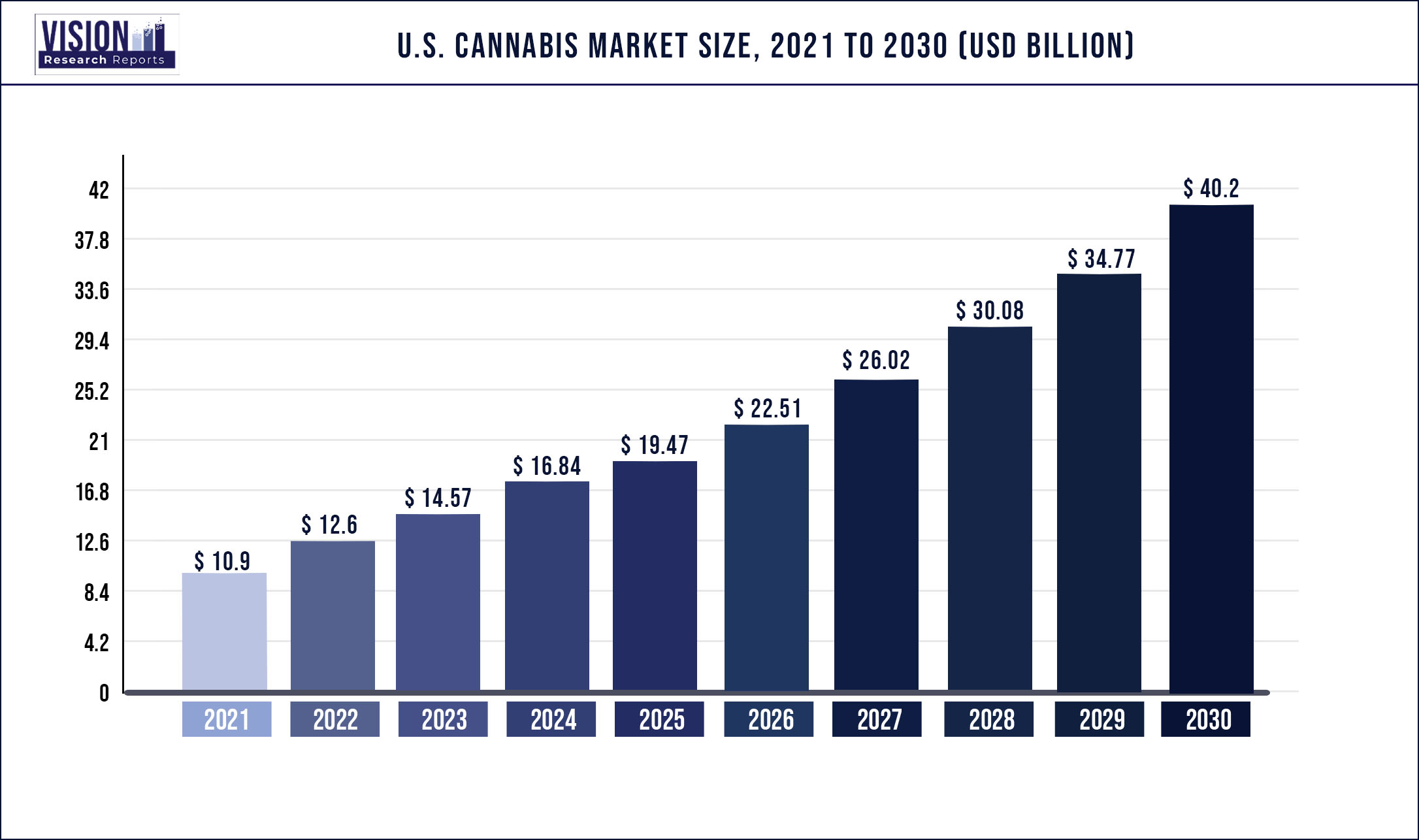

The U.S. cannabis market was valued at USD 10.9 billion in 2021 and it is predicted to surpass around USD 40.2 billion by 2030 with a CAGR of 15.61% from 2022 to 2030.

The increased legalization of cannabis for medical and recreational purposes is driving the market growth. Cannabis legalization has influenced the growth. The possibility of abuse owing to cannabis utilization has been reduced due to major, gradual legalization initiatives in many states. While some states have yet to authorize cannabis for recreational use, perspectives toward its usage and sale have shifted over time. As a result, cannabis use has become more popular, moving the overall cannabis business ahead. The safe utilization of marijuana due to legalization is benefitting the growth of the market.

Based on type, the medical segment dominated the market with a revenue share of 77.5% in 2021. Some of the primary factors responsible for this are increased knowledge about the medicinal benefits of cannabis, rising demand for plant-based medicines in pain management, and increasing legalization of cannabis for medical uses. Several states have authorized medicinal marijuana in recent years, although its prescription is based on the physician's preference and the patient's desire. The market is likely to develop at a healthy rate over the forecast period as the number of states that have legalized medical marijuana increases.

Based on the source, the marijuana segment dominated the market with a revenue share of 85.5% in 2021 owing to the use of marijuana for recreational as well as medicinal purposes. Also, the growing consumer base and legal purchasing of marijuana products are boosting the segment growth. Moreover, the initiatives undertaken by the government to legalize the consumption and selling of marijuana in different states in the region are impelling the segment growth.

