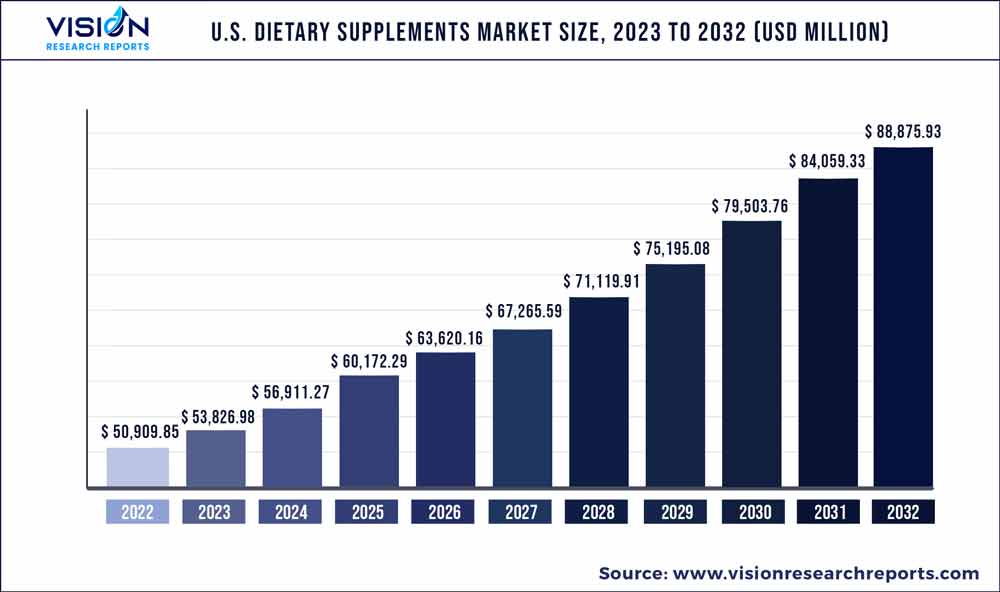

The U.S. dietary supplements market size was estimated at around USD 50,909.85 million in 2022 and it is projected to hit around USD 88,875.93 million by 2032, growing at a CAGR of 5.73% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Dietary Supplements Market

| Report Coverage | Details |

| Market Size in 2022 | USD 50,909.85 million |

| Revenue Forecast by 2032 | USD 88,875.93 million |

| Growth rate from 2023 to 2032 | CAGR of 5.73% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Amway; Abbott; Bayer AG; Glanbia plc.; Pfizer Inc.; Archer Daniels Midland; GlaxoSmithKline plc.; NU SKIN; Herbalife Nutrition; Nature's Sunshine Products Inc.; DuPont de Nemours Inc.; NOW Foods |

The demand is anticipated to be driven by the several factors including the aging population, increasing awareness about preventive healthcare, and rising demand for the sports nutrition supplements.

Furthermore, the trend towards self-directed care is also driving demand for the dietary supplements in the U.S. Consumers, those are becoming more proactive in managing their health and are turning to supplements as a way to enhancement their diets and maintain optimal health. As consumers take more responsibility for their health, they are seeking out natural and alternative remedies to improve their health and wellness.

Nutraceutical supplements have received immense popularity and focus in the recent past owing to their nutritional and medicinal benefits, along with being safe for consumption without any significant side effects. Nutraceuticals are also quickly replacing pharmaceuticals in the management and prevention of chronic and acute health problems. These products have ample scope as therapeutic agents with curative and preventive properties. They are generally available over the counter, without requiring a prescription, making them easily accessible to the general public.

The rising health concerns have driven consumers to eat better and lead healthier lives. However, with busy schedules and little time to make healthy, nutritious meals, consumers are relying on dietary supplements to make up for the inadequate intake of the required nutrients. Apart from this, the growing trend of personalized nutrition and the increased spending power of the consumers are expected to have a positive impact on product demand. There is a rising willingness among consumers in the U.S. to pay a premium price for products with better nutritional value. Add to this the growing tendency of companies to use eye-catching packaging and natural ingredients to attract more consumers. This will continue to drive the product adoption in the country.

Nanoencapsulation and microencapsulation technologies have gained popularity during the past few years owing to the controlled release and minimum utilization of the ingredients. The introduction and application of encapsulation technologies in the fortification of food & beverage products offer sports nutrition ingredients immense scope for the growth. Furthermore, ascending demand for the naturally derived ingredients in light of increasing health concerns related to synthetic ingredients is expected to fuel the penetration of herbal supplements in the sports nutrition industry.

