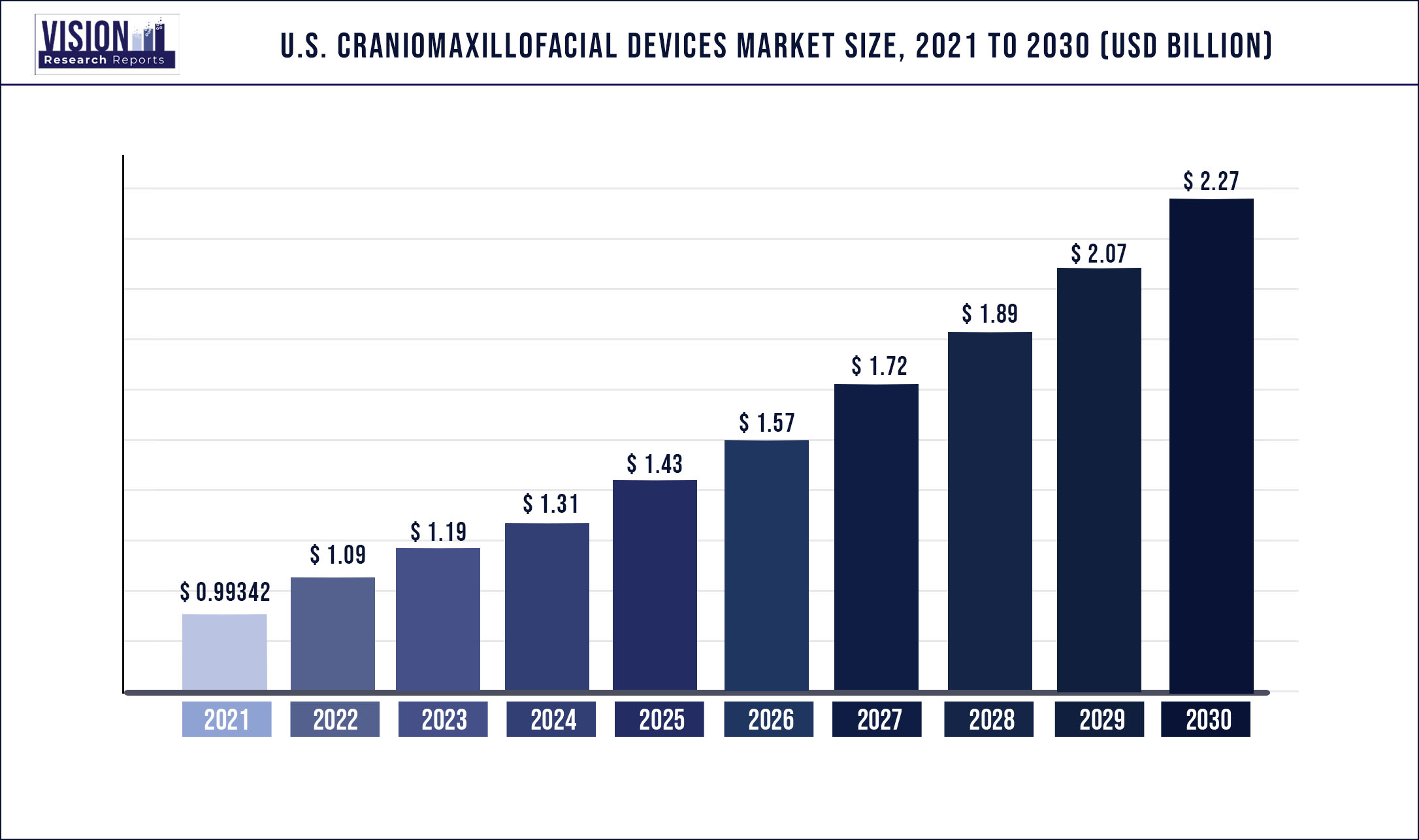

The U.S. craniomaxillofacial devices market was estimated at USD 993.42 million in 2021 and it is expected to surpass around USD 2.27 billion by 2030, poised to grow at a CAGR of 9.62% from 2022 to 2030

Report Highlights

The rising incidence of facial fractures due to sports injuries and road accidents, and increasing aesthetic consciousness are the key factors driving the product demand. The demand for Temporomandibular Joint Replacement is projected to witness a rise during the forecast period due to high adoption.

When a patient needs face or cranial bone surgery because of trauma-related fractures or other craniomaxillofacial injuries, they frequently undergo craniomaxillofacial surgery. Craniomaxillofacial devices are used in aesthetics and facial reconstruction. The devices mostly find application in neurosurgery, orthognathic and dental surgery, and plastic surgery.

The COVID-19 outbreak had a detrimental effect on the market for CMF devices since the manufacturers of products for elective procedures saw a significant drop in sales, as a result of production slowdown, a reduction in working hours, and layoffs. The Covid-19 problem had the greatest effect on the neurological product line. Due to the suspension of non-essential surgeries, orders were delayed and consumable sales were decreased. Covid Care Centers were created to house plastic surgeons, and only emergencies were treated with plastic surgery.

