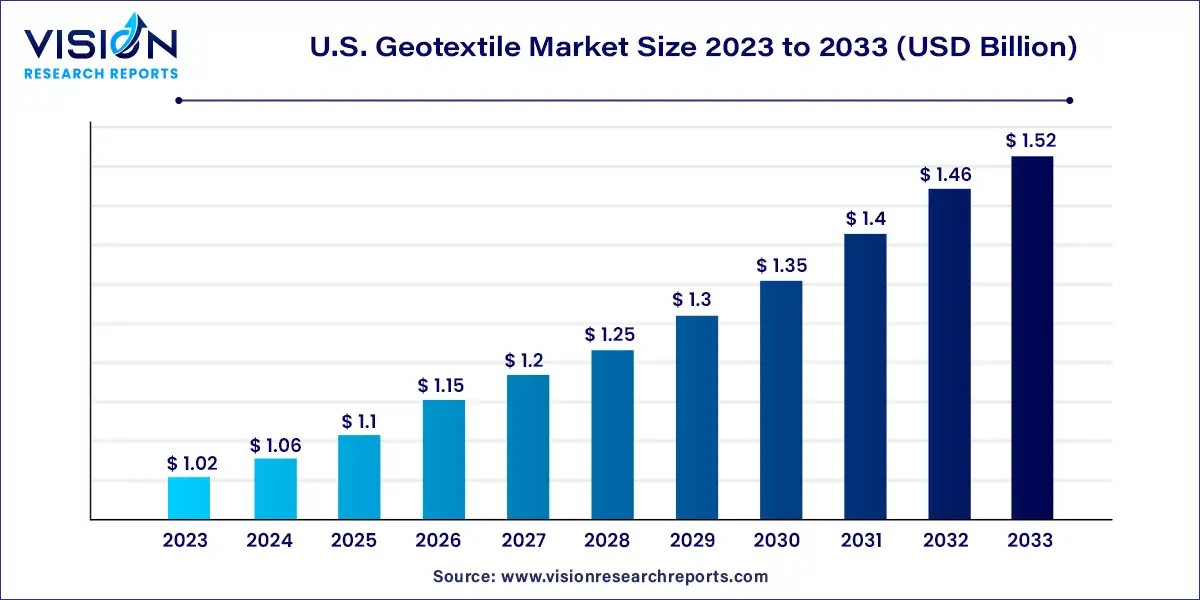

The U.S. geotextile market size was estimated at around USD 1.02 billion in 2023 and it is projected to hit around USD 1.52 billion by 2033, growing at a CAGR of 4.07% from 2024 to 2033.

The U.S. geotextile market stands as a crucial segment within the broader landscape of geosynthetic materials. Geotextiles, woven or non-woven fabrics, serve multifaceted roles in civil engineering, environmental conservation, and various infrastructure projects.

The growth of the U.S. geotextile market is driven by an increasing investment in infrastructure projects, particularly in transportation and road construction, are fueling the demand for geotextiles. These materials play a vital role in enhancing the durability and performance of infrastructure while providing cost-effective solutions for various engineering challenges. Additionally, stringent regulations aimed at environmental protection and erosion control are driving the adoption of geotextiles in a wide range of applications. Their versatility and effectiveness in mitigating soil erosion, improving drainage, and stabilizing slopes make them indispensable in sustainable construction practices.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.02 billion |

| Revenue Forecast by 2033 | USD 1.52 billion |

| Growth rate from 2024 to 2033 | CAGR of 4.07% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Synthetic geotextiles accounted for the largest share in terms of revenue with 93% in 2023. The major synthetic polymers used for production are polypropylene, polyester, polyethylene, and polyamide. Polypropylene and polyester-based geotextiles are the most commonly used synthetic polymers for technical applications such as drainage systems, lining systems, asphalt overlays, and slit fences.

Key manufacturers of synthetic geotextiles include Fibertex Nonwovens A/S, TenCate Geosynthetics, TYPAR, Cell-Tek Geosynthetics, LLC, and HUESKER International. Cell-Tek Geosynthetics, LLC specializes in spunbonded nonwoven continuous filament polypropylene geotextiles, which are highly durable, strong, and weatherproof for drainage and separation applications.

