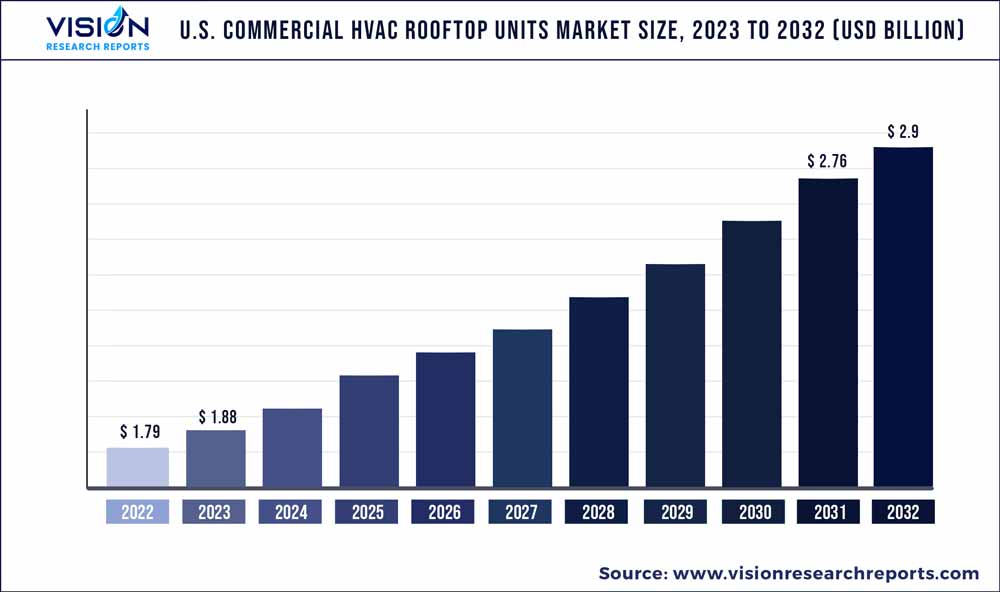

The U.S. commercial HVAC rooftop units market was estimated at USD 1.79 billion in 2022 and it is expected to surpass around USD 2.9 billion by 2032, poised to grow at a CAGR of 4.95% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Commercial HVAC Rooftop Units Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.79 billion |

| Revenue Forecast by 2032 | USD 2.9 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.95% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Carrier Global Corporation; DAIKIN INDUSTRIES Ltd.; Johnson Controls, Inc.; LG Electronics, Inc.; Danfoss; Lennox International; STULZ Air Technology Systems, Inc.; Rheem Manufacturing Company; Trane; Samsung; Mitsubishi Electric Corporation; Fujitsu; Gree Commercial; AAON |

The growth of the market can be attributed to the rising demand for cost-effective and energy-efficient space cooling and heating systems in commercial applications in the U.S. Moreover, the surging demand for heating equipment with a high seasonal coefficient of performance (SCOP) that can work efficiently in both, winter and summer seasons, is expected to fuel the growth of the U.S. market for HVAC rooftop units over the forecast period.

According to the ASHRAE 2021 report, the U.S. is the fourth-largest market for variable refrigerant flow (VRF) systems, followed by Japan, China, and South Korea. The energy efficiency of VRF systems, and their adaptability in zonal control, provision of simultaneous heat recovery, heating & cooling, and ease of installation with no ductwork required can be attributed to their widespread success. From single-family homes to workplaces, data centers, hotels, and hospitals, the spectrum of applications varies significantly for VRF systems.

Commercial HVAC rooftop units come in various capacities between 3 and 162 tons. The size of the space to be maintained and controlled decides the capacity of the HVAC rooftop units. For small businesses such as retail spaces, restaurants, and cafes, the 3 to 7-ton rooftop units can fulfill the basic HVAC requirements. This range of rooftop units is ideal for the small capacity and uneven requirement for cooling and heating.

The growth of restaurants, small businesses, and retail spaces is likely to drive the growth of the 5-7 ton segment over the forecast period. Moreover, continuous technological innovation and product launches in this capacity range are also expected to facilitate the segment’s growth over the forecast period. For instance, in December 2021, Daikin introduced a 5-ton gas/electric and AC rooftop unit. The new product includes the DF series and meets the Department of Energy (DOE) minimum efficiency standards.

According to the United Nations (UN), more than half of the global population lives in urban areas; the number of urban areas in the U.S. is expected to reach 53 by 2030 compared to 41 in 2010. The positive perception of people about the cities and changing standard of living encourage migration from rural to urban areas. This is expected to boost the development of new metro cities and urban areas and create the need for supermarkets and hypermarkets, thereby driving the U.S. commercial HVAC rooftop unit demand and market over the forecast period.

The increasing number of medium-sized buildings such as restaurants, retail stores, healthcare, educational institutes, and lodging/hospitality primarily drives the growth of the 7-10 ton segment. These buildings require the HVAC rooftop units to have a capacity between 7 to 10 tons. The growth of the 7 to 10-ton rooftop units is attributed to their higher space heating & cooling efficiency, ease of serviceability, and weather-resistant cabinet. Moreover, it offers various advantages over other space heating & cooling equipment, such as compact design, lower installation cost, and lower maintenance.

