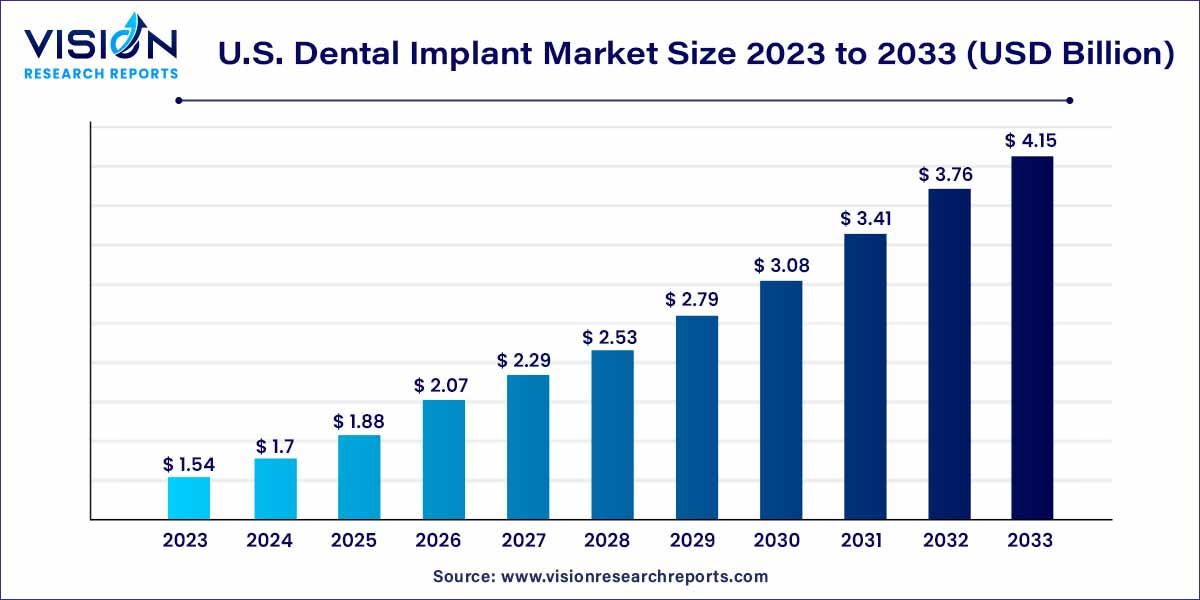

The U.S. dental implant market size was estimated at USD 1.54 billion in 2023 and it is expected to surpass around USD 4.15 billion by 2033, poised to grow at a CAGR of 10.43% from 2024 to 2033.

The U.S. dental implant market has witnessed significant growth and evolution in recent years, reflecting advancements in dental technology and an increasing focus on oral health. Dental implants have become a preferred solution for replacing missing teeth, offering patients a durable and natural-looking alternative to traditional prosthetics. This overview delves into key aspects of the U.S. dental implant market, providing insights into market trends, growth drivers, challenges, and notable players.

The growth of the U.S. dental implant market is propelled by several key factors. Firstly, an increasing emphasis on aesthetic dentistry has elevated the demand for dental implants as patients seek solutions that not only restore functionality but also enhance the overall appearance of their smiles. Technological advancements, such as the use of titanium alloys and ceramic compounds, contribute to improved durability and biocompatibility, while innovations in computer-aided design (CAD) and 3D printing enhance precision in implant placement. The aging U.S. population, coupled with a higher prevalence of tooth loss, has created a substantial market for dental implants as individuals increasingly opt for long-term solutions. Moreover, the expansion of insurance coverage for dental implant procedures has made them more accessible, positively influencing market growth by broadening the demographic segment that can afford these procedures. Overall, these factors collectively contribute to the robust growth observed in the U.S. dental implant market.

