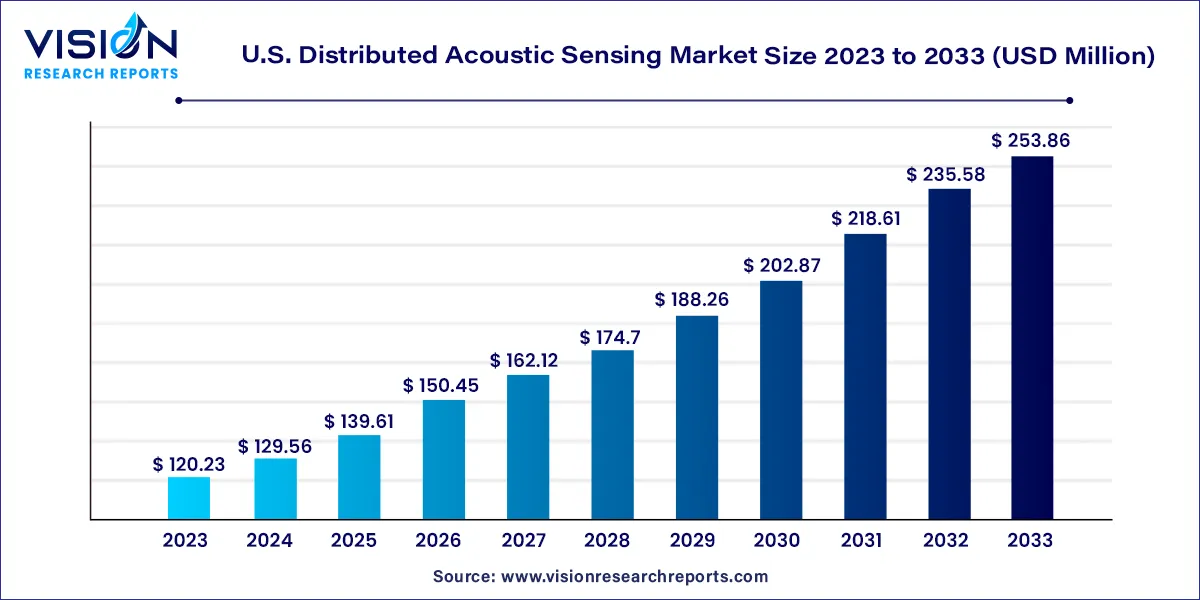

The U.S. distributed acoustic sensing market size was valued at around USD 120.23 million in 2023 and it is projected to hit around USD 253.86 million by 2033, growing at a CAGR of 7.76% from 2024 to 2033. The U.S. distributed acoustic sensing (DAS) market is a rapidly growing sector, driven by advancements in fiber-optic sensing technologies and the increasing need for real-time monitoring in various industries. Distributed Acoustic Sensing systems use the principles of fiber optics to detect and measure acoustic signals along the length of a fiber, offering a unique combination of sensitivity, accuracy, and spatial resolution.

The growth of the U.S. distributed acoustic sensing (DAS) market is driven by an advancements in fiber-optic technology have significantly enhanced the sensitivity and accuracy of DAS systems, making them increasingly valuable for real-time monitoring and surveillance. The escalating need for enhanced security and infrastructure protection is pushing the adoption of DAS solutions, particularly for perimeter security and critical infrastructure monitoring. Additionally, the oil and gas industry’s demand for efficient pipeline monitoring and seismic surveying is propelling market growth, as DAS systems provide early leak detection and optimize resource extraction. The growing emphasis on infrastructure health monitoring, including bridges and railways, further fuels the market’s expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 129.56 million |

| Revenue Forecast by 2033 | USD 253.86 million |

| Growth rate from 2024 to 2033 | CAGR of 7.76% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | OptaSense; Halliburton; Schlumberger Limited; Baker Hughes Company; Future Fibre Technologies; Northrop Grumman Corporation; Fotech Solutions Ltd.; Omnisens; Silixa Ltd.; Ziebel |

The oil & gas segment held the largest revenue share of over 31% in 2023. DAS technology is increasingly utilized for advanced wellbore monitoring in the oil and gas sector. Operators are leveraging DAS systems to gain real-time, distributed acoustic data along the entire length of the well, allowing for an improved understanding of well conditions, reservoir dynamics, and production optimization. This trend is driven by the industry's growing focus on maximizing operational efficiency and ensuring the integrity of wellbore assets. DAS technology is being employed to optimize the fracking process by monitoring fracture propagation, fluid movement, and proppant distribution in real time. The ability to gather high-resolution acoustic data using DAS systems enables operators to fine-tune their fracturing operations, increasing production efficiency and improving hydrocarbon recovery.

The transportation segment is estimated to grow significantly over the forecast period. DAS systems are increasingly being deployed for monitoring railroad tracks and ensuring their safety and reliability. DAS technology can detect acoustic signals caused by train movements, track irregularities, or potential defects by installing fiber optic cables along the tracks. This trend enables real-time monitoring of track conditions, early detection of faults, and proactive maintenance, contributing to improved operational efficiency and passenger safety. Additionally, DAS technology can detect acoustic signals caused by vibrations, deformation, or potential hazards by installing fiber optic cables within tunnels. This trend allows for continuous monitoring, early detection of anomalies, and proactive maintenance, enhancing the safety and reliability of tunnel infrastructure.

The single-mode fiber segment led the market in 2023, accounting for over 71% of the revenue share. The oil and gas sector in the U.S. increasingly uses DAS technology combined with single-mode fiber for applications such as wellbore monitoring, hydraulic fracturing optimization, and reservoir management. The ability of DAS systems to provide real-time, distributed acoustic data along the entire wellbore length using single-mode fiber offers valuable insights for improving production efficiency, ensuring wellbore integrity, and maximizing hydrocarbon recovery. DAS systems are being integrated with advanced data analytics and artificial intelligence technologies to enable the efficient processing and analysis of large volumes of acoustic data collected by DAS systems.

The multimode fiber segment is estimated to grow significantly over the forecast period. Traditional optical multimode fiber, such as OM1 and OM2, has limitations in terms of bandwidth and distance. However, advancements in multimode fiber technology have led to the emergence of higher-grade fibers like OM3 and OM4, which offer increased bandwidth capacity and longer transmission distances. This makes multimode fiber more viable for certain DAS applications requiring higher data rates and extended coverage. The U.S. market continues to witness ongoing research and development efforts focused on enhancing the capabilities and performance of multimode fiber-based DAS systems.

By Fiber Type

By Vertical

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Distributed Acoustic Sensing Market

5.1. COVID-19 Landscape: U.S. Distributed Acoustic Sensing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Distributed Acoustic Sensing Market, By Fiber Type

8.1. U.S. Distributed Acoustic Sensing Market, by Fiber Type, 2024-2033

8.1.1. Single Mode Fiber

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Multimode Fiber

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Distributed Acoustic Sensing Market, By Vertical

9.1. U.S. Distributed Acoustic Sensing Market, by Vertical, 2024-2033

9.1.1. Oil & Gas

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Power & Utility

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Security & Surveillance

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Environment & Infrastructure

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Transportation

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Distributed Acoustic Sensing Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Fiber Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 11. Company Profiles

11.1. OptaSense

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Halliburton

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Schlumberger Limited

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Baker Hughes Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Future Fibre Technologies

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Northrop Grumman Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Fotech Solutions Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Omnisens

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Silixa Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Ziebel

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others