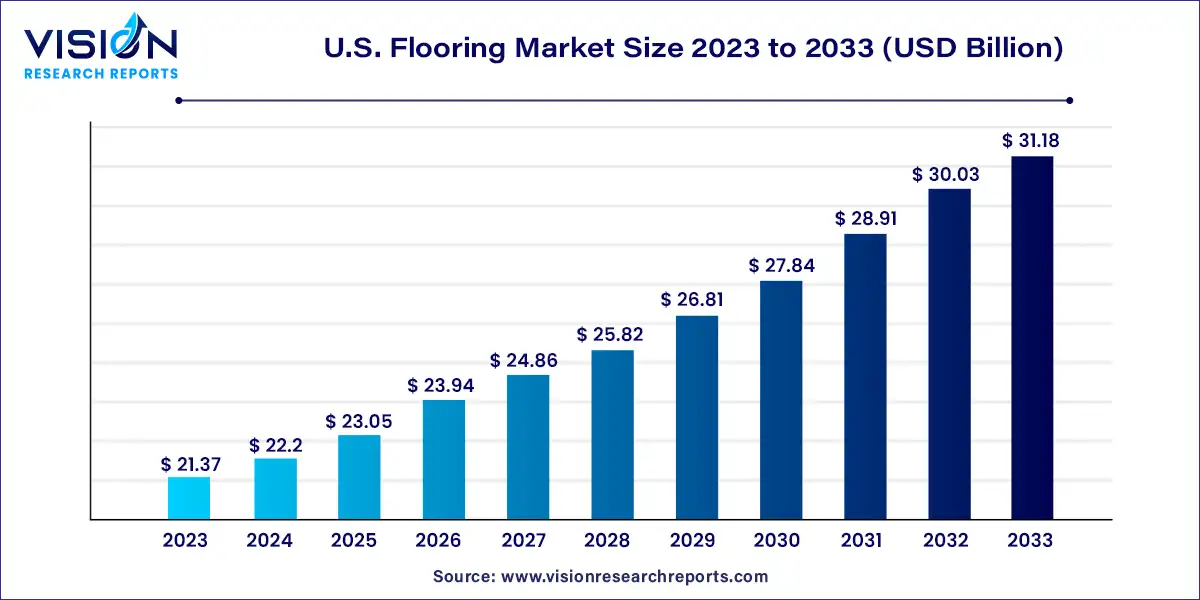

The U.S. flooring market was valued at USD 21.37 billion in 2023 and it is predicted to surpass around USD 31.18 billion by 2033 with a CAGR of 3.85% from 2024 to 2033.

The U.S. flooring market is characterized by robust growth driven by the sustained momentum in residential and commercial construction activities, coupled with the resurgence of renovation projects, fuels demand for flooring materials. Additionally, changing consumer lifestyles, preferences for aesthetically pleasing and durable flooring solutions, and evolving interior design trends contribute to market expansion.

| Report Coverage | Details |

| Market Size in 2023 | USD 21.37 billion |

| Revenue Forecast by 2033 | USD 31.18 billion |

| Growth rate from 2024 to 2033 | CAGR of 3.85% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The growth of the market in the country can be attributed to the surging demand for highly durable and aesthetically appealing flooring such as ceramic tiles, wood, and carpets that also offer insulation benefits. Moreover, the rising expenditure on renovating and remodeling old housing structures in the U.S. is expected to have a significant impact on the growth of the flooring market in the country in the coming years. The growing consumer demand for innovative buildings equipped with modern technologies and improved aesthetic appeal and energy efficiency is expected to drive the consumption of wood, ceramic, and carpet flooring in residential establishments over the forecast period. Moreover, there is growth in the construction of green buildings in the country owing to the rising awareness about the benefits of energy-efficient buildings that have improved indoor air quality. This is projected to drive sustainable construction activities, positively impacting the demand for wood flooring in the country owing to their low volatile organic compound (VOC) emissions.

The market has also seen continuous technological advancements in terms of raw materials and production processes for various flooring types, such as engineered wood and resilient floorings, including vinyl, linoleum, and luxury vinyl tiles. Because of this, manufacturers have been able to create realistic tiles that mimic the appearance of other flooring materials like stone and wood. Additionally, producers offer specialized goods with ornamental and distinctive features that are not available in other kinds of flooring.

The rising need for privacy and comfort owing to surroundings which are noisier has increased the need for insulation across the flooring market. A well-insulated floor helps in creating an improved environment and helps keep feet warm during winters. Different floors require different insulation solutions. Ventilated floors act as a facade below the buildings, whereas intermediate floors are well-insulated against the noise between floors. These factors have resulted in the growing demand for insulation and impacted the market positively.

