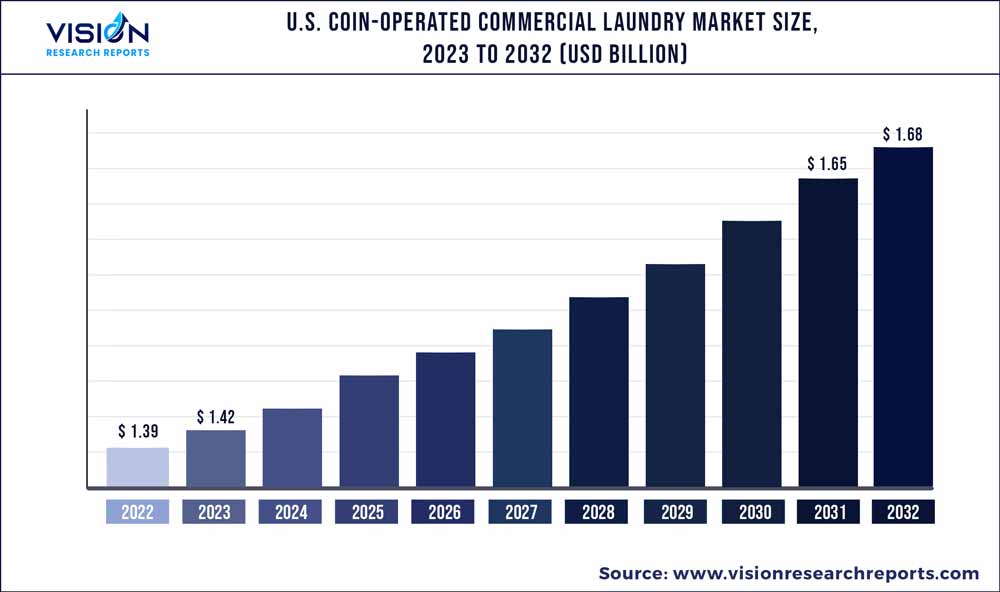

The U.S. coin-operated commercial laundry market was surpassed at USD 1.39 billion in 2022 and is expected to hit around USD 1.68 billion by 2032, growing at a CAGR of 1.93% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Coin-operated Commercial Laundry Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.39 billion |

| Revenue Forecast by 2032 | USD 1.68 billion |

| Growth rate from 2023 to 2032 | CAGR of 1.93% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | AB Electrolux; Alliance Laundry System LLC; B&C Technologies; Dexter Laundry; Domus; Ecolab; Fagor Professional; Laundrylux Inc.; LG Electronics; Maytag; TOLON; Wascomat; Whirlpool Corporation; Yamamoto; AAdvantage Laundry Systems; Champion Cleaners; Cintas Corporation; Clean Designs Inc.; Coin & Professional Equipment Co.; Ed Brown Distributors; Northwest Laundry Supply, Inc; Pierce Commercial Laundry Distributors; Professional Laundry Solutions; UniFirst Corp.; Wholesale Commercial Laundry S.E. |

The growth can be credited to the increasing urbanization and changing lifestyle patterns of consumers, leading to increased demand for coin-operated laundry services due to the higher concentration of apartments and smaller living spaces. Several people living in cities do not have laundry facilities within their homes, so they rely on coin-operated machines at laundromats or other commercial laundry facilities. Moreover, these facilities are often present in convenient locations and offer flexible hours of operation.

The growth of the coin-operated commercial laundry market in the U.S. is being further driven by increasing demand across the hospitality sector comprising hotels, restaurants, resorts, vacation homes, etc. These businesses require regular laundry services for a variety of purposes such as cleaning linens, towels, and bedding for guests. Several companies offer laundry solutions designed especially for the hospitality industry.

For instance, the UniMac brand by Alliance Laundry System LLC provides hotel washers and dryers that are reliable and designed to lower labor and utility costs. They offer faster drying times and cycle times that significantly save costs in the long run. These services are also being increasingly adopted across rental facilities, dormitories, food & food services, hospitals, clinics, etc.

