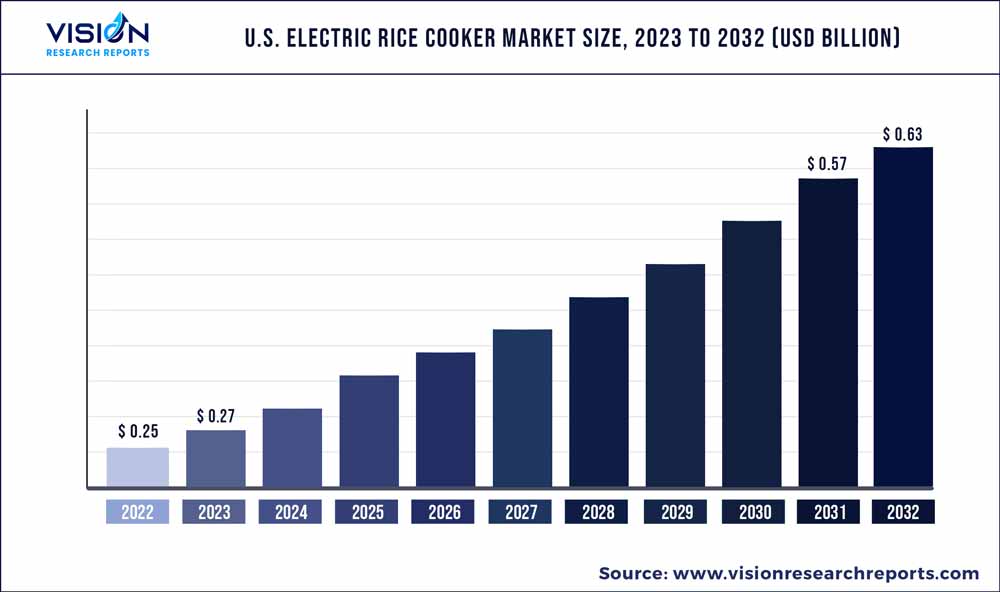

The U.S. electric rice cooker market was estimated at USD 0.25 billion in 2022 and it is expected to surpass around USD 0.63 billion by 2032, poised to grow at a CAGR of 9.63% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Electric Rice Cooker Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.25 billion |

| Revenue Forecast by 2032 | USD 0.63 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Tiger Corporation; Town Food Service Equipment Co., Inc.; Toshiba Corporation; Panasonic Holdings Corporation; Admiral Craft Equipment Corp.; Aroma Housewares; Black+Decker Inc.; Hamilton Beach Brands, Inc.; Cuckoo Electronics Co., Ltd.; Zojirushi America Corporation |

Rising awareness among consumers about the nutritional and health benefits associated with rice and easy cooking is boosting product demand. The demand for electric rice cookers is largely driven by the preferences and needs of consumers. For example, an increasing trend toward healthy eating leads to greater demand for rice cookers that can cook brown rice, oats, and quinoa. The level of competition in the market can also affect the demand for electric rice cookers. A high level of competition among similar products drives consumers to choose products based on price or brand reputation.

Electric rice cookers are very easy to use. These require a simple setup process and only the push of a button to start cooking. This is ideal for busy households who wish to prepare rice without needing to monitor the cooking process. Electric rice cookers are designed to always cook rice consistently. This means that U.S. households can rely on the rice cooker to produce the same quality of rice each time they use it. Electric rice cookers can save time, especially for households that regularly eat rice. Since rice cookers do not require constant monitoring, it frees up time for other tasks or activities.

Electric rice cookers are convenient and help save time. These cookers allow users to set a timer and switch off automatically after the cooking duration is over. This frees up time and effort that can be used for other tasks, making it a popular choice for busy households in the U.S. In addition to basic cooking features, many electric rice cookers offer a variety of other features that improve convenience and efficiency. For example, some models include pre-programmed cooking modes that are optimized for different types of rice, such as white rice, brown rice, or sushi rice.

Some models also have sensors that can detect when the rice is fully cooked and automatically switch to a keep-warm mode, maintaining the perfect temperature until it is time to serve, eliminating the need for reheating while preserving the quality of the rice. Furthermore, many electric rice cookers come equipped with a removable inner pot that makes cleaning easy and hassle-free. Some models even have dishwasher-safe components, making clean-up even more convenient for users.

The growing interest in healthy eating is another significant driver of the U.S. electric rice cooker market. Rice is often considered a healthier alternative to other carb-rich foods, and electric rice cookers provide a convenient and healthy way to cook rice at home. In addition, electric rice cookers allow users to cook rice without adding additional oils or fats, making it a low-fat and low-calorie option for those looking to reduce their intake of these ingredients.

Product Insights

Standard electric rice cooker is the leading product segment, which held a market share of 59% in 2022, in the U.S. electric rice cooker market. Standard electric rice cookers are suitable for use when there is limited space in the kitchen and inadequate ventilation. These cookers are much simpler to operate & maintain and are perfect for cooking smaller quantities of rice. They have a compact design and can be easily ported from one place to another as per convenience.

