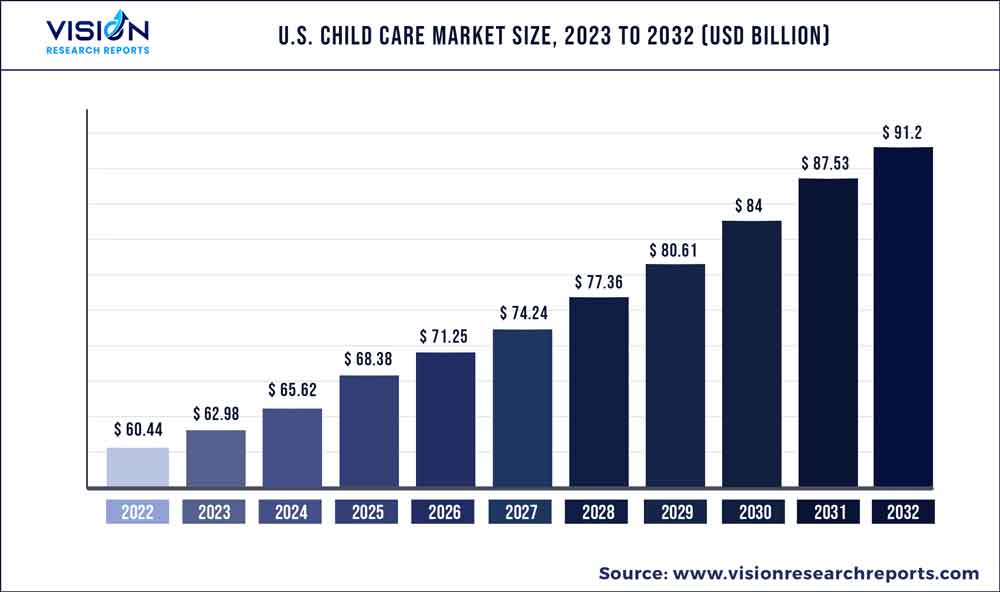

The U.S. child care market was surpassed at USD 60.44 billion in 2022 and is expected to hit around USD 91.2 billion by 2032, growing at a CAGR of 4.20% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Child Care Market

| Report Coverage | Details |

| Market Size in 2022 | USD 60.44 billion |

| Revenue Forecast by 2032 | USD 91.2 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.20% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Bright Horizons Family Solutions; KinderCare Learning Centers LLC.; Learning Care Group, Inc.; Spring Education Group; Cadence Education; The Learning Experience; Childcare Network; Kids 'R' Kids; Primrose School Franchising SPE, LLC.; Goddard Franchisor LLC |

The key factor driving the growth is the rising demand for early daycare & education services with more parents returning to working in offices, the rising number of single & working mothers, advancements in learning technologies for children, and the accessibility of government funding. The expenditure on daycare in the U.S. is very high. As per the cost of care survey facilitated by the U.S. Department of Health and Human Services, the expenditure on these services reached up to 7% of the household income in 2021. Families in the U.S. are willing to spend more on childcare services, indicating the high service demand in the U.S.

Furthermore, single-parent families are growing in the U.S. As per the 2022 single-parent statistics, in 2022 there were around 11 million single-parent families in the U.S. Single-parent families cannot give the required attention to the child, thus relying on childcare centers or their kid's early education and well-being.

In addition, the Southern states in the U.S. have the highest single-parent population. South Carolina, Florida, Georgia, Mississippi, and Louisiana have the highest number of single-parent households. Louisiana reported over 40% single-parent households, the highest in the U.S. Hence, the southern region is expected to have the highest demand.

Type Insights

Based on type, the market is segmented into early care, early education & daycare, backup service & others. Early education & daycare accounted for the largest revenue share of 47.05% in 2022. This can be attributed to monetary support from the government that can enable children from lower-income families to access childcare services. For Instance, the Department of Early Education and Care provides grants for center-based early education services. All EEC-licensed childcare service providers are eligible for this grant.

The backup care segment is expected to witness lucrative growth owing to the increasing number of working single parents driving growth. In some of the states in the U.S., the state government has laws requiring employers to provide backup service benefits. For instance, in March 2021, the California state government proposed a new bill making it mandatory for employers to facilitate subsidized backup care service benefits to their employees, thus boosting the growth opportunities for the segment in the region.

The early care segment is expected to grow significantly during the forecast period. This growth can be attributed to increased funding for high-quality early care programs. Several states and localities have implemented policies to expand access to early care, such as universal prekindergarten programs and increased funding for Head Start programs.

Delivery Type Insights

Based on delivery type, the market is segmented into organized care facilities and home-based settings. The organized care facilities segment accounted for the highest revenue share of 71.72% in 2022 and is expected to witness the highest CAGR during the forecast period. The rising number of working parents, technological advancement, and growing funding for supporting quality early education drive segment growth.

Furthermore, the organizations facilitating daycare collaborate to enable large-scale organized daycare. For instance, the first Steps 4K, an organization facilitating early education for 4-year-old children, collaborated with 200 non-profit daycare centers to facilitate high-quality early education as per the child's requirements.

The home-based settings are expected to witness lucrative growth during the forecast period. Home-based child care is popular for many families, particularly those with younger children or irregular schedules. According to a report by HomeGrown Childcare, approximately 7 million children under the age of five receive care in a home-based setting. It offers a range of benefits to families, such as lower costs, personalized care, and a more home-like environment. These benefits are expected to fuel the growth of the segment.

U.S. Child Care Market Segmentations:

By Type

By Delivery Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Child Care Market

5.1. COVID-19 Landscape: U.S. Child Care Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Child Care Market, By Type

8.1. U.S. Child Care Market, by Type, 2023-2032

8.1.1. Early Care

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Early Education & Early Daycare

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Backup Care

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Child Care Market, By Delivery Type

9.1. U.S. Child Care Market, by Delivery Type , 2023-2032

9.1.1. Organized Care Facilities

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Home-based Settings

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Child Care Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Delivery Type (2020-2032)

Chapter 11. Company Profiles

11.1. Bright Horizons Family Solutions

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. KinderCare Learning Centers LLC.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Learning Care Group, Inc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Spring Education Group

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Cadence Education

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. The Learning Experience

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Childcare Network

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kids 'R' Kids

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Primrose School Franchising SPE, LLC.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Goddard Franchisor LLC

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others