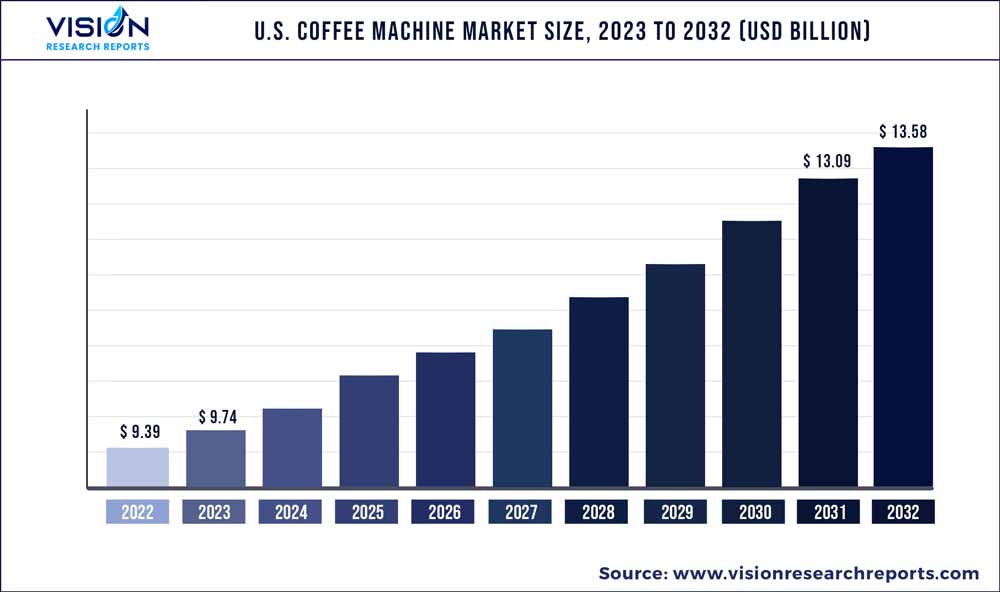

The U.S. coffee machine market was estimated at USD 9.39 billion in 2022 and it is expected to surpass around USD 13.58 billion by 2032, poised to grow at a CAGR of 3.76% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Coffee Machine Market

| Report Coverage | Details |

| Market Size in 2022 | USD 9.39 billion |

| Revenue Forecast by 2032 | USD 13.58 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.76% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Keurig Green Mountain, Inc.; Nestlé Nespresso SA; BUNN; Koninklijke Philips N.V.; Hamilton Beach Brands, Inc.; Spectrum Brands, Inc.; SharkNinja Operating LLC; Sunbeam Products, Inc.; De’ Longhi Appliances S.r.l.; Moccamaster USA; Supramatic; KitchenAid; Breville; BODUM; SMEG USA, Inc. |

Increased consumption of coffee, particularly in Asian countries, and the launch of new products, such as green and organic coffee, are key factors contributing to the growth of the market. The rising consumption of coffee can be attributed to growing awareness of some of the health benefits of coffee, such as reduced risk of liver cancer, type 2 diabetes, liver disease, and heart failure. This has directly driven the demand for coffee machines for residential and commercial use. However, excessive intake of caffeine can cause anxiety, jitters, insomnia, and restlessness, which could act as restraints to market growth.

Coffee machines reduce the time and effort required to prepare coffee at home, in coffee shops, and at office cafeterias, among other settings. While traditional coffee machines are already convenient and easy to use, the introduction of smart coffee machines with the latest technologies and a slew of advanced features and functions-has given the market a tremendous boost.

Smart coffee machines are integrated with Bluetooth, Wi-Fi, voice assistants, and other features, which can be accessed, operated, and controlled through smartphones from anywhere inside the house. Moreover, consumers looking for quick and easy brewing methods are increasingly embracing modern brewing technologies like pod-based systems and capsule machines. These trends will continue to aid in the expansion of the U.S. coffee machine market over the forecast period.

In the U.S., the consumption of coffee has been rising over the past few years. According to the data released by the International Coffee Organization in 2021, coffee consumption in the U.S. has grown by 1.2% in the past five years, driving the demand for coffee machines in the country. Changing consumer lifestyles and the growing coffee culture drive the demand for coffee machines. In addition, consumers are actively seeking quality coffee and convenience in preparing coffee, which is expected to drive the demand for coffee machines in the country.