Mounting health concerns stemming from hectic work schedules and unhealthy eating habits have increased consumer focus on health and fitness. Rising cases of obesity in the country have also driven people to exercise more. This rising participation of consumers in various physical activities, coupled with increasing international and national sporting events, has propelled demand for the sports nutritional supplements.

Ingredient Insights

Based on ingredient, the market is segmented into vitamins, botanicals, minerals, proteins & amino acids, fibers & specialty carbohydrates, omega fatty acids, probiotics, and others. In 2022, vitamins held a dominant position in the market; accounting for a share of 30.14%. This is primarily attributed to changing preferences and progressive aging of the U.S. population.

Americans are becoming increasingly health conscious and are interested in maintaining a healthy diet and lifestyle. Vitamins are among the most commonly consumed dietary supplements, especially those who may not get all the nutrients they need from their diet alone. Vitamins can be formulated with specific nutrients and doses to address various health concerns, such as immunity, bone health, and brain function. Vitamins A, B, C, and D-are expected to gain popularity among working professionals and sportspersons during the forecast period.

Probiotics and omega fatty acids are also expected to record a significant growth rate of 6.76% and 6.63% respectively during the forecast period. The demand for probiotic supplements stems from increasing gut-related issues and food sensitivities. Probiotic supplements are further beneficial for immunity and preventive healthcare which is likely to drive its growth during the forecast period.

Form Insights

Based on form, the market is segmented into tablets, capsules, soft gels, powders, gummies, liquid, and others. The capsules segment dominated the market with a revenue share of 30.34% in 2022 and is expected to retain its dominance during the forecast period.

The demand for capsules is attributed to its convenience and design. Capsules provide protection to the active ingredients from light, moisture, and oxygen. This further helps to preserve the potency and quality of the supplement during time leading to increased shelf-life. The rising importance of microencapsulation in the health & wellness industry to ensure the controlled release of finished products, along with maintaining the color characteristics, is expected to encourage manufacturers to opt for capsule dosage forms throughout the forecast period.

Gummies are expected to record the fastest CAGR of 6.73% during the forecast period. Over the recent past, manufacturers have focused on launching gummy supplements owing to its increasing preference among consumers. Gummies are likely to emerge as a profitable category during the forecast period. These were initially formulated for adults unwilling to take pills and later became popular among other groups as well because of their visual appeal and easy digestion. According to a survey by The Harris Poll found that 28.0% of adults in the U.S. have tried gummy vitamins in the past year, and 53.0% of those who tried them reported taking them daily. These trends indicate the increasing consumer preference towards gummy supplements in the U.S.

Application Insights

In 2022, the general health segment dominated the market with a revenue share of 23.69% owing to the growing emphasis on general and overall health and wellness. According to a survey conducted by the Council for Responsible Nutrition (CRN) in 2021, found that 80.0% of Americans were incorporating dietary supplements into their routines, indicating a 7.0% rise from the preceding year. The main driving force behind this trend is changing consumer dietary habits concerning preventive healthcare.

Cardiac health is projected to record the fastest CAGR of 6.571% during the forecast period. The rising occurrences of cardiovascular diseases owing to sedentary lifestyles, especially among those in the age group of 30 to 40 years, and fluctuating dietary patterns are expected to propel the intake of supplements featuring ingredients such as omega-3 fatty acids, coenzyme Q10, and magnesium to regulate heart health.

End-user Insights

In terms of revenue, the adults dominated the market with a revenue share of 46.25% in 2022 owing to growing health awareness among working professionals and athletes about the importance of maintaining a balanced diet which creates a significant demand for the dietary supplements to maintain general health.

The U.S. consumers especially women are incorporating dietary supplements in their established health and wellness routines due to the increasing health consciousness. Furthermore, sports athletes are likely to influence the demand for protein-based supplements used for muscle growth, energy & weight management, and recovery. Additionally, sedentary lifestyle is very common in the U.S. and it is largely associated with a range of health issues, including obesity, cardiovascular disease, and metabolic disorders. This is expected to drive demand for the dietary supplements among adults to mitigate the health-related risks.

Type Insights

In terms of revenue, the OTC (Over-the-Counter) segment dominated the market with a revenue share of 85.19% in 2022. The consumer trend of self-directed health care is likely to drive demand for the OTC supplements. OTC supplements are often less expensive than prescription supplements, which can make them an affordable option for the consumers. With the growth of e-commerce and online retailers, it has become easier for the consumers to purchase dietary supplements online, which has contributed to the segment growth.

Consumers are opting for OTC supplements owing to the factors such as illness prevention and treatment. Consumers are shifting towards natural over-the-counter products due to their increased efficacy in treatments and health management. The OTC segment is anticipated to develop at a significant CAGR of 5.76% during the forecast period.

