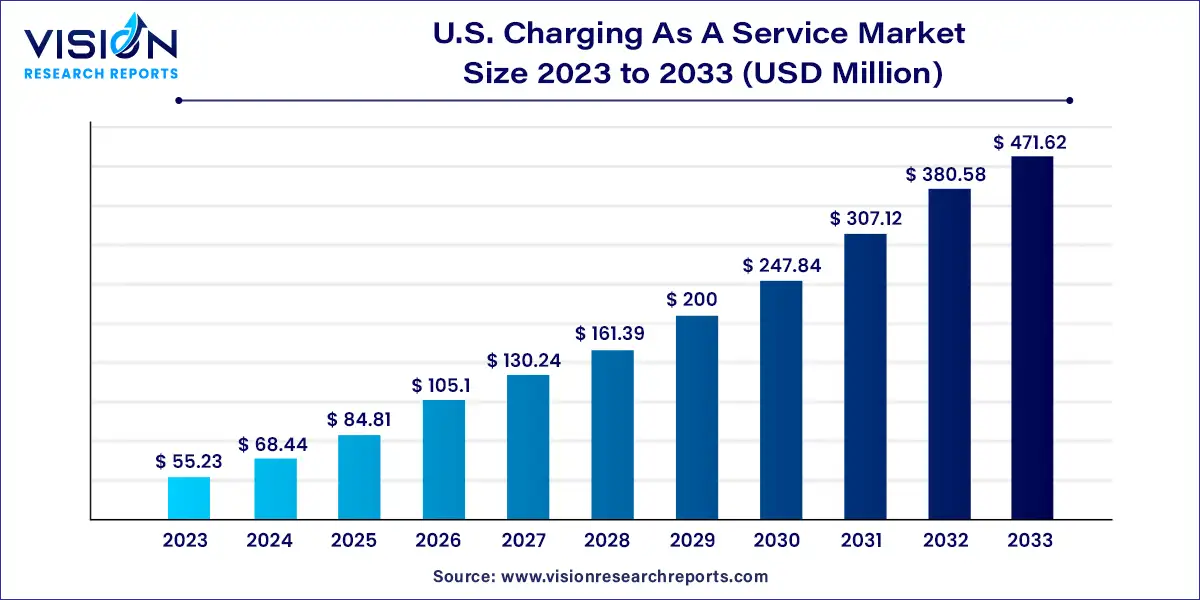

The U.S. charging as a service market size was estimated at around USD 55.23 million in 2023 and it is projected to hit around USD 471.62 million by 2033, growing at a CAGR of 23.92% from 2024 to 2033.

The U.S. has witnessed a significant shift towards electric vehicles (EVs), catalyzing the evolution of the charging infrastructure. Amidst this transformation, the concept of Charging-as-a-Service (CaaS) has emerged as a pivotal solution, offering convenience and accessibility to EV owners.

The growth of the U.S. charging-as-a-service market is propelled by an increasing adoption of electric vehicles (EVs) across the country is driving the demand for convenient and accessible charging solutions. This surge in EV ownership is fueled by growing environmental awareness, government incentives, and advancements in battery technology, all of which contribute to a favorable landscape for Charging-as-a-Service providers. Additionally, supportive regulatory policies at both the federal and state levels are encouraging investment in EV infrastructure, further bolstering market growth. Moreover, the collaboration between CaaS providers, automakers, and energy companies is fostering innovation and expanding the accessibility of EV charging infrastructure, enhancing the overall user experience.

In 2023, the AC charging segment dominated the U.S. charging-as-a-service market, accounting for 54% of the revenue share. AC charging stations present a cost-effective and convenient solution for EV owners. Their installation and maintenance are simpler compared to DC charging stations, thanks to lower equipment costs and widespread availability of technology. The steady rise in residential EV charger sales and the proliferation of public charging stations in the U.S. have fueled demand for AC charging stations. With the integration of smart technologies, features like remote monitoring, efficient billing, and user-friendly interfaces have become crucial for enhancing customer satisfaction in the AC charging segment. Various business models, including subscription-based services, pay-per-use, and partnerships with property owners, are driving market growth.

Conversely, the DC charging segment is poised for the fastest growth rate through 2033. This growth is driven by the escalating demand for rapid charging solutions for EVs across the United States. DC charging stations, renowned for their faster charging speeds compared to AC counterparts, play a vital role in alleviating range anxiety among EV owners, particularly during long-distance travel. Recognizing the surging demand for swift vehicle charging, companies are rolling out innovative services to meet consumer needs.

In 2023, the commercial segment emerged as the dominant force in the U.S. charging-as-a-service market, primarily driven by the increasing corporate embrace of sustainable initiatives and the expanding fleet of electric vehicles (EVs). Businesses spanning retail, hospitality, and corporate sectors are strategically investing in EV charging infrastructure to meet the evolving needs of employees and customers alike. A 2022 Deloitte survey revealed that 40% of respondents declined job offers due to inadequate climate-conscious practices, underscoring the importance of environmental considerations in employment decisions. Moreover, younger workers, particularly concerned about their employers' environmental impact, displayed greater job retention rates exceeding five years.

Meanwhile, the residential segment is poised for significant growth during the forecast period. The convenience and reliability inherent in residential charging solutions have spurred a consistent demand for affordable and efficient EV charging services. Service providers are prioritizing user-friendly and visually appealing charging solutions, often integrated seamlessly into smart home systems. The burgeoning development of residential properties in the U.S. has paved the way for collaborations between real estate developers and energy companies, opening avenues for market expansion. Notably, in August 2023, Duke Energy launched an EV charging subscription service in collaboration with industry giants like General Motors, Ford Motor Company, and BMW, targeting residential customers in North Carolina. The pilot initiative allowed participants to select their preferred charging schedule, with automakers optimizing charging times to meet individual needs while avoiding peak grid hours.

In 2023, the hosted segment claimed the largest revenue share in the charging-as-a-service market. This model involves third-party providers installing and managing EV charging stations at locations owned by other entities. It enables shopping centers, parking facilities, or businesses to offer EV charging services without installing stations directly. Hosted charging stations strategically positioned in high-traffic areas maximize accessibility for EV users. This model benefits site hosts by retaining or attracting EV-driving customers or employees and providing an additional revenue stream. Providers leveraging the hosted model capitalize on existing infrastructure, gain visibility in key locations, and contribute to the demand for EV charging systems.

Conversely, the subscription segment is projected to witness the highest CAGR during the forecast period. Subscription-based charging-as-a-service offers customers the convenience of charging on a monthly or yearly payment basis, eliminating upfront costs and installation needs. Increasing collaborations between market players and investors in offering subscription-based services are expected to drive segment growth. Several emerging companies have entered this space in recent years.

By Service

By Charging Station

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others