Capacity Insights

The 5-7 ton segment is expected to witness the fastest CAGR of 5.35% over the forecast period. For small businesses such as retail spaces, restaurants, and cafes, the 3 to 7-ton rooftop units can fulfill the basic HVAC requirements. This range of rooftop units is ideal for the small capacity and uneven requirement for cooling and heating.

The 10-15 ton HVAC rooftop units are ideally used for high-end medium-sized buildings, which include small office buildings, hotels, educational institutes, and shopping malls, among others. This system offers higher capacity for heating, cooling, and ventilation with easy installation and efficient energy usage. The growth in the hotel, restaurant, and shopping mall construction projects in the U.S. is expected to drive the segment’s growth over the forecast period.

Furthermore, the growing emphasis by manufacturers of HVAC rooftop units on technological advancements and the incorporation of value-added features in rooftop units is expected to drive the segment's growth. The inclusion of technological advancements and new product launches is likely to increase revenue generation from new as well as existing customers. In April 2023, Trane launched Precedent Hybrid Dual Fuel Rooftop Units with Symbio, consolidating a 3-10 ton solution with Voyager 2 12.5-25 ton solution. The new product offered by the company includes a hybrid heat pump solution that offers the option to switch to gas in colder conditions.

SEER Insights

The above 19 seasonal energy efficiency ratio (SEER) segment is expected to witness a CAGR of 4.73% over the forecast period owing to the rising importance of energy efficiency and a favorable regulatory environment. In the above-19 SEER HVAC systems, having best-in-class energy efficiency also leads to savings in energy bills. The adoption of above-19 SEER HVAC units is limited; however, over the forecast period, the adoption of these units is anticipated to increase.

The manufacturers of the U.S. HVAC rooftop units are continuously investing in technological improvements. For instance, in December 2021, Daikin launched a comfort product featuring R-32. Compared to its R410A predecessor line, the Daikin ATMOSPHERA system uses R-32 refrigerant. It is a ductless, single-zone system with up to 16.3 EER ratings, 13.8 HSPF, and 27.4 SEER. It also provides ultra-efficient heating and cooling. Such product launches along with the technological developments in the HVAC rooftop units are likely to fuel the market’s growth over the forecast period.

According to the new standard by the U.S. DOE, since January 2023, the minimum efficiency (SEER2) for most of the packaged units was increased. For the southern region of the U.S., the minimum efficiency for AC units was increased from 14.0 to 15.0 SEER. The units which fail to meet this requirement cannot be installed on the rooftops. In addition, the national heat pump minimum efficiency was increased from 14.0 to 15.0 nationwide. Such developments and the increasing need for energy-efficient heating and cooling systems will positively impact the growth of the 14-19 SEER segment over the forecast period.

Product Type Insights

The VRF HVAC rooftop units segment is expected to witness the fastest CAGR of 10.12% over the forecast period. The rising popularity of the VRF HVAC rooftop units is attributed to the characteristics and advantages offered by these units, which include energy efficiency, flexible zonal control capabilities, and easy installation. In addition, these units can simultaneously deliver heating and cooling without requiring ductwork. Such advantages are expected to drive the demand for VRF HVAC rooftop units over the forecast period.

Furthermore, continuous technological advancements and the availability of energy-efficient systems in the market are likely to fuel the segment’s growth in the future. In July 2022, Toshiba launched a new VRF flagship system for commercial buildings. This system offers customers high-quality cooling and heating, ultra-efficient operation, and enables commercial buildings to achieve the best sustainability rating.

The conventional HVAC rooftop unit segment’s growth is primarily driven by their continued usage and demand for packaged AC and packaged terminal heating units in the U.S. Conventional HVAC rooftop units are installed on the rooftop of commercial buildings such as hotels, office buildings, and shopping malls. The growing construction industry and several buildings in the U.S. are likely to propel the demand for conventional HVAC rooftop units. According to the U.S. Census Bureau, the total value of construction is increasing continuously. In May 2023, the total construction spending in the U.S. was USD 1,925.6 billion, up from USD 1,909.0 billion in April 2023.

Moreover, technological advancements by key players in traditional HVAC rooftop units are expected to drive the market. The major HVAC companies in the U.S. offer high-performance units, which meet RTU specifications. Conventional RTUs are comparatively cheaper, with less capital investments than the VRF systems.

