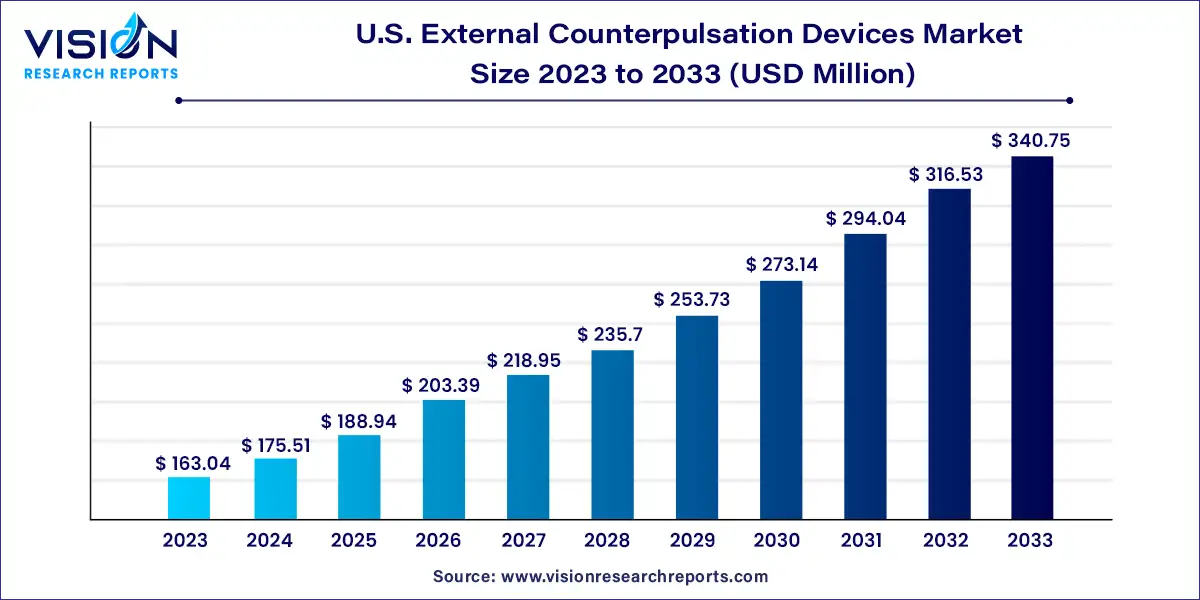

The U.S. external counterpulsation devices market size was estimated at USD 163.04 million in 2023 and it is expected to surpass around USD 340.75 million by 2033, poised to grow at a CAGR of 7.65% from 2024 to 2033.

External counterpulsation (ECP) devices have emerged as a promising non-invasive therapy for cardiovascular conditions, offering patients an alternative to traditional treatments like medications and invasive procedures. In the United States, the market for ECP devices has witnessed significant growth in recent years, driven by factors such as increasing prevalence of cardiovascular diseases, technological advancements, and growing preference for minimally invasive therapies.

The growth of the U.S. external counterpulsation devices market is propelled by an increasing prevalence of cardiovascular diseases, driven by factors such as sedentary lifestyles and aging population, creates a growing patient pool seeking effective treatment options. Secondly, the rising awareness among both patients and healthcare professionals about the benefits of external counterpulsation therapy contributes to higher adoption rates. Additionally, technological advancements in ECP devices, such as improved efficacy, portability, and user-friendly features, enhance their appeal and usability. Moreover, favorable reimbursement policies and government initiatives aimed at promoting cardiovascular health further stimulate market growth.

| Report Coverage | Details |

| Market Size in 2023 | USD 163.04 million |

| Revenue Forecast by 2033 | USD 340.75 million |

| Growth rate from 2024 to 2033 | CAGR of 7.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In 2023, the pneumatic ECP devices segment held a dominant the market with a share of 37%. These devices utilize air pressure to enhance blood flow to the heart. They have gained traction due to their proven effectiveness in reducing symptoms in angina and refractory angina pectoris patients. Their non-invasive nature and cost-effectiveness make them appealing to patients and healthcare providers, driving increased demand. The rising prevalence of cardiovascular diseases fuels the growth of the pneumatic ECP devices segment. In addition, ongoing technological advancements further contribute to its market expansion, making it a promising therapeutic option for cardiac patients.

The Enhanced External Counterpulsation (EECP) devices segment is expected to exhibit the highest CAGR during the forecast period. The growth is attributed to its demonstrated effectiveness in improving cardiac function and coronary circulation, making it a preferred choice for treating cardiovascular conditions. The non-invasive and safe nature of EECP therapy attracts patients seeking alternative treatments.

Moreover, continuous technological advancements and increasing clinical evidence position EECP Devices to meet the growing demand for effective non-invasive cardiovascular treatments. According to a study by the American College of Cardiology Foundation (published on February 14, 2023), long-term COVID-19 patients with and without coronary artery disease experienced significant improvement in symptoms after receiving 15–35 hours of EECP therapy.

Based on end-use, the U.S. ECP devices market is classified into hospitals and cardiac centers & clinics. The hospital segment dominated the market with a share of 37% in 2023Hospitals dominate the ECP devices market due to their larger patient volumes, specialized care for cardiovascular diseases, and access to advanced resources and technologies.

Moreover, with comprehensive treatment options provided by experienced medical professionals, hospitals are the preferred choice for patients seeking ECP therapy. The adoption of ECP therapy, particularly for managing congestive heart failure, exemplifies hospitals' dominance, supported by dedicated cardiology departments and intensive care units. As cardiovascular diseases continue to rise, the demand for ECP devices in hospitals is expected to reinforce their market dominance.

The cardiac center segment is anticipated to witness the highest CAGR of 8.54% during the forecast period. Cardiac centers are specialized healthcare facilities dedicated to the diagnosis and treatment of cardiovascular conditions. They often have advanced medical equipment, specialized staff, and expertise in managing cardiac diseases, including the implementation of ECP therapy.Additionally, as the awareness and recognition of ECP therapy's benefits continue to grow, cardiac centers are increasingly incorporating ECP devices into their treatment protocols. This trend is driven by the effectiveness of ECP therapy in managing various cardiovascular conditions, such as angina and heart failure.

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. External Counterpulsation Devices Market

5.1. COVID-19 Landscape: U.S. External Counterpulsation Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. External Counterpulsation Devices Market, By Product

8.1. U.S. External Counterpulsation Devices Market, by Product, 2024-2033

8.1.1. Pneumatic ECP Devices

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Electrocardiogram (ECG)-Synchronized ECP Devices

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Enhanced External Counterpulsation (EECP) Devices

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. External Counterpulsation Devices Market, By x`x

9.1. U.S. External Counterpulsation Devices Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cardiac Centers

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. External Counterpulsation Devices Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 11. Company Profiles

11.1. Vaso Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. ACS Diagnostics

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Scottcare Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Cardiomedics Inc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others