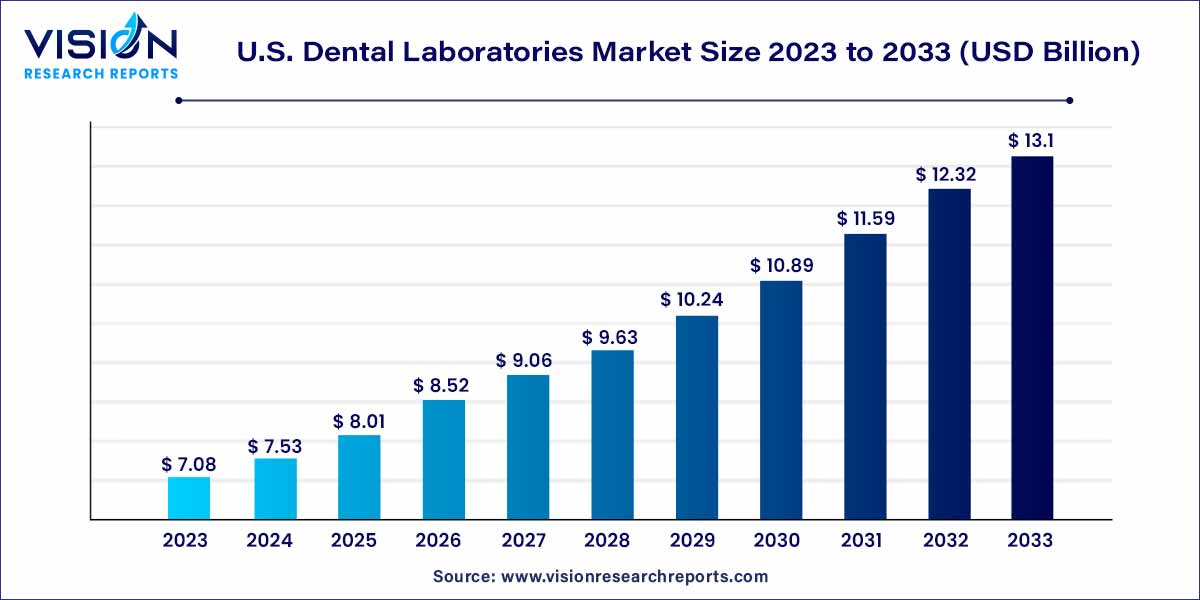

The U.S. dental laboratories market was surpassed at USD 7.08 billion in 2023 and is expected to hit around USD 13.1 billion by 2033, growing at a CAGR of 6.35% from 2024 to 2033. The U.S. dental laboratories market is driven by the rising demand for aesthetic dentistry, prevalence of dental disorders, and growing awareness of oral health.

The U.S. dental laboratories market plays a crucial role in supporting the dental healthcare industry, providing essential services that contribute to the overall oral health of the population. This overview aims to shed light on the key facets of the U.S. dental laboratories market, examining its current landscape, trends, and factors influencing its growth.

The growth of the U.S. dental laboratories market is propelled by several key factors. Firstly, the increasing prevalence of dental disorders, coupled with a progressively aging population, contributes significantly to the expanding demand for dental prosthetics and restorative solutions. Secondly, a heightened awareness of the importance of oral health and a growing emphasis on preventive dentistry are driving individuals to seek dental care, fostering the need for the services provided by dental laboratories. Furthermore, the adoption of advanced dental technologies, such as CAD/CAM systems, 3D printing, and intraoral scanning, plays a pivotal role in enhancing the precision and efficiency of dental prosthetic fabrication. As these growth factors converge, the U.S. dental laboratories market is well-positioned for sustained expansion, ensuring a continual evolution to meet the evolving demands of dental practitioners and their patient base.

