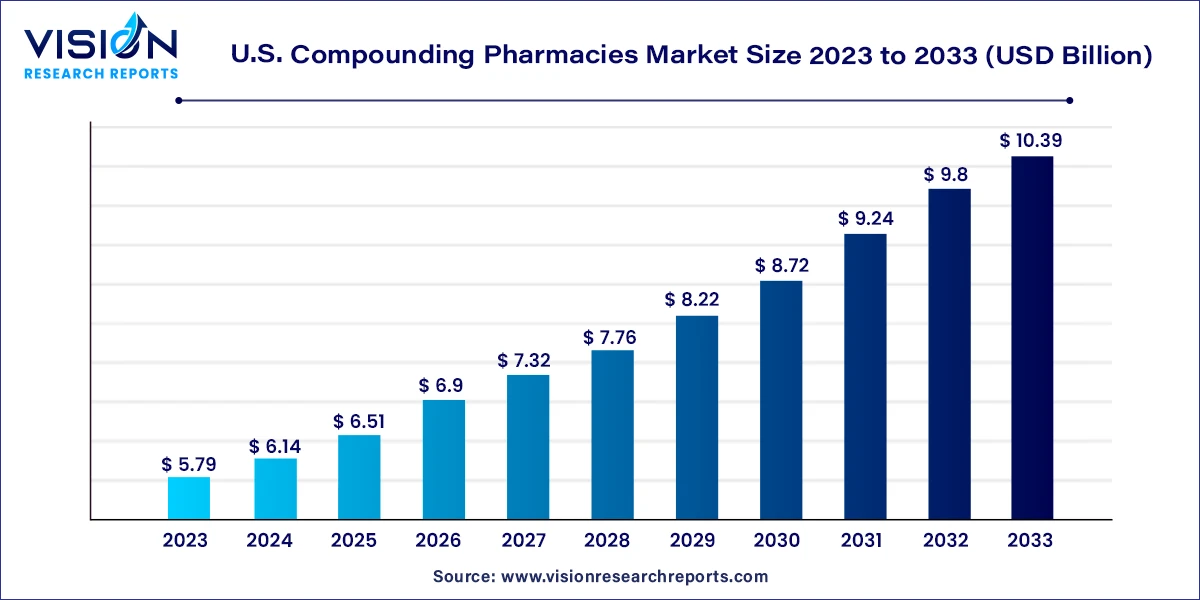

The U.S. compounding pharmacies market was estimated at USD 5.79 billion in 2023 and it is expected to surpass around USD 10.39 billion by 2033, poised to grow at a CAGR of 6.02% from 2024 to 2033. The U.S. compounding pharmacies market stands at the forefront of personalized medicine, catering to diverse patient needs through customized medications. With a focus on tailoring prescriptions to individual requirements, compounding pharmacies play a crucial role in filling the gaps left by mass-produced pharmaceuticals.

The growth of the U.S. compounding pharmacies market is propelled by several key factors. Firstly, there is a rising demand for personalized healthcare solutions, driven by the increasing prevalence of chronic diseases and the need for tailored medications to meet individual patient needs. Additionally, advancements in pharmaceutical compounding technology have enabled compounding pharmacies to offer a wider range of customized formulations, further driving market growth. Moreover, regulatory reforms aimed at enhancing the quality and safety standards of compounded medications have instilled greater confidence among healthcare providers and patients, fostering market expansion. Furthermore, shifting consumer preferences towards natural and alternative therapies have led to a growing demand for compounded formulations, presenting opportunities for market players to innovate and diversify their product offerings. Overall, these growth factors contribute to the dynamic and evolving landscape of the U.S. compounding pharmacies market.

The oral medications segment emerged as the dominant force in the US compounding pharmacies market, commanding approximately 37% of the market share in 2023. This surge can be attributed to the escalating prevalence of chronic ailments and the growing preference for oral medications due to their convenience and storage ease. Various forms such as tablets, capsules, powder, and granules contribute significantly to this segment, being the traditional and favored options for oral administration. Moreover, the increasing demand for personalized medications across different age demographics is poised to drive further growth in this segment in the forthcoming years.

Meanwhile, the Liquid Preparations segment captured approximately 24.48% of the US compounding pharmacies market share in 2023 and is anticipated to witness the swiftest expansion throughout the forecast period. Oral liquid solutions serve as versatile alternatives for healthcare practitioners seeking alternatives to the prevalent oral solid dose forms. Compounding pharmacies play a crucial role in formulating oral liquids when solid doses are unsuitable for specific patients or when achieving the desired dosage proves challenging. Particularly, children and the elderly find tablets and capsules difficult to swallow, thereby favoring liquid formulations for enhanced ease of consumption. Additionally, liquid pharmaceuticals offer a more palatable formulation and facilitate easier administration, catering to the needs of diverse patient populations.

In 2023, the 503A segment emerged as the leading player in the US compounding market, boasting dominance based on pharmacy type. Projections indicate that this segment is poised to maintain its growth trajectory, with an estimated Compound Annual Growth Rate (CAGR) of 6.12% during the forecast period. The ascendancy of the 503A segment can be attributed to government-imposed restrictions on drug production and the mandatory requirement for medicine prescriptions, which have propelled its expansion within the market. Notably, the 503A segment primarily caters to domestic consumption, thereby solidifying its stronghold in the US market. Moreover, stringent regulations mandating biannual monitoring and audit serve as safeguards to ensure the safety and quality of products within this segment.

