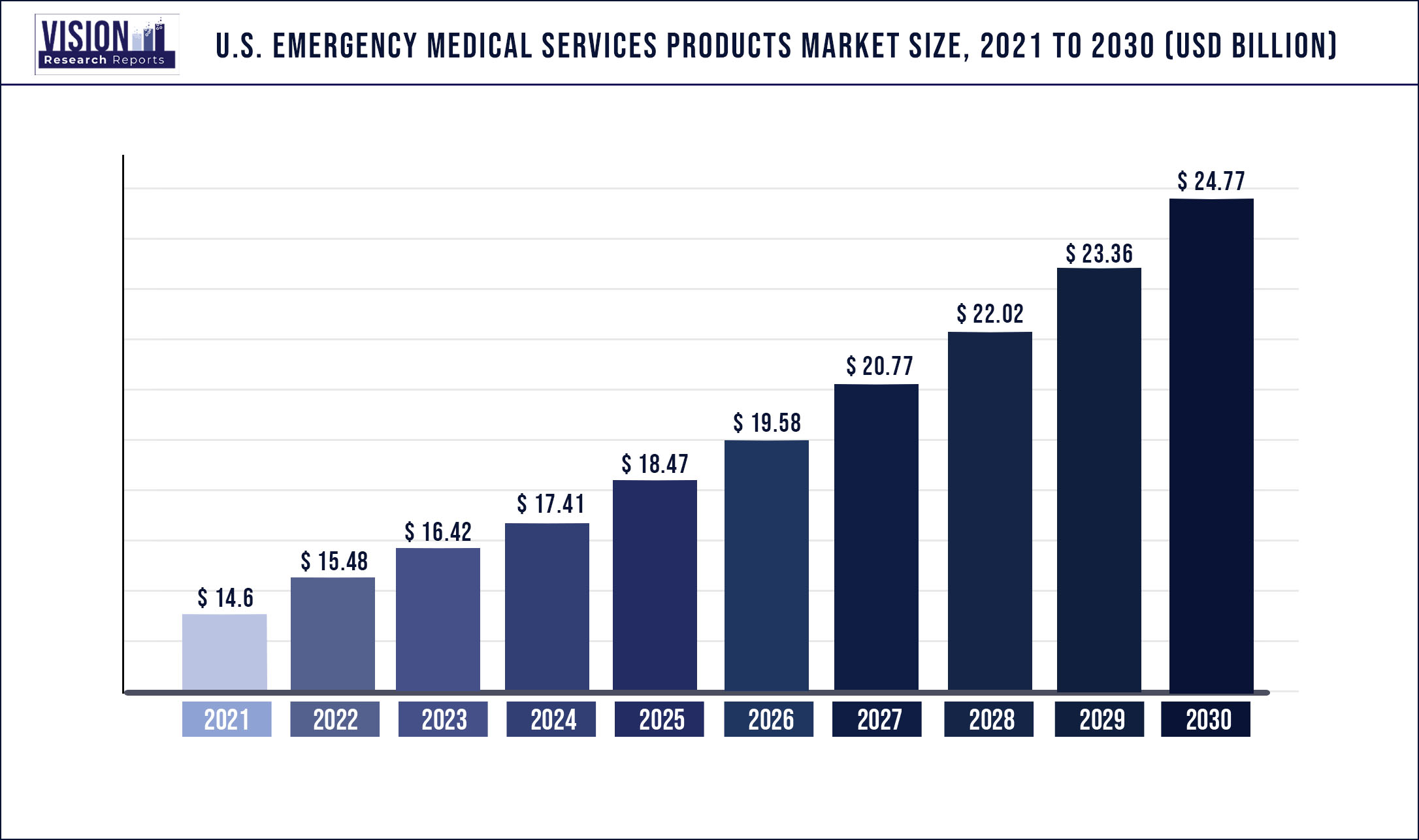

The U.S. emergency medical services products market size was estimated at around USD 14.6 billion in 2021 and it is projected to hit around USD 24.77 billion by 2030, growing at a CAGR of 6.05% from 2022 to 2030.

Burgeoning demand for emergency care, mounting cases of trauma, and growing healthcare spending are the key factors escalating the growth of the market.

Emergency departments manage patients with medical, obstetric, and surgical emergencies. The department is also equipped to treat injuries, infections, heart attacks, asthma, and acute pregnancy complications. The U.S. has hospital-based emergency departments as well as independent emergency departments that operate outside hospital premises. According to the Centers for Disease Control and Prevention (CDC), 141.4 million patients visited emergency rooms in the U.S. in 2014.

