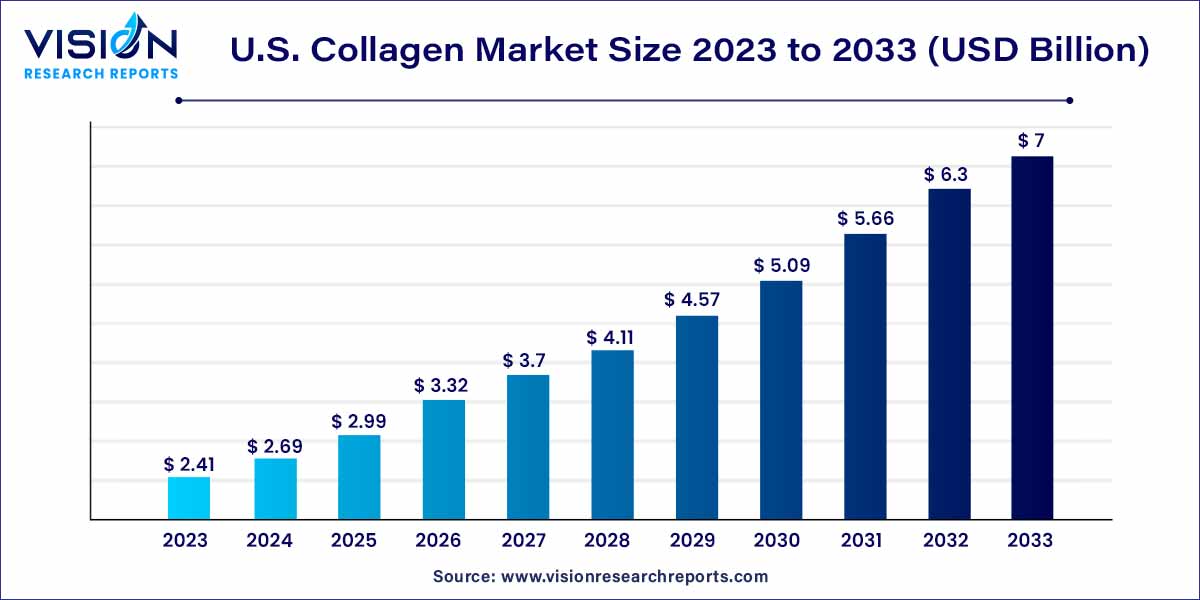

The U.S. collagen market was surpassed at USD 2.41 billion in 2023 and is expected to hit around USD 7 billion by 2033, growing at a CAGR of 11.24% from 2024 to 2033.

The U.S. collagen market has witnessed significant growth in recent years, driven by increasing consumer awareness of health and wellness, rising demand for natural and sustainable products, and the expanding application of collagen across various industries. This overview delves into the key factors shaping the U.S. collagen market and highlights the trends that are influencing its trajectory.

The growth of the U.S. collagen market can be attributed to several key factors. Firstly, the increasing awareness among consumers about the importance of health and wellness has led to a rising demand for collagen-based products. As individuals become more conscious of their dietary choices and overall well-being, collagen's positive impact on joint health, skin, and overall vitality has positioned it as a sought-after ingredient. Secondly, the diverse applications of collagen, extending beyond traditional supplements to include the food and beverage industry, pharmaceuticals, and medical applications, contribute significantly to market expansion. Additionally, the industry's response to sustainability concerns has played a pivotal role, with manufacturers actively exploring eco-friendly and ethically sourced collagen alternatives. Lastly, continuous technological advancements in collagen extraction and production methods enhance quality, efficiency, and cost-effectiveness, fostering a conducive environment for market growth. Overall, these interconnected factors underscore the robust trajectory of the U.S. collagen market.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.41 billion |

| Revenue Forecast by 2033 | USD 7 billion |

| Growth rate from 2024 to 2033 | CAGR of 11.24% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The gelatin segment held the largest revenue share of 65% in 2023. This can be attributed to the robust performance of the U.S. food and beverage industry, fueled by the consistent growth in annual consumer food expenditures. The escalating demand for gelatin as a food stabilizer is closely linked to the heightened consumption of various food products, including yogurt, pasta, jams, and jellies. Moreover, the surge in demand for food gelling agents utilized in desserts like trifles, marshmallows, gummy bears, and jelly bellies is anticipated to sustain and drive the demand for gelatin throughout the forecast period.