The natural geotextile was the fastest growing segment in terms of revenue and is expected to grow at a CAGR of 4.74% over the forecast period. Natural fibers include materials derived from natural sources including jute, coir, and sisal. The increasing focus on the sustainability of products used by manufacturers and end users has led to an increase in demand for natural fiber-based geotextiles. The increasing demand for organic substances is also expected to boost market growth.

Man-made or synthetic geotextiles are based on petrochemical derivatives, which can harm the environment in many ways. Moreover, the depletion of natural resources has led to a rise in the prices of raw materials, making them expensive for end users. Therefore, the need for eco-friendly, renewable, and economically viable products is expected to increase consumers’ inclination to use natural geotextiles.

Non-woven geotextiles were the largest and fastest growing in the U.S. geotextile industry, in terms of revenue. This can be attributed to their unique properties such as absorbency, liquid repellency, and mechanical strength. In addition, the rising demand for non-woven geotextiles in the transport & infrastructure industry, on account of their high tensile strength and low cost, is expected to drive the demand for the product.

Woven geotextiles offer the interlocking of fabric strips to provide high modulus and stability. The material is cheap, has great strength, and is inexpensive, which is predicted to grow the market. Furthermore, woven geotextile materials can endure high tension, and their impermeable nature makes them excellent for reinforcement and separation. Polyethylene is used to make the bulk of woven geotextiles in the form of slit film, extruded tape, monofilament, and multifilament.

The primary application of woven geotextile is in the construction of roads and parking lots, which is expected to boost the woven geotextile market owing to its high load capacity. It has a high strength-to-weight ratio, which is helpful for protection against UV rays, mildew, soil chemicals, and insects. The slit-film woven geotextiles are efficient separators and provide speed erection for road construction projects and embankment projects owing to their increased life of paved and unpaved areas.

Separation & stabilization dominated the market, with 30% in terms of revenue, contributing to a major share of the total market in 2023. Geotextiles separate fine subgrade soil from the base material and add strength to the material. The product is used as a part of the foundation for laying roads to strengthen weak soil by holding it together and increasing the lifespan of the roads. These factors help end users reduce maintenance costs and enhance the performance of unpaved and paved surfaces.

The market for geotextiles in erosion control applications is predicted to increase significantly over the forecast period as it minimizes soil erosion caused by running water, waves, wind, moving ice, and other bank erosion forces. They are most often utilized to strengthen retaining walls, dams, and embankments on soft soils.

Geotextiles are used for reinforcement in a variety of applications, including dams, retaining walls, highways, and embankments over soft soils. When utilized as reinforcement or to improve soil stability, geotextile can greatly strengthen the earth's surface. When placed on sand, for example, it evenly distributes the load to prevent deformations. In addition, robust woven geotextiles can lessen the amount of fill needed for embankments and strengthen brittle subgrade soils.

Geotextiles are commonly employed in drainage systems. They have benefits over traditional soil filtration systems because they can act as a constant filter, require less excavation, have a more negligible impact on the environment, are easier to build, are of superior quality, and need significantly less material.

By Material

By Product

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Material Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Geotextile Market

5.1. COVID-19 Landscape: U.S. Geotextile Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Geotextile Market, By Material

8.1. U.S. Geotextile Market, by Material, 2024-2033

8.1.1 Natural

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Geotextile Market, By Product

9.1. U.S. Geotextile Market, by Product, 2024-2033

9.1.1. Non-woven

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Woven

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Knitted

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Geotextile Market, By Application

10.1. U.S. Geotextile Market, by Application, 2024-2033

10.1.1. Erosion Control

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Reinforcement

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Drainage Systems

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Lining Systems

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Asphalt Overlays

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Separation & Stabilization

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Silt Fences

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Geotextile Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Material (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Fibertex Nonwovens A/S.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. TenCate Geosynthetics.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. NAUE GmbH & Co. KG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Officine Maccaferri SpA..

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Propex Operating Company.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. AGRU America Inc..

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. HUESKER International

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. TYPAR.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Terrafix Geosynthetics

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others