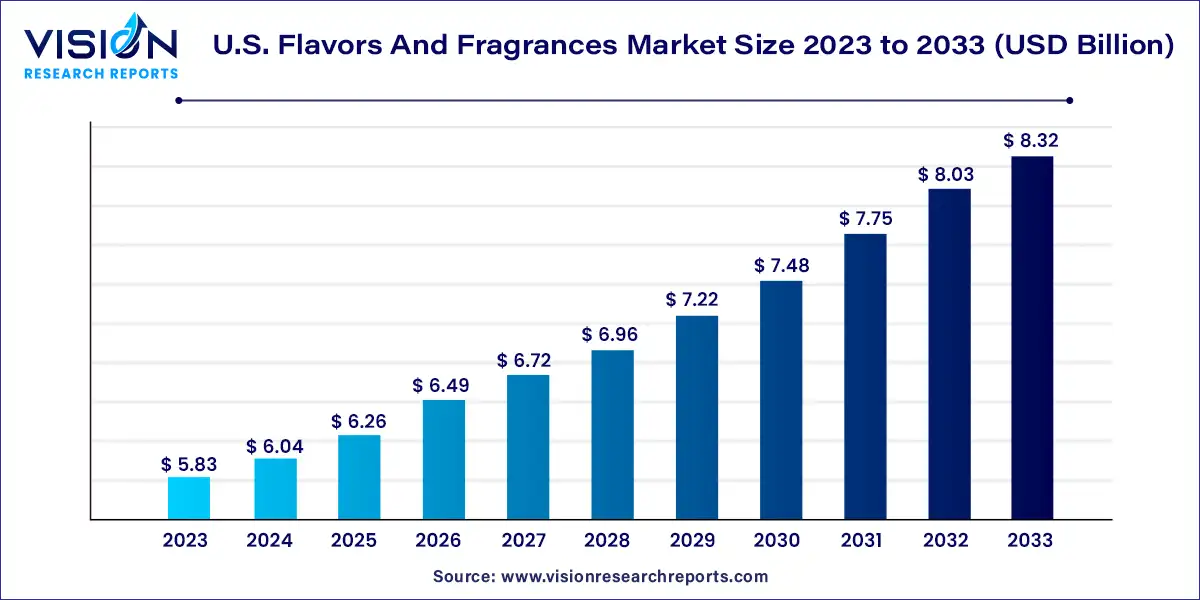

The U.S. flavors and fragrances market was estimated at USD 5.83 billion in 2023 and it is expected to surpass around USD 8.32 billion by 2033, poised to grow at a CAGR of 3.62% from 2024 to 2033.

The U.S. flavors and fragrances market represents a vibrant and dynamic industry at the intersection of consumer preferences, innovation, and technology. With a diverse array of applications spanning food and beverages, personal care products, household goods, and beyond, this market plays a pivotal role in enhancing sensory experiences and driving consumer satisfaction.

The growth of the U.S. flavors and fragrances market can be attributed to several key factors. Firstly, changing consumer preferences towards natural and sustainable ingredients have fueled demand for products that offer authentic sensory experiences. Additionally, the increasing disposable income and evolving lifestyles of consumers have led to a greater willingness to invest in premium flavors and fragrances across various applications. Furthermore, advancements in technology and research have enabled manufacturers to innovate and introduce novel formulations that meet the demands of modern consumers. Moreover, the rise of e-commerce platforms and digital marketing strategies have expanded market reach and accessibility, facilitating easier product discovery and purchase. Overall, these growth factors underscore the resilience and dynamism of the U.S. flavors and fragrances market as it continues to evolve and thrive in response to shifting consumer trends and market dynamics.

In 2023, fragrances dominated the market with a commanding revenue share of 53%, and they are poised to maintain their lead with the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This surge in the fragrance segment is primarily propelled by the robust disposable income in the U.S., fueling a heightened demand for luxurious fragrances across cosmetics, toiletries, and perfumes. Moreover, manufacturers venturing into natural fragrance development often apply a "green premium" to their products, further stimulating growth. Additionally, the bustling lifestyle in the U.S. is expected to spur the proliferation of retail outlets specializing in ready-to-eat meals. Furthermore, companies in the feed and feed additive sector, such as Kemin Industries, Inc. and Bentoli, LLC, are intensifying efforts to provide palatability solutions aimed at boosting feed intake. This, in turn, is anticipated to escalate the demand for flavors in animal feed applications.

Conversely, the flavors segment is poised for significant growth with a notable CAGR from 2024 to 2033, largely attributed to the increasing utilization of flavors in dietary supplements. The prevailing health and wellness trend within the market is expected to further elevate the preference for natural flavor ingredients. The food and beverage industry, offering vast potential, is witnessing a surge in demand for ready-to-eat meals, processed food, snacks, juices, and other beverages. This surge in demand for food and beverages is anticipated to drive flavor demand over the forecast period.

In 2023, the natural segment commanded the largest revenue share, accounting for 77% of the market, and it is anticipated to sustain this lead with the fastest Compound Annual Growth Rate (CAGR) during the forecast period. The escalating demand for natural essential oils in the cosmetics and skincare sectors is poised to drive market growth over the forecast duration. Furthermore, the increasing consumer preference for natural and organic products is expected to further boost the demand for essential oils across various end-use industries.

Additionally, the aroma chemicals segment is projected to witness significant expansion at a prominent CAGR from 2024 to 2033. Aroma chemicals play a pivotal role in the production of food flavors and fragrances, encompassing esters, alcohols, aldehydes, phenols, and other chemical compounds. This segment is anticipated to experience substantial growth in the coming years, driven by increased utilization in pharmaceuticals, wineries, and perfumeries.

By Product

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others