Small chain amino acids, derived through chemical processes from the bones and cartilage of bovine animals, stand as a primary source of hydrolyzed collagen. Within the food processing sector, it is a prevalent ingredient in the production of confectioneries such as hard candies and chocolates. The segment is poised for growth, propelled by manufacturers' concerted efforts to incorporate the product in the treatment of bone-related ailments, notably osteoarthritis.

Native collagen, a protein intrinsic to various animal connective tissues like cartilage, bone, ligaments, and skin, forms a crucial component in skincare formulations. Comprising amino acids arranged into a triple helix structure known as collagen helix, it serves to delay the emergence of new wrinkles and aids in minimizing marks resulting from skin burns and minor wounds. Additionally, native collagen finds application in addressing health concerns like osteoarthritis, joint pain, and muscle pain, illustrating its versatility and potential for varied applications.

The bovine segment captured the maximum market share of 36% in 2023. This dominance is attributed to the widespread use of bovine collagen derived from various species, including yak, water buffalo, bison, antelope, and cows. Bovine collagen encompasses both type I and type III collagen, found in gelatin and hydrolyzed forms. Renowned for its skin-boosting properties, bovine collagen contributes to enhanced suppleness, increased moisture retention, and the reduction of wrinkles. Its benefits extend to promoting hair growth, strengthening nails, aiding in stomach healing, enhancing muscle strength, and facilitating muscle recovery.

Poultry collagen primarily hails from domesticated species such as chickens, ducks, geese, and turkeys. The main source, chicken collagen, derived from the birds' cartilage, bones, and tissues, is employed for treating joint and arthritic conditions while bolstering overall immunity. The poultry source segment is anticipated to experience growth, driven by the increasing utilization of chicken collagen for joint-related therapeutic applications.

Marine collagen, sourced from fish scales, contains a significant amount of type I collagen that supports ligaments, bones, muscles, skin, nails, and hair. Extracted from marine organisms like sponges, jellyfish, squid, salmon, cod, and milkfish, marine collagen stands out for its bioavailability and rapid absorption, contributing to its elevated quality.

The food and beverage application segment had the largest market share of 52% in 2023. This dominance is attributed to the widespread adoption of collagen in the food and beverage sector, where it plays a pivotal role in enhancing elasticity, uniformity, and stability of products. Serving as a versatile culinary ingredient, collagen contributes to the improvement of flavor, color, and texture in various food items. Its prevalence extends to collagen-infused beverages, including juices, energy drinks, and coffee, among others.

Within the healthcare industry, collagen finds applications in the production of wound coverings, particularly valued as dressing material for serious burns and ulcers. Leveraging its biocompatibility and biodegradability, collagen serves as a crucial biomaterial, utilized in tissue engineering for creating synthetic blood arteries, valves, bone substitutes, and replacement skin. Collagen supplements in the healthcare sector prove beneficial for accelerating lean muscle growth, expediting the healing process, repairing damaged joint structures, and enhancing cardiovascular fitness.

In the cosmetics industry, collagen is a key ingredient in anti-aging creams, eye-pad kits, facial fillers, and other skincare products. This segment further branches into two sub-segments: topical cosmetics and nutri-cosmetics. Nutri-cosmetics contribute to improved skin texture by strengthening connective tissues and promoting skin suppleness, while topically applied cosmetics function as moisturizers, supporting continuous skin hydration. The category encompasses a variety of gels and creams designed to tone the skin and enhance its overall texture.

By Product Type

By Source Type

By Application Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Collagen Market

5.1. COVID-19 Landscape: U.S. Collagen Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Collagen Market, By Product Type

8.1. U.S. Collagen Market, by Product Type, 2024-2033

8.1.1 Gelatin

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hydrolyzed Collagen

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Native Collagen

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Collagen Market, By Source Type

9.1. U.S. Collagen Market, by Source Type, 2024-2033

9.1.1. Bovine

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Porcine

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Poultry

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Marine

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Collagen Market, By Application Type

10.1. U.S. Collagen Market, by Application Type, 2024-2033

10.1.1. Food & Beverages

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Healthcare

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cosmetics

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Other

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Collagen Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Source Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Application Type (2021-2033)

Chapter 12. Company Profiles

12.1. Rousselot.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. GELITA AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Tessenderlo Group.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. STERLING GELATIN.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Weishardt Holding SA.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Juncà Gelatines SL

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Symatese.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Collagen Matrix, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Collagen Solutions Plc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. DSM

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others