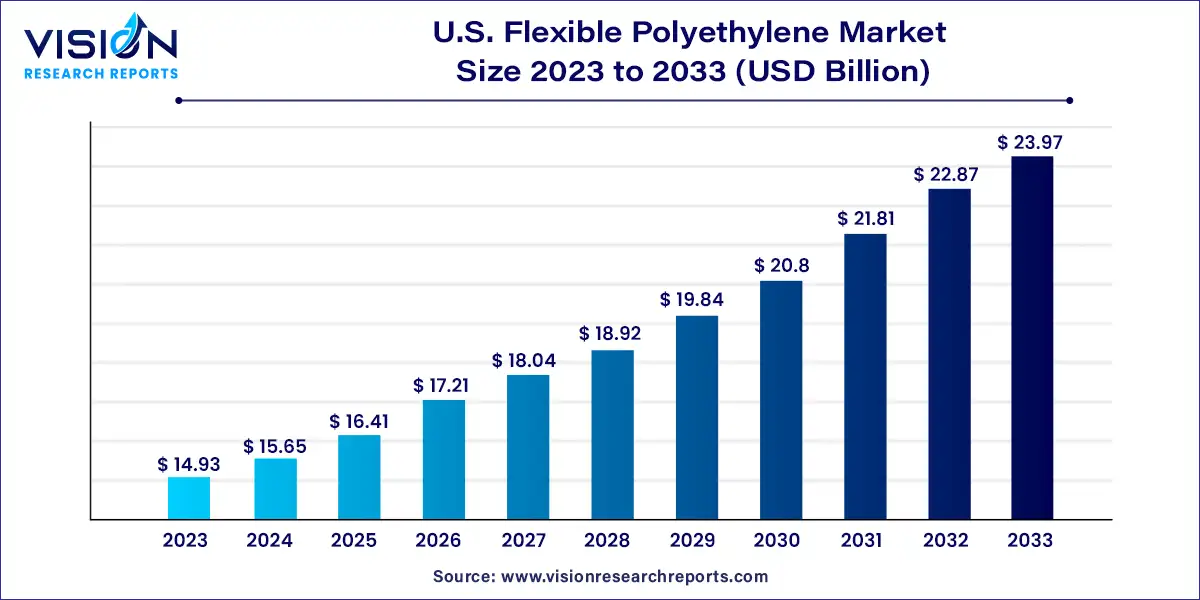

The U.S. flexible polyethylene market size was surpassed at USD 14.93 billion in 2023 and is expected to hit around USD 23.97 billion by 2033, growing at a CAGR of 4.85% from 2024 to 2033.

The U.S. flexible polyethylene market is a dynamic sector within the plastics industry, characterized by its versatility, durability, and widespread applications across various sectors. As a key player in the global polyethylene market, the United States boasts a robust infrastructure, technological advancements, and a thriving manufacturing ecosystem, driving growth and innovation in the flexible polyethylene segment.

The growth of the U.S. flexible polyethylene market is propelled by the burgeoning demand for flexible packaging solutions across industries, spurred by changing consumer preferences and sustainability imperatives, drives market expansion. Additionally, the robust performance of the construction sector, fueled by infrastructure development and urbanization trends, contributes to increased adoption of flexible polyethylene materials in applications such as vapor barriers and insulation. Moreover, the agriculture and horticulture sectors rely on polyethylene films and sheets for crop protection and greenhouse cultivation, further boosting market growth. Despite challenges such as fluctuating raw material prices and environmental concerns, ongoing innovations in polymer technologies and sustainable practices are expected to sustain the upward trajectory of the U.S. flexible polyethylene market.

| Report Coverage | Details |

| Market Size in 2023 | USD 14.93 billion |

| Revenue Forecast by 2033 | USD 23.97 billion |

| Growth rate from 2024 to 2033 | CAGR of 4.85% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The bags & pouches product segment dominated the U.S. flexible PE market with more than 34% of the revenue share in 2023. This is attributed to their widespread applications and convenience in various industries. These flexible PE products offer versatile packaging solutions, meeting the diverse needs of consumers and businesses alike. From grocery shopping to industrial packaging, bags & pouches provide a lightweight, durable, and cost-effective option for containing and protecting a wide range of goods.

Their popularity in the retail sector, especially in the food and beverage industry, owes to their ability to maintain freshness, prevent spillage, and ensure easy handling for customers. Additionally, bags & pouches' adaptability in industrial applications, such as for chemical or pharmaceutical products, further cements their dominant position in the U.S. market, reflecting their integral role in modern packaging solutions.

