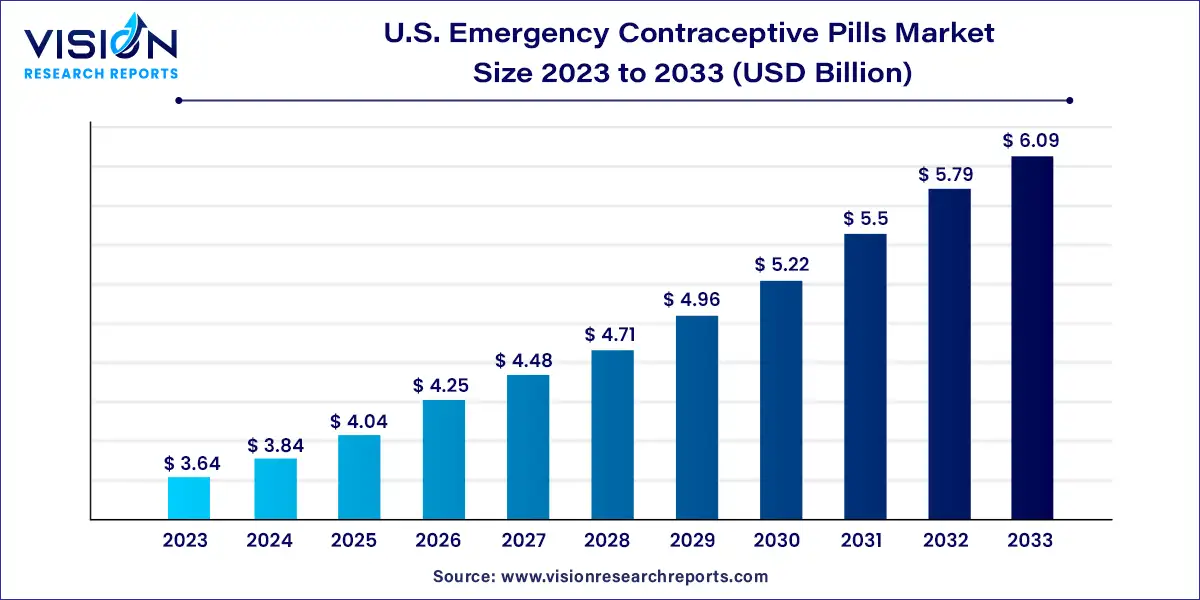

The U.S. emergency contraceptive pills (ECPs) market size was surpassed at USD 3.64 billion in 2023 and is expected to hit around USD 6.09 billion by 2033, growing at a CAGR of 5.28% from 2024 to 2033.

The growth of the U.S. emergency contraceptive pills market is driven by an increasing awareness about contraception and reproductive health among the population has led to greater acceptance and utilization of emergency contraceptive options. Secondly, rising incidences of unprotected intercourse and unintended pregnancies have underscored the importance of readily accessible emergency contraception, driving demand for emergency contraceptive pills. Additionally, advancements in pharmaceutical research and development have led to the introduction of new and improved formulations of emergency contraceptive pills, enhancing efficacy and tolerability. Furthermore, initiatives aimed at expanding access to reproductive healthcare services, including emergency contraception, have played a pivotal role in driving market growth. Lastly, regulatory reforms and policies aimed at promoting women's reproductive rights and healthcare access have facilitated the availability and affordability of emergency contraceptive pills, further fueling market expansion.

| Report Coverage | Details |

| Market Size in 2023 | USD 3.64 billion |

| Revenue Forecast by 2033 | USD 6.09 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.28% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The progesterone pills segment dominated the market, holding the largest revenue share of 47% in 2023. This segment’s growth is driven by the introduction of multiple products from various market players and their high efficacy rate of 85% when used perfectly. As a result, the Progesterone pills segment is expected to continue driving the market's growth, offering women a reliable and effective option for emergency contraception.

The combination pills segment is expected to witness the fastest CAGR during the forecast period. Combination pills, which include estrogen-progestin birth control pills, are the most used form of emergency contraception in the United States, with an efficacy rate of 75%. Its effectiveness is the key factor driving the increased demand for emergency contraception options among women. On the other hand, ulipristal acetate is expected to witness significant growth during the forecast period.

As an antiprogestin sold in the U.S. under the brand name ella, it offers emergency contraception when taken soon after intercourse, remaining effective for 120 hours. However, according to thestudy of pharmacy availability in southwestern Pennsylvania in 2021, only 5% of pharmacies had ulipristal acetate readily accessible, indicating the need for improved availability and awareness.