However, the post-pandemic period has seen a good recovery looking at the sales revenue generated by the companies. For instance, according to Johnson and Johnson financial report 2021, In all of its businesses, including Surgery, Interventional Solutions, Vision, and Orthopaedics, Medical Devices worldwide adjusted operational sales increased by 16.8%, mainly attributable to the market's recovery from COVID-19 impacts and the resulting postponement of medical procedures in the prior year.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 993.42 million |

| Revenue Forecast by 2030 | USD 2.27 billion |

| Growth rate from 2022 to 2030 | CAGR of 9.62% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, material, application |

| Companies Covered | Stryker Corporation; Medtronic Plc; KLS Martin L.P; Medartis AG; Johnson & Johnson; W. L. Gore & Associates, Inc; TMJ Concepts; Integra LifeSciences; OsteoMed L.P.; Aesculap Implant Systems, Inc; Zimmer-Biomet Inc. |

Material Insights

Metallic CMF implants held the largest share of about 70% of the U.S. craniomaxillofacial devices market in 2021, owing to their advantages over bioabsorbable and ceramic materials, such as their hard characteristics and minimal corrosiveness. The internal stiff fixation of the face skeleton frequently uses metals such as stainless steel, titanium, Vitallium, chromium, brass silver, and copper. In the surgery, stainless steel alloys made of nickel, chromium, copper, cobalt, aluminum, and molybdenum are still employed.

Bioabsorbable materials are easily absorbed by the human body and they eliminate the need for additional surgery. Hence, the segment is predicted to grow profitably. The growth is also greatly influenced by technological improvements. The growing acceptance of SR technology and its benefits, including ease of handling, biocompatibility, biodegradability, and reliability, have had a beneficial impact on the expansion of the segment. Technological advancements in the clinical use of bioabsorbable materials include copolymeric SR devices like PLGA, biosorb FX, and biosorb PDX.

The main benefit of these bioabsorbable implants is that after biologic fixation has been established, there is initial stability sufficient for healing followed by progressive resorption. These materials also reduce the amount of stress that shields bone, gradually apply load as they deteriorate, eliminate the need for hardware removal operations, and make postoperative radiologic imaging easier.

Application Insights

Craniomaxillofacial devices saw the most use in Orthognathic and Dental Surgery in 2021 as a result of an increase in the use of CMF devices for procedures for facial reconstruction, and increasing awareness of aesthetic consciousness. Applications for CMF devices are also in neurosurgery including otolaryngology and skull surgery. These tools aid in the management of CSF and the treatment of neuro-oncology, spinal illnesses, neurovascular diseases, nasal skull-based surgery, dura mater repair, deep brain stimulation, and cranial trauma.

Plastic surgery is likely to witness a growth rate of 9.62% in the U.S. during the forecast period. The surgery is used to treat aesthetic skull issues like a sloping forehead, frontal bossing/forehead horns, residual fontanelle depressions, a flat back of the head, an occipital knob or protuberance, excessive temporal fullness (a head that is too wide), excessive temporal depressions (a head that is too narrow), prominent temporal lines, and occipital asymmetries. According to the American Society of Plastic Surgeons, a total of 15.5 million cosmetic surgeries were performed in the U.S. in 2020.

Product Insights

MF plate and screw fixation held the largest revenue share of around 73.4% in 2021 owing to its extensive use in numerous procedures, including orthognathic, tumor removal, deformity correction, and cranial fixation. The Craniomaxillofacial (CMF) devices market is segmented based on product into cranial flap fixation, CMF distraction, temporomandibular joint replacement, bone graft substitute, and Maxillofacial (MF) plate & screw fixation. Cranial flaps are used in skull replacement surgery and they include connecting rods and inferior & superior disks.

CMF distraction system is used for post-trauma reconstruction, orthognathic surgeries, and oncology. Temporomandibular joints are used in jaw replacement surgery. Bone graft substitutes are used for the reconstruction of the bone cavity and spine fusion, while MF plates & screws are used for treating facial trauma and deformities. In 2020, there were roughly 256,085 maxillofacial surgeries conducted in the US, according to a report from the American Society of Plastic Surgeons (ASPS).

Due to an uptick in sports injuries, cranial fractures, and rising demand for face augmentation, the temporomandibular joint (TMJ) replacement market is anticipated to develop at the fastest rate throughout the projection period. It can be used for a variety of things, including fractures, deformities, degenerative joints, and arthritic disorders. Additionally, the utility of the device is in decreasing jaw discomfort, obstructing normal eating, and enhancing mouth opening ability.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Craniomaxillofacial Devices Market

5.1. COVID-19 Landscape: U.S. Craniomaxillofacial Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Craniomaxillofacial Devices Market, By Product

8.1. U.S. Craniomaxillofacial Devices Market, by Product, 2022-2030

8.1.1 Cranial Flap Fixation

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. CMF Distraction

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Temporomandibular Joint Replacement

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Thoracic Fixation

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Bone Graft Substitute

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. CMF Plate and Screw Fixation

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Craniomaxillofacial Devices Market, By Material

9.1. U.S. Craniomaxillofacial Devices Market, by Material, 2022-2030

9.1.1. Metal

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Bioabsorbable material

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Ceramics

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Craniomaxillofacial Devices Market, By Application

10.1. U.S. Craniomaxillofacial Devices Market, by Application, 2022-2030

10.1.1. Neurosurgery

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Orthognathic and Dental Surgery

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Plastic surgery

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global U.S. Craniomaxillofacial Devices Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Material (2017-2030)

11.1.3. Market Revenue and Forecast, by Application (2017-2030)

Chapter 12. Company Profiles

12.1. Stryker Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Medtronic Plc

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. KLS Martin L.P

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Medartis AG

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Johnson & Johnson

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. W. L. Gore & Associates, Inc

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. TMJ Concepts; Integra LifeSciences

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. OsteoMed L.P.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Aesculap Implant Systems, Inc

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Zimmer-Biomet Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others