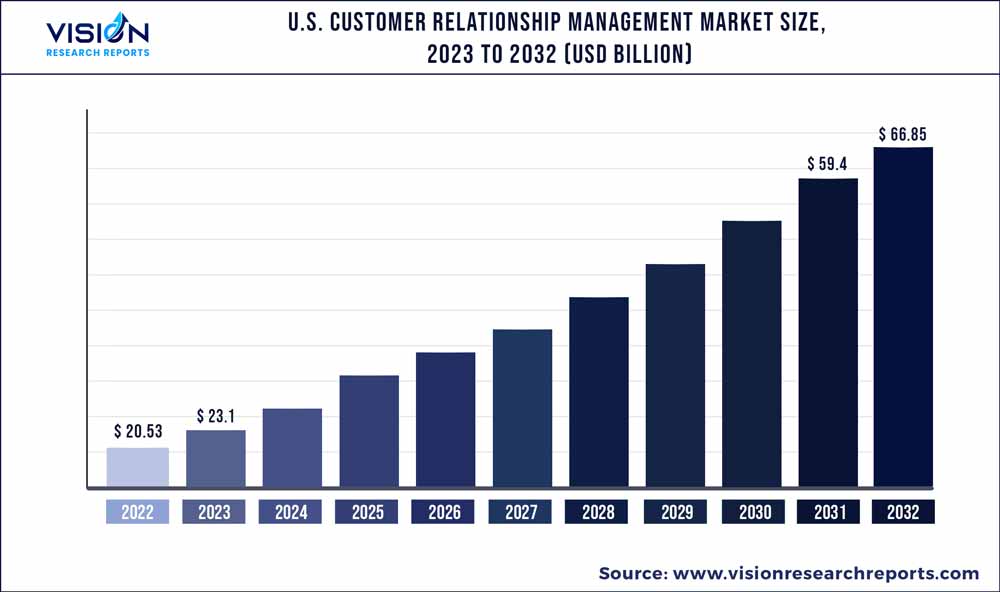

The U.S. customer relationship management market size was estimated at around USD 20.53 billion in 2022 and it is projected to hit around USD 66.85 billion by 2032, growing at a CAGR of 12.53% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Customer Relationship Management Market

| Report Coverage | Details | |

| Market Size in 2022 | USD 20.53 billion | |

| Revenue Forecast by 2032 | USD 66.85 billion | |

| Growth rate from 2023 to 2032 | CAGR of 12.53% | |

| Base Year | 2022 | |

| Forecast Period | 2023 to 2032 | |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) | |

| Companies Covered | Adobe Systems Inc.; Copper CRM, Inc.; Creatio; Genesys; HubSpot Inc.; IBM; Insightly, Inc.; Microsoft Corporation; Nimble; Oracle Corporation; SAP SE; Salesforce.com, Inc.; SugarCRM Inc.; Verint Systems Inc.; Zoho Corp. |

The increasing adoption of mobile CRM and cloud-enabled social solutions is expected to fuel the growth of the U.S. market during the forecast period. Customer Relationship Management (CRM) solutions are also anticipated to be more widely adopted in the U.S. as businesses increasingly recognize the growing significance of these solutions for B2B and B2C business processes. The entry of new market players with an innovative approach toward offering value-based results to end-users is triggering market demand.

For instance, an increased number of CRM solutions that focus on user-friendliness are being introduced in the market, and the rising adoption of such solutions is boding well for the market. It is also estimated that AI-enabled customer relationship management software, which offers benefits such as the quicker implementation of repetitive and mundane tasks, improved customer retention, and lead customization, would result in high revenue generation in the next few years.

The market offers substantial growth opportunities owing to the presence of several well-established players, well-developed business ecosystems, and the existence of a highly consumerist culture. There is a high impetus by solution providers for training and certification programs to create a technically sound workforce with CRM functionalities and operations. CRM applications integrated with wearable devices are being touted as the next big thing in the field. If these applications are embedded within wearable computing devices, businesses can modify and improve their customer relationship management strategy based on real-time information about customers and can engage with them on a more personalized level.

A key trend in the market is the increased adoption of social and mobile solutions. This can be attributed to the fact that several mobile customer relationship management solutions in the market deliver a wide range of capabilities on any device connected to the network. Real-time access to such solutions is another major advantage offered by mobile CRM. In addition, the number of smartphone users is increasing exponentially globally, consequently widening the potential customer base of these solutions.

However, not all businesses may benefit from CRM software. This is especially true for businesses that work on a highly standardized customer interaction model. For instance, a process-driven sales channel might not be a major concern for a small-scale organization. Similarly, a large-scale organization may demand a robust CRM capable of driving the business as well as addressing customer queries. In addition, security concerns are likely to exist in a centralized data server environment, which may discourage businesses dealing with critical business or consumer data from adopting such solutions. For instance, the General Data Protection Regulation (GDPR) regulation levies heavy penalties on organizations if they cannot provide privacy protections to all their customers.