However, manufacturing and installation of floorings have a negative environmental impact, which is expected to hamper the growth of the market in the U.S. The installation of new flooring often emits Volatile Organic Compounds (VOCs) containing carcinogens such as benzene and formaldehyde, which may take years to dissipate. This has led to the implementation of strict environmental regulations and policies over use of flooring materials. These regulations are expected to restrict or hinder the market growth over the coming years.

The players operating in the U.S. flooring industry sell their products through direct or indirect distribution channels. Direct channels enable companies to sell their products directly to customers through their sales representatives across the country. These manufacturers are forward integrated in the value chain, in that, they produce flooring and directly sell them to end users. A number of manufacturers utilize online platforms such as websites to showcase their products to a wide customer base and eliminate the involvement of middlemen or distributors. This helps them save cost and improve their market share and profit margins.

Carpet dominated the product segment with a revenue share of 42% in 2023. Carpets are manufactured with synthetic and natural fibers such as wool, nylon, acrylic, polyester, and polypropylene. Synthetic fibers account for over 90% of all materials used for developing carpets, with nylon holding a share of 50% and above of the total raw materials share. The increased use of nylon results in the production of carpets with superior color quality that are resistant to heat, stains, and soil.

Carpets are primarily of three types-woven, tufted, and knotted. They absorb sound and are non-slippery, as well as provide warmth, owing to their cushioned surfaces. Carpets are among the most affordable flooring products in the U.S. They are increasingly used in commercial and residential establishments such as hotels, retail stores, and private homes in the country.

Vitrified (Porcelain) tiles are expected to witness growth at a fastest CAGR of 5.85% over the forecast period. Porcelain tiles are developed from fine, dense clay. They are fired at extreme temperatures to make them highly durable. These tiles are heavy and hard-like stones; however, they are free from pores that make them highly resistant to moisture. Moreover, mold and bacteria resistance offered by impervious porcelain tiles leads to their long-term value for use in flooring applications. In addition, these tiles are free from fading and are easy to maintain.

Due to their increased vinyl composition, luxury vinyl tiles (LVTs) are more robust, flexible, and sturdy. Available in plank, tile, and sheet styles, they are adaptable and high-performance flooring solutions. Kitchens and other high-traffic areas are ideal places to utilize vinyl tiles since it is a non-porous, waterproof material. Furthermore, luxury vinyl tiles require minimal maintenance and are easy to clean. The aforementioned benefits of LVTs are projected to drive the segment growth over the forecast period.

The residential end-use segment dominated the market with the revenue share of 53% in 2023. The growing number of domestic and international immigrants and the ongoing urbanization are expected to drive the demand for residential buildings in the U.S. in the coming years. This is anticipated to lead to increased construction of residential buildings in the country, thereby resulting in a risen demand for flooring used in these buildings over the forecast period. Additionally, the surging number of single-family houses in the U.S., owing to the high disposable income of consumers is further projected to drive the demand for flooring in residential buildings.

Residential segment of the market includes residential buildings, apartments, complexes, single-family houses, multi-story residential buildings, rental housing properties, and small houses. The growing employment rate and the rising income level of the masses, along with the easy availability of finances for the public in general in the U.S., are further surging the demand for residential buildings in the country.

Non-residential end use segment is anticipated to grow at a fastest CAGR of 3.36% over the period of 2024-2033. Non-residential establishments in the U.S. are subject to the high-traffic influx and, therefore, require durable and resilient flooring made from wood and other materials. These establishments include commercial buildings such as offices, convenience stores, shopping malls, and retail stores. Commercial buildings are often maintained as high-security zones in the country and local authorities usually implement stringent regulations around them to maintain safety.

In non-residential facilities such as child care, old age, and hospitals are included. The selection of floorings for child care facilities depends upon various factors such as safety, durability, easy maintenance, resistance to water/moisture, and sound absorption. The flooring material should have the ability to withstand rough play and, at the same time, offers comfort to the kids. Additionally, floorings that are easy to clean and sanitize are opted for child care facilities as kids tend to stain floors easily. Furthermore, to engage children, the floorings with a wide variety of colors and designs are anticipated to gain high preference in child care facilities.

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Flooring Market

5.1. COVID-19 Landscape: U.S. Flooring Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Flooring Market, By Product

8.1. U.S. Flooring Market, by Product, 2024-2033

8.1.1. Ceramic Tiles

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Vitrified (Porcelain) Tiles

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Carpet

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Vinyl

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Luxury Vinyl Tiles (LVT)

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Linoleum/Rubber

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Wood & Laminate

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Natural Stone

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Others

8.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Flooring Market, By End-use

9.1. U.S. Flooring Market, by End-use, 2024-2033

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Non-Residential

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Flooring Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Mohawk Industries Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Tarkett

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Forbo Flooring North America

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Interface Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. EGGER Group

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. LG Hausys Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Shaw Industries Group Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Mannington Mills Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Armstrong Flooring

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Gerflor

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others