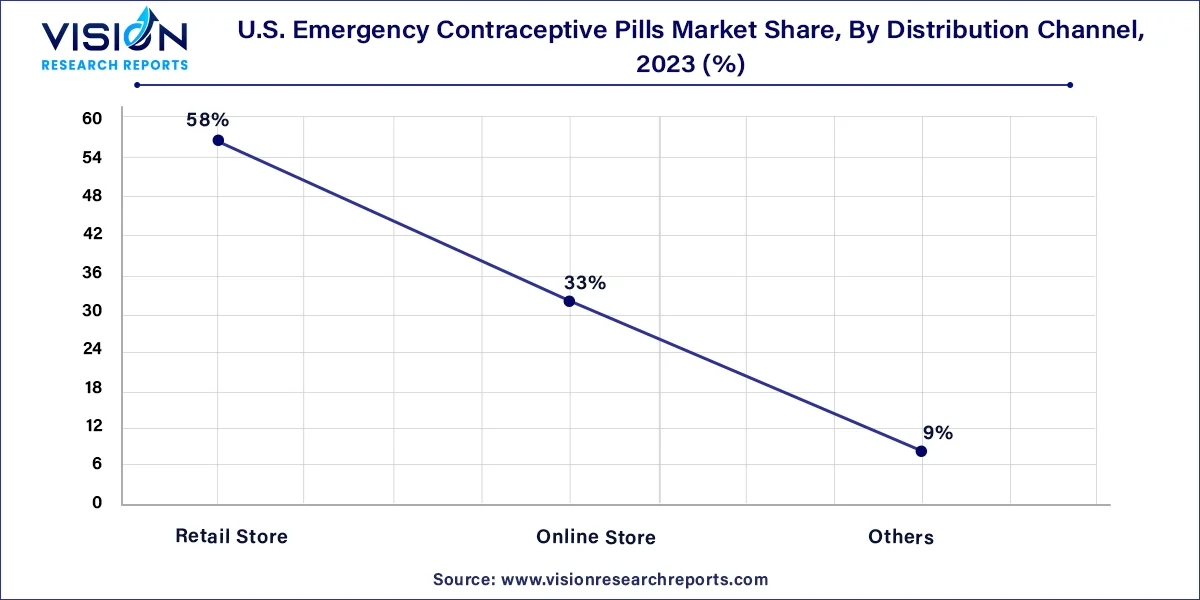

The retail store segment held the largest market share of 58% in 2023. According to the Journal of The American Pharmacists Association in 2023, around 61,715 pharmacies are operating in the U.S. These storesoffer a diverse range of products from different players, easy access to family planning services, and healthcare facilities. Additionally, factors such as the growing awareness and demand for emergency contraception are expected to fuel the segment's expansion.

The online store segment is anticipated to witness the fastest growth during the forecast period. The increasing internet accessibility and growing awareness among women about emergency contraceptives in the U.S. are driving segment growth. Despite the strong presence of e-commerce platforms, the 72-hour time constraint for consuming emergency contraceptive pills is expected to impact on online sales.

Hospital pharmacies are poised to play a significant role in providing emergency contraceptive pills, being key providers in the market. Its advantage lies in offering a comprehensive range of services under one roof, including medical prescriptions. This convenience and accessibility make them a preferred choice for women seeking emergency contraception.

By Type

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Emergency Contraceptive Pills Market

5.1. COVID-19 Landscape: U.S. Emergency Contraceptive Pills Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Emergency Contraceptive Pills Market, By Type

8.1. U.S. Emergency Contraceptive Pills Market, by Type, 2024-2033

8.1.1. Combination Pills

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Progesterone Pills

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Ulipristal Acetate

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Emergency Contraceptive Pills Market, By Distribution Channel

9.1. U.S. Emergency Contraceptive Pills Market, by Distribution Channel, 2024-2033

9.1.1. Retail Store

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Online Store

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Emergency Contraceptive Pills Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 11. Company Profiles

11.1. Afaxys Pharma LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Teva Pharmaceutical Industries Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Syzygy Healthcare, LLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Gedeon Richter USA, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Rapha Pharmaceuticals, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Perrigo Company plc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Foundation Consumer Healthcare LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Wockhardt USA.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Pfizer Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Bayer plc

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others