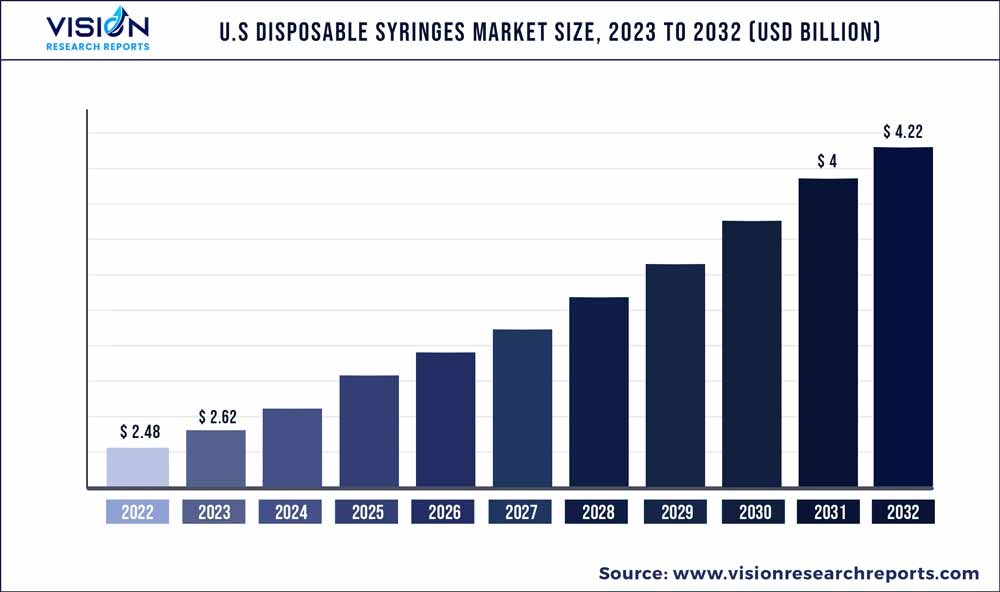

The U.S. disposable syringes market was valued at USD 2.48 billion in 2022 and it is predicted to surpass around USD 4.22 billion by 2032 with a CAGR of 5.46% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Disposable Syringes Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.48 billion |

| Revenue Forecast by 2032 | USD 4.22 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.46% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Cardinal Health; B. Braun Melsungen; Terumo Corporation; ICU Medical, Inc. (Smiths Medical) Nipro Corporation, BD; Sol-Millennium Medical; CODAN Medizinische Geräte GmbH & Co KG; Cole-Parmer Instrument Company, LLC; Henke-Sass, Wolf, UltiMed, Inc |

The growth of U.S. disposable syringes market is attributed due to growing prevalence of chronic disorders, increasing adoption of safety syringes, and growing number of surgeries in U.S. For instance, as projected by the American Heart Association, 45.1% of the U.S. population, or more than 130 million adults, are projected to suffer from some form of CVD by 2035. Moreover, about 655,000 Americans die from heart disease annually, that’s 1 in every 4 deaths.

Healthcare facilities had to use and reuse the same syringe on different patients before the medical sector advanced significantly. This is due to the fact that syringes were not manufactured abundantly and expensive. As a result, it was critical for all doctors/physicians to properly sterilize and sharpen the syringe after each use. Therefore, many chronic diseases began to spread. Due to which demand for U.S disposable syringes has been increased due to their several benefits over reusable syringes. Several benefits of U.S disposable syringes are course sterilization and safety. Since the introduction of U.S disposable syringes, patients no longer have to rely solely on the doctors' sterilization protocols for their safety, as they are discarded after one use. As a result, there is no risk of cross-contamination. Other advantages of U.S disposable syringes include their low cost and environmental friendliness. As a result of these reasons, the market is predicted to expand.

Moreover, the prevalence of chronic illnesses like Crohn's disease and diabetes, which can be treated with self-injectable medication, is rising. For instance, according to the Diabetes Research Institute Foundation, 10.5% of Americans, or 34.2 million people, have diabetes. There were 26.8 million persons with diabetes, according to estimates. Given their significance during the administration of medications and tests, syringes are necessary for the majority of diagnostic and therapeutic techniques for chronic diseases, driving up demand for the product. Major corporations are also making syringes specifically for the treatment of chronic diseases in an effort to strengthen their market positions, like BD and Smiths Medical. For instance, Chronic conditions are treated with BD's Hypak SCF PRTC glass pre-fillable syringe. Additionally, BD has stated that it intends to spin up its Diabetes Care division as a distinct, publicly traded company in May 2021. BD Diabetes Care, which supports about 30 million patients annually and produces around 8 billion injection devices, has been a significant driver of the adoption of insulin syringes and other products.

Along with the above factors, the need for U.S disposable syringes in various healthcare settings is likely to increase with its growing aging population, a demographic that is more susceptible to chronic illnesses such as diabetes and other lifestyle-related disorders. Furthermore, as per an article published in Mayo Clinic in 2020, older adult aged 65 years and older take up 16% of the U.S. population. However, they comprise 45% of Emergency Department (ED) visits. Patients in these age brackets are vulnerable to multiple chronic conditions and necessitate greater patient safety & care. These patients frequently suffer from several preexisting diseases. Moreover, alterations in vision & hearing, deterioration in functional reserve, and cognitive impairment are further aggravated by the ED setting which is expected to spur the market growth in near future.

