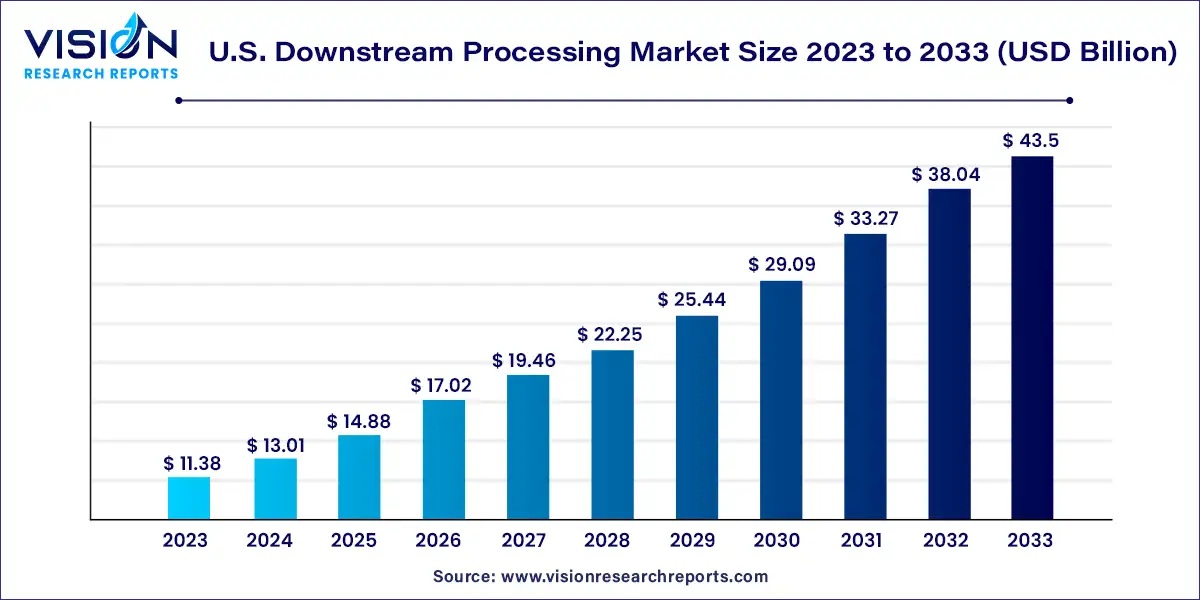

The U.S. downstream processing market size was estimated at USD 11.38 billion in 2023 and it is expected to surpass around USD 43.5 billion by 2033, poised to grow at a CAGR of 14.35% from 2024 to 2033.

The downstream processing market in the United States plays a pivotal role in the biopharmaceutical industry, serving as a crucial stage in the production of biologics and pharmaceuticals. This segment encompasses a range of purification and recovery techniques that are essential for isolating and refining biotherapeutic products to meet stringent quality standards. In this overview, we delve into the key components, trends, and dynamics shaping the landscape of the U.S. downstream processing market.

The growth of the U.S. downstream processing market is driven the rising demand for biopharmaceuticals, driven by an aging population and increasing prevalence of chronic diseases, is driving the need for efficient downstream processing solutions. Secondly, ongoing technological advancements in chromatography, filtration, and other downstream processing techniques are enhancing efficiency and scalability, thereby attracting investment and driving market growth. Additionally, the adoption of single-use systems and continuous processing is revolutionizing traditional manufacturing processes, offering flexibility, cost savings, and improved productivity. Furthermore, stringent regulatory requirements pertaining to product purity and safety are compelling biopharmaceutical companies to invest in advanced downstream processing technologies to ensure compliance and maintain competitiveness in the market.

In 2023, the chromatography systems segment dominated the revenue share, accounting for 42%. This segment encompasses a diverse range of products such as chromatography membranes, resins, cleaning-in-place solutions, buffers, and compatible hardware like single-use systems, multi-use systems, and columns. These components are integrated into systems utilized during the downstream processing (DSP) purification phase. Major market players provide comprehensive chromatography solutions ensuring safety and efficiency across all stages, from process development to production scale. Recent advancements have led to the development of technologically sophisticated chromatography systems, addressing the evolving needs of pharmaceutical manufacturers. Notably, single-use chromatography stands out as a significant innovation in the biopharmaceutical sector.

