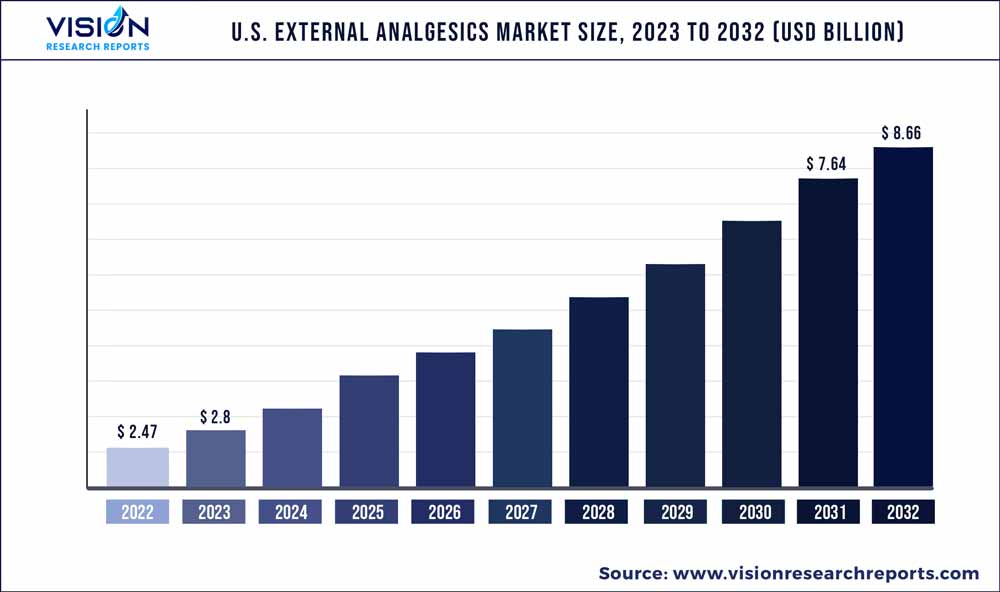

The U.S. external analgesics market size was estimated at around USD 2.47 billion in 2022 and it is projected to hit around USD 8.66 billion by 2032, growing at a CAGR of 13.37% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. External Analgesics Market

| Report Coverage | Details |

| Market Size in 2022 | USD 2.47 billion |

| Revenue Forecast by 2032 | USD 8.66 billion |

| Growth rate from 2023 to 2032 | CAGR of 13.37% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Baxter; Boston Scientific Corporation; Enovis; Medtronic; ICU Medical Inc.; Abbott; Stryker; Nevro Corp.; OMRON Healthcare, Inc. |

The market is driven by the increasing incidence of chronic & lifestyle diseases, leading to a higher demand for external analgesics. Investments from private and government organizations in pharmaceutical manufacturing and R&D activities for developing analgesic products are expected to influence market growth positively. The growing incidence of chronic disorders is main factor probable to contribute to the growth of the U.S. external analgesics market during the forecast period. The increasing incidence of lifestyle-related conditions such as obesity and diabetes has led to a higher need for muscle & nerve stimulators. For instance, as per Diabetes Research Institute Foundation (2022), diabetes affects a significant portion of the U.S. population. Approximately 37.3 million individuals, equivalent to 11.3% of the population, have diabetes. Around 28.7 million people, accounting for 28.5% of the population, have been diagnosed with the condition. The impact of diabetes is widespread and can be observed across various social, economic, and ethnic backgrounds. Patients tend to have diabetic neuropathy, making the disease one of the primary reasons for using electrical stimulators.

Further, the incidence of musculoskeletal disorders, such as arthritis, osteoarthritis, orthopedic degenerative disorders, and rheumatoid arthritis, is significantly increasing. This has augmented the prevalence of chronic pain among these individuals and the inability to perform routine tasks. For instance, according to Arthritis & Rheumatology, around 78 million adults are expected to be diagnosed with arthritis by 2040 in the U.S. This has fueled the demand for pain management stimulators to help manage chronic pain.

The demand for reduced hospital stays is increasing in the U.S. due to various factors shaping the healthcare industry. One significant driver is the growing emphasis on cost containment, which is compelling hospitals and healthcare providers to optimize resource utilization and reduce expenses. Prolonged hospital stays not only increase healthcare costs but also expose patients to a higher risk of complications and infections. Consequently, there is a growing focus on shifting certain treatments and services from inpatient to outpatient settings whenever possible.

The COVID-19 pandemic has had far-reaching effects on the management of chronic pain and the U.S. external analgesics market. The reduction of non-urgent procedures and the closure of specialty pain management centers disrupted patient care and increased home-based device usage which impacted the market. The shift toward telehealth and the increased demand for self-medication have influenced the choice of pain management methods, with medications gaining prominence over devices. Supply chain disruptions, e-commerce growth, and regulatory changes have also shaped the market landscape. As the world continues to navigate the pandemic, healthcare companies and regulatory bodies must adapt and innovate to meet the evolving needs of patients and consumers in the external analgesics industry.

Product Insights

Based on the product, the U.S. external analgesics market is segmented into hot/cold products, kinesiology tape, heating pads, TENS devices, and red light therapy products/infrared therapy products. The hot/cold products segment held the majority of the market share of 58% in the product segment in 2022. The segment is anticipated to witness remarkable growth during the forecast period. Growth of the segment can be attributed to its effectiveness in providing relief for a wide range of pain conditions.

The hot/cold product segment also has the advantage of being non-invasive and easy to use, making hot/cold products a convenient pain management solution for individuals seeking nonpharmacological approaches. With the growing demand for natural and self-directed pain management solutions, hot/cold products are expected to continue to dominate the U.S. external analgesics market.

On the other hand, kinesiology tape (KT) is anticipated to register the fastest growth rate of CAGR 13.33% over the forecast period. Further, kinesiology tape (KT) is a specialized adhesive tape that has gained significant popularity in the field of sports medicine and rehabilitation. KT is made from elastic cotton fabric with a wave-like acrylic adhesive, mimicking the properties of human skin. When applied correctly, it can enhance athletic performance, reduce pain, and aid in the recovery process.

Distribution Channel Insights

The distribution channel is segmented into retail/brick-and-mortar, e-commerce, and others. Retail/brick-and-mortar held the majority of the share of 72% in the distribution channel segment in 2022. Retail/brick-and-mortar stores continue to dominate the U.S. external analgesics market because consumers typically prefer to browse and purchase these products in stores physically.

The COVID-19 pandemic played an important role in increasing self-care adaptation and helped elevate drug store sales of external analgesics. Top-performing brands such as Salonpas, Bio freeze, and GlaxoSmithKline shifted from prescriptions to OTC in 2020, making it the top-selling brand.

However, with the increasing adoption of e-commerce and the growth of online sales, retailers are now exploring omnichannel strategies to enhance their reach and better cater to the evolving needs and preferences of consumers. E-commerce is expected to grow at the fastest CAGR of 14.83% during the forecast period.

U.S. External Analgesics Market Segmentations:

By Product

By Distribution Channel

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others