The economic advantages of Bags & Pouches have significantly contributed to their market penetration. These packaging solutions often prove to be more cost-effective than traditional alternatives, both in terms of production and transportation costs. Their lightweight construction minimizes shipping expenses while also reducing the carbon footprint, aligning with evolving sustainability concerns. As businesses seek efficient and budget-friendly packaging options, Bags & Pouches emerge as a logical choice.

Moreover, continuous innovation and technological advancements in materials and manufacturing techniques have further propelled the growth of Bags & Pouches. With the development of eco-friendly materials, improved sealants, and customized printing options, these packaging solutions have become increasingly attractive for branding and consumer engagement. Additionally, the convenience offered by resealable and easy-to-carry pouches resonates with modern lifestyles, adding to their appeal among consumers.

Flexible High-Density Polyethylene (HDPE) grade type dominated the U.S. flexible polyethylene (PE) market with a revenue share of over 40% in 2023. The market is experiencing significant growth, influenced by several driving factors, particularly among the different grades, including flexible HDPE, flexible LDPE, and flexible LLDPE. The primary factor driving the market's expansion is the increasing demand for sustainable and eco-friendly packaging solutions across various industries.

The Flexible HDPE segment is witnessing growth due to its excellent strength and barrier properties, making it an ideal choice for packaging applications in industries such as food and beverage, retail, and e-commerce. On the other hand, flexible Low-Density Polyethylene (LDPE) is finding widespread use in industries like healthcare and pharmaceuticals, where its flexibility and ease of sealing are crucial for medical packaging and other specialized applications. Flexible Linear Low-Density Polyethylene (LLDPE) is also driving growth in the market due to its enhanced puncture resistance and flexibility, making it suitable for use in heavy-duty bags and industrial liners.

Moreover, the shift in consumer preferences toward sustainable and recyclable materials has significantly influenced the market's growth. The growing awareness of environmental concerns has prompted industries to opt for more eco-friendly packaging solutions, which has boosted the adoption of flexible PE grades. Additionally, advancements in manufacturing technologies have improved the production process and the quality of flexible PE products, making them more cost-effective and accessible for businesses across various sectors.

As a result, companies are actively adopting flexible PE materials to meet the demands of environmentally-conscious consumers and align their practices with sustainable business models. This combination of increasing demand, technological advancements, and a focus on sustainability is driving the growth of the U.S. flexible PE market.

The dominance of the food & beverage end-use industry in the U.S. flexible polyethylene (PE) market in 2023, with over 32% of the revenue share, is primarily fueled by the high demand for PE packaging in preserving and conveniently delivering food and beverage products, catering to consumer preferences for sustainable, cost-effective, and innovative packaging solutions, while also aligning with the growth of e-commerce and regulatory compliance requirements.

The janitorial/sanitary industry has embraced flexible PE products for various purposes, such as trash bags and liners, catering to the growing need for waste management solutions. In the building & construction sector, flexible PE liners and covers have become essential components for waterproofing, insulation, and protective applications. The automotive industry has also witnessed growth, utilizing flexible PE materials for automotive parts, interior trim, and protective coatings, taking advantage of its durability and low cost

Additionally, the electrical & electronics industry has adopted flexible PE as a valuable material for wire and cable insulation, ensuring safety and efficiency in electrical applications. The increasing demand from these diverse end-use industries, coupled with continuous advancements in manufacturing technologies, is driving the growth of the U.S. flexible PE market, making it a versatile and sought-after material across various industries.

By Grade

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Grade Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Flexible Polyethylene Market

5.1. COVID-19 Landscape: U.S. Flexible Polyethylene Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Flexible Polyethylene Market, By Grade

8.1. U.S. Flexible Polyethylene Market, by Grade, 2024-2033

8.1.1 Flexible HDPE

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Flexible LDPE

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Flexible LLDPE

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Flexible Polyethylene Market, By Product

9.1. U.S. Flexible Polyethylene Market, by Product, 2024-2033

9.1.1. Films

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Liners

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Bags & Pouches

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Covers

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Flexible Polyethylene Market, By End-use

10.1. U.S. Flexible Polyethylene Market, by End-use, 2024-2033

10.1.1. Food & Beverage

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Healthcare/Medical

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Janitorial/Sanitary

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Building & Construction

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Automotive

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Electrical & Electronics

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Flexible Polyethylene Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Grade (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Dow Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. ExxonMobil Chemical.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Chevron Phillips Chemical Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. LyondellBasell Industries.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Formosa Plastics Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. NOVA Chemicals

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Westlake Chemical Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Pinnacle Polymers LLC

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. INEOS Olefins & Polymers USA.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Sasol North America Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others