Another crucial factor driving the expansion of the coin-operated commercial laundry market in the country is the significant technological developments. Unique machine controls, user-friendly interfaces, remote access & monitoring, IoT technologies, energy-efficient technologies, mobile applications, data analytics, and laundry management software are some recent developments in commercial laundry services. For instance, Xeros provides a comprehensive laundry management software solution with order tracking, scheduling, inventory management, billing, reporting & customer management.

Equipment Insights

The top-load segment is estimated to record a CAGR of 1.52% through 2032, owing to rising demand for the equipment due to associated benefits such as faster cycle times, large capacities, high energy efficiency, etc. Another advantage of top-load machines is their dependence on gravity to contain the water instead of potentially short-lived front door seals. Besides, top-load washers are cost-effective, which makes them a preferred option for commercial applications. They are largely adopted across coin-operated units where the initial price is crucial, as they become cost-effective in the long run.

The front-load segment captured a revenue share of over 87% in 2022, owing to increasing product demand driven by its ability to provide cleaner clothes due to tumbling motion, less usage of water, greater efficiency, reduced dry time, etc. Moreover, front-load machines are capable of handling larger laundry loads as their drums have more laundry space to accommodate more clothes. They can also self-regulate the water required for appropriate washing and rinsing.

Product Insights

The washer segment accounted for a revenue share of 55% in 2022, owing to ongoing technological developments in washers. Several new washers offer unique drum movements and water jets to provide the best possible output. Many new washers introduced in 2022 have been equipped with artificial intelligence that enables machines to sense the weight of laundry and automatically use the precise amount of detergent and water during every wash. Certain washers also have soil sensors which automatically add extra time to the laundry cycle to clean extra dirty clothes.

The dryer segment is estimated to record a CAGR of 2.35% from 2023 to 2032 with the increasing product demand driven by advancements in drying technologies. For instance, the Speed Queen brand by Alliance Laundry System LLC provides washers with unique control options – Quantum Touch and Quantum Gold – providing a user-friendly interface, easy-to-understand cycle modifiers, on-screen timers, and more than 30 languages. They also offer various payment options such as dual coin drop, single coin drop, prep for coin, app pay, etc.

Capacity Insights

The 6 to 14 kg segment captured a revenue share of nearly 49% in the U.S. coin-operated commercial laundry market in 2022. This can be credited to the increasing product demand due to growing consumer preference for commercial laundry services as they help save utility costs due to less electricity and water usage. Besides, they can handle small to large laundry loads and provide different programs according to the fabric.

The 14 to 27 kg segment is poised to record a CAGR of 2.44% through 2032, aided by the rising demand for laundry equipment in this capacity range across laundromats. Besides, the growing trend of on-premise laundry in hospitals, hotels, restaurants, salons, and food service industries is also favoring segmental growth. Several companies offer laundry solutions designed especially for the hospitality industry. The UniMac brand by Alliance Laundry Systems provides hotel washers and dryers that are reliable and lower labor and utility costs. They offer faster drying and cycle times to aid in cost savings in the long run.

U.S. Coin-operated Commercial Laundry Market Segmentations:

By Equipment

By Product

By Capacity

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Equipment Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Coin-operated Commercial Laundry Market

5.1. COVID-19 Landscape: U.S. Coin-operated Commercial Laundry Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Coin-operated Commercial Laundry Market, By Equipment

8.1. U.S. Coin-operated Commercial Laundry Market, by Equipment, 2023-2032

8.1.1 Top Load

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Front Load

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Coin-operated Commercial Laundry Market, By Product

9.1. U.S. Coin-operated Commercial Laundry Market, by Product, 2023-2032

9.1.1. Washer

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Dryer

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Coin-operated Commercial Laundry Market, By Capacity

10.1. U.S. Coin-operated Commercial Laundry Market, by Capacity, 2023-2032

10.1.1. 6 to 14 kg

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. 14 to 27 kg

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Above 27 kg

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Coin-operated Commercial Laundry Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Equipment (2020-2032)

11.1.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.3. Market Revenue and Forecast, by Capacity (2020-2032)

Chapter 12. Company Profiles

12.1. AB Electrolux

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Alliance Laundry System LLC

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. B&C Technologies.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dexter Laundry

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Domus

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Ecolab

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Fagor Professional.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Laundrylux Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. LG Electronics.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Maytag

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others