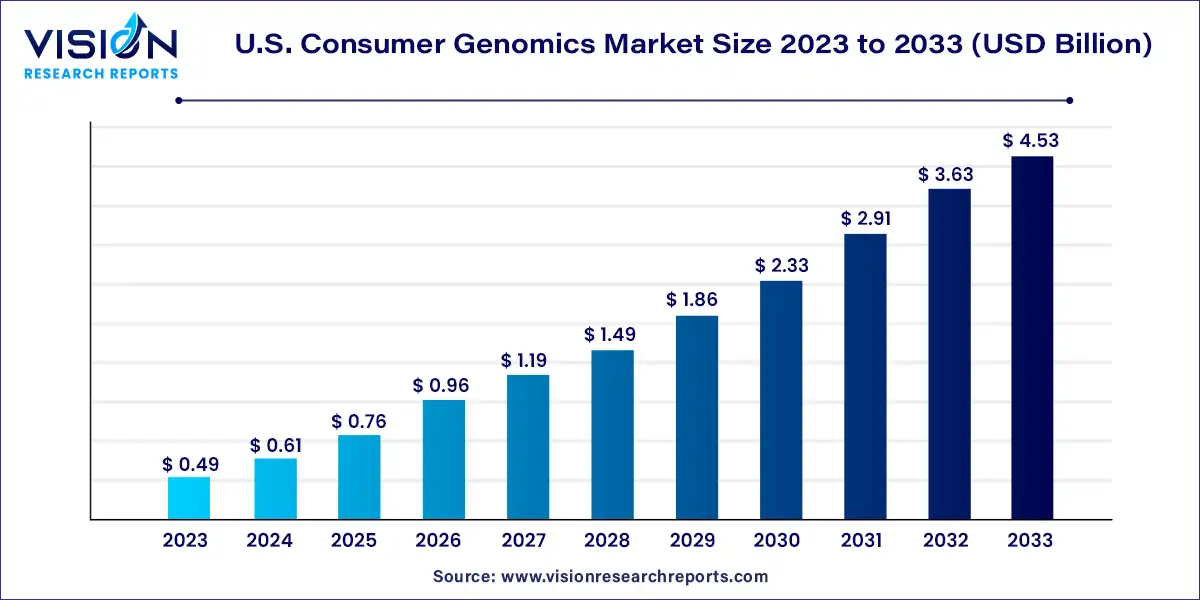

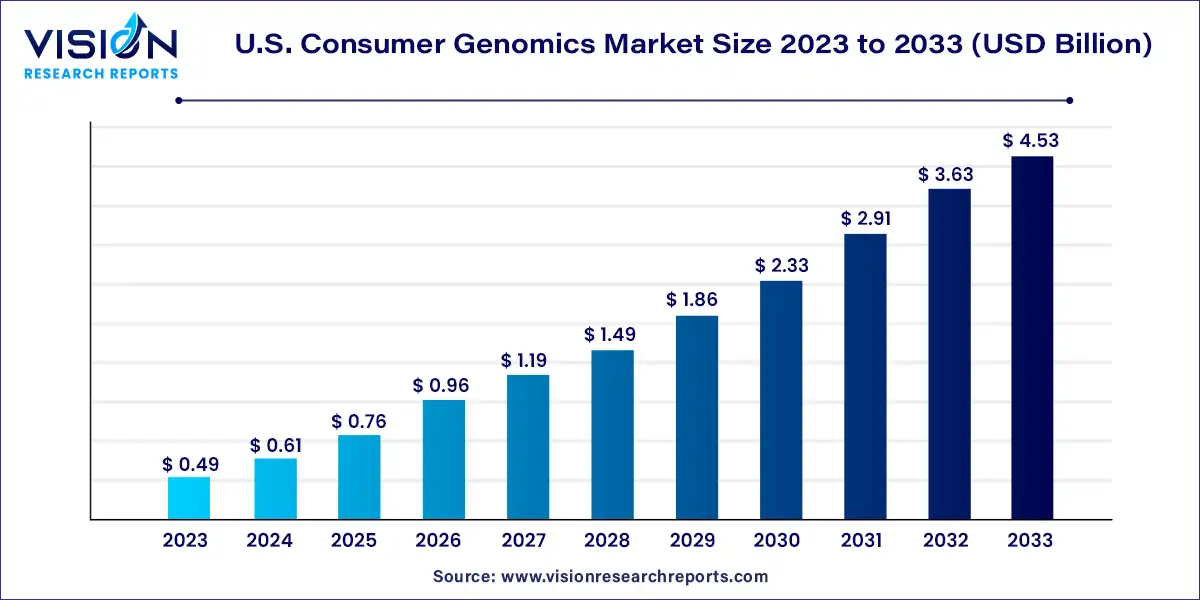

The U.S. consumer genomics market was estimated at USD 0.49 billion in 2023 and it is expected to surpass around USD 4.53 billion by 2033, poised to grow at a CAGR of 24.92% from 2024 to 2033.

Key Pointers

- By Application, the genetic-related services segment captured the maximum market share of 20% in 2023.

- By Application, the lifestyle, wellness, and nutrition segment are expected to expand at the highest CAGR of 26.64% from 2024 to 2033.