Distribution Channel Insights

The offline distribution channel is estimated to dominate the market with a revenue share of 78.16% in 2022. An increase in prescribed dietary supplements by the medical practitioners for treating gastrointestinal disorders, immunity-related issues, bone health, folic acid deficiencies, heart health, and age-related macular degeneration, among others, is a key factor driving demand for the dietary supplements through offline distribution channels.

Apart from this, geriatric consumers in the U.S. prefer purchasing dietary supplements through traditional distribution channels as they are not tech-savvy. This further boosts the segment growth.

The online distribution channel is expected to record the fastest growth rate of 6.33% during the forecast period. The advent of COVID-19 outbreak has accelerated the growth of e-commerce in general, including the online sales of dietary supplements. According to a 2021 survey by Nutrition Business Journal online sales of dietary supplements in the U.S. increased by 20.8% to USD 14.3 billion in 2020, representing a significant growth trend.

Bulk discounts, convenience of online shopping, and 24/7 availability of wide range of products is likely to favor the growth of online distribution channels in the U.S. dietary supplements market.

U.S. Dietary Supplements Market Segmentations:

By Ingredient

By Form

By Application

By End-user

By Type

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Distribution Channel Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Dietary Supplements Market

5.1. COVID-19 Landscape: U.S. Dietary Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Dietary Supplements Market, By Ingredient

8.1. U.S. Dietary Supplements Market, by Ingredient, 2023-2032

8.1.1. Vitamins

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Botanicals

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Minerals

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Proteins & Amino acids

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Fibers & Specialty Carbohydrates

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Omega Fatty Acids

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Probiotics

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Dietary Supplements Market, By Form

9.1. U.S. Dietary Supplements Market, by Form, 2023-2032

9.1.1. Tablets

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Capsules

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Soft Gels

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Powders

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Gummies

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Liquids

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Dietary Supplements Market, By Energy & Weight Management

10.1. U.S. Dietary Supplements Market, by Application, 2023-2032

10.1.1. Energy & Weight Management

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. General Health

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Bone & Joint Health

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Gastrointestinal Health

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Immunity

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Cardiac Health

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Anti-cancer

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Diabetes

10.1.8.1. Market Revenue and Forecast (2020-2032)

10.1.9. Lungs Detox/Cleanse

10.1.9.1. Market Revenue and Forecast (2020-2032)

10.1.10. Skin/Hair/Nails

10.1.10.1. Market Revenue and Forecast (2020-2032)

10.1.11. Sexual Health

10.1.11.1. Market Revenue and Forecast (2020-2032)

10.1.12. Brain/Mental Health

10.1.12.1. Market Revenue and Forecast (2020-2032)

10.1.13. Insomnia

10.1.13.1. Market Revenue and Forecast (2020-2032)

10.1.14. Menopause

10.1.14.1. Market Revenue and Forecast (2020-2032)

10.1.15. Anti-aging

10.1.15.1. Market Revenue and Forecast (2020-2032)

10.1.16. Prenatal Health

10.1.16.1. Market Revenue and Forecast (2020-2032)

10.1.17. Others

10.1.17.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Dietary Supplements Market, By End-user

11.1. U.S. Dietary Supplements Market, by End-user, 2023-2032

11.1.1. Adults

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Geriatric

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Pregnant Women

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Children

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Infants

11.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Dietary Supplements Market, By Type

12.1. U.S. Dietary Supplements Market, by Type, 2023-2032

12.1.1. OTC

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Prescribed

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. U.S. Dietary Supplements Market, By Distribution Channel

13.1. U.S. Dietary Supplements Market, by Distribution Channel, 2023-2032

13.1.1. Offline

13.1.1.1. Market Revenue and Forecast (2020-2032)

13.1.2. Online

13.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 14. U.S. Dietary Supplements Market, Regional Estimates and Trend Forecast

14.1. U.S.

14.1.1. Market Revenue and Forecast, by Ingredient (2020-2032)

14.1.2. Market Revenue and Forecast, by Form (2020-2032)

14.1.3. Market Revenue and Forecast, by Application (2020-2032)

14.1.4. Market Revenue and Forecast, by End-user (2020-2032)

14.1.5. Market Revenue and Forecast, by Type (2020-2032)

14.1.6. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 15. Company Profiles

15.1. Amway

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Abbott

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Bayer AG

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Glanbia plc.

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Pfizer Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Archer Daniels Midland

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. GlaxoSmithKline plc.

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. NU SKIN

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Herbalife Nutrition

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Nature's Sunshine Products Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others