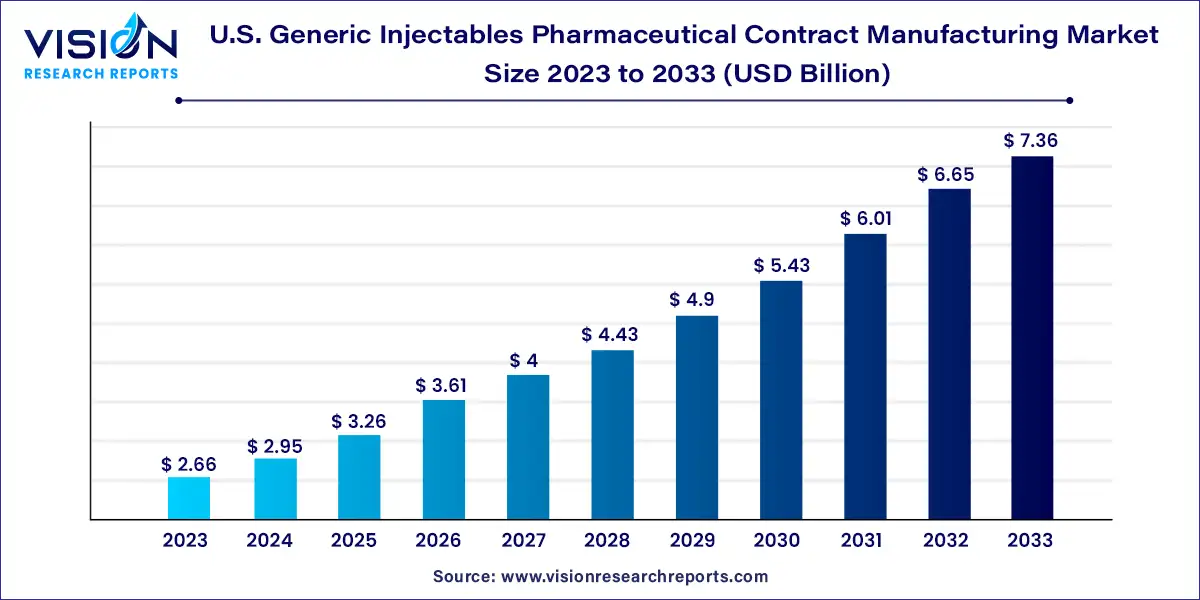

The U.S. generic injectables pharmaceutical contract manufacturing market was surpassed at USD 2.66 billion in 2023 and is expected to hit around USD 7.36 billion by 2033, growing at a CAGR of 10.72% from 2024 to 2033.

The U.S. Generic Injectables Pharmaceutical Contract Manufacturing Market represents a pivotal segment within the broader pharmaceutical industry, marked by its dynamic growth, evolving regulatory landscape, and strategic significance in the provision of affordable healthcare solutions.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.66 billion |

| Revenue Forecast by 2033 | USD 7.36 billion |

| Growth rate from 2024 to 2033 | CAGR of 10.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Expanding Healthcare Needs

Pharmaceutical Supply Chain Resilience:

The large molecule segment held the largest revenue share of 63% in 2023. large molecules, often referred to as biologics, are a distinct category of injectable pharmaceuticals. These molecules are considerably larger and more complex than small molecules, comprising proteins, peptides, and monoclonal antibodies. Large molecule injectables have gained prominence in recent years, particularly in the field of biopharmaceuticals and biosimilars. Their manufacturing requires specialized facilities and expertise due to the intricacies involved in bioprocessing and cell culture techniques. As such, contract manufacturing of large molecule injectables, while growing, is limited to CMOs with the necessary capabilities and infrastructure.

The small molecule segment is expected to expand at a remarkable CAGR of 10.55% during the forecast period. Small molecules are typically characterized by their low molecular weight and are chemically synthesized. They constitute a significant portion of the generic injectables market, offering a broad spectrum of therapeutic options. The production of small molecule generic injectables involves well-established manufacturing processes and technologies, making them more accessible for contract manufacturing organizations (CMOs) to handle.

The oncology segment has held a maximum revenue share of 30% in 2023 in the U.S. generic injectables pharmaceutical contract manufacturing market. Oncology, a key domain within the generic injectables market, focuses on the diagnosis and treatment of cancer. The production of injectable oncology medications requires precise formulations and sterile manufacturing processes. Contract manufacturing organizations (CMOs) play a vital role in producing generic injectable oncology drugs, offering pharmaceutical companies the capacity and expertise needed to meet the increasing demand for these life-saving treatments. The dynamic nature of cancer research and treatment advancements necessitates flexible and responsive contract manufacturing solutions.

For instance, from 2007 to 2020, the U.S. Food and Drug Administration (FDA) approved 16 oncology biosimilars.

The neurology segment is expected to register the fastest CAGR of 11.38% during the forecast period. Injectable pharmaceuticals are pivotal in addressing a range of neurological disorders and conditions. From pain management to the treatment of neurodegenerative diseases like multiple sclerosis and Parkinson's disease, neurology represents a diverse and vital sector of the generic injectables market. Contract manufacturers specializing in neurology-related injectables contribute to the production of essential therapies, ensuring that patients receive consistent and reliable treatments. The intricacies of neurological disorders require stringent quality control and adherence to regulatory standards, making contract manufacturing expertise in this area particularly valuable.

For instance, in April 2023, Teva Pharmaceuticals and MedinCell announced that the U.S. FDA had granted approval for UZEDY (risperidone) extended-release injectable suspension for treating schizophrenia in adults.

By Molecule Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Generic Injectables Pharmaceutical Contract Manufacturing Market

5.1. COVID-19 Landscape: U.S. Generic Injectables Pharmaceutical Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Generic Injectables Pharmaceutical Contract Manufacturing Market, By Molecule Type

8.1. U.S. Generic Injectables Pharmaceutical Contract Manufacturing Market, by Molecule Type, 2024-2033

8.1.1. Small Molecule

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Large Molecule

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Generic Injectables Pharmaceutical Contract Manufacturing Market, By Application

9.1. U.S. Generic Injectables Pharmaceutical Contract Manufacturing Market, by Application, 2024-2033

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Immunology

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Antidiabetic

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Neurology

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Cardiovascular

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Respiratory

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Generic Injectables Pharmaceutical Contract Manufacturing Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Molecule Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Hikma Pharmaceuticals plc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Pfizer Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Fresenius Kabi

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sandoz AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Jubilant Pharma Limited

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Baxter

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. PCI Pharma Services

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Gland Pharma Limited (USA)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Dr. Reddy’s Laboratories Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Grand River Aseptic Manufacturing

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others