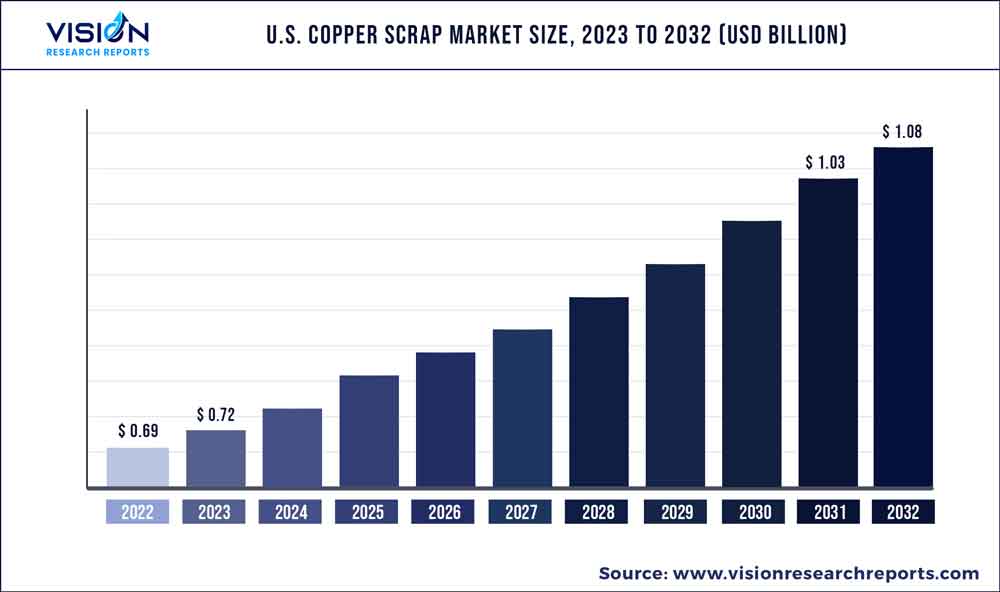

The U.S. copper scrap market was estimated at USD 0.69 billion in 2022 and it is expected to surpass around USD 1.08 billion by 2032, poised to grow at a CAGR of 4.54% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Copper Scrap Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.69 billion |

| Revenue Forecast by 2032 | USD 1.08 billion |

| Growth rate from 2023 to 2032 | CAGR of 4.54% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Ames Copper Group; Aurubis; The David J. Joseph Company; Denkai America; Hussey Copper; Louis Padnos I&M; Mueller Industries; OmniSource LLC; SIC Recycling; United Scrap Metal; The Wieland Group; Joseph Freedman Co., Inc. |

The market is expected to be driven by the rising electrification of vehicles, amidst global pressure to reduce greenhouse gas emissions. Electric vehicles require 3 to 4 times more copper compared to internal combustion engine (ICE) vehicles. Copper has significant importance in the production of electric vehicles (EVs) and related infrastructure. The focus on lowering carbon emissions through alternative energy sources has gained top priority in the U.S. and other countries around the world. EVs have the potential to reduce greenhouse gas emissions and thus aid in the goal of achieving a carbon-neutral economy.

Copper exhibits the highest conductivity after silver. With the advent of battery-powered and hybrid electric vehicles, the amount of copper wiring in the components of automobiles has increased at a greater pace. There are various types of EVs, which require more copper content than ICE vehicles. Copper is used in batteries, windings, busbars, wiring, electric motors, and charging infrastructure.

In 2020, the temporary suspension of industrial activities due to the COVID-19 pandemic impacted both primary and secondary (scrap) copper businesses. This affected the copper supply, ultimately resulting in a shortage of copper scrap and a hike in copper prices, reaching an all-time high of USD 10,000 per ton in 2021. In the U.S., copper production declined by nearly 5% in 2020 amidst the pandemic.

In 2022, nearly 160 kilotons of the overall copper scrap were produced from old resources i.e., post-consumer scrap, while 670 kilotons of copper scrap were recovered from industrial fabrication operations in the U.S. Copper scrap accounted for a share of 32% of the total copper supply in the U.S. The key driving factors for the U.S. copper scrap industry include the rapid adoption of electric vehicles (EVs), solar panels, and 5G technology.

The U.S. copper scrap market has the presence of several companies with a strong base in North America and other parts of the world. The competition is expected to rise over the coming years, as companies are focusing on various inorganic growth strategies such as joint ventures and mergers & acquisitions. For instance, in February 2021, the joint venture of Prime Materials Recovery, Inc. and the Spanish CuNext Group - the Ames Copper Group - announced the construction of a copper recycling facility that produces copper anodes from copper scrap and fines.

Application Insights

The wire rod mills segment accounted for a revenue share of over 26% in 2022 and is likely to grow at a lucrative pace in the coming years. Wire rod mills use copper scrap for mainly producing wires, which are further used in electrical applications. With the help of cold drawing and a series of dies, wires are produced at these mills. The individual wires then are insulated or stranded depending on their intended end-use application, such as cable assemblies.

Investments in new copper mills are projected to benefit the market. For instance, in May 2020, Southwire Company, LLC installed a copper wire rod mill at its Carrollton plant in the U.S. The company has acquired the SCR-9000S copper rod mill from Primetals Technologies. This mill can produce electrolytic tough-pitch copper rods for electrical cables and wire applications, with an annual capacity of 353 kilotons.

Brass mills melt and produce alloy materials to further manufacture sheets, tubes, strips, rods, bars, forgings, extrusions, and mechanical wires. Nearly half of the copper input in these mills is obtained from copper scrap. Fabrication processes such as extrusion, cold rolling, hot rolling, and drawing are employed to convert melted and cast feedstock into the final mill products.

Copper or brass radiators are a major source of copper scrap for ingot producers, captive foundries, and brass mills. These materials also have significant amounts of copper, tin, lead, and zinc, which help in producing red-brass or semi-red brass alloy ingots. Nearly 50% of these alloy ingots are used in plumbing and fittings in the U.S. As per the Copper Development Association Inc., nearly 50,000 tons of radiators are recycled each year to produce red-brass alloy ingots.

U.S. Copper Scrap Market Segmentations:

By Application

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on U.S. Copper Scrap Market

5.1. COVID-19 Landscape: U.S. Copper Scrap Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. U.S. Copper Scrap Market, By Application

8.1.U.S. Copper Scrap Market, by Application Type, 2023-2032

8.1.1. Wire Rod Mills

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Brass Mills

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Ingot Makers

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Foundries and Other Industries

8.1.4.1.Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Copper Scrap Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Application (2020-2032)

Chapter 10.Company Profiles

10.1. Ames Copper Group

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Aurubis

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. The David J. Joseph Company

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Denkai America

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Hussey Copper

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Louis Padnos I&M

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Mueller Industries

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. OmniSource LLC

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. SIC Recycling

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. United Scrap Metal

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others