market, by End-use, 2023-2032

9.1.1. BFSI

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Healthcare

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Manufacturing

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. IT & Telecommunications

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Retail

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Business Process Outsourcing Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Service (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Accenture

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Capgemini

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Cognizant

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Concentrix Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. ExlService Holdings, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Genpact

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. HCL Technologies Limited

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. IBM Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Infosys Limited

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. NCR Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others