U.S. Consumer Genomics Market Growth Factors

The growth of the U.S. consumer genomics market is driven by an advancement in technology, particularly in DNA sequencing and analysis, have significantly lowered the cost of genetic testing, making it more accessible to the general population. This increased affordability has fueled consumer interest in exploring their genetic makeup for insights into ancestry, health traits, and disease predispositions. Additionally, rising awareness and acceptance of personalized healthcare have led individuals to seek out genetic testing services as a means of proactively managing their health. Moreover, the popularity of genealogy services has contributed to the expansion of the consumer genomics market, as consumers are drawn to the opportunity to uncover their familial roots through DNA testing.

U.S. Consumer Genomics Market Trends:

- Increased Adoption of Direct-to-Consumer (DTC) Genetic Testing: There is a noticeable uptick in the number of individuals opting for direct-to-consumer genetic testing kits to gain insights into their ancestry, health traits, and potential disease risks.

- Growth of Personalized Healthcare: With a growing emphasis on personalized medicine, consumers are increasingly interested in leveraging genetic information to tailor healthcare decisions and treatment plans to their individual needs.

- Expansion of Genetic Testing Services: The market is witnessing an expansion of genetic testing services beyond basic ancestry and health trait analysis, with companies offering more comprehensive testing options including carrier screening, pharmacogenomics, and predisposition to specific diseases.

- Integration of Genetic Data in Healthcare: Healthcare providers are increasingly incorporating genetic data into clinical practice, using it to inform diagnoses, treatment decisions, and disease prevention strategies.

- Rising Interest in Health and Wellness: Consumers are becoming more proactive about managing their health and wellness, leading to increased demand for genetic testing as a tool for early detection of health risks and lifestyle optimization.

- Focus on Regulatory Compliance: Regulatory bodies such as the FDA are closely monitoring the consumer genomics market to ensure the safety, accuracy, and ethical use of genetic testing services, leading to greater emphasis on compliance and transparency within the industry.

Application Insights

Genetic-related services dominated the market, holding the largest revenue share of 20% in 2023. The increasing availability of paternity and maternity tests online is expected to further drive market growth. Many consumers opt for direct-to-consumer (DTC) genetic testing to explore their genetic traits and uncover distant relatives. Additionally, a 2021 study conducted by the University of Cambridge revealed that genome sequencing from a single blood test could identify 31% more rare genetic disorders compared to standard tests. With the American Cancer Society estimating almost 2 million new cancer cases in the U.S. in 2022, and the International Agency for Research on Cancer (IARC) projecting over 30 million undiagnosed cases by 2040, genetic testing plays a crucial role in identifying potential cancer risks and understanding the hereditary nature of the disease.

The lifestyle, wellness, and nutrition segment is poised for rapid growth, expected to achieve the fastest compound annual growth rate (CAGR) of 26.64% during the forecast period. Several companies, including Natures Remedies Ltd, Pathway Genomics, Helix, and Toolbox Genomics, offer nutrigenetic testing services. These services encompass fitness assessments and extend to personalized diet plans, wellness recommendations, and various nutrition strategies. Some companies specialize in providing tailored diets, meal plans, and supplements based on genetic insights. Genetic tests focusing on lifestyle and nutrition are increasingly seen as promising tools to support individuals in optimizing their diet and lifestyle choices.

U.S. Consumer Genomics Market Key Companies

- Ancestry

- Gene By Gene, Ltd. (FamilyTree DNA)

- 23andMe, Inc.

- Color Health, Inc

- Myriad Genetics, Inc

- Mapmygenome

- Helix OpCo LLC

- MyHeritage Ltd.

- Pathway Genomics

- Veritas

- Amgen, Inc.

- Diagnomics, Inc.

- Toolbox Genomics

- SomaLogic, Inc.

- inui Health (formerly Scanadu)

- QuickCheck Health

- Illumina, Inc.

Recent Developments

- In September 2023, Ancestry introduced an update to its 2023 Ethnicity Estimate. This update incorporated a revised algorithm and reference panels, leveraging a larger quantity of DNA samples compared to previous iterations.

- In June 2023, Color Health and the American Cancer Society (ACS) announced a partnership aimed at providing comprehensive cancer prevention and screening services to over 150 million Americans covered by their employer or union. The focus of this collaboration is on prevalent cancers such as breast, prostate, lung, cervical, and colorectal.

- In March 2023, Gene by Gene partnered with Verogen to accelerate the integration of forensic investigative genetic genealogy (FIGG). This collaboration significantly expands the pool of profiles available for FIGG matching, effectively doubling its capacity.

U.S. Consumer Genomics Market Segmentations:

By Application

- Genetic Relatedness

- Ancestry

- Lifestyle, Wellness, & Nutrition

- Diagnostics

- Sports Nutrition & Health

- Reproductive Health

- Personalized Medicine & Pharmacogenetic Testing

- Others

Frequently Asked Questions

The U.S. consumer genomics market size was reached at USD 0.49 billion in 2023 and it is projected to hit around USD 4.53 billion by 2033.

The U.S. consumer genomics market is growing at a compound annual growth rate (CAGR) of 24.92% from 2024 to 2033.

Key factors that are driving the U.S. consumer genomics market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others