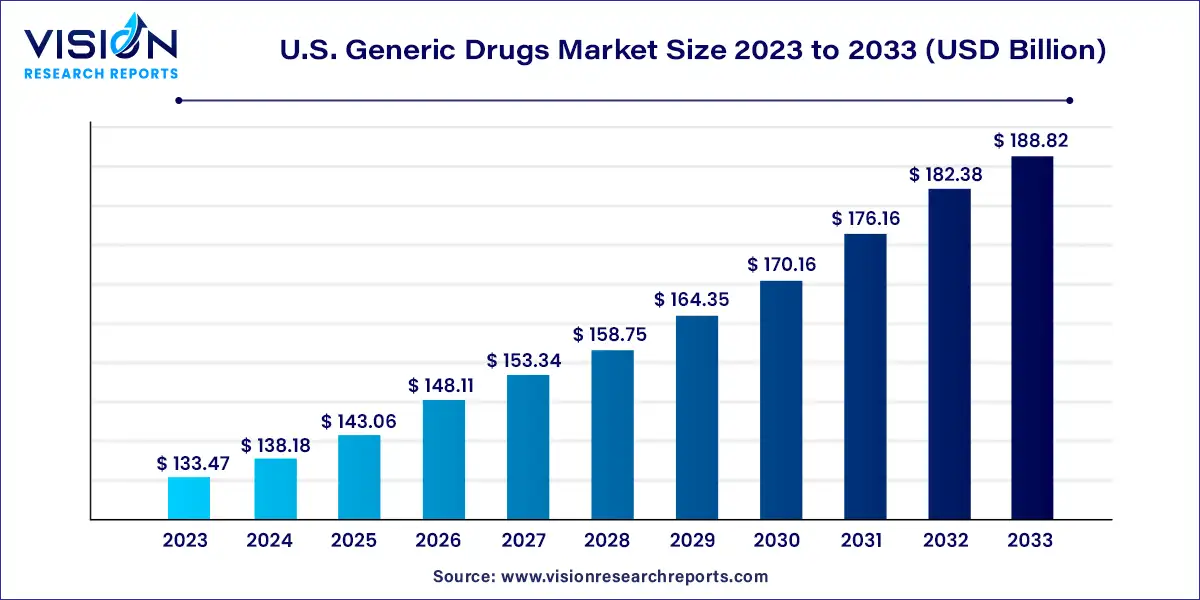

The U.S. generic drugs market size was estimated at around USD 133.47 billion in 2023 and it is projected to hit around USD 188.82 billion by 2033, growing at a CAGR of 3.53% from 2024 to 2033.

The U.S. generic drugs market stands as a cornerstone of the nation's healthcare system, playing a pivotal role in enhancing accessibility and affordability of pharmaceuticals. Generic drugs serve as cost-effective alternatives to brand-name medications, offering comparable efficacy and safety profiles at lower prices. Their widespread availability empowers patients to manage chronic conditions, mitigate healthcare expenses, and improve medication adherence. Moreover, the utilization of generic drugs fosters competition within the pharmaceutical landscape, catalyzing innovation and driving down overall healthcare expenditures.

The growth of the U.S. generic drugs market is propelled by an expiration of patents for branded medications creates opportunities for generic equivalents to enter the market, driving competition and expanding consumer choice. Additionally, supportive government policies and initiatives, such as the Hatch-Waxman Act, incentivize the development and approval of generic drugs, fostering market growth. Moreover, the rising prevalence of chronic diseases and the increasing burden of healthcare costs underscore the importance of affordable pharmaceutical options, further fueling demand for generic medications.

Based on brand, pure generic drugs are distinct from branded generics. They necessitate less time for research and development and undergo fewer clinical trials for approval compared to branded generics.

In 2023, the pure generic drugs segment comprised over 53% of the market. This category demands greater financial investment for research and development and undergoes numerous animal and human trials for approval, resulting in a lengthier approval process by the FDA.

For generic medicines and vaccines, oral formulations dominate the global market, constituting approximately 90% of all pharmaceutical formulations intended for human consumption. Of the top-selling medications, about 84% are administered orally. The World Health Organization reports annual occurrences of 2 to 3 million cases of non-melanoma skin cancer and 132,000 cases of melanoma skin cancer. Given that topical drug administration is the primary treatment method for most skin conditions, the market for advanced topical products is anticipated to experience significant growth in the coming years.

The elderly population is increasing, and modern-day diseases affect people of all ages due to high workloads and unhealthy lifestyles. Physical inactivity contributes to both physical and mental health issues, leading to a rise in various diseases. Conditions such as cardiovascular diseases, central nervous system (CNS) disorders, dermatological issues, and oncology and respiratory diseases are becoming more prevalent. According to the American Heart Association, there were approximately 874,613 cardiac deaths in the United States in 2019.

Furthermore, nearly 15% of middle-aged and older adults in the U.S. suffer from lung disorders such as chronic obstructive pulmonary disease (COPD) and asthma. The cardiovascular therapeutic application segment dominated the market in 2020, while the oncology segment is expected to grow rapidly in the foreseeable future.

Generic drugs are available for purchase in hospitals, pharmacies, and online pharmacies. Retail pharmacies have traditionally held a prominent position in the distribution channel segment, as people preferred to buy their medications from physical retail outlets. However, the trend is shifting towards online distribution channels, as more people now prefer the convenience of online shopping. Consequently, online pharmacies are expected to experience the fastest growth in the forecast period.

By Drug Type

By Brand

By Route of Administration

By Therapeutic Application

By Distribution Channels

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Generic Drugs Market

5.1. COVID-19 Landscape: U.S. Generic Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Generic Drugs Market, By Drug Type

8.1. U.S. Generic Drugs Market, by Drug Type, 2024-2033

8.1.1. Simple Generics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Super Generics

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Generic Drugs Market, By Brand

9.1. U.S. Generic Drugs Market, by Brand, 2024-2033

9.1.1. Pure Generic Drugs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Branded Generic Drugs

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Generic Drugs Market, By Route of Administration

10.1. U.S. Generic Drugs Market, by Route of Administration, 2024-2033

10.1.1. Oral

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Injection

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cutaneous

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Generic Drugs Market, By Therapeutic Application

11.1. U.S. Generic Drugs Market, by Therapeutic Application, 2024-2033

11.1.1. Central Nervous System (CNS)

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Cardiovascular

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Infectious Diseases

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Musculoskeletal Diseases

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Respiratory

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Oncology

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Generic Drugs Market, By Distribution Channels

12.1. U.S. Generic Drugs Market, by Distribution Channels, 2024-2033

12.1.1. Retail Pharmacy

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Hospital Pharmacy

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Online and Others

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Generic Drugs Market, Regional Estimates and Trend Forecast

13.1. U.S.

13.1.1. Market Revenue and Forecast, by Drug Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Brand (2021-2033)

13.1.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

13.1.4. Market Revenue and Forecast, by Therapeutic Application (2021-2033)

13.1.5. Market Revenue and Forecast, by Distribution Channels (2021-2033)

Chapter 14. Company Profiles

14.1. Pfizer Inc

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Teva Pharmaceuticals USA, Inc

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Aurobindo Pharma USA, Inc

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Sun pharma Inc

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Abbott Laboratories Inc

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Lupin Pharmaceuticals, Inc

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Mylan

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Dr. Reddy’s

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Novartis

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Eli Lilly company

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others