Deployment Insights

The cloud segment accounted for the largest market share of 57% in 2022. This is owing to rising awareness regarding the benefits of cloud in terms of cost and flexibility. It offers seamless access to the system from any point or device that proves beneficial for any large-scale business. Owing to the rising focus of U.S.-based companies on developing an automated and customized customer management approach, the development and deployment of cloud software services are expected to rise at a promising pace in the country in the next few years.

The on-premise segment is anticipated to grow at a CAGR of 9.15% during the forecast period owing to a rise in the number of paid subscriptions. It involves a system database to be installed on the internal server of the end-user, wherein security levels are to be managed completely at the organizational level. In addition to offering the versatility to upgrade to the newest versions of software as and when needed, this mode proves to be a cost-effective investment. These factors fuel the demand for on-premise deployment, resulting in significant growth prospects.

Solution Insights

The customer service segment accounted for the largest market share of 24% in 2022. The growing adoption of customer service teams to track customer interactions, manage support tickets, and resolve issues efficiently is expected to fuel the demand of the market in future years. CRM software enables agents to access customer data, history, and preferences, allowing them to provide personalized and timely support. With the adoption of CRM tools, customer service representatives can handle inquiries, address concerns, and resolve problems effectively, leading to higher customer satisfaction.

The social media monitoring segment is anticipated to grow at a CAGR of 15.03% during the forecast period. Social media marketing is essential to customer relationship management (CRM) strategies. CRM systems can be integrated with social media platforms to enhance marketing efforts and strengthen customer relationships. CRM systems can integrate with social media advertising tools, allowing businesses to target specific audience segments, track leads, and capture customer information directly into the CRM database. These benefits have boosted the adoption of social media marketing solutions, thereby leading to market growth.

End-use Insights

The large enterprises segment accounted for a market share of 64% in 2022. thanks to the rising need for the adoption of customer relationship management platforms to enhance customer engagement. In addition, several key benefits offered by these platforms, such as improvement in internal business processes and customer relationship management approach, are also encouraging small- and medium-sized businesses (SMBs) to use CRM services and solutions in the U.S. Furthermore, customer relationship management solutions have also enabled manufactures and service providers to effectively communicate and work with a large number of business in emerging economies across regions.

The SMBs segment is anticipated to grow at a CAGR of 14.13% during the forecast period. Declining prices of cloud-based CRM solutions are also a key factor driving SMEs' adoption of customer relationship management solutions in the U.S. As a result, SMBs are anticipated to emerge as the fastest-growing segment during the forecast period owing to the increasing rate of digitization in businesses and the growing importance of customer engagement. SMBs also increasingly acknowledge the importance of a robust CRM platform to complement their sales strategy.

Application Insights

The retail segment accounted for the largest market share of 24% in 2022. The emergence of artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) technologies are trending in the retail industry in the U.S. Advantages such as easy access to newer markets, seamless customer experience across channels, and capability of building an interpersonal relationship with customers are helping drive the adoption of CRM solutions in the retail sector in the country.

The telecom & IT segment is anticipated to grow at a CAGR of 14.34% during the forecast period. Factors such as the availability of high-speed wireless internet infrastructure and services and the booming IT industry are expected to further fuel the growth of the segment. For instance, software-as-a-service (SAAS) for CRM deployment enables companies to own multiple datasets from discrete systems to enhance decision-making and customer service delivery. This approach facilitates various organizations with a vertical-specific CRM to serve a dedicated purpose.

U.S. Customer Relationship Management Market Segmentations:

By Solution

By Deployment

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Customer Relationship Management Market

5.1. COVID-19 Landscape: U.S. Customer Relationship Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Customer Relationship Management Market, By Solution

8.1. U.S. Customer Relationship Management Market, by Solution, 2023-2032

8.1.1. Customer Service

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Customer Experience Management

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Analytics

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Marketing Automation

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Salesforce Automation

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Social Media Monitoring

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Customer Relationship Management Market, By Deployment

9.1. U.S. Customer Relationship Management Market, by Deployment, 2023-2032

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Customer Relationship Management Market, By Application

10.1. U.S. Customer Relationship Management Market, by Application, 2023-2032

10.1.1. BFSI

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Retail

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Healthcare

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Telecom & IT

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Discrete Manufacturing

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Government & Education

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Customer Relationship Management Market, By End-use

11.1. U.S. Customer Relationship Management Market, by End-use, 2023-2032

11.1.1. Large Enterprises

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. SMBs

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Customer Relationship Management Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Solution (2020-2032)

12.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.3. Market Revenue and Forecast, by Application (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Adobe Systems Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Copper CRM, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Creatio

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Genesys

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. HubSpot Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. IBM

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Insightly, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Microsoft Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Nimble

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Oracle Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others