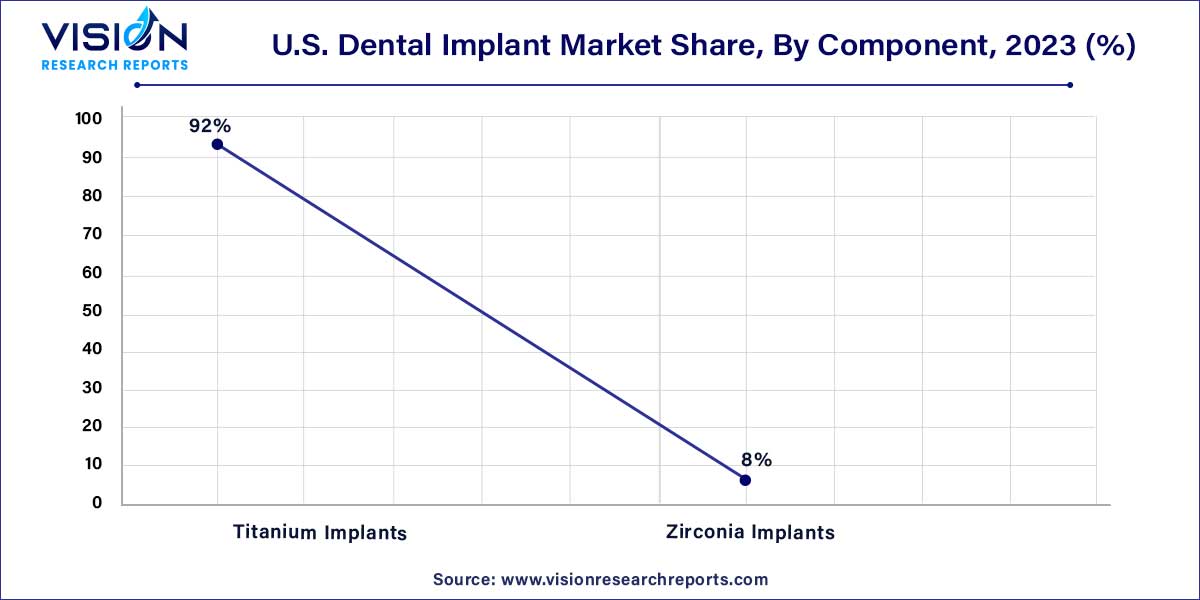

The titanium implants segment dominated the dental implant market in 2023, accounting for a substantial 92% of the revenue share. This segment is poised for significant growth from 2024 to 2033. Titanium implants are renowned for their non-allergenic properties, promoting biocompatibility that is instrumental in dental restorative procedures by preventing bacterial infections. Notably, ongoing research suggests that porous titanium implants, still in the prototype stage, exhibit a potential lifespan without the need for replacement. A notable development in this realm occurred in May 2022, when Osstem Implant introduced the KS implant system. This system not only enhances fatigue fracture toughness but also diversifies the implant portfolio, contributing to advancements in dental implant technology.

On the other hand, the zirconia implants segment stands out as the fastest-growing category in the U.S. dental implant market. The surge in popularity of zirconia implants can be attributed to their aesthetic appeal and resistance to bacterial infections. Additionally, studies have demonstrated that zirconia implants result in minimal chronic inflammation post-implantation, positioning them as a preferred alternative. Recognizing the structural benefits, major players in the market have incorporated zirconia implants into their product offerings. For example, in March 2022, Neodent, a prominent dental implant company within the Straumann Group, unveiled Zi, a zirconia implant system. This system allows for immediate placement with a focus on high-end aesthetics, thanks to its modern naturally tapered implant design.

By Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Dental Implant Market

5.1. COVID-19 Landscape: U.S. Dental Implant Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Dental Implant Market, By Type

8.1.U.S. Dental Implant Market, by Type Type, 2024-2033

8.1.1. Titanium Implants

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Zirconia Implants

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Dental Implant Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Type (2021-2033)

Chapter 10. Company Profiles

10.1. Henry Schein Inc.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Straumann Holding AG

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Nobel Biocare Services AG

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. DENTSPLY Sirona Inc

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Zimmer Biomet Holdings, Inc.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Osstem Implant Co Ltd

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Kyocera Corporation

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. BioHorizons IPH, Inc.

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Bicon, LLC

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Dentium Co., Ltd.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others