Surging demand in the U.S. for emergency medical services creates a favorable environment for market growth. The Centers for Medicare and Medicaid Services (CMS) has divided emergency departments in the U.S. into two segments: Type A and Type B. Type A functions 24 × 7 and Type B includes emergency departments, which operates during a specified period of time. As per Becker's Hospital Review, a magazine for hospital business news, in 2016, the number of emergency department visits in the U.S. was 136.3 million. These figures indicate a strong demand for EMS products.

Moreover, in 1986, the government had introduced the Emergency Medical Treatment and Labor Act (EMTALA). As per the law, anyone going to emergency department has to be treated, regardless of their ability to pay or their insurance status. Such laws are improving the accessibility to emergency care, which in turn can propel the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 14.6 billion |

| Revenue Forecast by 2030 | USD 24.77 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.05% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, end-use |

| Companies Covered | Bound Tree Medical; McKesson Medical-Surgical, Inc.; Henry Schein, Inc.; Medline Industries; Emergency Medical Products, Inc.; Stryker Corporation; Smith Medical, Inc.; Cardinal Health; Life-Assist; Penn Care, Inc. |

Product Insights

The life support & emergency resuscitation segment dominated the U.S. emergency medical services (EMS) products market with a share of 34.11% in 2021. The dominance can be accredited to the high demand for emergency care due to the rising number of road accidents. For instance, according to the U.S. Department of Transportation, in 2020, around 38,824 motor vehicle road fatalities were recorded in the U.S., which was around 2,469 more than that in 2019. Life support & emergency resuscitation equipment such as defibrillators, resuscitators, and ventilators are used during road accidents.

Moreover, an increase in the number of people suffering from cardiac arrest is predicted to drive the demand for emergency services in the U.S. For instance, according to the latest stats by Sudden Cardiac Arrest Foundation, more than 356,000 people suffered from out-of-hospital cardiac arrest, of which nearly 90% were fatal. Emergency products such as ventilators are used during such situations. Thus, as a result of the aforementioned factors, the segment is projected to have a significant growth rate during the forecast duration.

The patient monitoring systems segment is projected to witness a significant growth rate of 7.53% during the forecast period. The rising incidence of cardiac arrest, traumatic accidents, and the emergence of COVID-19 have impacted the demand growth rate of patient monitoring systems. For instance, according to the American Heart Association, in a single year, 350,000 Americans die as a result of cardiac arrest. Moreover, as per a similar source, around 10,000 cardiac arrests occur at the workplace in the U.S.

Additionally, the number of traumatic accidents has increased in the U.S. For instance, as per CDC, around 64,000 traumatic brain injury-related deaths were recorded in the U.S. in 2020. Furthermore, as per a similar source, unintentional injuries lead to 200,955 deaths in the U.S, whereas the death rate as a result of accidents was calculated to be 12.4 per 100,000 population. As patient monitoring systems are used to monitor patients’ vital signs and warning systems to detect & record changes, the use of such systems is expected to rise during the projected duration, thereby impelling the segment growth.

End-use Insights

Hospitals and trauma centers dominated the end-use segment with a market share of 46.60% in 2021. This can be attributed to an increase in the number of hospitals in the U.S. For instance, as per data released by the American Health Association.

Moreover, as per the CDC, the total number of emergency department visits in the U.S. tallied up to 130 million, with 35 million injury-related visits. Owing to the aforementioned factors, the segment is anticipated to propel during the forecast period.

However, ambulatory surgical centers are projected to advance at the fastest CAGR of 8.08% during the forecast years. This can be credited to the increasing number of ambulatory surgical centers in the region. For instance, according to the Ambulatory Surgical Center Association and ASCA Foundation, the number of ASCs present in Texas was 461 in 2022.

Moreover, as per a similar source, the number of ASCs present in California tallied up to 845 as of March 2022. ASCs provide same-day surgery and care, which includes diagnosis and preventive procedures. This trend is expected to surge the demand for emergency products, thereby boosting the segment growth during the assessment period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Emergency Medical Services Products Market

5.1. COVID-19 Landscape: U.S. Emergency Medical Services Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Emergency Medical Services Products Market, By Product

8.1. U.S. Emergency Medical Services Products Market, by Product, 2022-2030

8.1.1. Life Support & Emergency Resuscitation

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Patient Monitoring Systems

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Patient Monitoring Systems

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Infection Control Supplies

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Other EMS Products

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global U.S. Emergency Medical Services Products Market, By End-use

9.1. U.S. Emergency Medical Services Products Market, by End-use, 2022-2030

9.1.1. Hospitals & Trauma Centers

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Ambulatory Surgical Centers

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global U.S. Emergency Medical Services Products Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. Bound Tree Medical

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. McKesson Medical-Surgical, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Henry Schein, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Medline Industries, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Emergency Medical Products, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Stryker Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Smith Medical. Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Cardinal Health

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Life-Assist

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Penn Care, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others