Coffee is one of the most popular hot beverages in the world, with Europe and North America accounting for the highest consumption. Exclusive consumer polling released in March 2022 by the National Coffee Association (NCA) (U.S.) revealed that 66% of the U.S. population drinks coffee each day, more than any other beverage, including tap water, and was up by nearly 14% since January 2021, the largest increase since the NCA began tracking data. Furthermore, the survey found that 517 million cups of coffee are consumed each day in the U.S.

According to the Food Institute, coffee intake is increasing among younger generations, which is the key factor driving the growth in coffee consumption in developed countries, including the U.S. Innovation in product offerings, changing work patterns, and drinking coffee as a social activity are driving coffee consumption among this demographic, which, in turn, drives the demand for coffee machines.

Product Insights

The espresso coffee machine segment accounted for a share of over 36% in 2022. This can be attributed to the emergence of the "home barista" phenomenon which has driven the desire among individuals to replicate the quality of café-style beverages within the comfort of their own homes. The emergence of the "home barista" phenomenon has driven the desire among individuals to replicate the quality of café-style beverages within the comfort of their own homes.

In November 2022, Breville, a renowned global brand known for its innovation and design in delivering exceptional coffee machines to customers worldwide, unveiled the latest version of its best-selling espresso machine, the Barista Express Impress. This machine combines advanced automation with user-friendly features to assist consumers in achieving the optimal espresso dose and precise tamp, all the while minimizing the mess associated with espresso grinding.

The bean-to-cup coffee machine segment is anticipated to grow at a CAGR of 5.04% over the forecast period from 2023 to 2032 owing to the evolving preferences of consumers. Coffee drinkers place a lot of emphasis on freshness and flavor. Bean-to-cup machines enable users to grind coffee beans on demand, ensuring that each cup of coffee is brewed with maximum freshness and aromatic richness.

This aspect resonates with consumers who prioritize the quality and authenticity of their coffee experience. Additionally, the expanding market for specialty coffee has fueled the growth of bean-to-cup machines. Specialty coffee enthusiasts appreciate the superior quality and unique flavor profiles of specialty beans. Bean-to-cup machines provide the necessary tools and precision required to extract the full potential of these beans, allowing users to indulge in a premium coffee experience at home.

Application Insights

The commercial coffee machine segment accounted for a share of over 56% in 2022. The rise of the café culture and the increasing number of coffee shops and specialty coffee establishments across the U.S. have significantly contributed to the growth of the commercial coffee machine market. As consumers develop a greater appreciation for high-quality coffee and unique brewing methods, coffee shop owners and hospitality businesses strive to meet these expectations by investing in advanced commercial coffee machines. These machines enable them to consistently deliver exceptional coffee and cater to the discerning tastes of their customers.

The residential coffee machine segment is expected to grow at a CAGR of 4.65% over the forecast period. The most significant driver for the growth of the residential coffee machine market is cost savings. Regularly purchasing coffee from coffee shops can add up to a substantial expense over time. Individuals can significantly reduce their expenditure on daily coffee purchases by investing in a high-quality coffee machine for home use. They can enjoy the same quality coffee experience at a fraction of the cost, making it an attractive option for budget-conscious consumers.

U.S. Coffee Machine Market Segmentations:

By Product

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Coffee Machine Market

5.1. COVID-19 Landscape: U.S. Coffee Machine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Coffee Machine Market, By Product

8.1. U.S. Coffee Machine Market, by Product, 2023-2032

8.1.1. Drip Filter

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Capsule

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Espresso

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Bean-to-Cup

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Coffee Machine Market, By Application

9.1. U.S. Coffee Machine Market, by Application, 2023-2032

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Coffee Machine Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Keurig Green Mountain, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Nestlé Nespresso SA

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BUNN

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Koninklijke Philips N.V.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Hamilton Beach Brands, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Spectrum Brands, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. SharkNinja Operating LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Sunbeam Products, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. De’ Longhi Appliances S.r.l.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Moccamaster USA

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others