The pandemic, caused by the virus SARS-CoV-2 in the year 2020, has drastically increased the demand for medicines, medical disposable products, emergency supplies, and hospital equipment. Therefore, the COVID-19 outbreak has immensely impacted medical disposables market and is considered to be a highly effective driver for disposable syringes market. With the COVID - 19 outbreak, a huge surge in immunizations is expected. Moreover, the pandemic has also spurred the development of prefilled syringes, especially for low-temperature storage. As a result, due to the outbreak of the COVID-19, the sales of syringes grew significantly.

Additionally, due to syringe shortages, global manufacturing capacity has been increased in a number of nations, including U.S., which has doubled its syringe supply for the COVID-19 immunization campaign in 2021. Moreover, according to the WHO which predicts a 2.0 billion needle deficit through 2022. This is due to increased demand, supply-chain disruptions, and ‘syringe nationalism' are all factors that "may pose substantial hurdles in 2022. As a result, most countries throughout the world have begun to reduce security regulations and resume certain elective treatments, indicating that the market will continue to develop over the projection period. Furthermore, organizations are gaining knowledge in their end-to-end supply chains in order to reduce product prices and improve the quality and services associated with disposable syringes. Such operational ideas help organizations save money by eliminating third-party expenses. These characteristics are projected to generate lucrative market growth prospects.

Manufacturers are focused on efficient sterilizing procedures to avoid infections among healthcare practitioners and patients in the wake of the rapidly spreading COVID-19 pandemic. As a result, firms in the U.S disposable syringes market are focusing on improving operational performance in order to increase their U.S credibility. For instance, in June 2021, to support global COVID-19 immunization efforts, BD, a multinational medical technology company, announced that it has received pandemic orders for 2 billion injectable devices in syringes and needles. This new milestone reflects assurances from governments around the world, including Australia, the UK, Canada, Brazil, Germany, France, the Philippines, India, South Africa, Spain, Saudi Arabia, and the U.S, as well as non-governmental organizations that support vaccine deployment in developing countries. These characteristics are projected to generate lucrative market growth prospects.

An increase in the number of surgical procedures/hospital visits, well-established healthcare infrastructure, and favorable reimbursement & regulatory rules in the healthcare industry are expected to present significant states growth opportunities in the market. For instance, according to Centers for Medicare & Medicaid Services (CMS), the health spending in the U.S. is expected to grow at 5.5% every year from 2018 to 2027 and is estimated to reach USD 6 trillion by 2027. In addition, high disposable income in developed economies and availability of skilled professionals are some factors responsible for the large share of the state’s market.

Product Insights

The safety syringes led the market and accounted for more than 64% share of the U.S revenue in 2022. The safety syringes are majorly used for administering medications by utilizing specialized and standard techniques. The unsafe injection practices lead to almost 33,800 HIV infections, 315,000 hepatitis C transmissions, and 1.7 million hepatitis B infections every year globally. Unsafe practices such as multiple use of a syringe & needle without taking precautionary measures as guided by the healthcare professionals lead to needlestick injuries. In addition, conventional disposable syringes provide protection to the recipient, but do not assure the safety of patients. Such factors are anticipated to boost the segment growth.

The WHO has issued guidelines for the use of safety syringes to prevent needlestick injuries. The aim of these guidelines is to prevent the reuse of conventional syringes. The International Organization for Standardization (ISO) has also issued a set of requirements for manufacturers of safety syringes to ensure safety and high performance level of the products.

The conventional syringes are the second leading segment in 2022. Conventional syringes are mostly made of plastic with visible graduation and are intended for single use. Some of the advantages of disposable conventional syringes are that they eliminate the risk of infections from blood-borne pathogens, such as HIV, Ebola virus, and Hepatitis B & C. However, less use of disposable conventional syringes & needles in undeveloped countries due to high additional costs for maintenance may hamper the segment growth. The governments in these countries are undertaking initiatives to increase the use of conventional disposable syringes & needles with an aim to reduce the transmission of diseases in patients; thereby, propelling the segment growth over the forecast period.

