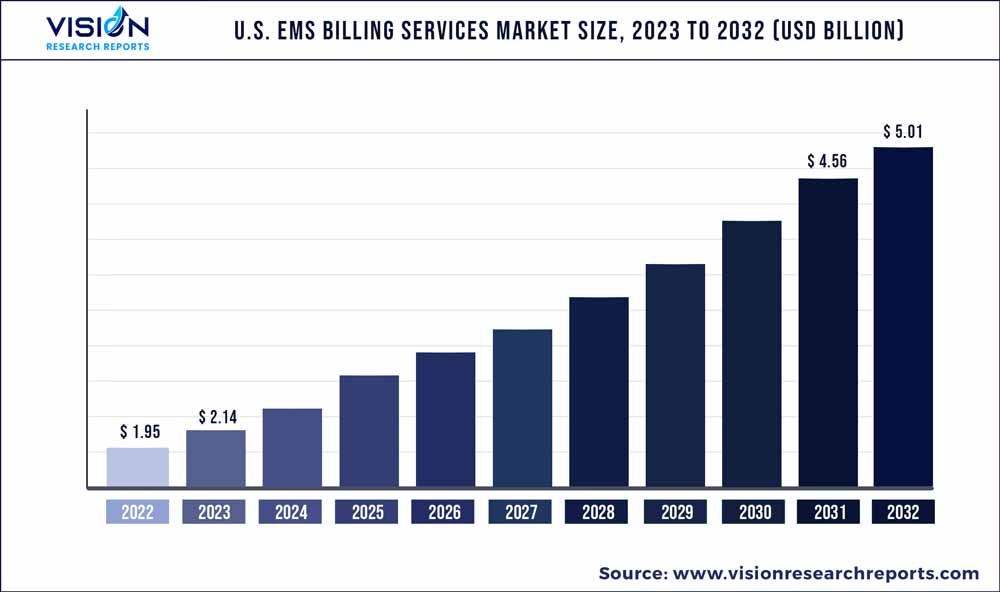

The U.S. EMS billing services market was surpassed at USD 1.95 billion in 2022 and is expected to hit around USD 5.01 billion by 2032, growing at a CAGR of 9.89% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. EMS Billing Services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.95 billion` |

| Revenue Forecast by 2032 | USD 5.01 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.89% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | EMS Management & Consultants, Inc.; Cvikota EMS; Omni Medical Billing Service, Inc.; Quick Med Claims, LLC.; 911 Billing Services & Consultant, Inc.; Change Healthcare; PCC Ambulance Billing Service; EMS Billing Management, LLC; Pintler Billing Services; AIM EMS Software & Services |

The market is expected to witness growth during the forecast period, due to the cost-saving benefits of outsourcing billing operations. Emergency medical services (EMS) agencies are turning to specialized billing companies to focus on patient care and reduce overhead costs. Outsourcing allows agencies to utilize expert claims management and reimbursement knowledge, ensuring accurate processing.

The rising number of Emergency Department (ED) visits and the emergence of independent freestanding ED facilities are expected to drive the EMS billing services market in the U.S. According to the National Hospital Ambulatory Medical Care Survey 2020, there were 131.3 million ED visits in the U.S. Of these visits, 38.0 million were injury-related, indicating a substantial demand for emergency medical services.

Furthermore, technological advancements for improved billing services are expected to significantly impact the overall market over the forecast period. As billing procedures become increasingly complex, there is a growing demand for software solutions that can enhance the process and increase client revenue. Billing service providers are either developing their in-house software applications or purchasing them from technology firms to meet this demand.

One such technological advancement is the recent approval received by AIM EMS Software and Services in March 2023. This allows them to aid ambulance services operating in states where implementing NEMSIS v3.5 compliant software for patient care reporting is mandatory. By staying up to date with the latest regulations and standards, billing service providers can ensure smooth operations and compliance with industry requirements.

The COVID-19 pandemic has had a substantial impact on the market, especially on the utilization of emergency department (ED) services. As a result of the pandemic, there has been a significant decrease in ED visits, leading to a negative effect on market growth. According to data from the Centers for Disease Control and Prevention (CDC), the number of ED visits in the United States was estimated to be around 151 million in 2019. However, this figure experienced a decline of 13.2% in 2020.

Component Insights

Based on component, the U.S. EMS billing services market is segmented into outsourced and in-house. The outsourced segment held the majority of the market share of 57% in 2022. The segment is expected to witness the fastest growth rate during the forecast period. Increasing administrative costs are leading to high demand for outsourced EMS billing services.

In addition, growing demand for third-party billing services to enhance revenue, improve claim filing efficiency and minimize claim denial rates is anticipated to fuel market growth. The availability of certified medical coders and skilled billing staff helps avoid unnecessary delays, thus helping patients save costs and avail quality service.

The in-house segment is expected to witness growth during the forecast period as this component enables healthcare providers to control and oversee their financial operations. The growth of the in-house segment in the U.S. EMS billing services market is driven by the need for increased authority, effectiveness, and financial optimization in the healthcare industry.

U.S. EMS Billing Services Market Segmentations:

By Component

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on U.S. EMS Billing Services Market

5.1. COVID-19 Landscape: U.S. EMS Billing Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. U.S. EMS Billing Services Market, By Component

8.1.U.S. EMS Billing Services Market, by Component Type, 2023-2032

8.1.1. In-house

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Outsourced

8.1.2.1.Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. EMS Billing Services Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Component (2020-2032)

Chapter 10.Company Profiles

10.1. EMS Management & Consultants, Inc.

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Cvikota EMS

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Omni Medical Billing Service, Inc.

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Quick Med Claims, LLC.

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. 911 Billing Services & Consultant, Inc.

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Change Healthcare

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. PCC Ambulance Billing Service

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. EMS Billing Management, LLC

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Pintler Billing Services

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. AIM EMS Software & Services

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others