Furthermore, the filters segment is projected to exhibit the highest compound annual growth rate (CAGR) from 2024 to 2033. Filtration plays a crucial role in harvesting biological products from large cultures, given the sensitivity of biomolecules to heat and chemical treatments. Consequently, alternative methods for biopharmaceutical filtration are largely disregarded. Various types of filters utilized during DSP include depth filters, absolute filters, rotary drum vacuum filters, and membrane filters. Manufacturers have responded to increased demand for viral clearance and enhanced cell densities and titers by developing advanced filters with heightened capacity and performance. Filtration, especially in viral safety, is paramount, as a virus can significantly disrupt an entire production process.

In 2023, the purification by chromatography segment commanded the largest revenue share at 42%. Chromatography plays a crucial role in the isolation and purification of most high-value products, particularly during the downstream processing (DSP) of proteins. It serves as a fundamental technique employed across all stages of DSP, from initial capture to the final purification step. Key chromatographic techniques utilized during DSP include ion exchange chromatography, hydrophobic interaction chromatography, affinity chromatography, and gel filtration chromatography.

The solid-liquid separation is anticipated to witness the fastest compound annual growth rate (CAGR) during the forecast period. This process involves the initial recovery stages where whole cells and insoluble components are separated from the culture broth containing the desired products. Major techniques employed for solid-liquid separation encompass flotation, flocculation, filtration, centrifugation, or a combination thereof. On a production scale, large centrifuges and microfilters are commonly utilized for separation purposes. Microfiltration emerges as the preferred method for removing cell debris from the medium, wherein the mixture passes through membranes featuring pores ranging from 0.1 to 0.8 microns in diameter, depending on the cell types present in the process medium.

In 2023, the antibiotic production segment emerged as the top revenue generator, accounting for 31% of the market share. Antibiotics play a critical role in treating various conditions, ranging from cancers to infectious diseases. Notably, β-lactam antibiotics, including cephalosporin and penicillin, stand out as highly commercialized antibiotics worldwide. These antibiotics, whether natural or synthetic, are manufactured on an industrial scale through bioprocessing techniques and are subsequently harvested via downstream processing. With the escalating prevalence of antibiotic resistance, there's a growing demand for developing antibodies targeting resistant strains. This surge in demand for bioprocessing technologies for industrial-scale antibody production is poised to drive market growth significantly during the forecast period.

The antibody production is anticipated to witness the fastest compound annual growth rate (CAGR) during the forecast period. Monoclonal antibodies find extensive use across various clinical indications such as cancers, inflammatory disorders, and infectious diseases. They represent one of the most prevalent modalities offered by the biopharmaceutical industry today. This dominance can be attributed to the establishment of robust manufacturing platforms capable of generating high titers of monoclonal antibodies in mammalian cell cultures. Furthermore, the advent of innovative methods in antibody bioprocessing has further fueled market growth, facilitating advancements in process platform approaches

By Product

By Technique

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Downstream Processing Market

5.1. COVID-19 Landscape: U.S. Downstream Processing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Downstream Processing Market, By Product

8.1. U.S. Downstream Processing Market, by Product, 2024-2033

8.1.1 Chromatography Systems

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Filters

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Evaporators

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Centrifuges

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Dryers

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Downstream Processing Market, By Technique

9.1. U.S. Downstream Processing Market, by Technique, 2024-2033

9.1.1. Cell Disruption

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Solid-liquid Separation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Concentration

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Purification By Chromatography

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Formulation

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Downstream Processing Market, By Application

10.1. U.S. Downstream Processing Market, by Application, 2024-2033

10.1.1. Antibiotic Production

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Hormone Production

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Antibodies Production

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Enzyme Production

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Vaccine Production

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Downstream Processing Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Technique (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Merck KGaA.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sartorius Stedim Biotech S.A.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. GE Healthcare.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Thermo Fisher Scientific Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Danaher Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Repligen

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. 3M Company.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Boehringer Ingelheim International GmbH

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Corning Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lonza Group Ltd

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others