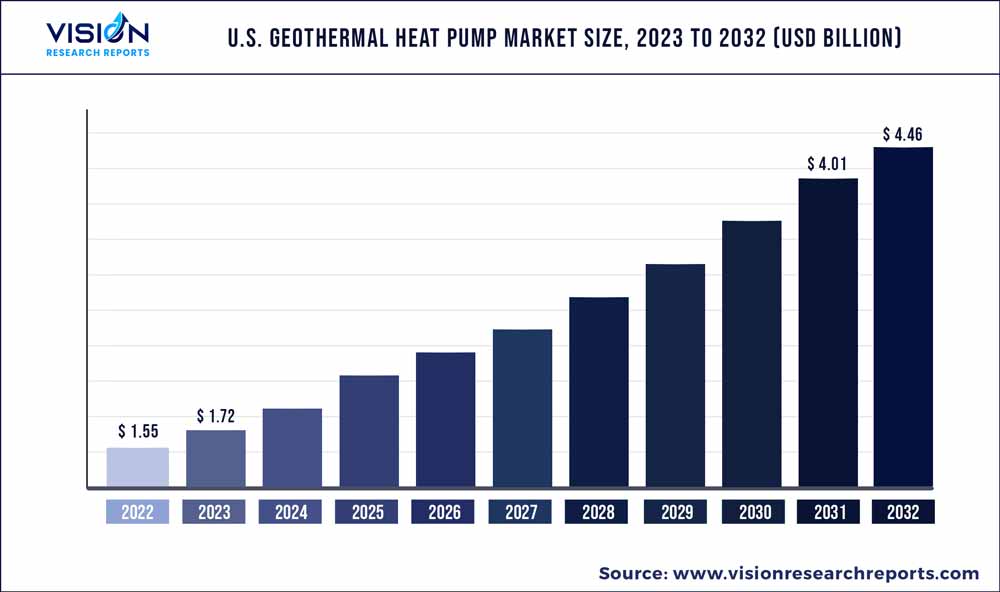

The U.S. geothermal heat pump market was estimated at USD 1.55 billion in 2022 and it is expected to surpass around USD 4.46 billion by 2032, poised to grow at a CAGR of 11.15% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Geothermal Heat Pump Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.55 billion |

| Revenue Forecast by 2032 | USD 4.46 billion |

| Growth rate from 2023 to 2032 | CAGR of 11.15% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Bard HVAC; Carrier; ClimateMaster, Inc.; Daikin Industries, Ltd.; Dandelion; Encon Heating & A/C; Glen Dimplex; Ingersoll Rand (Trane); Maritime Geothermal; NIBE; Robert Bosch LLC; Stiebel Eltron; Vaillant Group; Viessmann; Spectrum Manufacturing |

The growth is expected to be driven by favorable government policies regarding the tax incentive schemes for the installation of geothermal heat pumps. Geothermal heat pumps (GHPs) are a type of renewable energy technology that can be used for heating and cooling applications in residential and commercial buildings. GHPs utilize the earth’s constant temperature as a source of thermal energy to provide a highly efficient and cost-effective heating and cooling solution.Thus, increasing demand for energy-efficient solutions and the growing global carbon footprint are expected to drive the geothermal heat pump market in the U.S. over the forecast period.

The market is expected to witness significant growth over the forecast period. The U.S. government has been promoting environmentally friendly construction practices and reduction of the amount of carbon emissions caused by newly constructed buildings. As the construction sector accounted for more than 25% of the greenhouse emissions in 2022, a number of guidelines are now being enforced to reduce the environmental footprint of construction activities. Regulatory requirements in the U.S. related to the construction industry include voluntary certifications for LEED and EDGE and NYC emissions reduction law.

The growing consumption of fossil fuels, such as coal, oil, and natural gas, to meet heating needs has a significant harmful impact on the environment. Most building furnaces or boilers run on fossil fuels, accounting for 42% of the total greenhouse gas emissions. Growing awareness regarding climate change and greenhouse gas emissions is expected to boost the demand for energy-efficient products and technologies in the coming years.

Government regulations and emission standards are also projected to positively influence the preference for energy-saving products in the industrial and residential sectors. Each KW of energy consumed by a heat pump produces 4 KW of thermal energy, which resembles 300% efficiency. According to IEA, heat pumps across the EU help reduce CO2 emissions amounting to an annual reduction of 9.16 Billion tons of CO2. Thus, increasing demand for energy-efficient solutions and growing carbon footprint across the globe are predicted to drive the geothermal heat pump market over the coming years.

Geothermal heat pumps consume less electricity as compared to traditional units, which helps in reducing utility costs. These systems are also eco-friendlier in comparison to other heat pumps as they do not burn fossil fuels. Moreover, geothermal heat pumps can efficiently operate in any climate, because of the earth’s constant temperature. These factors are expected to drive the demand for geothermal heat pumps over the forecast period.