Based on derivative type, the CBD segment dominated the market with a revenue share of 66.3% in 2021. The growing acceptance of CBD products and legalization of CBD in the region are the major factors contributing to the dominance of the segment. Also, CBD has shown its potential in treating various diseases like PTSD and different types of cancer. Moreover, the key players focusing on the development of CBD-infused products is another factor boosting the growth of the segment.

The COVID-19 pandemic outbreak dramatically impacted the cannabis supply chain and has thrown it into turmoil. As a result of the significant ban, the availability of cannabis in dispensaries has dropped due to the global lockdown. Furthermore, the COVID-19 pandemic has harmed the export industry. As a result of the disruption, the distribution system has been interrupted by lockdowns in major countries, affecting both import and export commerce from the U.S. to other countries. On the other hand, the number of patients using cannabis as a medication is certain to rise due to the rise in the number of diseases that require cannabis treatment, thereby paving way for the growth of the market in the forthcoming years.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 10.9 billion |

| Revenue Forecast by 2030 | USD 40.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 15.61% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | End-use, source, derivative |

| Companies Covered |

Canopy Growth Corporation; GW Pharmaceuticals, plc; Aurora Cannabis, Inc.; Aphria, Inc.; Cronos Group; Tilray |

End-use Insights

The medical segment accounted for the largest revenue share of 77.5% in 2021. The factors attributing to the largest share of this segment include the growing acceptance of cannabis for the treatment of various chronic conditions such as cancer, depression and anxiety, diabetes, arthritis, and epilepsy. Also, the approval of drugs for treating various conditions is contributing to the growth. For instance, Marinol and Syndros are the two specific drugs approved by FDA intended for treating the side effects associated with chemotherapy such as nausea and vomiting.

Also, the medical application of cannabis has witnessed massive expansion over the years due to the growing amount of scientific literature supporting its benefits in the treatment of various chronic diseases. Moreover, the number of U.S. states legalizing medical cannabis is increasing. For instance, as of April 2022, 37 U.S. states including Alaska, Arizona, Mississippi, Missouri, Montana, etc. have legalized the use of medical cannabis. Furthermore, the medical conditions for which marijuana is being used are also increasing, which is expected to open up new avenues for growth.

However, the recreational segment is anticipated to witness the fastest growth rate over a forecast period owing to its use in the treatment of various health conditions. Also, recreational products can be sold without a prescription, thereby impelling the segment growth. Furthermore, the legalization of cannabis for recreational purposes is adding fuel to the growth of the segment. For instance, 19 states in the U.S. including Colorado, Washington, California, Alaska, Oregon, and Michigan have legalized the use of cannabis for recreational purposes.

Source Insights

The marijuana segment accounted for the largest revenue share of 85.5% in 2021owing to the growing adoption of marijuana products and the high efficacy of marijuana-derived cannabinoids. Traditionally, marijuana flowers were used to stop the progression of Alzheimer’s disease. Furthermore, marijuana oil is used for the treatment of cancer and nausea and can also be used for the improvement of the sleep cycle and alleviating stress, pain, and anxiety. This is thus increasing legalization of medical marijuana is impelling the growth.

In addition, the segment is anticipated to witness the fastest growth rate over the forecast period owing to the changing perceptions toward cannabis-based products coupled with development in the regulatory frameworks. In addition, the use of cannabis for recreational purposes as well as medical purposes is impelling the growth of the segment. This can be justified by the increase in the adoption of marijuana-based medical products for medical conditions by a large number of patients.

Derivative Insights

The CBD segment held the largest market share of 66.3% in 2021, owing to the acceptance of CBD products due to its medicinal properties and lack of psychoactive effects. It is used to treat various conditions including anxiety, depression, stress, seizures, etc. Epidiolex is an FDA-approved prescription CBD drug used to treat seizures associated with Lennox-Gastaut Syndrome. Also, the high demand for CBD for health and wellness purposes is a major factor responsible for the largest share of the segment.

Moreover, the legalization of CBD in some states of the U.S. due to the sanctioning of the U.S. Farm Bill 2018 created enormous opportunities for segment growth. Also, the favorable government regulation allowed several players to enter the market, thereby fueling the growth of the segment.

However, the other segment is anticipated to grow at the fastest CAGR over the forecast period owing to the rising number of research claiming the benefits of minor cannabinoids, such as CBC, CBG, and CBDa. Furthermore, an increase in the number of players in the country providing minor cannabinoid products and rising awareness regarding the health benefits offered by them are expected to fuel the segment growth over the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Cannabis Market

5.1. COVID-19 Landscape: U.S. Cannabis Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Cannabis Market, By End-use

8.1. U.S. Cannabis Market, by End-use, 2022-2030

8.1.1 Medical

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Recreational

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Industrial

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Cannabis Market, By Source

9.1. U.S. Cannabis Market, by Source, 2022-2030

9.1.1. Marijuana

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Hemp

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Cannabis Market, By Derivative

10.1. U.S. Cannabis Market, by Derivative, 2022-2030

10.1.1. CBD

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. THC

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global U.S. Cannabis Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by End-use (2017-2030)

11.1.2. Market Revenue and Forecast, by Source (2017-2030)

11.1.3. Market Revenue and Forecast, by Derivative (2017-2030)

Chapter 12. Company Profiles

12.1. Canopy Growth Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. GW Pharmaceuticals, plc

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Aurora Cannabis, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Aphria, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cronos Group

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Tilray

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others