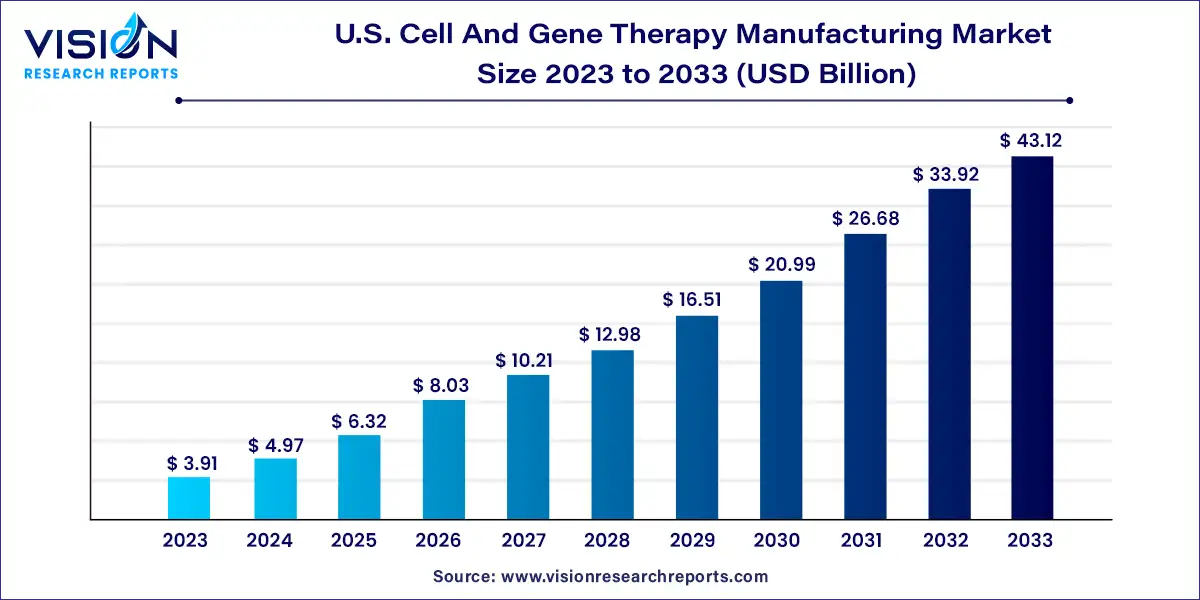

The U.S. Cell and gene therapy manufacturing market size was estimated at around USD 3.91 billion in 2023 and it is projected to hit around USD 43.12 billion by 2033, growing at a CAGR of 27.13% from 2024 to 2033.

The growth of the U.S. cell and gene therapy manufacturing market is propelled by an advancement in biotechnology and genetic engineering have enabled the development of novel therapies with the potential to address previously untreatable diseases. Additionally, increasing investment from both public and private sectors is driving research and development efforts, leading to a pipeline of innovative cell and gene therapies. Moreover, regulatory initiatives aimed at streamlining approval processes and ensuring product safety are facilitating market growth by expediting the commercialization of new therapies. Furthermore, growing awareness among healthcare providers and patients about the potential benefits of cell and gene therapies is driving demand and adoption. Finally, strategic collaborations between industry players, academic institutions, and regulatory agencies are fostering innovation and knowledge exchange, further fueling market expansion.

In 2023, the cell therapy manufacturing segment took the lead in the market, commanding a revenue share of 57%. This dominance is attributed to the escalating number of ongoing clinical trials and the influx of products entering the market, thereby elevating the significance of cell therapy, particularly in immuno-oncology. Despite limited U.S. FDA approvals for CAR T-cell therapies, the landscape is rapidly evolving, with over 250 clinical trials exploring CAR T-cell and other cell therapies across a spectrum of indications, spanning both solid and liquid tumors. Consequently, there is a burgeoning demand for advanced cell manufacturing services anticipated in the forthcoming years, fueled by the projected market expansion of allogeneic cell therapy products. As these products are poised to attain sizable market shares, the imperative for commercial-scale production amplifies.

The gene therapy segment is poised for significant growth throughout the forecast period. With numerous products advancing through clinical trials, there arises a pressing need for enhancements in the production processes within the gene therapy manufacturing domain. Bolstered by heightened investments from industry players and the mounting clinical successes of various products, several gene therapy companies are directing their efforts towards manufacturing and commercialization endeavors. When designing the manufacturing process for gene therapy products, critical considerations include the evaluation of existing processes and their scalability, alongside the strategic determination of in-house versus outsourced manufacturing options.