The oral care segment took the lead in the dental laboratories market, contributing to 28% of the revenue in 2023. This segment is poised for continued growth over the forecast period, fueled by increased awareness of oral hygiene and a rising adoption of dentures. Following closely, the restorative segment held a significant share of revenue. Technological advancements in areas like CAD/CAM implant dentistry, digital radiography, intraoral imaging, and caries diagnosis have elevated the precision of restorations, contributing to overall market expansion. The market is further categorized into five product segments: restorative, orthodontics, endodontic, oral care, and implant.

Anticipated to exhibit substantial growth, the orthodontic segment is influenced by increased research initiatives and a growing preference for novel dental treatments. The demand for long-term alternatives to traditional procedures is a key driver for the expanding orthodontic consumables market. The dental laboratories market, like many others, faced significant challenges during the coronavirus outbreak. Stringent regulations imposed globally to curb the spread of the virus impacted various industries, including the dental and cosmetics sectors

The metal ceramics segment has emerged as the dominant force in the market, securing a significant share of revenue. This can be attributed to the segment's long-standing reputation for reliability, durability, and versatility in the field of restorative dentistry. Metal ceramic restorations, renowned for combining the strength of metal with the aesthetic appeal of porcelain, are widely utilized in various dental procedures, including crowns, bridges, and implant-supported restorations. The success of these restorations hinges on factors such as the compatibility of the two materials, the strength of their bond, and the thermal expansion coefficients of both the ceramic and metal components.

In contrast, the CAD/CAM materials segment is poised for substantial growth in the forecast period. This growth is directly linked to the transformative impact these materials have on the fabrication process of dental prosthetics. Specifically engineered for use with CAD/CAM systems, these materials enable precise digital design and automated milling or 3D printing of restorations. The integration of CAD/CAM technology streamlines laboratory workflows, reducing manual errors, improving efficiency, and facilitating the creation of highly customized and accurate dental prosthetics, including crowns, bridges, and veneers. The market is further segmented into restorative, orthodontics, endodontic, oral care, and implant categories based on the type of product.

The system and parts category has emerged as the market leader, capturing a substantial revenue share of 36%. Innovations such as 3D printing and Cone Beam CT Systems have empowered technicians to craft prosthetics that precisely meet the unique requirements of individual patients. The rapid production capabilities of 3D printing equipment, capable of generating surgical guides, implants, and splints, have positioned it as a dominant force in the market. This has enabled dental laboratories to enhance productivity, efficiently addressing the growing demand for personalized and high-quality dental prosthetics.

Anticipated to experience significant growth in the forecast period, the dental lasers segment is indispensable for dental practices and has witnessed notable developments and product variations. For instance, in December 2023, Oral Science and Zolar Technologies introduced the Photon EXE Soft-Tissue Diode Laser. This laser is designed for various dental treatments, including soft tissue crown lengthening, implant recovery, gingival troughing, managing uninterrupted teeth, and addressing other dental issues. Such advancements contribute to the expanding utility and effectiveness of dental lasers in the field

