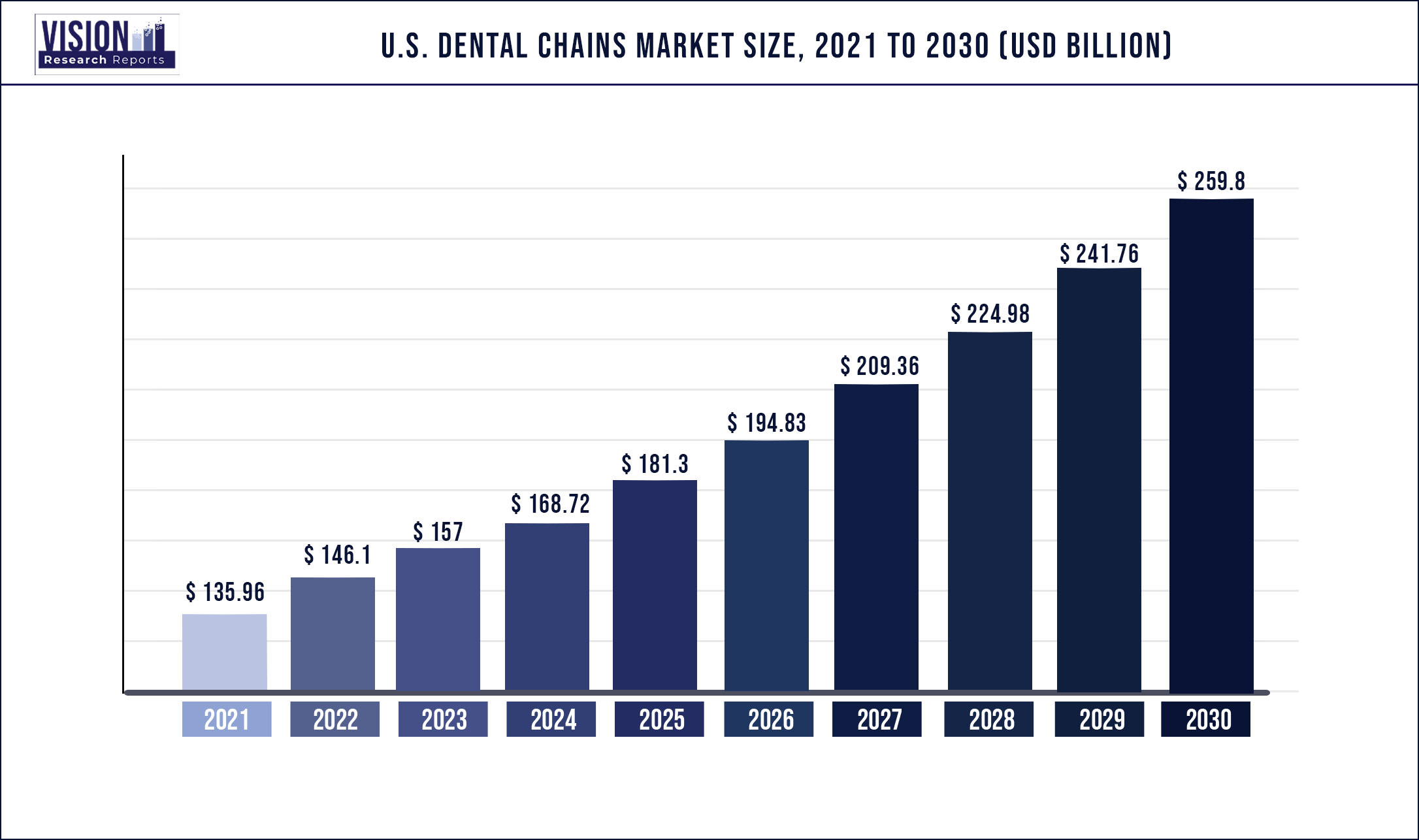

The U.S. dental chains market was surpassed at USD 135.96 billion in 2021 and is expected to hit around USD 259.8 billion by 2030, growing at a CAGR of 7.46% from 2022 to 2030

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 135.96 billion |

| Revenue Forecast by 2030 | USD 259.8 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.46% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Region |

| Companies Covered | Heartland Dental; Smile Brands; Western Dental; Pacific Dental Services; Dental Care Alliance; Onsite Dental, LLC; Affordable Care, LLC; Great Expressions Dental Centers; Mortenson Family Dental, Inc.; North American Dental Management, LLC (New Hampshire Company Directory); Aspen Dental Management, Inc.; InterDent; MB2 DENTAL; Mid-Atlantic Dental Service Holdings LLC |

The growth of the dental chains in the country is mainly attributed to an increase in the prevalence of dental caries and other periodontal problems and rising awareness regarding the availability of various dental services. The technological improvements in dentistry and the growing demand for cosmetic and laser dentistry are some of the additional factors contributing to the market expansion.

In the U.S., the COVID-19 outbreak effectively closed down around 198,000 practicing dentists and dental professionals. Most dental treatments emit aerosols that can be inhaled or come into contact with contaminated surfaces, increasing the risk of infection among dental professionals or subsequent patients. As a result, the dental practices were closed. According to the American Dental Association (ADA) Health Policy Institute's study of current data from various federal authorities, national dental expenditures declined by 1.8%in 2020.

The Covid-19 pandemic encouraged dental practices to adopt new operational practices and technological innovations. For instance, in December 2020, 3M Oral Care, a global corporation, invested in AI's prospects. The firm stated that the BluelightCheckUp Radiometer was the result of a collaboration with Bluelight Analytics. The radiometer can directly measure all significant curing lights and determine the optimal curing period for light and material combinations by combining AI with an extensive database of light-curing data.

In May 2021, American Dental Partners Incorporated (ADPI) and Heartland Dental, the key dental support organizations in the country, agreed on a strategic transaction. ADPI is widespread with 278 locations spread across 21 states and 23 dental group practices with headquarters in Massachusetts. Thus, with more patients having access to enhanced oral healthcare, this strategic partnership increases the number of doctor leaders within the Heartland Dental community. Additionally, as a result of this agreement, Heartland Dental and ADPI would collectively have a network of over 2,300 backed dentists in over 1,400 locations across 38 states.

Report Highlights

Key Players

Market Segmentation

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others