Application Insights

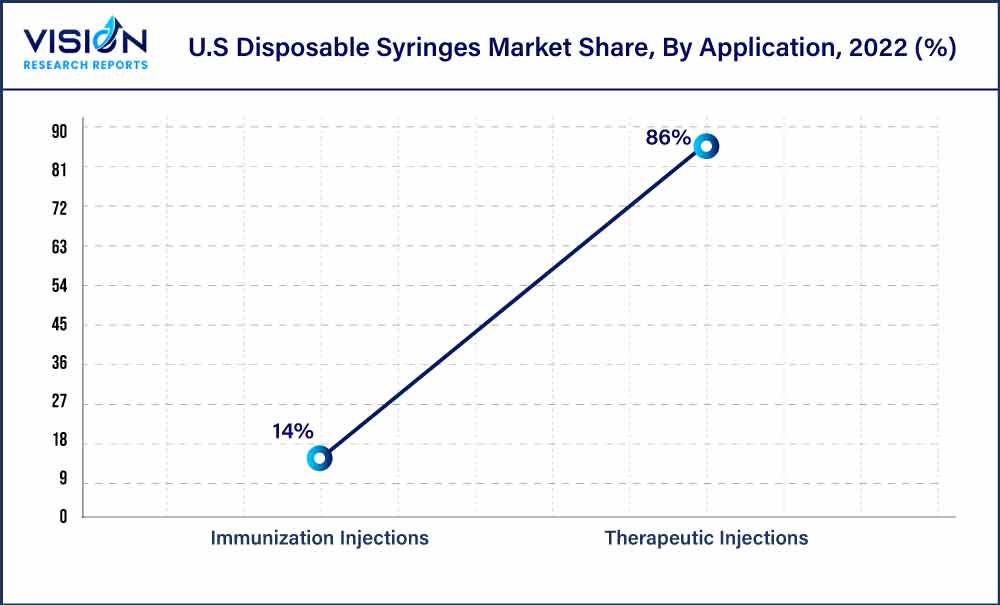

The therapeutic injections led the market and accounted for more than 86% share of the U.S revenue in 2022. Increasing awareness toward blood donations in the country is one of the major factors for driving the segment. For instance, as per the America’s Blood Centers, approximately 3 percent of the U.S. population donates blood each year. There were approximately 7.3 million donors in 2019. High prevalence of diseases such as AIDS, tuberculosis, malaria, and dengue leads to demand for high volume of injections as they are one of the essential requirements for diagnosis and treatment.

Furthermore, developments in drugs and delivery systems is also expected to propel the segment growth. For instance, in 2022, CytoDyn, Inc. has completed phase 3 clinical trial of their injectable HIV drug. This injectable is expected to replace the daily antiretroviral pill dose with once-a-week injection, thus improving the quality of life of the 33.00 million people living with AIDS. The success of this drug is expected to provide great opportunity for the growth of disposable syringes market over the forecast period.

The immunization injections segment is anticipated to witness the fastest growth over the forecast period. The process of vaccination is majorly a mass activity, thus, increasing the risk of transmission of blood-borne pathogens. In such cases, the multiple use of a syringe & needle needs to be avoided to prevent the risk of needlestick injuries. In addition, the type of injections used depends on the safety, cost, and type of vaccine to be administered. Prefilled auto-disable syringes are majorly preferred, provided all the vaccines are available in a prefilled form. This prevents vaccine contamination, increases the accuracy of dose, and reduces the waste generated due to multiple vials.

End-use Insights

The hospitals led the market and accounted for more than 35% share of the U.S revenue in 2022. Hospital institutions are the largest market for disposable syringes as they cater to majority of the population at any given time. In terms of volume of disposable syringes, hospitals are observed to be the largest consumer of related products and services. Furthermore, hospitals are considered significant buyers because they have long-term contracts with providers of disposable syringes, which gives them higher negotiation leverage and makes them a larger market for product after-sales services. Furthermore, the increasing rate of hospitalization due to rise in trauma cases, & other infectious diseases; growing number of well-furnished, well-equipped, & advanced hospitals; aging population; and increasing prevalence of chronic diseases are expected to drive the segment growth

The other segment is anticipated to witness the fastest growth over the forecast period. The others section includes academic & medical research centers, ambulatory surgical centers, and defense forces. Increasing healthcare expenditure can boost the number of research centers and academics, owing to which, this segment is anticipated to witness growth over the forecast period. The need for optimum sterility and accuracy in research procedures has resulted in increased demand for sterile disposable syringes in academic and medical research centers. Sterility is of utmost importance in research centers, owing to increasing awareness about possible contamination and increase in academic & research centers. Furthermore, the FDA and other regulatory bodies has set guidelines to review the safety and sterility practices in research labs, which is expected to boost segment growth.

U.S Disposable Syringes Market Segmentations:

By Product

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S Disposable Syringes Market

5.1. COVID-19 Landscape: U.S Disposable Syringes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S Disposable Syringes Market, By Product

8.1. U.S Disposable Syringes Market, by Product, 2023-2032

8.1.1 Conventional Syringes

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Safety Syringes

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S Disposable Syringes Market, By Application

9.1. U.S Disposable Syringes Market, by Application, 2023-2032

9.1.1. Immunization Injections

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Therapeutic Injections

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S Disposable Syringes Market, By End-use

10.1. U.S Disposable Syringes Market, by End-use, 2023-2032

10.1.1. Hospital

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Diagnostic Laboratories

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Blood Banks

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Pharmaceutical industry

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Veterinary purposes

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S Disposable Syringes Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Cardinal Health

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. B. Braun Melsungen

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Terumo Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. ICU Medical, Inc. (Smiths Medical) Nipro Corporation, BD

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sol-Millennium Medical

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. CODAN Medizinische Geräte GmbH & Co KG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Cole-Parmer Instrument Company, LLC

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Henke-Sass, Wolf, UltiMed, Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others