Multifunctional electric rice cooker is the most lucrative product segment, accelerating at a CAGR of 10.45% during the forecast period. The increasing demand for convenient and time-saving cooking solutions has driven the uptake of electric rice cookers with advanced features such as smart controls and multifunctional cooking capabilities. Multifunctional electric rice cookers add variation to the cooking process. They include settings for a variety of rice and also offer steaming options to fluff the rice after it is cooked.

Application Insights

Household application is expected to be the leading market segment in the U.S. electric rice cooker market. Electric rice cookers can be used to cook a variety of grains apart from rice, such as oats and barley, and provide additional functions like slow cooking and steaming. The household application held the dominant share of 77% in 2022. Growing consumer preference for convenient, energy-efficient, and multifunctional cooking appliances is a key factor driving the demand for electric rice cookers among U.S. households.

The commercial application is expected to register a CAGR of 8.15% from 2023 to 2032. Electric rice cookers have a range of applications in the commercial sector, particularly in the food service industry. The growing number of restaurants and hotels in the U.S. is driving the sales of electric rice cookers in the commercial sector.Apart from this, government regulations against using gas connections in highly populated commercial areas are likely to support the uptake of electric rice cookers for commercial use.

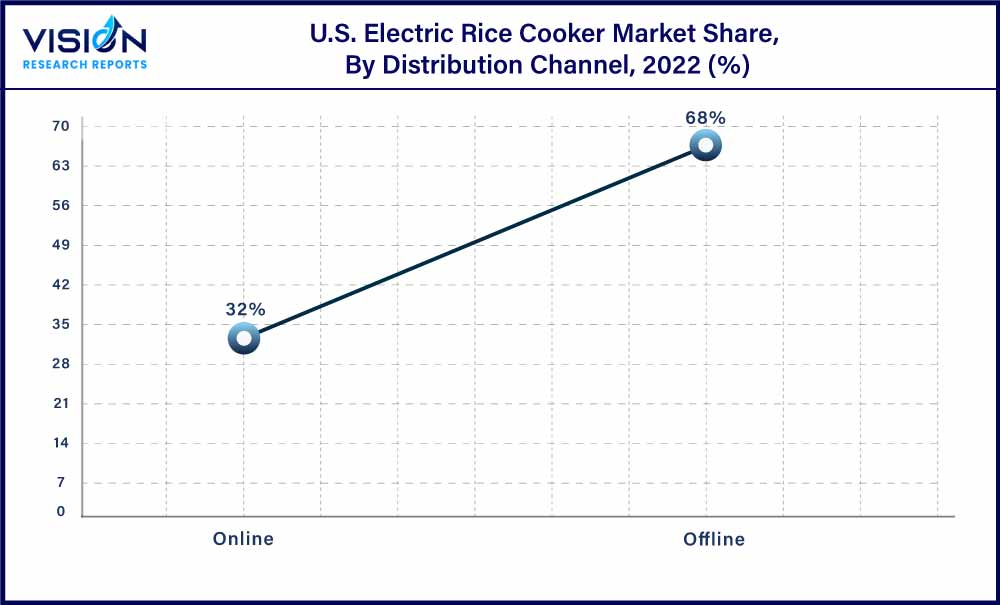

Distribution Channel Insights

The offline distribution channel accounted for the largest share of 68% in 2022. Offline distribution channels, which include supermarkets, hypermarkets, and specialty stores, play an important role in the distribution of electric rice cookers. These channels offer consumers the opportunity to physically verify the product and compare prices before making a purchase. Offline distribution channels also provide consumers with the option of immediate purchase, eliminating the need to wait for delivery and the added costs and risks of shipping.

The online distribution channel is expected to register the fastest CAGR of 12.33% from 2023 to 2032. E-commerce has brought a major change in shopping habits worldwide. An increasing number of consumers now shop online as the channel provides various advantages such as doorstep delivery, lucrative discounts, the availability of a large variety of items on a single site, and ease of comparing product specifications. Due to this growing popularity of online shopping, especially among millennials and young people, players in the U.S. electric rice cooker industry are increasingly launching their e-commerce websites.

U.S. Electric Rice Cooker Market Segmentations:

By Product

By Application

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Electric Rice Cooker Market

5.1. COVID-19 Landscape: U.S. Electric Rice Cooker Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Electric Rice Cooker Market, By Product

8.1. U.S. Electric Rice Cooker Market, by Product, 2023-2032

8.1.1 Standard

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Multifunction

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Induction

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Electric Rice Cooker Market, By Application

9.1. U.S. Electric Rice Cooker Market, by Application, 2023-2032

9.1.1. Household

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Electric Rice Cooker Market, By Distribution Channel

10.1. U.S. Electric Rice Cooker Market, by Distribution Channel, 2023-2032

10.1.1. Online

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Offline

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Electric Rice Cooker Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Tiger Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Town Food Service Equipment Co., Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Toshiba Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Panasonic Holdings Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Admiral Craft Equipment Corp.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Aroma Housewares

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Black+Decker Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Hamilton Beach Brands, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Cuckoo Electronics Co., Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Zojirushi America Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others