Type Insights

The closed loop type segment led the market and accounted for 87% of the revenue share in 2022. Closed-loop geothermal heat pumps are popular in the U.S. as they are highly efficient and reliable. They have minimal maintenance requirements. These pumps also have a long lifespan with some of them lasting up to 50 years or more.

Closed-loop geothermal heat pumps are preferred as a result of both significant improvements in closed-loop technology and environmental concerns in the U.S. The use of open loops that inject water underground is likely to continue to be legal despite the U.S. Environmental Protection Agency's mention of banning "pump and dump" systems.

Moreover, to increase the number of pipes in a shorter trench and reduce installation costs, the pipe is looped. This allows for horizontal installation in locations where conventional vertical applications are impractical. Vertical systems are frequently used in large commercial buildings and schools because horizontal loops require vast land. These factors are expected to drive the demand for closed-loop systems over the forecast period.

Application Insights

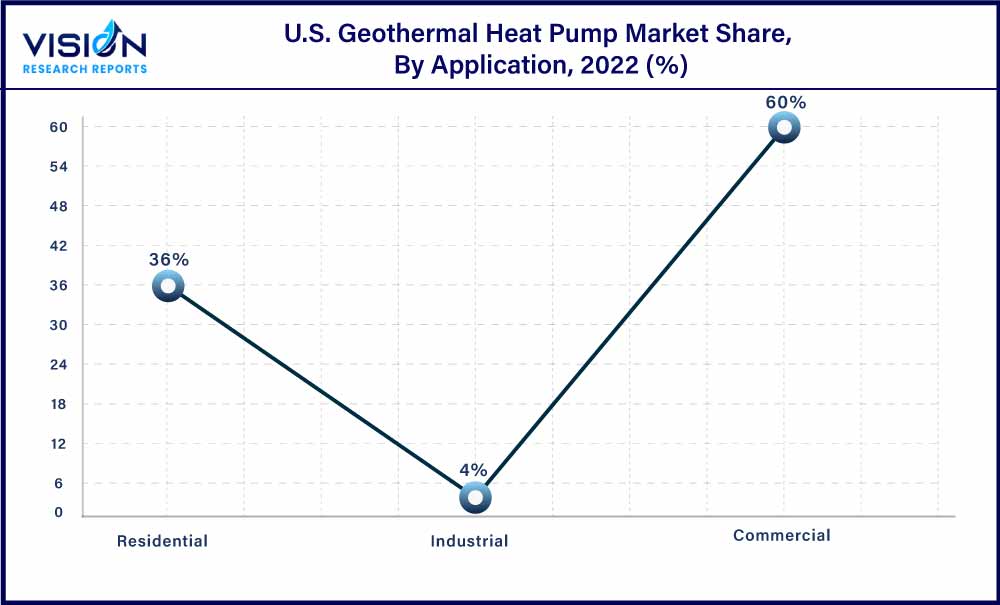

The application segment consists of residential, commercial, and industrial. The commercial segment led the market and accounted for 59.95% of the revenue share in 2022. The growth of the commercial application segment of the U.S. geothermal heat pump market is driven by rising energy costs and increasing awareness about the benefits of geothermal heating and cooling systems of geothermal heat pumps, along with the presence of government incentives and tax credits given by the government for geothermal heat pump installations.

Geothermal heat pumps provide significant energy savings and can be installed in a wide range of commercial facilities, including office buildings, medical facilities, schools, courthouses, and training facilities. Increasing usage of large geothermal heat pumps in commercial buildings for space heating or cooling is expected to be one of the major factors influencing the growth of the market. Vertical closed-loop systems are typically ideal for large commercial buildings.

Moreover, the residential application segment of the U.S. geothermal heat pump industry has been experiencing steady growth in recent years owing to a surge in the implementation of various energy efficiency standards, the presence of different government incentives and tax credits, and the rise in awareness among homeowners about the benefits of geothermal heat pumps.

U.S. Geothermal Heat Pump Market Segmentations:

By Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Geothermal Heat Pump Market

5.1. COVID-19 Landscape: U.S. Geothermal Heat Pump Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Geothermal Heat Pump Market, By Type

8.1. U.S. Geothermal Heat Pump Market, by Type, 2023-2032

8.1.1. Closed Loop

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Open Loop

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Hybrid

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Geothermal Heat Pump Market, By Application

9.1. U.S. Geothermal Heat Pump Market, by Application, 2023-2032

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Geothermal Heat Pump Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Bard HVAC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Carrier

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ClimateMaster, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Daikin Industries, Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Dandelion

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Encon Heating & A/C

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Glen Dimplex

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Ingersoll Rand (Trane)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Maritime Geothermal

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. NIBE

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others