In terms of sterility, the US compounding pharmacies market saw the non-sterile segment leading the way, capturing a market share of approximately 5.9% in 2023.

However, the sterile segment is poised for notable growth during the forecast period. This surge can be attributed to the escalating incidence of chronic conditions such as cancer and cardiovascular diseases, which are anticipated to drive substantial demand for sterile compounded medications in the near future. Additionally, the rising adoption of ophthalmic and parenteral medications contributes to the growing prominence of sterile compounding pharmacies, further fueling the segment's growth trajectory throughout the forecast period.

In terms of application, the adult segment emerged as the dominant force in the US compounding pharmacies market in 2023. This can be attributed to the heightened prevalence of various chronic illnesses among the adult population in the United States. Moreover, increased healthcare expenditure and the growing adoption of health insurance policies among adults have further propelled the growth of this segment within the market.

Meanwhile, the pediatric segment is poised to present significant opportunities during the forecast period. The increasing preference for personalized compounded prescriptions and the formulation of flavored and sugar-free dosage forms by pharmacists are expected to drive demand for compounding pharmacies among children. Additionally, the easy availability of customized medications such as oral liquids, topical gels, gummy treats, and effervescent drinks is bolstering growth in the pediatric segment within the US market.

In addition to the aforementioned segments, there are other significant areas in which compounding pharmacies play a crucial role, including oncology, hematology, dental, and others. According to the International Diabetes Federation (IDF), the global number of adult diabetics was projected to reach 537 million in 2021, with a further increase to 643 million by 2030. Cancer patients often face considerable challenges beyond the disease itself, with chemotherapy's adverse effects compromising their overall health and well-being. Oncology compounding addresses these complexities by tailoring drug combinations and treatments to meet patients' specific needs, thereby minimizing the burden of medication management. Innovative formulations such as mouthwashes or topical creams are utilized for patients experiencing nausea, difficulty swallowing pills, or other conditions hindering traditional dosage methods.

Furthermore, the pain medications segment reached US$ 0.89 billion in 2023 and is anticipated to grow at a CAGR of 6.43% from 2024 to 2033. Pain is a primary symptom driving patients to seek medical assistance, and untreated acute pain can progress into chronic, challenging-to-manage conditions. While commercially available pain relief medications are convenient, they may induce undesirable side effects such as dizziness, drowsiness, or stomach irritation, particularly for chronic conditions like arthritis, fibromyalgia, and migraines.

By Pharmacy Type

By Product

By Sterility

By Application

By Compounding Type

By Therapeutic Area

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Therapeutic Area Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Compounding Pharmacies Market

5.1. COVID-19 Landscape: U.S. Compounding Pharmacies Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Compounding Pharmacies Market, By Pharmacy Type

8.1. U.S. Compounding Pharmacies Market, by Pharmacy Type, 2024-2033

8.1.1. 503A

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. 503B

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Compounding Pharmacies Market, By Product

9.1. U.S. Compounding Pharmacies Market, by Product, 2024-2033

9.1.1. Oral

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Liquid Preparations

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Topical

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Rectal

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Parenteral

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Ophthalmic

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Nasal

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Otic

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Compounding Pharmacies Market, By Sterility

10.1. U.S. Compounding Pharmacies Market, by Sterility, 2024-2033

10.1.1. Sterile

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Non-Sterile

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Compounding Pharmacies Market, By Application

11.1. U.S. Compounding Pharmacies Market, by Application, 2024-2033

11.1.1. Adult

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Geriatric

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Pediatric

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Veterinary

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Compounding Pharmacies Market, By Compounding Type

12.1. U.S. Compounding Pharmacies Market, by Compounding Type, 2024-2033

12.1.1. Pharmaceutical Ingredient Alteration (PIA)

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Currently Unavailable Pharmaceutical Manufacturing (CUPM)

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Pharmaceutical Dosage Alteration (PDA)

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Compounding Pharmacies Market, By Therapeutic Area

13.1. U.S. Compounding Pharmacies Market, by Therapeutic Area, 2024-2033

13.1.1. Hormone replacement

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Pain management

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Dermatology

13.1.3.1. Market Revenue and Forecast (2021-2033)

13.1.4. Specialty drugs

13.1.4.1. Market Revenue and Forecast (2021-2033)

13.1.5. Nutritional supplements

13.1.5.1. Market Revenue and Forecast (2021-2033)

13.1.6. Others

13.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 14. U.S. Compounding Pharmacies Market, Regional Estimates and Trend Forecast

14.1. U.S.

14.1.1. Market Revenue and Forecast, by Pharmacy Type (2021-2033)

14.1.2. Market Revenue and Forecast, by Product (2021-2033)

14.1.3. Market Revenue and Forecast, by Sterility (2021-2033)

14.1.4. Market Revenue and Forecast, by Application (2021-2033)

14.1.5. Market Revenue and Forecast, by Compounding Type (2021-2033)

14.1.6. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

Chapter 15. Company Profiles

15.1. Triangle compounding pharmacy

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Fagron

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. B. Braun melsungen ag

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Fresenius kabi ag

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Pencol Compounding Pharmacy

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. US Compounding Inc.

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Avella specialty pharmacy

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Institutional pharmacy solutions, llc

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Pharmedium services llc

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Vertisis custom pharmacy

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others