In 2023, pre-commercial and R&D scale manufacturing claimed a substantial revenue share of 73%. This dominance is primarily attributed to the rapidly evolving market landscape for cell and gene therapies, which drives innovation in research and development concerning gene and cell therapy. As the market continues to evolve, with more positive data emerging from ongoing clinical trials, the pre-commercial manufacturing segment is poised for further growth. Notably, over 400 companies in North America are actively engaged in the development of cell and gene therapy products targeting various diseases.

Concurrently, the commercial-scale manufacturing segment is forecasted to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. Major biopharmaceutical companies such as Bristol-Myers Squibb (BMS), Novartis AG, and Merck KGaA are making substantial investments in cell and gene therapy programs and manufacturing infrastructure. Leveraging their capabilities, resources, and skilled workforce, these companies can expedite entry into clinical trials and accelerate time to market. Consequently, the market for commercial-scale manufacturing is expected to be propelled by the increasing number of products entering the market through these established players.

In 2023, the contract manufacturing segment claimed the highest revenue share at 66%. The escalating demand for cell and gene therapies has brought forth challenges related to sufficient manufacturing capacity, thereby creating opportunities for contract manufacturing service providers. As the industry undergoes rapid transformation, outsourcing services are anticipated to provide market participants with a competitive advantage, offering expertise and experience vital for navigating complex manufacturing processes.

Conversely, the in-house manufacturing segment is forecasted to demonstrate the fastest compound annual growth rate (CAGR) during the forecast period. Establishing a small-scale in-house manufacturing facility may be a viable option for gene therapy companies encountering difficulties in securing contract manufacturing service partners or obtaining production time slots within required timelines. However, the associated capital investment for constructing a manufacturing facility tailored to a single cell or gene therapy product can pose challenges for emerging and small pharmaceutical or biotechnology firms.

In 2023, the process development segment accounted for a significant revenue share of 17%. This growth is primarily attributed to the increasing number of therapies transitioning from clinical trials to regulatory approvals, thereby driving demand for robust process development methodologies in cell therapy production. The development of efficient and organized processes is crucial for ensuring the safety and quality of candidate programs, thus enhancing their overall profiles.

Concurrently, the vector production segment is poised to register the fastest compound annual growth rate (CAGR) during the forecast period. Viral vectors are witnessing a surge in adoption for the treatment of diverse health conditions, spanning metabolic, muscular, infectious, cardiovascular, hematologic, ophthalmologic, and various types of cancer. Among the widely utilized viral vectors are adenoviral, lentiviral, adeno-associated viral (AAV), retroviral, and herpes simplex virus vectors. Manufacturing viral vectors involves utilizing different cell lines characterized by unique growth and transfection characteristics.

By Therapy Type

By Scale

By Mode

By Workflow

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Cell and Gene Therapy Manufacturing Market

5.1. COVID-19 Landscape: U.S. Cell and Gene Therapy Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Cell and Gene Therapy Manufacturing Market, By Therapy Type

8.1. U.S. Cell and Gene Therapy Manufacturing Market, by Therapy Type, 2024-2033

8.1.1. Cell therapy manufacturing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Gene therapy manufacturing

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Cell and Gene Therapy Manufacturing Market, By Scale

9.1. U.S. Cell and Gene Therapy Manufacturing Market, by Scale, 2024-2033

9.1.1. Pre-commercial/ R&D scale manufacturing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial scale manufacturing

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Cell and Gene Therapy Manufacturing Market, By Mode

10.1. U.S. Cell and Gene Therapy Manufacturing Market, by Mode, 2024-2033

10.1.1. Contract manufacturing

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. In-house manufacturing

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Cell and Gene Therapy Manufacturing Market, By Workflow

11.1. U.S. Cell and Gene Therapy Manufacturing Market, by Workflow, 2024-2033

11.1.1. Cell processing

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Cell banking

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Process development

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Fill & finish operations

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Analytical and quality testing

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Raw material testing

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Vector production

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Others

11.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Cell and Gene Therapy Manufacturing Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Therapy Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Scale (2021-2033)

12.1.3. Market Revenue and Forecast, by Mode (2021-2033)

12.1.4. Market Revenue and Forecast, by Workflow (2021-2033)

Chapter 13. Company Profiles

13.1. Lonza

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bluebird Bio Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Catalent Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. F. Hoffmann-La Roche Ltd

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Samsung Biologics

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Boehringer Ingelheim

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Cellular Therapeutics

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Hitachi Chemical Co., Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Takara Bio Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Miltenyi Biotec

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others