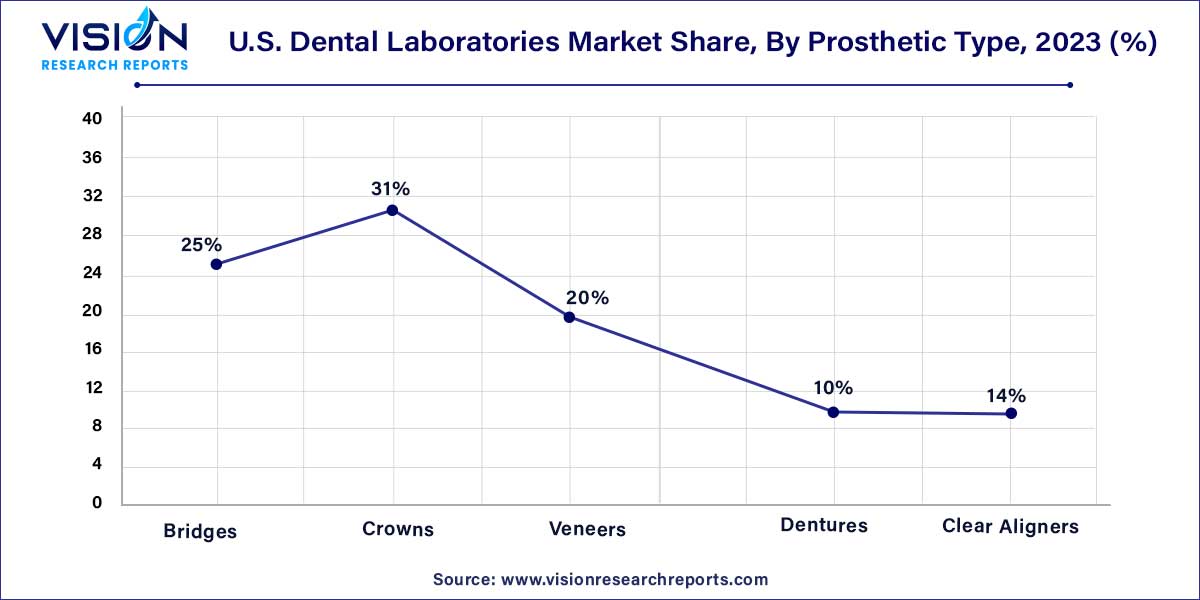

In 2023, the crowns segment emerged as the leader in the U.S. dental laboratories market, commanding a share of approximately 31%. This dominance can be attributed to the extensive utilization of crowns in restorative dentistry. Crowns, being highly versatile prosthetics, can be crafted from various materials, including metal, porcelain-fused-to-metal (PFM), all-ceramic, or zirconia, providing flexibility to cater to diverse patient needs and preferences. Customized to meet specific patient requirements, crowns play a vital role in various dental applications, such as restoring damaged or decayed teeth, enhancing their shape, size, strength, and overall appearance. The increasing demand for cosmetic dentistry and growing patient awareness regarding the benefits of dental prosthetics further contribute to the prominence of crowns in the market.

On the other hand, the bridges segment is poised for lucrative growth in the forecast period. The rising incidence of tooth loss, stemming from factors like decay, trauma, or age-related issues, has propelled the demand for bridges as a reliable and aesthetically pleasing solution. Dental bridges, composed of two or more crowns, anchor onto adjacent teeth or implants, effectively bridging the gap caused by one or more missing teeth.

By Product

By Material

By Equipment

By Prosthetic Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Dental Laboratories Market

5.1. COVID-19 Landscape: U.S. Dental Laboratories Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Dental Laboratories Market, By Product

8.1. U.S. Dental Laboratories Market, by Product, 2024-2033

8.1.1. Restorative

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Orthodontic

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Endodontic

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Oral care

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Implant

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Dental Laboratories Market, By Material

9.1. U.S. Dental Laboratories Market, by Material, 2024-2033

9.1.1. Metal Ceramics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Traditional All Ceramics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. CAD/CAM Materials

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Plastic

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Metals

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Dental Laboratories Market, By Equipment

10.1. U.S. Dental Laboratories Market, by Equipment, 2024-2033

10.1.1. Dental Radiology Equipment

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Dental Lasers

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. System and Parts

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Laboratory Machines

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Dental Scanners

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Dental Laboratories Market, By Prosthetic Type

11.1. U.S. Dental Laboratories Market, by Prosthetic Type, 2024-2033

11.1.1. Bridges

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Crowns

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Veneers

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Dentures

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Clear Aligners

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Dental Laboratories Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Material (2021-2033)

12.1.3. Market Revenue and Forecast, by Equipment (2021-2033)

12.1.4. Market Revenue and Forecast, by Prosthetic Type (2021-2033)

Chapter 13. Company Profiles

13.1. Envista Holdings Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Dentsply Sirona

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. A-dec Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Straumann AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Henry Schein, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Champlain Dental Laboratory, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Knight dental design

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. National Dentex Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. 3M Health Care

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Dental Services Group

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others