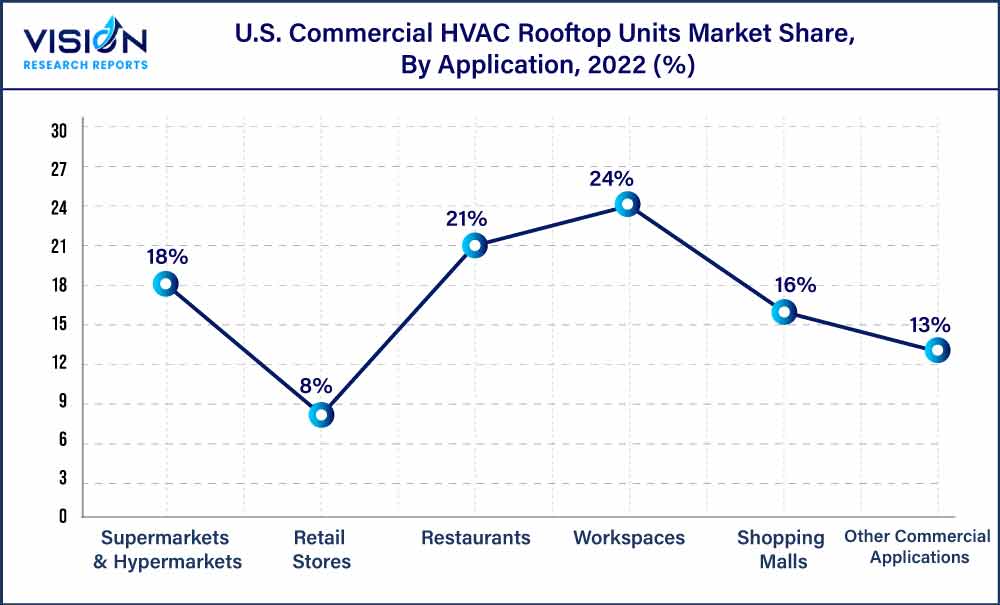

Application Insights

The workspaces application segment led the market and held 24% of the revenue share in 2022. The workspaces segment growth is substantially driven by the growth of the commercial sector, primarily office buildings. The HVAC RTU plays a vital role in maintaining the indoor air quality, proper heating, cooling, and ventilation of buildings. Education, mercantile, offices, and warehouse buildings account for 50% of the total buildings and 61% of the total floor space.

The growing population, customer preference for outdoor dining, and increasing demand for unique restaurants are likely to augment the restaurant industry’s growth. This will positively impact the overall demand for HVAC RTUs over the forecast period. Moreover, the new strategic initiatives are expected to support the growth of the market. In March 2023, Carrier Global Corporation announced a distribution strategy, in partnership with Budderfly, for energy-efficient HVAC systems designed for restaurants.

The growing urbanization across the U.S. significantly drives the supermarket and hypermarket segment’s growth. The population in the country is witnessing enormous growth and a subsequent change in the landscape of human settlement. Furthermore, the positive perception of people about cities and changing standard of living fuel the migration from rural to urban areas. This is expected to boost the development of new metro cities and urban areas and create the need for supermarkets and hypermarkets, thereby driving the U.S. HVAC rooftop unit demand and market over the forecast period.

The growing number of retail stores is projected to drive the demand for HVAC rooftop units over the forecast period. The growth in retail stores is driven by the growing population, increasing disposable incomes, and high expenditure on consumer goods and commodities. According to the National Retail Federation, in 2022, annual retail sales grew by 7% in the U.S. compared to 2021 and are expected to attain a growth rate of 4-6% in 2023.

U.S. Commercial HVAC Rooftop Units Market Segmentations:

By Capacity

By SEER

By Product Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Commercial HVAC Rooftop Units Market

5.1. COVID-19 Landscape: U.S. Commercial HVAC Rooftop Units Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Commercial HVAC Rooftop Units Market, By Capacity

8.1. U.S. Commercial HVAC Rooftop Units Market, by Capacity, 2023-2032

8.1.1. 5-7 Ton

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. 7-10 Ton

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. 10-15 Ton

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Commercial HVAC Rooftop Units Market, By SEER

9.1. U.S. Commercial HVAC Rooftop Units Market, by SEER, 2023-2032

9.1.1. Less than 14 SEER

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. 14-19 SEER

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Above 19 SEER

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Commercial HVAC Rooftop Units Market, By Product Type

10.1. U.S. Commercial HVAC Rooftop Units Market, by Product Type, 2023-2032

10.1.1. Conventional HVAC Rooftop Units

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. VRF HVAC Rooftop Units

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Commercial HVAC Rooftop Units Market, By Application

11.1. U.S. Commercial HVAC Rooftop Units Market, by Application, 2023-2032

11.1.1. Supermarkets & Hypermarkets

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Retail Stores

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Restaurants

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Workspaces

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Shopping Malls

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Other Commercial Applications

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Commercial HVAC Rooftop Units Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Capacity (2020-2032)

12.1.2. Market Revenue and Forecast, by SEER (2020-2032)

12.1.3. Market Revenue and Forecast, by Product Type (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Carrier Global Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. DAIKIN INDUSTRIES Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Johnson Controls, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. LG Electronics, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Danfoss

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Lennox International

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. STULZ Air Technology Systems, Inc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Rheem Manufacturing Company

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Trane

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Samsung

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others